Author: Wang Tiange support: Yuanchuan Research Institute Consumer Group

When Amazon.Com Inc became the world's largest retail brand, founder Jeff Bezos (Jeff Bezos) also firmly sat in the position of the world's richest man. Just when the stock market of the richest 500 people lost nearly a trillion dollars, Bezos became the only billionaire, and Amazon.Com Inc's stock also rebounded after a sharp fall.

It is rumored that Amazon.Com Inc has set up an internal department in Seattle to study the profitability and development model of China's e-commerce platform, and is constantly revising and trying to combine with the American market. This is also the reason why we in China are always familiar with the taste of Amazon.Com Inc's various fancy operations.

Amazon.Com Inc announced an additional 100000 employees in the United States on March 16 to cope with the order pressure caused by COVID-19 's epidemic.Behind this is not only a simple increase in scale, but also Amazon.Com Inc's plan for the next decade. In this chess game, China has two "teachers" who are ahead of Amazon.Com Inc's turning point.

Amazon.Com Inc announced an additional 100000 employees in the United States on March 16 to cope with the order pressure caused by COVID-19 's epidemic.Behind this is not only a simple increase in scale, but also Amazon.Com Inc's plan for the next decade. In this chess game, China has two "teachers" who are ahead of Amazon.Com Inc's turning point.

Part 1. The Kan of Amazon.Com Inc

The epidemic has punctured fragile lives and the golden economic era of the United States. Trump, who was on the sidelines a month ago, is now desperately advising Americans to stay at home while doing everything he can to protect the US stock market. On the eve of the economic crisis predicted by many, Amazon.Com Inc announced that 100000 new jobs would be created in the United States.

As an e-commerce, the reason for the increase in enrollment is simple: a surge in platform orders and an acute shortage of manpower in warehousing, logistics and distribution. However, behind the 100000 increase in enrollment is Amazon.Com Inc's moat on the territory of the United States in the next decade.

However, the underlying intention behind Amazon.Com Inc's expansion of 100000 employees is:

In a letter to shareholders in 1997, Jeff Bezos, founder of Amazon.Com Inc, set four keynotes for Amazon.Com Inc's development thinking:"pay attention to users", "long-term investment, everything for the future", pay attention to cash flow and economies of scale.The first three keynotes have become the advantages of Amazon.Com Inc, and the construction of a self-supporting warehousing and logistics center to expand the scale has become Amazon.Com Inc's bottleneck for a long time.

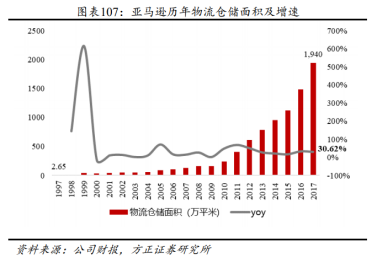

Since its establishment, Amazon.Com Inc has continuously increased his investment in the field of warehousing and logistics, and the global storage area has increased from 265m square meters in 1997 to 1940 million square meters at the end of 2017, with an average annual compound growth rate of 39.1 per cent. However, the construction of self-supporting warehousing and logistics center is a real long-term project, which requires a great cost in the early stage.

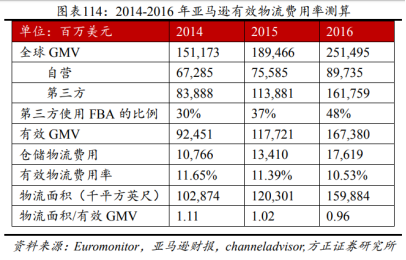

However, thanks to the scale effect of Amazon.Com Inc's warehousing, Amazon.Com Inc's logistics expense rate continued to decline, reaching a low of 8.37% in 2009, followed by Amazon.Com Inc fresh (launched in 2007), FBA (launched in 2007), Prime Now (launched in 2014), Amazon.Com Inc began to do trunk transportation on a large scale in 2014, and the last kilometer distribution business in 2015. In the later period, Amazon.Com Inc's actual logistics expense rate showed a downward trend as a whole.

Excluding the influence of FBA, the rate of logistics expenses is still decreasing year by year.

The scale effect formed by the self-built logistics center makes the logistics expense rate of Amazon.Com Inc reduce year by year, which can be said to be one of the important drivers for Amazon.Com Inc to turn losses into profits and create profits. And this epidemic has greatly promoted the growth of Amazon.Com Inc's business and users. Amazon.Com Inc took advantage of the opportunity to recruit 100000 more employees in the warehousing and logistics departments on the basis of more than 400,000 employees in the United States. in the context of the next opportunity to expand the business to make preparations for further giving full play to the scale advantages of the warehousing and logistics system.

