Xpeng Motors released its Q4 2024 Earnings Reports yesterday. The reports show that

Revenue: Q4 2024 revenue was 16.11 billion yuan, a year-on-year increase of 23.4% and a quarter-on-quarter increase of 59.4%; of which auto sales revenue was 14.67 billion yuan, a year-on-year increase of 20.0% and a quarter-on-quarter increase of 66.8%. Total revenue for the entire year of 2024 was 40.87 billion yuan, a year-on-year increase of 33.2%.

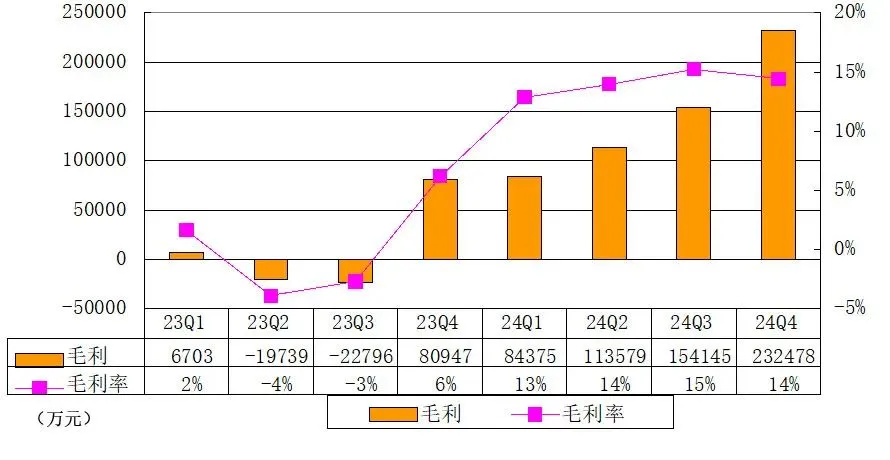

Gross Margin: The overall gross margin for Q4 2024 was 14.4%, significantly up from 6.2% in the same period of 2023; the auto gross margin increased to 10%, a significant increase from 4.1% in the same period of 2023, with Q3 being 8.6%. The overall gross margin for the entire year of 2024 was 14.3%.

Expenses: Expenses for Q4 2024 were 4.28 billion yuan, an increase of 32% from 3.244 billion yuan in the same period last year; of which R&D expenditure was 2.01 billion yuan, a year-on-year increase of 53.4%, with Q3 being 1.63 billion yuan; sales, general and administrative expenses were 2.28 billion yuan, a year-on-year increase of 17.5%, with Q3 being 1.63 billion yuan.

Net Loss: The net loss for Q4 2024 narrowed to 1.33 billion yuan, while the net loss was 1.35 billion yuan in the same period of 2023, and the net loss for Q3 was 1.81 billion yuan; the adjusted net loss for Q4 2024 narrowed to 1.39 billion yuan, compared to an adjusted net loss of 1.77 billion in the same period of 2023, and the adjusted net loss for Q3 was 1.53 billion yuan.

Delivery volume: In Q4 2024, the delivery volume of Autos was 91,507 units, a year-on-year increase of 52.1%; the total delivery volume of Autos for the year 2024 was 190,068 units, a year-on-year increase of 34.2%. Delivery volume in January and February 2025: January delivered 30,350 units, February delivered 30,453 units, accumulating 60,803 units for the year.

Sales Network: As of December 31, 2024, there were a total of 690 stores covering 226 cities. Charging Network: There were 1,920 self-operated charging stations, including 928 fast charging stations.

Cash reserves: As of December 31, 2024, cash and cash equivalents, restricted cash, short-term investments and time deposits amounted to 41.96 billion yuan (5.75 billion USD).

Since the beginning of the year, Xpeng Motors' stock price has been continuously strong. After the release of the Earnings Reports, $XPeng (XPEV.US)$the stock price fell back, closing down 7.82% on the day at $22.64, with an increase of over 91% year-to-date.

1. Xpeng's overall gross margin has significantly rebounded year-on-year, and the gross margin of Autos has once again reached double digits.

Xpeng Motors' gross profit for the fourth quarter was 2.325 billion yuan, with a gross margin of 14.4%, compared to 6.2% in the same period of 2023, exceeding Bloomberg's expectation of 13.6%, but slightly down from 15.3% in the third quarter.

