From the beginning of the year to now, the impact of the global industrial chain brought by the epidemic has gone through three stages.

[outbreak period in China]

Before mid-February, the market focused on the impact of delays in resuming work after the outbreak in China on domestic and foreign industrial chains. In the previous report, we analyzed in detailThe three most affected industrial chains in China are chemical industry, computer electronics, non-ferrous smelting and textile industry.

[outbreak period in Japan and South Korea]

At the end of February, at the beginning of the overseas outbreak, the market began to pay attention to the possible impact of the epidemic in Japan and South Korea on the domestic industrial chain. In our previous report, we specifically suggestedPossible risks in the semiconductor and automotive industry chain.

[outbreak period in Europe and America]

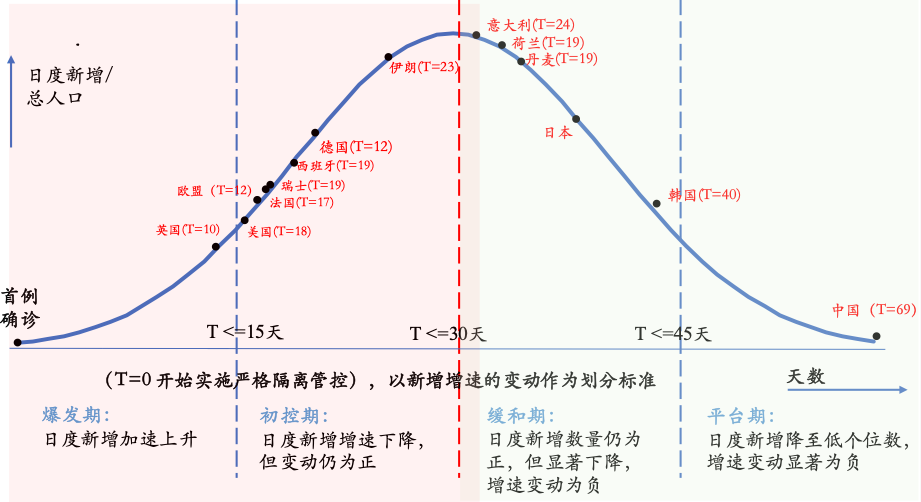

However, today, when the epidemic in East Asia is gradually under control, countries in Europe and the United States are in the stage of outbreak.

Epidemic situation in ▼ countries (updated to 31 March)

Data sources: Wind, Guotai Junan Securities Research.

Count the overseas countries involved in this major epidemic, whether it is Japan, South Korea, or the United States and Germany, are all important node countries in the global economy and trade, and occupy a pivotal position in the trade and industrial chain with China.

So, if there is a recession in these four important economies,How much impact will it bring to China's economy and industrial chain?

Guotai Junan Macro team updated the calculation in the latest report, and pointed out the risk differences between the epidemic in Europe and the United States and the epidemic in Japan and South Korea on the domestic industrial chain.

Overseas outbreaksCalculation of the impact on China's economy

With regard to the impact on the economy and employment, we use the data of the Ministry of Commerce on the pull of unit export employment to discuss three situations.

Impact calculation of external epidemic situation of ▼

Source: Guotai Junan Securities Research

[case 1: benchmark case]

The growth rates of the United States, Europe, Japan and South Korea in 2020 were-4.4%,-8.4%,-6.7% and-5.1%, respectively.

Generally speaking, this situation will drag down China's exports by 19.4 points, directly lead to the loss of China's GDP by 3.9%, affect the employment of more than 17 million people, and affect the unemployment rate by 4%.

[case 2: optimistic scenario]

The growth rates of the United States, Europe, Japan and South Korea in 2020 were-3.2%,-5.5%,-4.0% and-3.6%, respectively.

In this case, the overseas economic downturn will drag down China's exports by 13.9 points, directly lead to the loss of China's GDP by 2.8%, affect the employment of more than 13 million people, and affect the unemployment rate by 2.9%.

