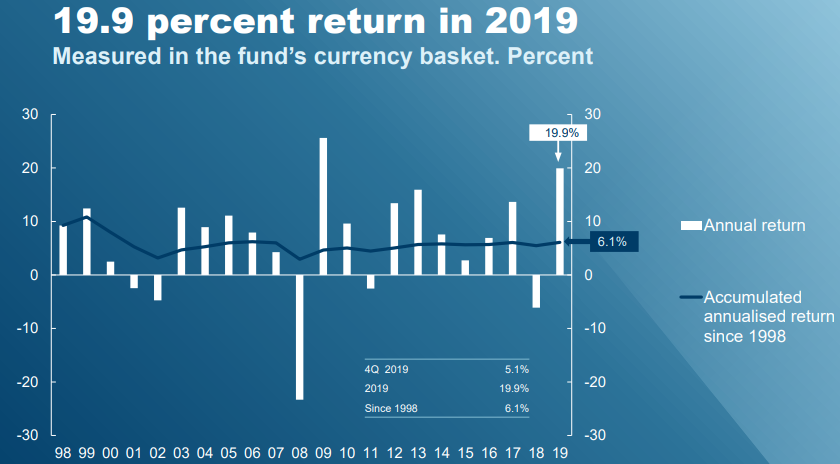

The Norwegian government global pension fund, the world's largest sovereign wealth fund, recently announced its investment results in 2019: the total assets of the fund at the end of the year are 10.09 trillion Norwegian kroner (about 7.53 trillion yuan); cumulative profits of 1.692 trillion Norwegian kroner (about 1.26 trillion yuan), a record high; full-year return of 19.9%The second highest in history。

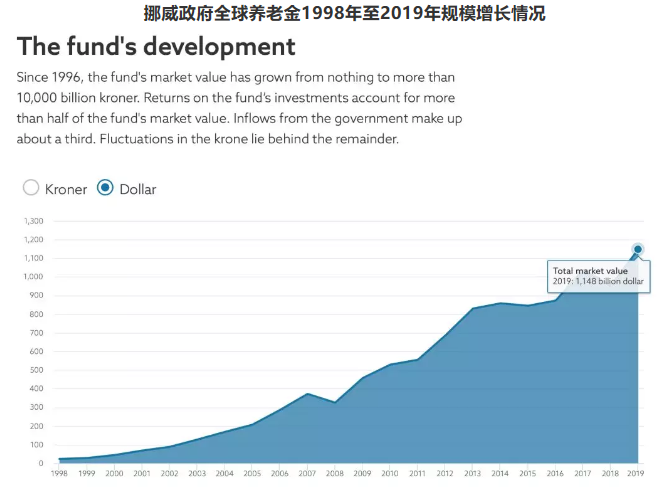

Since its establishment in 1996, the fund has grown from almost zero to more than $1 trillion in 2019.

Source: Norwegian central bank investment management company website

The fund invests 70.8 per cent in equity, 26.5 per cent in fixed income and 2.7 per cent in unlisted real estate. The return on equity investment is 26.0%. The return on fixed income investment is 7.6%, and that on unlisted real estate investment is 6.8%. The total return of the fund is 0.23 percentage points higher than that of the benchmark index.

Buy, love these stocks!

By the end of 2019, the largest equity investments of the Norwegian government's global pension fund were Apple Inc, Microsoft Corp and Google parent company Alphabet, respectively. Apple Inc, Microsoft Corp and Nestle made the greatest contribution to the performance. BABA and Tencent ranked 8th and 15th respectively, with positions of 51.992 billion Norwegian kroner (about 38.81 billion yuan) and 34.056 billion Norwegian kroner (about 25.422 billion yuan) respectively.

From the perspective of time dimension, the change in the investment focus of Norwegian global pension funds in the past decade also reflects the changes of the times and enterprises:

At the end of 2019, the top five major positions of the Norwegian global pension fund were:$Apple Inc (AAPL.US) $、$Microsoft Corp (MSFT.US) $、$Alphabet Inc-CL A (GOOGL.US) $、$ADR (NSRGY.US) $、$Amazon.Com Inc (AMZN.US) $The first three are all technology stocks.

At the end of 2009, the top five positions were:$HSBC Holdings PLC (00005.HK) $、Royal Dutch Shell-B (RDS.B.US) $、$BP P.L.C. (BP.US) $、$ADR (NSRGY.US) $、$TotalEnergies SE (TOT.US) $Three of them are oil and gas stocks.

And consumer goods stocks$ADR (NSRGY.US) $After ten years, he still has a "good heart".

Continue to increase positions in Chinese stocks!

It is particularly noteworthy that Chinese stocks account for the highest share of all emerging markets it invests, at 4.3 per cent, totaling 308.738 billion Norwegian kroner (about 230.346 billion yuan), up from 3.6 per cent at the end of 2018.

