Foreword:

Since the epidemic spread overseas, I have always felt vaguely that the US economy may be dragged down by the epidemic and the pace of the global recession will accelerate. With the sharp fall in US stocks, I expect it to continue.11The American stock market has peaked for a long time.And it may trigger systemic financial risks, affecting the whole world. So I'm here.2月28A conference call was held by the total team of China and Thailand Research Institute on Sunday to discuss the domestic and foreign economic situation and capital market issues. Although there is a great deal of controversy about whether the epidemic will lead to systemic risks in the United States, Tang Jun, chief analyst of the Ministry of Financial Engineering, believes that the probability of overseas outbreaks getting out of control is very high, see3月2Published on the 1st."what is the probability of overseas outbreaks getting out of control? "This reinforces my judgment: one is no less than2008The financial crisis of this year's subprime crisis will break out and it will be difficult to control.

Tang Jun was once in2月3It was published on Sunday."when will the inflection point of the epidemic occur?——Novel coronavirus Communication Forecast based on Mathematical ModelIn this paper, the prediction results are very accurate. He believes that the main reasons for overseas outbreaks getting out of control are lack of public awareness of the spread of the epidemic, limited social habits and limited government control.

My logical interpretation of the outbreak of the financial crisis is that most of the assets of American residents are in the capital markets, long-term low interest rates induce excessive expansion of corporate balance sheets, "inflate" profits through stock buybacks, push up stock prices, and form a wealth effect. promote consumption, drive employment, form a "false" prosperity, but the end of prosperity is lonely, the game of drumming stops unexpectedly, and finally triggers systemic risks. At the same time, in the past, the federal government10During the year, in order to stabilize the economy, we continued to borrow, resulting in an increase in leverage.100%When a crisis occurs, it is weak to deal with it.

Look back at the last two crises in the United States.2000The year was the crisis triggered by the bursting of the dotcom bubble2008The financial crisis of the bursting of the real estate bubble in 2008, when the previous two crises occurred, the level of interest rates were high. This crisis is triggered by the bursting of the stock market bubble at low interest rates. This shows that it is difficult to avoid a crisis, no matter whether it is high or low interest rates, and the root cause of the crisis is the gradual solidification of the distorted economic structure. When the economic growth continues to slow down and the government's countercyclical policies fail, a crisis will break out sooner or later, and the epidemic is just a catalyst.

The report by Xu Chi and Zhang Wenyu provides a very detailed analysis of the characteristics, scale and risks of debt expansion in the government, corporate and residential sectors of the United States.1929The comparison of the Great Depression in 2000, detailed data, rigorous logic, in-depth analysis, and made a sand table deduction of the crisis, it is worth reading.

Li Xunlei

2020年3月19日

First, the "appearance" of the current crisis: under the impact of the epidemic, the trampling of leveraged funds and the return of the mean valuation of US stocks

Recently, overseas markets are "jittery", especially the recent "four circuit breakers" of US stocks, which are mainly attributed by the media and the market to the global spread of the "COVID-19 epidemic" and the panic caused by it to the pessimistic expectations of the global economy. The new inflection point, response measures, vaccine, and specific drug progress of the overseas epidemic are regarded as the core variables that the market is most concerned about. It seems that if the inflection point of the epidemic occurs, US stocks will return to the "ten-year bull market" channel.

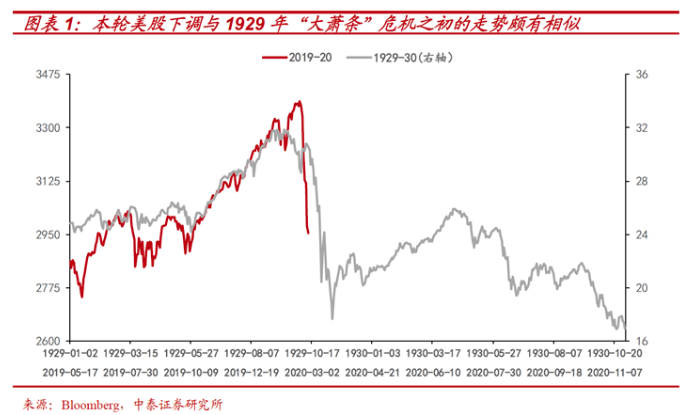

However, paying too much attention to short-term disturbances at the expense of long-term factors seems to be an inherent shackle in investors' thinking. Intuitively observing the global spread of the epidemic, the extent and intensity of the decline of US stocks have exceeded the European debt crisis of 12 years, the subprime mortgage crisis of 2008, and the Internet bubble crisis of 2000, and are quite similar to the trend at the beginning of the Great Depression crisis in 1929. The epidemic in the United States itself is not the most serious in the world. This tells us that the long-term structural factors exposed in this round of decline in US stocks deserve particular attention, and the possibility that the "COVID-19 epidemic" will become the "last straw" to burst the balance sheet bubble of US stocks should not be underestimated.