It is noteworthy that Xpeng Motors' gross margin for Autos in the fourth quarter of 2024 (i.e., the percentage of gross profit from Autos sales to the revenue from Autos sales) will return to double-digit growth at a profit level of 10%, significantly up from 4.1% in the same period of 2023, and increasing by 1.4 percentage points compared to 8.6% in the third quarter, also better than Bloomberg's expectation of 9.4%.

This still reflects the significant improvement in Xpeng's cost reduction capabilities, mainly due to substantial improvements in its supply chain management.

Technology + supply chain cost reduction: Xpeng Motors has maintained a double-digit gross margin level for whole vehicles while implementing a strategy of price reduction, reflecting breakthrough improvements in the efficiency of its supply chain management.

"Exchange price for volume": Xiaopeng's low-price strategy significantly enhances the cost-performance ratio of its products. Through the strong sales of two models, P7+ and M03, in Q4, it not only achieved a leap in sales volume but also brought down the fixed amortization costs.

The phenomenon of price-volume divergence revealed by core data is worth noting: In Q4, Xiaopeng's average selling price per car decreased by nearly 0.03 million yuan to 0.16 million yuan, lower than the market expectation of 0.167 million yuan and Xiaopeng's guidance of 0.162 million yuan (implied unit price guidance of revenue guidance), and it is expected that the implied unit price of revenue guidance will further drop to 0.15 million yuan in Q1 this year. However, the gross margin of the Autos rose against the trend to 10%, indicating that after sharing various manufacturing costs, Xiaopeng's economies of scale have become evident, starting a virtuous cycle.

Additionally, the manufacturing cost per car for this quarter decreased to 0.1442 million yuan. Despite pressure on the revenue side, it maintained a gross profit of 0.016 million yuan per car, demonstrating the effect of unit cost dilution. Xiaopeng's Chairman He Xiaopeng mentioned at the Earnings Conference that through improved operational capabilities, cost-reducing technologies, and greater economies of scale, the gross margin of the Autos is expected to continue improving this year.

In the area of services and other income, Xiaopeng's revenue from this business in 2024 is expected to be 5.04 billion yuan, a year-on-year increase of 89%. This is attributed to the collaboration with the Volkswagen Group in areas such as platform and Software technology research services as well as electrical and electronic architecture, resulting in increased revenue from relevant technology research services.

The gross margin for this business in Q4 was 59.6%, far exceeding the overall gross margin of 14.4% in the same period, which was 38.2% in 2023 and 60.1% in Q3; therefore, the significant year-on-year growth in Xiaopeng's overall gross margin is also attributed to the high gross margin of this business.

On January 6 of this year, Xiaopeng Motors and Volkswagen Group (China) announced the signing of a memorandum of understanding to engage in strategic cooperation on China's ultra-fast charging network. According to the memorandum, Xiaopeng Motors and Volkswagen Group (China) will work together to build one of China's largest ultra-fast charging networks.

It should be noted that the overall gross margin in Q4 declined by 0.9 percentage points to 14.4%, mainly because the proportion of low gross margin car revenue increased significantly while the proportion of high gross margin service revenue decreased. Therefore, simply focusing on the overall gross margin indicator is not very meaningful; attention should be paid to the improvement of gross margin in Autos.

2. Deliveries set a new high but the guidance is tepid; will the profitability turning point be achieved by the end of 2025.

According to the announcement from Xpeng Motors, the total delivery volume in the fourth quarter of 2024 was 91,507 units, a year-on-year increase of 52.1%, setting a new historical high for single-quarter deliveries, exceeding the delivery guidance upper limit of 87,000 to 91,000 units for the fourth quarter. Xpeng Motors achieved an average monthly delivery of over 30,000 units in the fourth quarter, breaking the milestone of 90,000 units in a single season.

For the first quarter of 2025, Xpeng Motors' sales guidance is mediocre, with total delivery expected to be between 91,000 and 93,000 units, a year-on-year increase of approximately 317%-326.2%. Breaking down the data, cumulative deliveries from January to February were 60,803 units (30,350 in January and 30,453 in February), implying a March delivery of approximately 30,000-32,000 units, only a slight increase of about 2,000 units month-on-month.

This guidance is slightly conservative compared to market expectations, especially in the context of the launch of the all-new G6/G9 models, raising concerns about whether the sales momentum of P7+ and MONA M03 can continue. He Xiaopeng mentioned that the G6 is expected to start deliveries only after the 21st, but there was no guidance on orders for the two best-selling models P7+ and M03 in this conference call.

