This article is edited by China Merchants's "focus on domestic substitution of High-end Medical equipment".

Abstract: on March 2, General Secretary Xi inspected COVID-19 's scientific research work on prevention and control in Beijing, and proposed to speed up to make up for the shortcomings of China's high-end medical equipment, speed up the tackling of key core technologies, break through the bottleneck of technical equipment, and achieve self-control of high-end medical equipment. Judging from the experience of US stocks, the 10-fold share of innovative devices is far more than innovative drugs in the past decade. Hillhouse Capital, with the slogan "Chong Cang China", is also optimistic about the prospect of domestic medical devices.

1. The domestic demand for high-end medical devices is huge, and the domestic substitution is insufficient.

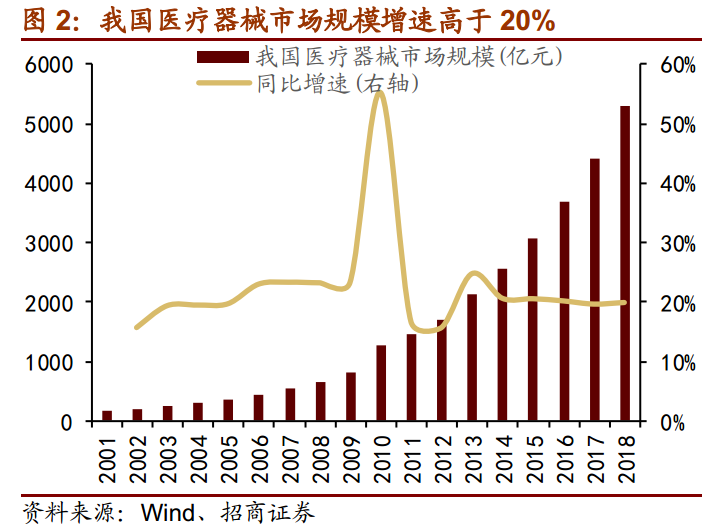

The demand for medical devices in China is huge, and the growth rate of the market scale is much higher than that of the whole world.From 2001 to 2018, the size of China's medical device market increased from 17.9 billion yuan to 530.4 billion yuan, with a compound annual growth rate of 22%, and still maintains a growth rate of nearly 20%. Compared with the global market, the growth rate of the global medical device market has slowed down significantly in the past eight years, with a growth rate of only 3-5%.

With the increase of national disposable income, the increase of medical demand brought about by the aging population, and the improvement of the coverage and depth of medical insurance, China's demand for medical devices will continue to increase, and the scale of the medical device market will further expand.

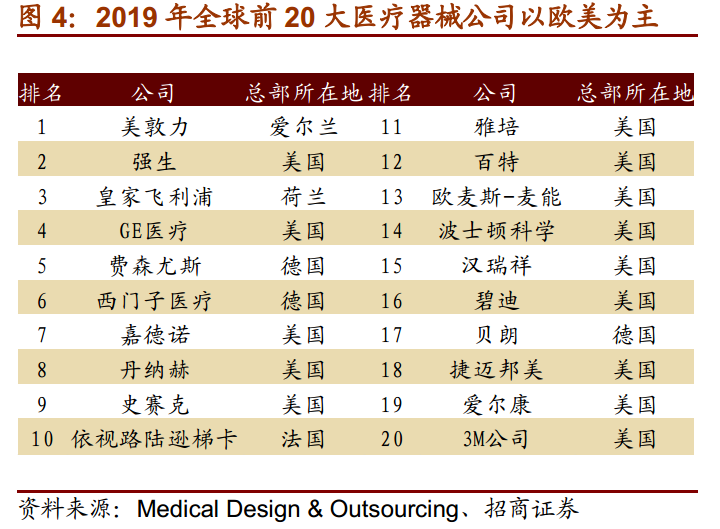

In terms of the market pattern, the United States and Europe dominate the global medical device market. In 2018, the United States accounts for 38.8% of medical device sales in various countries and regions, while Western Europe accounts for 30.8%, accounting for the vast majority, while China accounts for only 3.8%. The scale is still small.

According to the 2019 list of the top 100 medical device companies published by the medical device industry website Medical Design & Outsourcing, the top 20 medical device companies in the world are all from the United States and Europe. The development of Chinese medical device companies is relatively short, and their strength is not comparable to that of large pharmaceutical companies in the United States and Europe.