1.1 The driver of the "decade Bull Market": low inflation+In a loose environment, the balance sheet expansion of the three major sectors

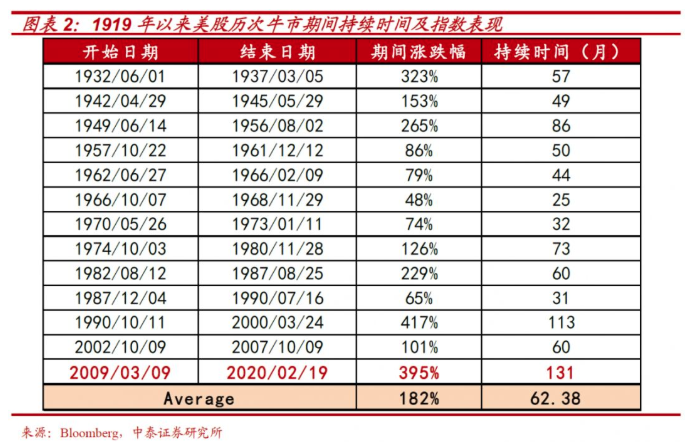

The rally in u.s. stocks began after the 2008 financial crisis, and by February 20, the s & p 500 rose 395%, creating a "ten-year bull market." In terms of growth and duration, the bull market ranked second and first in the history of US stocks. However, the differences from the rapid economic growth and the large cycle of scientific and technological innovation accompanied by previous bull markets in US stocks are as follows:

1) this bull market in US stocks began with the quantitative easing (QE) of the Federal Reserve from the end of 2008 to early 2009. After three rounds of QE and Trump administration tax and interest rate cuts during the Obama administration, the overall compound growth rate of the US economy in the past decade is only 3.04%, which is still on a downward path, and there has been no "subversive innovation" in the past decade as a whole.

2) on the other hand, the US corporate debt ratio, the amount of assets purchased by the Federal Reserve and the scale of US government debt have all hit record highs.

As shown in figure 5, the persistently low interest rate environment has led many companies to borrow heavily to buy back their own shares instead of investing in industry. The rise in stock prices thickens corporate profits, which in turn increases the dividend rate, and at the same time expands investors' capital gains, forming a wealth effect, which in turn promotes consumption and creates more job opportunities, which in turn further contributes to the rise in stock prices.

It should be pointed out thatThe Fed's practice of continuing to ease at high asset prices is similar to that of the Federal Reserve.1929The macro environment and practices before the Great Depression were similar to a certain extent. Inflation has remained relatively low, making the Fed more tolerant of the risks of asset price bubbles fuelled by rising debt.

It should be pointed out thatThe Fed's practice of continuing to ease at high asset prices is similar to that of the Federal Reserve.1929The macro environment and practices before the Great Depression were similar to a certain extent. Inflation has remained relatively low, making the Fed more tolerant of the risks of asset price bubbles fuelled by rising debt.

Therefore, at least in terms of macro-drive, the macro factors of the current bull market of US stocks are based on the large cycle of economic fundamentals.Rather, it is based on the "policy cow" and "loose cow" formed by the continuous expansion of the balance sheets of the government, enterprises and residents under the stimulation of continuous loose policies in a low inflation environment.

Therefore, at least in terms of macro-drive, the macro factors of the current bull market of US stocks are based on the large cycle of economic fundamentals.Rather, it is based on the "policy cow" and "loose cow" formed by the continuous expansion of the balance sheets of the government, enterprises and residents under the stimulation of continuous loose policies in a low inflation environment.

1.2 Liquidity crisis under the impact of the epidemic: valuation and leveraged funds tend to be "extreme"

From the perspective of valuationThe Shiller PE Ratio of the S & P 500 (adjusted for inflation-adjusted profits over the past decade compared with stock prices) was about 32 times before the current decline, more than 26 times the 2008 financial crisis and 30 times before the Great Depression.Belong to the historical high range.. Even if the index has fallen by more than 30 per cent, the current valuation level of 23.20 times is still at the historical quantile level of 60 per cent (if you consider the "whitewashing" of earnings per share by buybacks we described in detail later, the valuation and its historical quantile level will be even higher). In other words, even after four circuit breakers, it is hard for US stocks as a whole to say that valuations are absolutely cheap.

Behind the valuation bubble is the rise of low-cost funds, especially leveraged funds, under the continued loose monetary policy of the Federal Reserve.

On the one hand, the total amount of stock market leverage measured by the sum of debt margin, ETFs leverage and net speculative futures positions is about $400 billion. Based on the standardised market capitalization of the s & p 500, such leveraged funds account for about 1.36 per cent of market capitalization, up from 1.1 per cent at the peak of the dotcom bubble.The historical maximum of leveraged funds means that in the event of external shocks, US stocks begin to decline, which can easily lead to a liquidity crisis of leveraged capital chain, and the process of market valuation returning to the mean will be extremely fierce.

On the other hand, the "popular" passive fund "runs into the market".Over the past decade, the scale of passive investment stock funds has expanded rapidly and has become one of the main forces driving up the valuation of US stocks. In 2019, the assets of US equity funds reached US $8.5 trillion, with passive fund assets accounting for 51%, which has exceeded that of active management funds, reaching US $4.27 trillion. The bull market in the past decade has created the "vogue" of passive investment.Similarly, once the market turns down, the selling pressure caused by the huge redemptions faced by passive funds will make it impossible to undertake the trading volume of small and medium-sized stocks in the index they track, which will also aggravate the drying up of market liquidity.