He Xiaopeng also mentioned that the delivery of the all-new G6 is planned to start on March 21, and will work with the supply chain to fully enhance production capacity to allow more users to pick up their cars as soon as possible. Following this, Xpeng's MONA M03 Max, G7, X9, etc., will welcome the new Max versions or facelifts.

He Xiaopeng reiterated at the earnings conference that Xpeng Motors will be profitable in the fourth quarter of this year. According to people in the New Energy Industry analyzing the Earnings Reports, Xpeng still needs more time to achieve GAAP-level revenue and expense balance. To achieve this by the end of 2025, at least three conditions must be met:

Deliveries in 2025 must exceed 400,000 units, which is more than double the total sales in 2024. Currently, the MONA series is taking on the heavy responsibility of volume; however, the profit margin in the 150,000 yuan market is inherently limited and needs synergy from overseas markets (especially Europe with right-hand drive models) to fill the profit gap.

The gross margin for Autos must be maintained above 10%: Xpeng's gross margin for Autos just reached 10% in Q4 2024, but if the MONA series accounts for half of the sales in 2025, it may lower the overall gross margin. Countering this would require technical licensing income and high stock price strategies abroad.

Controlling costs: In 2024, the combined R&D and sales expenses reached 13.3 billion yuan, accounting for 32.6% of total revenue. If revenue doubles to 80 billion yuan in 2025, these two expenses must be kept below 20% growth, which means that platform-based manufacturing and the reform from direct sales to agency channels must show results.

If these three goals are achieved, Xpeng may reach profitability by the end of 2025; on the contrary, if technological investments do not yield market premiums, the larger the scale, the more losses may occur.

Three, significant increase in research and development, and sales administrative expenses.

Xpeng Motors' losses in the fourth quarter improved, with a net loss narrowing to 1.33 billion yuan (compared to 1.81 billion yuan in the same period of 2023), and an adjusted net loss narrowing to 1.39 billion yuan (compared to 1.53 billion yuan in the same period of 2023), mainly due to a significant increase in R&D and marketing costs.

In terms of sales administrative expenses, Xpeng Motors' Q4 sales costs were 2.275 billion yuan, compared to 1.937 billion yuan in the same period of 2023, and 1.633 billion yuan in Q3.

The significant increase in sales administrative expenses is one reason for the drag on Xpeng's adjusted operating profit, while the increase in sales costs is due to the expansion of dealer stores in preparation for the downward adaptation of vehicle model structure. To deepen channel reform, Xpeng Motors is accelerating the implementation of the 'Jupiter Plan' to enhance the dealer ratio, transitioning from a direct sales model to a dealer model. The transition to Xpeng's dealer model requires increased commissions paid to franchise stores, resulting in sales and administrative expenses exceeding market expectations by about 0.5 billion yuan.

As of December 31, 2024, Xpeng Motors' sales network continues to expand, with a total of 690 stores covering 226 cities; at the same time, Xpeng's self-operated charging station network further expanded to 1920 charging stations, including 928 ultra-fast charging stations for the Xpeng S4 and S5.

In terms of R&D expenses, Xpeng Motors' Q4 R&D costs were 2.006 billion yuan, compared to 1.308 billion yuan in the same period of 2023, and 1.633 billion yuan in the third quarter. Xpeng's R&D expenses are mainly invested in AI and new model development:

In terms of AI, Xpeng Motors builds a technological moat with fully self-developed algorithms at its core, and its intelligent driving system has achieved a disruptive iteration of the algorithm architecture, fully turning to an end-to-end pure visual perception architecture. The P7+, G6, and G9 series models equipped with the 'AI Eagle Eye Vision' solution have achieved a 50% reduction in autonomous driving hardware costs through deep optimization of neural network models. This technological breakthrough not only brings high-level intelligent driving functions down to the 0.15 million yuan price range for the first time but also promotes the democratization process of intelligent driving technology and reconstructs the market pricing system.

In terms of new models: 2025 is set to be a significant year for Xpeng Motors, requiring continuous investment in the research and development of new models and facelifts. Unlike previous years' minor updates, this year’s Xpeng G6 and G9 have substantial upgrades, especially in critical areas like smart driving + range (800V + 5C fast charging) + chassis optimization.

Fourth, Xpeng's "three growth curves," will launch L3-level autonomous driving in the second half of the year.

Facing the future market, He Xiaopeng shared Xpeng's "three growth curves" during the earnings conference call: AI + Autos, expanding from China to the global market, humanoid robots, and deeper integration with the automotive industry.