According to the division of Medical equipment Research Institute, medical devices can be divided into four categories: high-value medical consumables, low-value medical consumables, medical equipment and in vitro diagnosis.China's medical device market is dominated by middle and low-end products, while domestic substitution of high-end products is insufficient. From the sales of medical device segment in 2018, the middle and low-end medical devices account for the largest proportion, while high-value consumables and IVD account for only 20% and 11%.

From the import proportion of typical high-end medical devices, the imports of CT machines, ultrasound instruments, testing instruments, magnetic resonance equipment and other high-end medical devices all account for 80-90%, while domestic imports account for relatively low. at present, the domestic substitution of high-end medical devices is insufficient.

2. American stocks are 10 times higher than those of medical devices in 10 years.

Statistics show that in the past decade, there are far more ten-fold shares of innovative devices than innovative drugs in US stocks. From 2009 to 2019, US stocks gave birth to 14 tenfold pharmaceutical stocks with a market capitalization of more than US $10 billion, of which 8 were medical devices, 3 were innovative drugs and 3 were medical services. The analysis points out that the medical device patent-free cliff is better than biological innovation to create a new drug race track.What is the essential difference between innovative drugs and medical device business?

The market believes that innovative drugs essentially sell patents, while instruments sell complex precision manufacturing systems.

The reason why innovative drugs have high pricing power is that patents protect the corresponding molecular structures (chemical drugs) or amino acid sequence structures (biological drugs), which cannot be imitated by other pharmaceutical companies during the patent protection period. Once the patent expires (usually 20 years) and generic drug companies enter, the price of drugs belonging to this molecular structure or amino acid sequence will be greatly reduced as a result of competition, and generally speaking, the life cycle of the drug is almost over.

Because medical devices are interdisciplinary comprehensive products, the difficulty of imitation will be more complex than drugs. Compared with medicine leader Heng Rui and device leader Mindray, among the disciplines involved in the recruitment of R & D positions, medical devices involve many disciplines, while pharmaceutical companies mainly involve chemistry, molecular biology and other disciplines. The main production of hip prosthesis and knee prosthesis Aikang Medical and Chunli Medical, the production of products involved in mechanics, material science and other fields.

3. The layout of medical devices in Hillhouse

Hillhouse Capital, with the slogan "Chong Cang China", is also optimistic about the prospect of domestic medical devices.On February 24, Hillhouse issued a letter to entrepreneurs, officially announcing the establishment of a company focused on investing in early-stage start-ups.Ten billion Hillhouse Venture CapitalMainly focuses on venture capital in four areas: biomedicine and medical devices, software services and original technological innovation, consumer Internet and technology, emerging consumer brands and services.

At present, there are two main directions in the layout of medical devices in Hillhouse:

① orthopedic joint leader: Aikang Medical

Aikang Medical was founded in Beijing in 2003 and listed on the Hong Kong Stock Exchange in 2017. The company listed its first knee joint product in 2004, the first hip joint product in 2005, the first to introduce 3D printing technology for orthopedic implant research and development in 2009, and won China's first 3D printing metal implant registration certificate in 2015. After years of development, the company's product line has been continuously upgraded and enriched, and has grown into a leading enterprise of domestic joint implants, which can provide knee joint, hip joint, spine, bone tumor and personalized surgical tools.

② Heart Valve intervention: Kai Ming Medical, Peijia Medical (preparation for Hong Kong IPO)

According to Frost Sullivan statistics, Qiming Medical is the largest transcatheter heart valve medical device company in China, accounting for 79.3% of the market share of transcatheter aortic valve replacement (TAVR) in 2018. The company's R & D layout covers all over the world, including China, the United States, the United Kingdom, Israel and other places.

Many domestic industries learn from overseas leading companies, but they have just made a breakthrough in the valve industry abroad. Domestic and overseas medical device giants have developed synchronously, and the domestic market is blank without the suppression of overseas giants.At the same time, this field also benefits from aging, and Qiming Medical is likely to grow into a company with a market capitalization of hundreds of billions. Hillhouse Capital also invests in Peijia Medical through the primary market, and this company is immediately IPO in the Hong Kong market, which can be followed, and may also be an investment opportunity.

In addition to the above Hillhouse holding medical equipment cattle shares, Hong Kong stocks of Li medical equipment cattle stocks are:Chunli Medical, which is on the same track as Aikang Medical; the product layout involves minimally invasive medicine in many fields, such as cardiovascular intervention, heart rate management and so on.

Edit / jasonzeng