In addition, it is worth noting that quantitative hedge fund trading as a share of total US stock trading volume has risen rapidly in recent years (from about 25 per cent in 17 years to 50-60 per cent today). To a certain extent, the high-frequency automated quantitative trading system adopts the momentum strategy of following the trend, so it has the characteristics of "chasing the rise and killing the fall" and increases the volatility of the market.This means that once the market falls below a so-called technical "key point", it is very easy to trigger the automatic closing and stampede of the quantitative system, causing the market to fall further.

Second, the "collapse" of corporate balance sheet: the decline of endogenous growth and the risk of default of high-yield debt.

2.1 Behind the "buyback whitewash": weak Endogenous growth of Enterprises

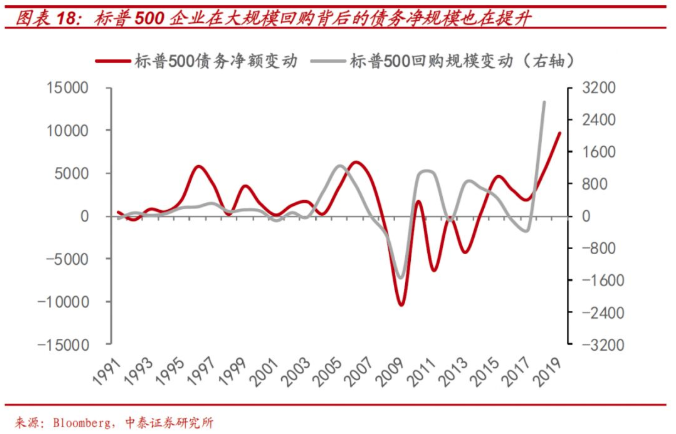

From the perspective of the split of the performance of US listed companies, over the past 15 years, the compound annual growth rate of earnings per share (EPS) of US listed companies has been 11%, while the compound growth rate of corporate profits is only 8%. The 3% difference between the two is the "artificially driven"growth" of buybacks. That is to say,Current US stocksEPSIn the process of growth, the proportion of "false increase" contributed by the company through share buyback is close to that of the company.30%In the performance growth that does not match the increase in stock prices, there is still an obvious phenomenon of "water injection".

In 2018-19, the total repurchase amount of the S & P 500 index reached $806.7 billion and $606.5 billion, respectively, which are all historical highs. We thinkOnce the spread of the epidemic impacts demand and circulation, exerting pressure on the cash flow of listed companies and causing listed companies to reduce or stop buybacks, then the real earnings of US stocks after "makeup removal" may be in the future.1-2It is centrally revealed in the quarterly results.(recently, the eight banks, including JPMorgan Chase & Co, which are considered by US regulators to be the most important to the financial system, stopped their planned $119 billion buyback program or started because of the epidemic.)

More importantly, for American companies themselves, over the past decade"share buyback—Executive shareholder return——Push upEPS--Pull up the stock price. "This "feast" seems to have only led to a sharp increase in the wealth of corporate executives and Wall Street investors (the richest 1% of households in the United States own 40% of the shares)The endogenous growth and innovation ability of enterprises has been weak in the past decade, and even regressed to a certain extent in some areas.

Take the manufacturing output index as an exampleOver the past decade, though, overall US stocks have risen 300 per cent above their pre-crisis highs in 2008. But the level of US manufacturing output is still 2% lower than it was in November 2007 before the crisis.Total industrial output in the past12 It took a total of 20 years to get promoted.4%。

More serious than weak manufacturing output is the decline in investment in innovation by American companies. Enterprise R & D expenditure accounts for only a proportion of cash.11%Much lower than that used for share buybacks27%。In terms of the proportion of R & D expenditure in various growth industries, compared with five years ago, except for biotechnology (33%), the proportion of R & D expenditure in industries, including the Internet, semiconductors (15% of R & D), software and consumer electronics (12%), did not increase significantly, or even decreased slightly.

The malaise of manufacturing output and the lack of R & D investment are consistent with the macro "hollowing out" of US manufacturing and the absence of major "subversive" technological innovation in the US after iPhone led the smartphone and mobile Internet in 2007.In other words, the foundation of this "ten-year bull market" of US stocks may be more fragile than that of most previous bull markets.Accordingly, the loose policies of the past decade have not systematically enhanced the competitiveness of US manufacturing companies or created the conditions for the birth of "great companies", apart from enriching Wall Street investors and executives of public companies.

2.2 "buybackFeastBehind: the fragility of corporate balance sheets

The "fragility" hidden behind US companies' balance sheets may be more noteworthy than inflating earnings per share through buybacks, which in turn contributes to the rise in share prices.