He Xiaopeng pointed out that the L3 autonomous driving capability will be improved "tenfold to several dozen times" compared to L2. Xpeng's closed-loop capability, which is fully self-developed—including cloud models, onboard systems, data iteration, chip optimization, and cost control—has already formed significant technological barriers. Through multi-domain integration (such as horizontal integration of smart driving with cabin, chassis, and power) and an efficient data iteration system, Xpeng is expected to widen the gap with followers after the popularity of L3.

Regarding the globalization layout, He Xiaopeng revealed that Xpeng products have entered over 30 countries globally, ranking among the top three in electric vehicle sales in some markets. In 2024, it will accelerate overseas expansion: the number of stores will double to over 300, nearly doubling the countries covered, while also exploring local production in places like Indonesia and planning to establish overseas R&D centers to attract local talent. He set a sales target for Xpeng of 50% coming from domestic and overseas markets by 2030.

For flying cars and humanoid robot businesses, He Xiaopeng emphasized the value of technology reuse and ecological synergy. He revealed that Xpeng's physical world model for autonomous driving and the action model for humanoid robots are highly homologous, and data and AI development capabilities can be shared. Flying cars and robots will also share a global sales network and production resources. He stated, "By 2026, our flying cars, and even our humanoid robots, will begin mass production to some extent, and we believe we are one of the first companies in China and even globally to start mass production."

Since the beginning of this year, the AI craze has ignited the capital markets, creating investment opportunities in the smart driving sector. As driver assistance technology becomes more widespread in China, the recent entry of Tesla's FSD into China has added fuel to the competition in smart driving. On February 10, electric vehicle manufacturer BYD officially launched the advanced smart driving system "Eye of the God," which will cover all models, with 21 models set to be launched first, covering the 0.07 million to 0.2 million range, exceeding market expectations.

On the same day, Xpeng Motors founder He Xiaopeng announced plans to launch L3-level autonomous driving later this year. Level 3 autonomous driving allows drivers to not closely monitor road conditions under specific conditions (such as specific roads, speeds, and times).

He Xiaopeng stated at the 2024 Earnings Conference that the upcoming MONA M03 Max model will lower the threshold for urban AI smart driving to the level of 0.15 million for the first time. He emphasized that Xiaopeng Motors is advancing the development of smart driving technology that does not rely on high-precision maps and Lidar; currently, only Tesla and Xiaopeng are focusing on this technology globally.

He Xiaopeng mentioned that Xiaopeng trained a cloud-based model with hundreds of billions of parameters, using hundreds of millions of kilometers of real driving data for pre-training. Based on this, Xiaopeng improves the model's generalization ability and the ability to handle long-tail scenarios through reinforcement learning, and deploys it on-car with distillation, pruning, and Algo techniques, achieving more than double the model's accuracy.

He Xiaopeng believes that AI will drive significant changes in the Automotive Industry, accelerating the realization of L3-level automated driving and L4-level Self-Driving Cars. In the second half of this year, Xiaopeng will be the first in China to achieve L3-level smart driving software capabilities and experiences. By 2026, Xiaopeng will also scale mass-produce models supporting L4-level Self-Driving Cars in low-speed scenarios. Additionally, this year, Xiaopeng will scale mass-produce its self-developed Turing chips, which can be applied to Autos, flying cars, and humanoid robots, and also facilitate rapid global deployment across all scenarios.

Five, Valuation and Risks.

Xiaopeng Motors P/S.

As of now, Xiaopeng Motors has a total market value of approximately 21.5 billion USD, with a P/S ratio of about 3.6 times. This multiple is significantly higher than its peers, reflecting the market's high expectations for Xiaopeng's CSI Leading Technology Index and sales elasticity. If the sales of new models are not strong in the future, there will be a substantial risk of pressure on the valuation.

Risks and Challenges for Xiaopeng Motors.

Profit Pressure: Xiaopeng Motors reported a net loss of 1.33 billion yuan in Q4 2024, and its gross margin still ranks low among new energy vehicle companies.

Increased competition risk: Competing products like Xiaomi SU7 and BYD Han are squeezing the price range of 0.1-0.3 million yuan, and Tesla's FSD entering China may impact the self-driving subscription model.

Global challenges: The NPS (net promoter score) in the European market is lower than that in the domestic market, and localization adaptation and brand recognition still need breakthroughs.

Policy risk: The EU's new battery law implementation may increase overseas costs, and the limitations of the US IRA Act tax credits affect localized capacity layout.

Editor/jayden

Comment(2)

Reason For Report