Could not be spared! Norwegian wealth funds have wiped out nearly 80% of last year's gains.

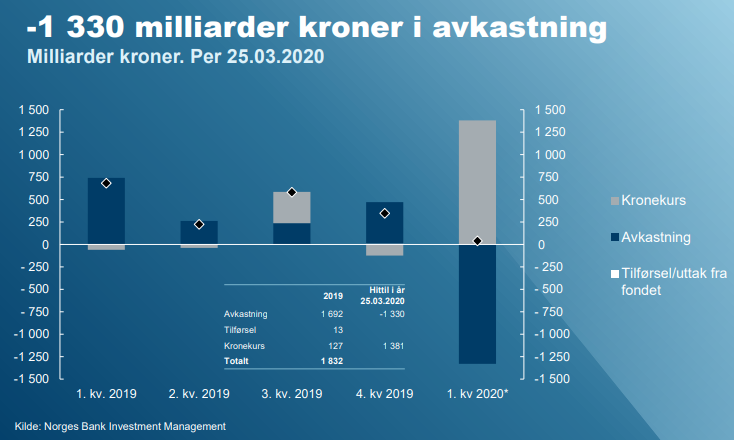

The Norwegian Wealth Fund, the world's largest sovereign wealth fund, said on March 26th that it had lost 1.33 trillion Norwegian kroner ($124 billion) in the year to Wednesday as novel coronavirus triggered a collapse in global markets.

What is the concept of losing 1.33 trillion Norwegian kroner?

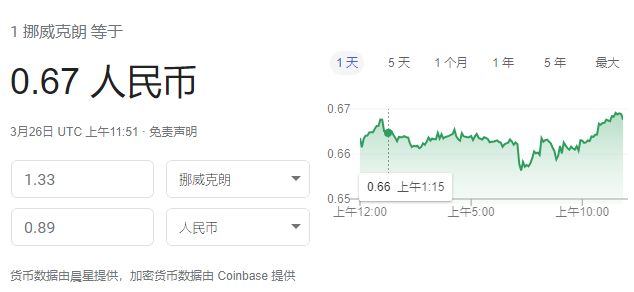

If calculated at today's exchange rate, 1.33 trillion Norwegian kroner is about 890 billion yuan.

We've taken stock before.Returns and positions of the Norwegian Government's Global Pension FundAs of the end of 2019, the total assets of the fund were NOK 10.09 trillionA profit of 1.692 trillion Norwegian kroner in 2019The highest return in history.

That is to say: from the beginning of 2020 to the present1.33 trillion Norwegian kronerThe loss wiped out about 78.6% of last year's gain.

Norwegian Wealth Fund made a profit of 1.692 trillion NOK in 2019

As of March 25, the total assets of Norwegian wealth funds were NOK 10.127 trillion, with equity investments accounting for 65.3 per cent, fixed income investments accounting for 31.5 per cent and unlisted real estate investments accounting for 3.2 per cent. (by the end of 2019, the fund had invested 70.8 per cent in equity, 26.5 per cent in fixed income and 2.7 per cent in unlisted real estate. )

From the beginning of the year to Wednesday, its main asset class, the stock market portfolio, lost 22.82%, fixed income-0.06%, and only unlisted real estate investments earned 0.40%, with a total return of-16.17%.

What shall I do? Head of the fund: the proportion of stocks will be restored to 70%.

At a news conference held by the Norwegian Wealth Fund today, Dag Huse, director of market venture capital, introduced the key points of the fund on risks and returns in 2019, and the head of the fund, Yngve Slyngstad, commented on the development so far this year before leaving office.

The head of the rebalancing rule, Yngve Slyngstad, said Norway's sovereign wealth fund would restore its stock market investments to 70 per cent from the current 65.3 per cent. He declined to say when the proportion of stocks would be restored to 70%, or to comment on whether he bought stocks during the recent market crash.

At the same time, Nicolai Tangen was announced as the new head and CEO to succeed Yngve Slyngstad.

Nicolai Tangen, the new head of the fund, is also a hedge fund manager and philanthropist

He has a long-term preference for technology stocks, but reduced his holdings of Tesla, Inc. last year.

By the end of 2019, the Norwegian Wealth Fund (also known as "The largest equity investments of the Norwegian government global pension fund or the Norwegian sovereign wealth fund are respectively$Apple Inc (AAPL.US) $、$Microsoft Corp (MSFT.US) $And Google parent company$Alphabet Inc-CL A (GOOGL.US) $Apple Inc, Microsoft Corp,$ADR (NSRGY.US) $Make the greatest contribution to performance$BABA (BABA.US) $、$Tencent (00700.HK) $It is the 8th and 15th place of the stock investment scale of the fund, with positions of 51.992 billion Norwegian kroner and 34.056 billion Norwegian kroner respectively.

The fund has invested in more than 1400 Chinese companies, ranked by market capitalization of their positions by the end of 2019.There is no distinction between A shares and H shares, and the top 60 are:

According to Societe Generale Securities report "20 years of Investment of Norwegian Sovereign Wealth funds" in November 2019, the heavy positions of Norwegian wealth funds have four main characteristics:

The average holding time is more than 9 years, and more than 40% of companies hold it for more than 10 years.

More than half of the heavy stocks come from American companies, and the industry has a preference for technology sectors.

Prefer super-large market capitalization stocks, and nearly 80% of the holdings exceed 100 billion US dollars.

80% of the companies with positions have a price-to-earnings ratio of less than 30 times earnings and a reasonable performance valuation match.

Just in early March this year, according to Bloomberg, the Norwegian wealth fund put it in the$Tesla, Inc. (TSLA.US) $The shareholding fell to 0.45% from 0.77% a year ago, before the new surge in Tesla, Inc. 's share price last year. The Norwegian government's global pension fund has questioned Tesla, Inc. 's development prospects. A senior executive of the fund said in 2018 that the fund only wanted to invest in "profitable companies."

(附:Supplementary analysis of the Norwegian Wealth Fund Annual report. Pdf)

(previous related information:The world's largest sovereign fund has increased its position in China! Apple Inc, BABA, Tencent and these Hong Kong and US stocks are all on the list.)

Edit / Iris