From the perspective of transmission mechanism, as we have discussed before, the strategy of corporate borrowing to increase manufacturing capacity and operating leverage is different from that of previous US stock "bubbles".The main body of the current round of American companies with leverage is to buy back shares directly through the secondary market. As a result of financial, debt repurchase will directly reduce the enterprise's net assets while increasing liabilities. Compared with the traditional borrowing of increasing fixed assets investment, it will make the enterprise's asset-liability ratio increase more rapidly, and then quickly enlarge its potential debt risk.When an enterprise suffers from the double impact of COVID-19 's epidemic on demand and stock price, and then affects the operating cash flow and the value of owners' equity at the same time, the increasingly fragile corporate balance sheet due to "debt buyback" may face the risk of "collapse". And trigger a corporate debt crisis.

1) in terms of data, nearly a decade of low interest rates have pushed total US corporate debt to nearly $10 trillion and non-financial corporate debt to more than 74.4 per cent of GDP, up from 72 per cent at the peak of the housing bubble in 2008.

2) according to the current debt scale, the proportion of non-financial corporate debt to the company's market capitalization in October 2019 is 29.85%.According to our estimates, according to the current round of US stocks,30%By the extent of the decline, the indicator will be expanded to45%(与2012It performed quite well during the European debt crisis in 2008. This means that the probability of a debt crisis among US companies should not be underestimated.

One of these17-19The high position cost and the high interest cost carried out by the "bull market peak" in1.9The trillion-dollar repurchase may become an important "fuse" for the follow-up "buyback crisis".From the amount of debt repurchase of American listed companies in each time period, we can see that the peak of debt repurchase of American companies in the past decade is mainly in three periods: 09-10, 13-15 and 17-19.The last two buybacks have been accompanied by a widening gap between net debt and earnings before interest and tax.Among them, the background of the large-scale repurchase of listed companies in 2009-10 and 13-15 is that the Fed tends to have low interest rates at zero in the context of the crisis, but in the middle of 17-19 years, with the continuous increase of interest rates by the Fed, the continuous expansion of the buyback scale may be mainly caused by the moneymaking effect of the bull market in US stocks.

After the continuous decline of US stocks, on the one hand, the current position and market price of US stock index have fallen below the average position cost of many companies that buyback during this period; on the other hand, the high financing costs caused by the average federal funds rate of 2% in 17-19 and most companies tend to carry out "debt buybacks" through long-term borrowing at fixed interest rates, so that the current Fed interest rate cut can not reduce the corresponding financial costs of companies.

2.3 The risk of default of High-yield debt under the expansion of Credit spread and the impact of demand

In addition to the debt mismatch generated by the share buyback itselfUnder the impact of the epidemic on demand, corporate debt financing in the United States, especially the "high-yield debt" of enterprises with low credit ratings (includingBBBGrade andBBBThe default risk associated with the prevalence of financing or the "unbearable weight" of the balance sheet of another American company.

According to data, the market for BBB-rated corporate bonds in the US has grown from $726.9 billion at the beginning of 2008 to $3.2 trillion in 2019, accounting for more than 55 per cent of investment grade bonds.

And from the perspective of the maturity time distribution of corporate debtUs corporate high-yield bonds may reach their maturity peak in the next three years:The maturities from 2020 to 2022 are $424.8 billion, $530.5 billion and $581 billion, respectively. Among them, according to the classification, the maturity of BBB bonds will peak in 2022, with a maturity of US $209.4 billion. Overall, the share of maturity of investment grade bonds remained at a high of about 75 per cent in 2020-2022.

At the same time, as mentioned earlier, the endogenous growth capacity of American enterprises has not been significantly improved in this "bull market".The rapid rise in the size of high-yield corporate debt means that even without the "Black Swan" incident, the risk of undercoverage of debt by American companies' own cash flow should not be underestimated.. According to the Fed's Financial Stability report, earnings before tax, interest, depreciation and amortisation (EBITDA) are used to reflect corporate operating cash flow, and it is found that the proportion of borrowers with debt / EBITDA ≥ 6 has risen rapidly from 18.9% in 2015 to 41.9% in 2019.

If the economy is in recession, the decline in the credit quality of highly leveraged enterprises will lead to a rapid increase in recent years.BBBRated bonds can easily be downgraded to high-yield junk bonds by rating companies, which can lead to passive clearance of institutional investors (institutions' risk control requirements, rating must be investment grade or above), which will further accelerate the decline in bond prices. in turn, magnify the risk of the corporate bond market.

In terms of the industry distribution of high-yield bonds, communications, consumption and energy industries account for the highest proportion, respectively.20%、16%及14%。And these industries or the current round of COVID-19 epidemic, the demand suffered the most obvious impact. In the oil and gas industry, for example, energy high-yield debt is $142.1 billion, accounting for 14.4% of the total high yields. among them, light tight oil (LTO), the fastest-growing US shale oil, pays more than $20 billion a year in long-term debt interest, which means it takes nearly half of current production (6 million b / d) to pay interest on the debt. Superimposed by the impact of OPEC+ crude oil price war, the debt default risk of related enterprises in the future may not be underestimated.

meanwhile,The impact of the epidemic on the capital market and economy has significantly reduced investors' risk appetite, and credit spreads will continue to expand, which will further increase the capital cost, financing difficulty and repayment pressure of low-rated debt enterprises.Since mid-February, although the Fed has cut interest rates by 150bp, US high-yield bond yields have risen from 11.25 per cent to 16.65 per cent. The option-adjusted spread (OAS) of BBB-rated corporate bonds has risen from 135to 290bp.