Part 2. Learn from Meituan: how to reduce labor costs?

People familiar with China's Internet e-commerce industry will find Amazon.Com Inc's move very familiar, because he mentions the precedent of economies of scale reducing costs, forcing management and technological progress.There are successful cases of scale effect in China: Meituan, the takeout leader.。

Little Meituan has always had a great development strategy, beating competitors to become the leader of the takeout industry. Meituan relies on familiar economies of scale.

In order to further seize the "big market", Meituan takeout insisted on developing its own distribution services. at first glance, this insistence had a negative impact on Meituan: the gross profit margin was significantly lower than that of overseas companies with a lower proportion of self-owned distribution.

With the increase of Meituan's takeout market share and orders in recent years, the advantages of scale have emerged: the market share and the number of orders have increased, the number of riders has increased, but the average distribution cost of riders has decreased. The average gross profit margin per unit of distribution has increased year by year from negative to positive in 2017.

Amazon.Com Inc's average gross profit margin per unit of distribution began to turn negative to positive in 2017.

The reason for Meituan to reduce the distribution cost and improve the gross profit margin lies in the advantage of scale and technical management.The increase in the number of orders improves the efficiency of the rider and reduces the average distribution cost. at the same time, it also gave birth to the Meituan intelligent scheduling system: through the intelligent allocation of orders to the rider, matching routes and other operations, the distribution efficiency of the rider was greatly improved, and the per capita cost of distribution was further reduced.

The advantages of distribution network and price brought by scale effect to Meituan also make it a preferred platform for more merchants, which further stimulates the expansion of Meituan market and the scale of riders. The larger the rider network, the greater Meituan's value to merchants and users. The larger the merchant network, the greater Meituan's value to users and riders, thus reducing the cost of expanding new merchants, riders and users. Greatly raise the barriers to entry for newcomers in the industry.

With the increase of business, the acquisition cost apportioned to each user will also be reduced, the utilization efficiency of related facilities such as the rider network will also be higher, the distribution cost will be further reduced, the scale advantage will be expanded, and finally the firm increase of enterprise barriers will be realized. Meituan's leading position of takeout has been consolidated.

With Meituan takeout, the pioneer of scale effect, it is no wonder that Amazon.Com Inc's expansion of 100000 new employees appears to be very confident and confident.

Amazon.Com Inc imitated Meituan's attempt to increase the size of the market and labor force to reduce costs and improve efficiency to get its essence, but also because this strategy is very consistent with Amazon.Com Inc's early development concept. However, for Amazon.Com Inc, not every trick can be so perfect to transfer flowers and trees for their own use. This is not true. Last year, the live broadcast of Ali Taobao was copied by Amazon.Com Inc. However, compared with the host of goods in our country, the live broadcast of Amazon.Com Inc's website does not seem to be like that.

Part 3. Learn from BABA: the anchorman brings goods.

To say that the recent domestic e-commerce industry hot keywords, it may be "cross-border marketing", "Li Jiaqi", "Vera" and other common words focused on live streaming with goods. Taobao Live has created many hits and viewing miracles in recent years, triggering a surge in e-commerce sales.

Since its establishment in 2016, Taobao live streaming has maintained a triple-digit growth rate. According to the financial report, Taobao live streaming helps merchants and Internet celebrities interact with fans and consumers through live streaming, which has become one of the most rapid and effective sales models for Taobao Tmall merchants.

In Tmall's "double 11" event in 2019, more than 50% of merchants achieved new growth through live streaming. In the first hour and 03 minutes, the transaction volume of live broadcast exceeded that of the whole day of "double 11" last year; in 8 hours and 55 minutes, the transaction volume of live broadcast on Taobao exceeded 10 billion yuan.

Real-time, face-to-face recommendation, weeding, answering questions, explaining the product in depth, and "buy it, buy it" have become the reasons that countless consumers cannot refuse. Live Vs such as Li Jiaqi and Vera brought up goods regardless of gender and across the generation gap, making countless men, women and children trapped in it, while BABA Taobao more tactfully introduced various traffic stars to detonate the traffic. Many fans chopped hands unstoppable, and even they were afraid to buy it.

