Since the beginning of this year, Southbound funds (North Water) have continuously flowed into Hong Kong stocks, and this wave of enthusiasm has not changed due to the high-level fluctuations in the Hong Kong stock market; instead, it has been increasing in buying.

Wind data shows that as of March 17th, the net amount of Southbound funds bought this year reached 386.016 billion Hong Kong dollars, more than five times that of the same period last year. Among them, the net inflow for the month of February reached 152.778 billion Hong Kong dollars, setting a new high since January 2021; on March 10th, the net amount of Southbound funds bought in a single day reached 29.626 billion Hong Kong dollars, breaking the previous high since the opening of the interconnection mechanism.

From the trend of 'North Water buying up', the domestic capital's significant net purchases are mainly distributed at both ends of the 'barbell' - Technology and high dividends.

First, after the Spring Festival, driven by the DeepSeek effect, the market experienced a strong technology market. In the Technology Sector, the top five individual stocks $BABA-W (09988.HK)$ 、 $TENCENT (00700.HK)$ 、 $SMIC (00981.HK)$ 、 $KUAISHOU-W (01024.HK)$ $XIAOMI-W (01810.HK)$ And $LI AUTO-W (02015.HK)$ Become the top 6 technology stocks bought by North Water.

First, after the Spring Festival, driven by the DeepSeek effect, the market experienced a strong technology market. In the Technology Sector, the top five individual stocks $BABA-W (09988.HK)$ 、 $TENCENT (00700.HK)$ 、 $SMIC (00981.HK)$ 、 $KUAISHOU-W (01024.HK)$ $XIAOMI-W (01810.HK)$ And $LI AUTO-W (02015.HK)$ Become the top 6 technology stocks bought by North Water.

Secondly, the significant Inflow of northbound capital this year has driven up sectors such as Technology and dividends. Insurance stocks. $ICBC (01398.HK)$ 、 $CCB (00939.HK)$ , communication operators. $CHINA MOBILE (00941.HK)$ 、 $CHINA UNICOM (00762.HK)$ Energy giants $CHINA SHENHUA (01088.HK)$ and Insurance $PING AN (02318.HK)$ are the income stocks favored by southbound funds.

So how much more capital will flow into Hong Kong stocks from the southbound funds? According to China International Capital Corporation's estimates, the space for various types of investors in southbound funds to flow into Hong Kong stocks is approximately 600-800 billion Hong Kong dollars.

Northern water 'Technology stocks + Income stocks' are all needed.

After the Spring Festival holiday, there has been a "strong and rapid" net inflow of Southbound capital. The AI Sector has become a significant consensus among Southbound capital and foreign investment in this round of market trend, with Southbound capital significantly increasing its allocation in the "AI+" sector represented by Specialty Retail, Autos, Biotechnology, Software, Telecommunications, and Semiconductors. Among these, the constituents represented by the Hang Seng TECH Index occupy the majority. As of the market close on March 18, this year has seen $Hang Seng TECH Index (800700.HK)$ A cumulative increase of over 36%.

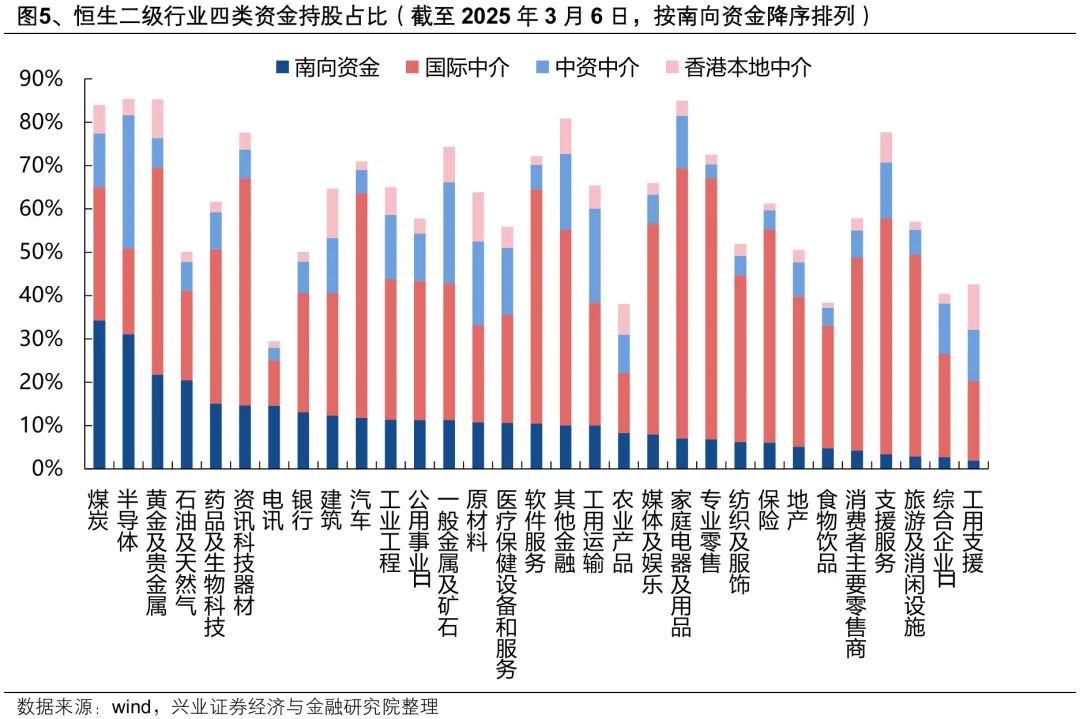

On the other hand, southbound funds continue to flow into the value dividend sector represented by Banks, Public Utilities, and Insurance. Among the various industries in the Hong Kong stock market, southbound funds have greater pricing power in high-dividend sectors and some Technology sectors.