If companies from Taiwan, Hong Kong and the mainland are included, the Norwegian government's global pension fund has invested in more than 1400 Chinese companies! Among them, they are arranged according to the market value of their positions.There is no distinction between A shares and H shares, and the top 60 are:

BABA is one of the companies with the largest market capitalization.There is no BABA in the 2018 annual report and the top ten heavy stocks in the third quarter of 2019. Except for some traditional companies, Meituan (10th) and XIAOMI(第40)、 Pinduoduo(第99)And other emerging companies have also won the favor of the fund.

The industries of these more than 1400 companies include:

Industry (21.9%), such as Cheung Kong Hutchison,Sunny Optical, AAC Technologies Holdings Inc., etc.

Finance (16.9%), such as China Construction Bank Corporation,Ping An Insurance 、Industrial and Commercial Bank of China 、Hong Kong Exchanges and Clearing

Consumer goods (14.9%), such as Guizhou Moutai,Anta,Mengniu

Technology (14.9%), such as Baidu, Inc.,XIAOMI 、China Tower Corporation, etc.

Consumer services (9.5%), such as New Oriental Education & Technology Group,Vipshop Holdings Limited 、BABA Film,IQIYI, Inc., etc.

Basic materials (8.7%), such as Fosun,Jiantao laminate, Ganfeng Lithium, etc.

Health care (6.7%), such as CSPC Pharmaceutical、Wuxi Biologics 、Baiyunshan, etc.

Oil and gas (2.6%), such as CNOOC,Petrochina Chemical,Petrochina, etc.

Public utilities (2.6%), such as Hong Kong And China Gas, China Resources Gas, CGN Power Co.,Ltd., etc.

Communications (0.08%), such as China Mobile Limited Co., Ltd., China Unicom Hong Kong Co., Ltd., China Telecom Corporation Co., Ltd.

Some market participants have noticed that Rongchuang (50th), Country Garden Holdings (54th), Longhu (55th), Vanke (60th) and other well-known Chinese real estate enterprises are on the list, except for China Evergrande Group. Futu Information search Fund website disclosed data and found that, in fact,$China Evergrande Group (03333.HK) $It is also on the list of Chinese equities invested by the Norwegian government's global pension fund, but the market capitalization of its positions is at the bottom, ranking 124th.

A detailed list of investments can be found atNorwegian central bank investment management company websiteDownload "REPORTS".

Fund investment style prefers long-term holding and technology sector.

According to Societe Generale Securities report "20 years of Norwegian Sovereign Wealth Fund Investment", the Norwegian global pension fund has previously invested in a total of 1560 Chinese companies, of which 26 have held positions for more than 10 years.

Overall, the heavy holdings of Norwegian global pension funds have four main characteristics:

The average holding time is more than 9 years, and more than 40% of companies hold it for more than 10 years.

More than half of the heavy stocks come from American companies, and the industry has a preference for technology sectors.

Prefer super-large market capitalization stocks, and nearly 80% of the holdings exceed 100 billion US dollars.

80% of the companies with positions have a price-to-earnings ratio of less than 30 times earnings and a reasonable performance valuation match.

![]()

This investment style is related to the initial purpose of the fund-Norway, as a country with rich energy resources and a single industry, has set up an oil fund under the responsibility of NBIM (Norges Bank Investment Management), an investment management company of the Norwegian Central Bank, in order to achieve intergenerational transfer of wealth and avoid "development lag" like Nauru after the resources are exhausted. In 2006, with the passage of the Norwegian Pension Fund Act, the name was changed to "Norwegian Sovereign Fund", namely GPFG (Government Pension Fund-Global), also known as "Norwegian Government Global Pension Fund".

Therefore, this fund is responsible for the wealth inheritance of the Norwegian people, which is very important to the Norwegian people, and the stocks they invest in should also be long-term bullish targets.

The fund began to enter the Chinese market in 2003, 12 Chinese companies appeared for the first time in the position list in 2004, and became one of the second batch of QFII in October 2006. it is a larger QFII institution in China.

It was also mentioned earlier that 70.8% of the fund invests in equity, which is also related to the nature of the fund. Different from our common social security reserve fund (social security reserve funds, SSRF), sovereign fund is a reserve fund established independently of the social security system, and its funding source is mainly obtained through the sale of state-owned assets, such as the Irish National Pension Reserve Fund (NPRF) and the French Retirement Reserve Fund (FRR). SSRF is conservative and usually invests more or all in China; SPRF is flexible and usually invests more or all abroad, and the proportion of equity asset allocation is relatively high.

(附:Report of the Norwegian Government Global Pension Fund 2019. PDF)

Edit / Iris