Even the father horse personally went to the live broadcast to bring the goods, will Bezos also come off the court?

With such a big response, how can Amazon.Com Inc, who is eager to learn about China's e-commerce strategy, stand idly by? of course, he has to learn and learn again.

In April last year, Amazon.Com Inc officially entered the live streaming industry by adding an Amazon Live (Amazon.Com Inc Live) module to his application. For the seller port, there is an App similar to Douyin or Taobao Live-Amazon Live Creator (Amazon.Com Inc Live), which allows sellers to show their products to consumers entirely in the form of live video, and allows consumers to buy goods directly under the video.

A little serious live page.

However, it is obvious that Amazon.Com Inc, who has just set foot in the live broadcast industry, still looks relatively young, the live broadcast content appears to be regular, and many brand programs even directly use TV shopping content. Compared with Taobao's hundreds of thousands of live broadcast sales, Amazon.Com Inc live broadcast seems a bit old-fashioned.

Lauren Hallanan, a well-known foreign expert in the field of social media marketing and consulting, hit the nail on the head: "Amazon.Com Inc Live has not broken away from the traditional mode of product evaluation, but is more of a 'one-way' recommendation from the anchor. When you watch Amazon.Com Inc live, it's like watching a Youtube blogger you don't know making product reviews. It lacks social influence and ignores users' sense of participation and their willingness to establish interactive relationships. "

In addition, in addition to Amazon.Com Inc's official live programs similar to TV shopping, most of the existing live broadcasts are less than 10 minutes long, and the broadcasting time is irregular, which is not conducive to shaping the trust relationship between anchors and consumers. Hallanan: "Trust is a key issue that e-commerce platforms need to solve. For example, Taobao believes that content and community are the best way to generate trust." "

The comments of this overseas expert may resonate with us, who are experienced online shoppers in China. Accustomed to the domestic more mature video live mode, we watch Amazon live like watching Taobao live "low-configuration version", do feel some stiff lack of attraction and interaction. But it doesn't matter. I believe Amazon.Com Inc, who is good at paying homage to Chinese teachers, will soon learn.

Although there is still a lot of room for improvement in Amazon.Com Inc LVB, after this attempt, Amazon.Com Inc Live has still achieved initial results, and has made achievements that can inspire the enthusiasm of all kinds of businesses:

According to statistics, by using the live broadcast function, the sales conversion rate of sellers can be increased by 3.6 times.

Amazon.Com Inc sellers also admire the function of live streaming with goods. Backpack seller Fenrici Brands's sales early this year at Prime Day were 10 times higher than usual. The founder said that during the period, he made use of Amazon.Com Inc's live broadcast function to help them increase a lot of sales and customer clicks, and said he would become a loyal fan of Amazon.Com Inc's live broadcast function.

At present, Amazon.Com Inc has only just begun to try the field of live streaming, and sellers may still be at the stage of testing the water and trying not to touch thunder. In the future, with the further increase of the acceptance and familiarity of the platform buyers and sellers to the live streaming mode, Amazon.Com Inc Live may soon release itself and create its own overseas characteristic model for foreign consumer groups, so that the craze of live streaming will spread to the world.

Part 4. The end.

The development of e-commerce in China is far ahead of the rest of the world. Chinese consumers buy a wide variety of goods online, from snacks to luxury cars, with more activity than any other country. The world was amazed at the potential vitality of the e-commerce industry.

The development and marketing model of China's e-commerce industry has long been the object of peer learning and imitation, and Amazon.Com Inc is just one of them.

Although he withdrew from China's e-commerce market, the fate between Amazon.Com Inc's e-commerce business and China has not come to an end. It is believed that there is still a long way to go between Amazon.Com Inc and Chinese e-commerce enterprises in the future. Learning from China, the advanced Chinese model in e-commerce may help Amazon.Com Inc and more e-commerce companies to make a difference overseas.

Edit / Ray

3月16日亚马逊宣布在美国扩招10万名员工,以应对新冠疫情的订单压力。这背后不只是简单的规模增加,更是亚马逊下一个十年版图的谋局。而在这场棋局中,中国有两位「老师」,走在了亚马逊转折点的前面。

3月16日亚马逊宣布在美国扩招10万名员工,以应对新冠疫情的订单压力。这背后不只是简单的规模增加,更是亚马逊下一个十年版图的谋局。而在这场棋局中,中国有两位「老师」,走在了亚马逊转折点的前面。