According to analysis by Huaan Fund, the emergence of DeepSeek has driven a reshaping of valuations in China's AI Industry Chain, and since Hong Kong stocks have a higher AI content, they have significantly outperformed A-shares recently, leading the Global market. Coupled with the overall valuation cost-effectiveness of Hong Kong stocks, domestic and foreign capital is accelerating its inflow into Hong Kong stocks, also driving the rise of sectors like Technology and beyond.

It is worth noting that since the beginning of the year, insurance capital has frequently been buying up Bank stocks and has continued to increase Shareholding after taking stakes, attracting market attention.

A person from the relevant business department of Ping An Asset Management indicated that insurance capital favors Bank stocks, partly due to the significant advantage of dividend yield in Bank stocks. On the other hand, under the new accounting standards, the advantage of dividends being able to enter the profit statement can serve as a performance stabilizer.

From the perspective of the Banks themselves, the advantage of dividend yield in Bank stocks is significant, as the dividend yield of state-owned large banks in the Hong Kong stock market is notably higher than that of their A-share counterparts. According to estimates by the team of Wang Xianshuang from China Merchants Securities, as of February 27, 2025, the average dynamic dividend yield of the six major state-owned banks' H shares is 5.71%, which is 1.02 percentage points higher than the average dynamic dividend yield of 4.69% for corresponding banks in A-shares.

Additionally, the recent "Special Action Plan to Boost Consumption" proposed encouraging Financial Institutions to increase the issuance of personal consumer loans, and providing financial subsidies for qualifying consumer loans, indirectly enhancing market expectations for economic recovery, giving Bank stocks an opportunity for valuation recovery.

Western Securities indicated the two main allocation lines for mid-to-short-term bank stocks: the release of retail bank resilience under consumption-driven expectations, focusing on quality regional banks and those in debt improvement areas; attention to Hong Kong-listed banks that are undervalued with solid fundamentals and high dividend cost-performance, as there is still a net inflow of long-term funds.

Contend for pricing power! How much more capital will Northbound funds flow into Hong Kong stocks?

Southbound funds are one of the main driving forces for the current bull market in Hong Kong stocks, and since the beginning of this year, the correlation between A-shares and Hong Kong stocks has significantly increased. Under the strong drive of the Hong Kong stock Technology sector, the A-share TMT sector has also risen, as domestic capital seeks to seize pricing power in Hong Kong stocks.

However, China International Capital Corporation stated that the Southbound pricing power is reflected in Small Cap stocks and dividend stocks, which are phase-specific and localized, and may further strengthen with the increase of Southbound funds in the future.

Regarding future inflows of Southbound funds, China International Capital Corporation estimates that the space for various types of investors (insurance funds, public offerings, private placements, and individuals) to flow into Hong Kong stocks is approximately 600-800 billion Hong Kong dollars. Specifically looking at,

Insurance funds: If the allocation to Hong Kong stocks increases to 20% of equity investments, the space is approximately 300-350 billion Hong Kong dollars.

Private equity funds: If the proportion of allocation to Hong Kong stocks increases by 5%, the space is approximately 150-200 billion Hong Kong dollars.

Active equity mutual funds: If the allocation to Hong Kong stocks rises to 40-45%, the space is approximately 250 billion Hong Kong dollars.

For individual investors (mainly in ETFs): If the allocation ratio for Hong Kong stocks is increased by 5%, there is a potential space of about 250 billion Hong Kong dollars.

By summing the above four types of investors, China International Capital Corporation estimates that the inflow of southbound funds this year may reach 950 billion to -1.1 trillion Hong Kong dollars. After deducting the 375.5 billion Hong Kong dollars that have already flowed in since the beginning of the year, the corresponding incremental space is about 600 to 800 billion Hong Kong dollars.

However, among these, except for the relatively certain long-term stable inflow of insurance funds, the inflow and speed of other types of funds are greatly affected by the market. Moreover, it is also difficult to assume a maximum allocation ratio, so the relatively certain incremental funds are around 300 billion Hong Kong dollars.

Looking ahead, exemptions on dividend taxes, lowering the threshold for individual investors, and including more symbols and products are expected to further increase the inflow of southbound funds.

![]() Understand the trends of northbound capital and stay updated on the latest investment trends! Market > Shanghai and Shenzhen Stock Connect >Hong Kong Stock Connect (Southbound)Additionally, there are several lists for you to choose from such as Top Gainers, Active Trading List, Hold Positions List, and Net Inflow List.

Understand the trends of northbound capital and stay updated on the latest investment trends! Market > Shanghai and Shenzhen Stock Connect >Hong Kong Stock Connect (Southbound)Additionally, there are several lists for you to choose from such as Top Gainers, Active Trading List, Hold Positions List, and Net Inflow List.

Editor/Rocky

首先是春节后,在DeepSeek效应带动下,市场走出了一波强势科技行情。科技板块中前五大个股

首先是春节后,在DeepSeek效应带动下,市场走出了一波强势科技行情。科技板块中前五大个股

Comment(4)

Reason For Report