According to our study of the law of crisis transmission such as the Great Depression of 1929The expansion of credit spreads and the corresponding corporate financing difficulties will become more and more serious with the evolution of the crisis, and this expansion will be transmitted step by step from low ratings to higher ratings. Fed measures such as successive interest rate cuts and liquidity injection cannot reverse this situation.For example, from October to November at the beginning of the 1929 crisis, although the spread between low-rated corporate bonds and high-rated bonds widened to the highest level in 1929, the demand for high-rated corporate bonds was still hot. A year later, in October 1930, although the Fed cut interest rates for four consecutive rounds in five months, the rediscount rate fell from 6% to 3.5%. Yields on municipal bonds issued by the government and the railway industry, an important pillar industry at the time, began to rise rapidly.

Third, the "collapse" of residents' balance sheet: the loss of lifelong wealth and the increase of rigid expenditure.

3.1 The proportion of residents' lifetime wealth in stock assets has reached an all-time high.

The residential sector, the other half of the US economy, will face rising unemployment and falling incomes in the future, not only because of the impact of the epidemic and the "collapse" of corporate balance sheets.

Moreover, with the moneymaking effect of the "ten-year bull market" in US stocks, the proportion of US households' asset allocation in stocks is also rising, which is now 40 per cent, which is close to that of the 2002 dotcom bubble in history.

In the meantime, the reason why Americans dare to be famous for their low savings rate and early consumption habits (half of Americans have bank deposits of less than $1000), the per capita pension balance of 401k accounts is the biggest support (take the median US wage of $50,000. based on 10 per cent of individual contributions and 5 per cent of corporate deliveries each year, accounts exceed $1.3 million by the time they retire at the age of 65). The stock market is the main investment direction of the most 401K accounts.Us stocks have fallen this round.30%Equivalent to the decline in the lifetime wealth accumulation of most middle-class families in the United States30%About, for the follow-up to the United StatesGDPProp——The impact of the consumer industry is conceivable.

3.2 With the aggravation of the gap between the rich and the poor, the rigid increase in education and medical expenditure has been "overwhelmed".

On the other handWhile the income of American residents has declined and their wealth has shrunk on a large scale, their spending on education and health care has increased rigidly, which not only aggravates the contraction of consumption, but also forces residents to accelerate the realization of stock assets. this further increases the selling pressure on the market.

In the longer term, it will also increase the chances of radical politicians winning this year's congressional re-election. Then, in the process of the evolution of the follow-up crisis, the government will increase the "moral cost" of rescuing systemically important institutions.

As we showed in our previous report, "what impact will Sanders' Breakthrough have on the US economy", the gap between the rich and the poor in the United States has been growing in the low interest rate environment of the past decade.Due to the scarcity of education and medical care in society, student education loans are derived from2008The financial crisis of6110100 million all the way up to2019Q3的1.49Trillions of dollars, medical cost ratio2010Annual increase44%And the wealth polarization in the United States has increased the debt of low-income households.In other words, most young people in the middle class and below in the United States face the dilemma of looking down on medical treatment and unable to afford to go to school. This is also the reason for the rise of radical politicians such as Sanders and Cortez.

If the COVID-19 epidemic and financial risks are further fermented, we cannot rule out the possibility that radical politicians will further expand their seats in both houses of Congress after this year's general election. The hostility of radical politicians to billionaire classes such as Wall Street and multinational executives has led to a sharp increase in the moral cost of bailing out systemically important institutions in the United States.

Fourth, the "collapse" of the balance sheet of the government and the Federal Reserve: the space on the verge of exhaustion and the restriction of "political polarization"

4.1 Fed balance sheet: interest rate cuts andQEThe exhaustion of space and the possible way out of "deficit monetization"

The flip side of the expansion of corporate and household borrowing in a low-interest-rate environment is the expansion of the Federal Reserve and the US government. On the part of the Federal Reserve, the current situation that interest rates are close to zero after successive interest rate cuts makes it difficult to have room for interest rate cuts. Over the past decade, the Fed has expanded its asset purchases by 1.93 trillion, which means that even if the Fed further implements QE4, represented by the purchase of financial assets, it will face the dilemma of diminishing marginal utility as the subsequent crisis continues to be transmitted from asset prices to the real economy.

At a time when the price policy represented by interest rate reduction and quantitative easing represent the increasingly limited space for the purchase of financial assets, according to1929With the experience of the crisis in 2008, we can only cooperate with the strong stimulus of fiscal policy and monetize the fiscal deficit, that is, the chairman of Qiaoshui Investment.Ray DalioThe third kind of monetary policyMP3Will it be possible to change the market's pessimistic outlook for the economy and stop the further spread of the US balance sheet crisis.

During the Great Depression of 1929, although President Hoover took many easing measures during 1929-1932, including cutting interest rates to an all-time low and setting up rebuilding financial companies to provide liquidity to solvent banks, but these measures did not stop the further spread of the crisis.Throughout the history of the Great Depression, the real policy with obvious effect is the coordination of monetary and fiscal policies.