[case 3: pessimistic situation]

The growth rates of the United States, Europe, Japan and South Korea in 2020 were-7.6%,-13.3%,-9.2% and-7.4%, respectively.

In this case, China's exports will be dragged down by 33.5 points, directly leading to the loss of 6.7% of China's GDP, affecting the employment of more than 29.5 million people and affecting the unemployment rate by 6.7%.

To sum up, even according to the benchmark situation, the epidemic situation in Europe and the United StatesThe impact of Chinese demand may also directly lead to the loss of 4% of China's GDP, and more than 17 million jobs will be affected.

To deal with such a situation, an active and effective domestic hedging policy is essential. We thinkMaybe.At least 7 percentage points of fiscal (including quasi-fiscal) hedging is needed.

On the other hand, it is increasingly urgent to analyze and remedy the differences in China's industrial chain and supply chain between Europe and the United States, Japan and South Korea.

Risk screening:The particularity of European and American Trade with China

On the whole, China's import and export trade to Europe and the United States is different from that of Japan and South Korea, no matter from the perspective of subdivided commodities or product types.

1. Not just imports

Unlike Japan and South Korea, the impact of Europe and the United States on the domestic industrial chainIt is reflected not only in imports, but also in the decline in exports.

In terms of export trade, both the European Union and the United States accounted for about 17% of China's total exports in 2019. China's exports to Japan and South Korea are about 6 per cent and 4 per cent respectively.

It can be seen that Europe and the United States are important to China.Exporting country.

▼ China's share of imports and exports to Europe, America, Japan and South Korea

Data sources: Wind, Guotai Junan Securities Research

In terms of import trade, in 2019, China accounted for 5.9% of imports from the United States, 13.3% from the European Union, 8.3% and 8.4% for Japan and South Korea, respectively.

In terms of trade volume, whether it is imports (19.2% in Europe and the United States > 16.7% in Japan and South Korea) or exports (34% in Europe and America > 10% in Japan and South Korea), the impact of the epidemic in Europe and the United States on China's trade side is greater than that of Japan and South Korea.

Therefore, the impact of Europe and the United States on the domestic industrial chain is not only reflected in the import supply.The interruption of the chain is also more reflected in the decline in China's foreign exports.

The United States and Europe in the Lower reaches of ▼ China's Industrial chain

Data source: WIOD 2016, Guotai Junan Securities Research, data quoted from the previous report "the path and scale of Industrial relocation in China: the Enlightenment of Japan, South Korea and Taiwan"

Due to the decline in demand from overseas economies, the industries that are expected to be hit hardest at home areElectrical equipment manufacturing, mechanical equipment manufacturing, as well as some electronic, textile and other industries。

2. A wider range

Japan and South Korea account for a prominent share of exports in the electronics sector, while the European Union and the United States have a wider range of exports to China, such as agricultural products, food and beverages, light industrial paper and other consumer goods and primary products.

Compared with Japan and South Korea, the United States is a major contributor to China's upstream in agricultural products, food and beverage tobacco, coal and crude oil products, forestry and timber, mining and selection industries.

The impact of the above-mentioned primary products or consumer goods is an industry in which the United States is quite different from other countries.

We believe that although the above products are more substitutable than core components, with the global outbreak, we need to be vigilant against the supply risks of primary products.

The United States and Europe in the Upper reaches of ▼ China's Industrial chain

Source: WIOD 2016, Guotai Junan Securities Research, data quoted from the previous report "the path and scale of Industrial relocation in China: the Enlightenment of Japan, South Korea and Taiwan"

3. Focus is different.

In terms of spare parts supply, Europe and the United StatesThe greater influence is mainly concentrated in automobiles, aircraft, aircraft and mechanical equipment, while Japan and South Korea are mainly concentrated in semiconductors, cars and optical equipment.

The United States has a certain influence on China in the manufacture of upstream chemicals in the rubber, plastic and pharmaceutical industries, as well as furniture manufacturing and papermaking in the traditional manufacturing industry. as well as machinery and equipment, automobiles and other transportation equipment in high-tech manufacturing constitute the upper reaches of China's industrial chain.