For example, the first quarterly rebound during the Great Depression (1930年11月-3The month is approaching50%The driving force behind the rebound is:Congress approved President Hoover's proposal to reduce the income tax rate by 1%, to increase spending on roads and other public facilities to 1% of GDP, and to cooperate with the Fed to reduce the discount rate from 6% to 3.5%.

The reason for the end of the Great Depression was that after Roosevelt won the 1932 US election by a historic landslide and took full control of Congress, Roosevelt implemented a near-unsecured liquidity injection of systemically important financial institutions, including withdrawal from the gold standard, and unprecedented fiscal policy stimulus, including public infrastructure, that quickly reversed the crisis. (expenditure increased by $2.7 billion in fiscal year 1934, accounting for 5 per cent of GDP)

CorrespondinglyThe most damaging and painful phase of the Great Depression is also inseparable from Congress's tightening fiscal policy because of its control of the deficit ratio (although interest rates are still at an all-time low).As President Hoover's Republican Party lost a majority of congressional seats in the mid-term elections in 1930, fiscal policy was always "controlled" and his own understanding of finance was not clear. The tax Act passed by Congress in June 1932, on the one hand, raised a variety of taxes, including income tax, corporate tax, and consumption tax, and on the other hand, cut federal spending in an attempt to achieve a balanced budget. But the result was an extreme deterioration in the economy in the second half of 1932, with consumer spending and industrial production falling by more than 20 per cent, unemployment rising to more than 15 per cent, and rising bank failures.

4.2 The rising fiscal deficit limits the room for further fiscal policy.

However,This is empirically effective, with deficit monetization as the main means, the so-called "third monetary policy" (MP3), highly dependent on the coordination of fiscal policy.This in turn requires a healthier fiscal base and strong support from members of Congress, both of which unfortunately will be difficult for the United States to meet this year, or even for the foreseeable future.

In terms of fiscal space, the US fiscal deficit rose to 4.6 per cent of GDP in 2019, higher than the average of 2.9 per cent over the past 50 years. The reason behind this is that over the past 40 years, the Democratic administration has generally adopted the approach of increasing welfare without increasing taxes, that is, "increasing expenditure without increasing income", while the Republican administration has generally adopted the practice of reducing taxes without reducing expenditure, that is, "reducing revenue without reducing expenditure". In order not to offend voters, neither party has come up with a systematic plan to effectively cut spending or raise taxes in order to balance the budget.

In terms of debt interest alone, interest on US public debt will reach a record $591 billion in fiscal 2019, exceeding the budget deficit for fiscal year 2014 ($483 billion) or fiscal year 2015 ($439 billion), and nearly 3% of expected gross domestic product (GDP), the highest ratio since 2011.

According to the latest forecast by the United States debt Management Office for annual public debt issuance in the United States in mid-2019:从2024At the beginning of the year when the basic deficit is reduced to zero, all the funds raised from the newly issued public debt in the United States will be used to pay the net interest on existing debt.With sizes ranging from $700 billion to $1.2 trillion or more. This fragile fiscal foundation makes it unrealistic for the United States to further stimulate the economy through radical fiscal policy.

4.3 The degree of cooperation of Congress under "political polarization" will limit many rescue policies, including finance.

More importantly, as we have analyzed in detail in the report "what impact Sanders' Breakthrough will have on the US economy", the rise of radical politicians has made it more difficult to put the above fiscal policy propositions into practice in the short to medium term under the "political polarization" of the United States-the growing division and hostility between the democratic and Republican parties, as well as the growing polarization between the rich and the poor.

Just as after the first circuit breaker of US stocks triggered by the US epidemic on March 8, the White House has begun to discuss a "coronavirus response plan", including a phased reduction of the $1.1 trillion payroll tax rate to zero this year. However, by the unanimous opposition of Democratic House Leader Pelosi and Senate Leader Schumer, the final compromise response plan was launched on March 14, but the tax reduction plan has been abandoned. In the foreseeable future, we believe that the House of Representatives controlled by the Democratic Party may approve relief bills directly related to the epidemic, but tax cuts and major infrastructure related to economic stimulus itself may be difficult.

Referenc1929According to the historical experience of the Great Depression, in the process of the spread of the crisis, the degree of cooperation of Congress is not only reflected in the restriction of fiscal expenditure, but also on the loosening of monetary policy and capital controls, especially after the debt crisis. the bailouts of systemically important institutions will have an important impact.In October 1932, the Democratic-controlled Congress denounced the rebuilding Financial Corporation as a "tool for wealthy bankers" because it rescued the Central Republican Trust Company, which was headed by its former chairman. It was ordered that "rebuilding financial companies must publish the names of loan rescue institutions." In effect, this means that financial institutions must publicly admit that they are in trouble before they can be bailed out. The introduction of this law accelerated the run on depositors and reduced the frequency of bailouts and was an important driver of the extreme deterioration of the economy in the second half of 1932.

Within the first week after Roosevelt took office, Congress quickly passed the Emergency Banking Act of 1933, which allowed virtually any systemically important bank to borrow from the Federal Reserve against any asset. The Fed has also been granted "money printing authority" beyond the restrictions on the gold standard. This is considered the most important measure to end the vicious cycle of the Great Depression.