In terms of product breakdown, the major categories of goods that account for a relatively high proportion of China's imports from the United States are aviation, spacecraft and spare parts, while some chemicals, vehicles and parts, and optoelectronic equipment account for a relatively high proportion. In addition, machinery and equipment and spare parts account for about 9% of China's total imports.

▼ 2018 imports from the United States accounted for a higher chapter (HS binary code)

Data sources: UNcomtrade, Guotai Junan Securities Research. Note: the standard yellow unit is in the field of high-tech manufacturing, and the parts are relatively concentrated.

The upstream position of the European Union and the United States is somewhat similar, and the impact is more concentrated inTraditional furniture, paper, textile, and high-end equipment manufacturing.

Subdivided into product categories, pumps and compressors in mechanical equipment, lead-acid batteries for starting piston engines, railways, trams, rolling stock and their parts, helicopters (with a no-load weight of more than 2000 kg) all account for a relatively high proportion of China's total imports.

▼ 2018 China's imports to the European Union accounted for the top industries

Source: UNcomtrade, Guotai Junan Securities Research. Note: the data are mainly in Germany, France, Italy and the Netherlands. The standard yellow unit is in the field of high-tech manufacturing, and the parts are relatively concentrated.

The impact of the epidemic in Europe and the United States:Focus on two major chains

Considering the intensification of economic and trade impact and the differences in the industrial chain, our risk assessment for the rise of the epidemic in Europe and the United States will be raised to another level on the basis of Japan and South Korea, and its core impact is mainly concentrated in two aspects:

First, furniture, paper and textiles in the traditional manufacturing industry.

The impact of this chain can not only consider the supply chain risk, due to the decline in external demand brought about by the economic downturn in Europe and the United States, the production of the industry itself will decline, so the core risk of traditional manufacturing is still in demand.

However, under the policy stimulus, domestic consumer demand is likely to pick up first, mismatch with overseas supply and demand, and form a certain degree of hedge against the above risks.Second, in the high-tech manufacturing industry, the influence of Europe and America is relatively concentrated in machinery and equipment.Other areas of transportation equipment and cars.

Among them, the supply chain risk in Europe and the United States is focused on the supply of core components.

On the one hand, in these industries, the United States and Europe account for a higher proportion of investment than Japan and South Korea, on the other hand, the short-term substitutability of parts in these industries is not strong.

In addition, in the automobile industry, for example, most Japanese car companies have contingency plans after the earthquake, while European and American car companies are relatively weak in the face of sudden problems. If the potential impact of the epidemic is incorporated into the domestic industrial chain transmission, we find that the impact on primary products involves more chains.

The impact Point of the Industrial chain of ▼ epidemic in Europe and America

Source: national Bureau of Statistics, Guotai Junan Securities Research. The influence of red is greater than that of yellow

From the perspective of supply chain risk, it is a top priority.It is to stabilize China's position in the global industrial chain, in addition to the smooth development of the resumption of work and production, the support for the transportation industry is also particularly important, as well as何Take more detailed measures to remedy the industrial chain and supply chain affected by the epidemic in Europe and the United States, Japan and South Korea respectively.

At the same time, in the stage of overall rising risk in the supply chain, we should also see that the opportunities in China are expanding.

As both the United States and Europe are involved in the supply of Chinese consumer goods and primary products, if the demand side recovers under policy stimulus, then the logic of "domestic substitution" in the field of raw materials in these consumer goods or traditional industries, will be easier to implement than high-tech manufacturing.

In addition, China leads the world in the stage of epidemic control, which is bound to bring opportunities for China to expand and extend the global industrial chain.

As the integrity of China's industrial chain is high and the manufacturing chain is rich enough, we believe that in the process of overseas supply problems, China should not only promote domestic demand and steady growth, but also actively participate in the repair of the global industrial chain. further seize the high point of the global industrial chain.

Edit / Edward