Based on this experience, it is not only because of congressional constraints in this election year that it is difficult for the Trump administration to introduce more targeted unconventional measures to stop the crisis from spreading further. Moreover, taking into account the increasing gap between the rich and the poor in the US residential sector and the catalysis of the epidemic, more radical politicians may occupy more seats in this year's congressional re-election, as well as the relative lack of "personal charisma" of Democratic presidential candidate Joe Biden. This means that even if Biden becomes the new president of the United States, or even if the Democratic Party ostensibly controls both the Senate and the House of Representatives, due to the rise of radical forces in the Democratic Party, it will also impose obstacles for the new US government to rescue important financial institutions in the future.

In short, the "unbearable weight" of the Fed and finance limits the scope for further stimulus. At the same time, the "political polarization" of the two parties and the rise of radical forces in Congress also make the introduction of subsequent economic policies "difficult".

Fifth, fatalism and resistance: from1929On the deductive Rhythm of the risk of American stocks in the five stages of the Evolution of the crisis in 2000

While discussing the fragility of the balance sheet of American enterprises, residents and government under the low interest rate environment, we look forward to the possible deductive process of this round of US stock risk. Here we still use the Great Depression of 1929 as a model. The reason why we chose the "Great Depression" as a template is that there are many similarities between the technical aspects of US stocks, capital, valuation, debt of enterprises and residents, and crises such as 1929. During the relatively long evolution time of the Great Depression in 1929, the transmission process, market reaction and policy resistance of the successive bursting of various asset bubbles were interpreted incisively and vividly, which can be called the "model" of debt crisis research.

5.1 The five Evolutionary stages of the Great Depression and the quarterly rebound under policy resistance

First of all, on the whole, the 1929 crisis did not happen overnight, but was actually divided into"liquidity crisis under leverage stampede——Economic downturn and run on financial institutions caused by debt default——Populism and the return of dollars have triggered foreign debt crises such as Germany.——Sterling selling crisis and Dollar crisis caused by abandoning the Gold Standard——Rebuilding the financial company bailout scandal and the fiscal austerity crisis, that is, the five stages of the gradual bursting of the global asset bubble.At each stage, the Dow fell by about 50 per cent, with the Dow falling from a peak of nearly 400 in 1929.09 to less than 50 at the end of 1932, an overall drop of 90 per cent.

But we need to emphasize in particular thatEven so, the "unprecedented" crisis, the resistance of policies, the inertia of the economy and the "marginal thinking" that exaggerates the effectiveness of short-term policies in the investor's mode of thinking have all created an average increase between each crisis.30%The five-round quarterly rebound.It's just that after each rally, investors eventually find that policy is not strong enough to offset the continued deterioration in economic fundamentals, triggering a sharper decline after exploding new risks.

5.2 The current stage of the US stock market crisis: the middle and later stages of the first round of liquidity crisis

How will this crisis be interpreted in the future? In contrast to the 1929 crisis, we believe thatIt may be in the middle and later stages of the first liquidity crisis, that is, the equivalent of the Great Depression.1929年10-11Around the middle of the month.

In the first phase of the 1929 crisis, the market experienced several "black week ×" declines of more than 10 per cent a day because of liquidity crises caused by a trampling of leveraged funds and a series of unwinding of positions. During this period, despite the Fed's interest rate cut (6% to 5%), liquidity injection ($100 million) and a number of short-term one-day rebounds triggered by spontaneous buybacks and disk protection by entrepreneurs' associations, the overall decline was still close to 50%. But then, from January to April 1930, u.s. stocks ushered in the first round of sharp rebound, which lasted more than a quarter and rose nearly 48%.

The core reason for the rebound lies in the resolution of the liquidity crisis and the phased change of market pessimistic expectations under continuous policy stimulus.Including: at that time, based on past experience (recessions of 1907 and 1920), investors thought that the decline in US stocks by 50% was basically adjusted; the liquidity crisis was gradually resolved under the continued easing of the Federal Reserve; and the short-term resilience of economic data and the continuous stimulus of fiscal policy turned investors' expectations for the future economy from recession to recovery.

At present, US stocks have fallen by more than 30%, surpassing any adjustment since the 2008 financial crisis; at the same time, the overall apparent valuation of US stocks has returned to the historical median; the continuous injection of liquidity by the Federal Reserve and 150bp interest rate cuts have helped to resolve short-term liquidity; after the US government declared a state of emergency and other measuresIf there is an inflection point in the new cases of the US epidemic, US stocks may rebound in the short term.

But even if the market rebounds to a certain extent, or even a strong rebound, it does not mean the resolution of systemic risk, on the contrary, the risk of a greater depression may be brewing.

The impact of fluctuations in US stocks on the real economy is generally gradually reflected by a lag of half a year. At the same time, with the deterioration of the credit environment and the gradual evolution of the debt crisis, the market will often fall into the main decline.Since the second half of 1930, the economy continued to weaken after the policy stimulus, with industrial production falling by 17.6%, department store sales down by 8%, and investors'"illusion of recovery" disillusioned. At the same time, pillar industries such as the railway industry have suffered from deteriorating credit conditions and a large amount of debt cannot be rolled over. By October 1930, the stock market had hit a new low.

CorrespondinglyThis round of debt problems in the US corporate sector under low interest rates are reflected not only in rising buybacks, but also in the rapid increase in high-yield bond financing in key industries such as shale oil. It is expected that after the third or fourth quarter of this yearWith the gradual emergence of the impact of US stock volatility on the real economy, and the medium-and long-term damage to global demand and circulation under the "COVID-19 epidemic", the maturity peak of high-yield bonds is superimposed.At that time, companies in related industries in the United States will default on their debts, and even the financial institutions that hold relevant debts will have a repayment crisis, which will have a new impact on the global capital markets.

VI. The essence of this crisis: the "triple circular collapse" of the balance sheets of American residents, enterprises and the government.

To sum up, the surface of this round of US stock crisis is: under the impact of the "COVID-19 epidemic", the liquidity crisis caused by the concentration of leveraged funds which has tended to the extreme value "trampling" has triggered a "mean return" of valuations of US stocks at historic highs.

And behind it is:In the low interest rate environment of the Federal Reserve over the past decade, there has been a concentrated outbreak of vulnerability risks accumulated by the balance sheet expansion of American companies, residents and governments and a reversal in the direction of the wealth cycle.

As far as American companies are concerned, the huge amount of borrowing is not used to enhance the endogenous growth capacity of output and R & D, but to buy back shares to "whitewash profits" and boost stock prices, thereby increasing the capital gains of management and investors. and create a wealth effect. Once the cash flow is hit and the number of repurchased shares decreases, it is very easy to trigger a "reverse cycle". Because this round of enterprises mainly through borrowing to buy back their own shares to add leverage, and this way will increase liabilities while reducing net assets, thus making the enterprise asset-liability ratio rise rapidly. Under the impact of the crisis, it will increase the possibility of corporate debt default.One of these17-19High position cost plus high interest cost of the "peak of the bull market"1.9The debt formed by trillion-dollar buybacks may become an important "fuse" for the follow-up crisis.

At the same time, the financing scale of high-yield bonds carried out by industries such as energy is large and the cash flow coverage is insufficient. The epidemic will not only have a direct impact on demand, but also impact risk appetite and widen credit spreads step by step, thus increasing the financing difficulties of the above-mentioned enterprises.And further aggravated2020-22Repayment pressure under the peak maturity of annual high-yield bonds.

As far as the US residential sector is concerned, on the one hand, the proportion of US residents' wealth and pensions in the stock market has also tended to an all-time high. The US stock market has fallen by 30%, which means that the lifetime wealth has shrunk by 30%, which will have a huge impact on consumption. On the other hand, the aggravation of the gap between the rich and the poor in the United States under the "buyback feast", especially the continuous increase and rigidity of the proportion of education and health care in income, while forcing residents to further redeem stock assets and increase market selling pressure.It also increases the chances that radical politicians will win this year's congressional elections, which in turn will limit the government's bailout policies.

As far as the US government is concerned, the Fed is already in the zero interest rate range and the amount of asset purchases means that interest rate cuts and the effectiveness of QE are diminishing. If the crisis spreads further, there may be an urgent need for the Fed to launch a third monetary policy, the monetization of fiscal deficits, to ease the spread of the crisis. However, the high US fiscal deficit and debt interest payments limit the room for fiscal policy, and the "political polarization" of the two parties and the rise of radical forces in Congress also make it difficult to introduce subsequent economic rescue policies.

The "collapse" of the balance sheets of the above three major sectors of the United States tends to be cause and effect, accelerating the cycle and constantly triggering new crises.

From the perspective of the evolution of the crisis, with reference to the Great Depression of 1929, the crisis did not happen overnight, but experienced five stages of the gradual bursting of the global asset bubble.Between each stage, policy resistance and investors' magnification of short-term factors have created an average of nearly30%Five rounds of quarterly reboundAfter each rebound, the further deterioration of economic fundamentals and the detonation of new risks will lead to a new wave of more violent declines.

Us stocks may be in the middle and later stages of the first round of liquidity crisis.After the emergence of a new inflection point of the epidemic in the United States, there may be a medium-and short-term stabilizing rebound. But after the third or fourth quarter of this year, when the stock market volatility is transmitted to the entity, there may be an economic downturn and the accompanying high-yield bond repayment crisis.

All in all, we recommend that for capital market investors:

On the one hand,Great attention should be paid to the possibility of triggering systemic risks in US stocks and even around the world.The liquidity crisis in US stocks under the impact of COVID-19 's epidemic may only be "the first domino that falls". Do a good job in response to the plan in advance (such as: relatively balanced allocation and fixed position management), prepare in advance, and be more vigilant against the "bull market restlessness" in the phased rebound of the market.

On the other hand, there must beBottom line thinkingEven in the 1929-style Great Depression, policy resistance will still lead to a quarterly rebound, and the market will still have a structural opportunity to dare to lay out high-quality companies with obvious "wrong" valuations at the bottom of the market.

Risk hint:

The COVID-19 epidemic is still intensifying in the summer and the global spread is much higher than expected; the intensification of friction between China and the United States has reduced international cooperation.

Edit / emily