Source: Li Xunlei Finance and Investment

Authors: Liang Zhonghua, Li Jun, Zhang Chen

The arrival of novel coronavirus epidemic, the impact on the consumer sector is very great, the specific impact on how many GDP? Our team made a rough estimate using the input-output table. If you only consider the impact of tourism, retail and other consumption on the industry, then the decline in consumption will reduce GDP by about 1.4 trillion in the first quarter, down 6.4 percent, and 1.4 percent for the whole year. If the indirect impact on other industries is taken into account, the decline in consumption will reduce GDP by about 1.8 trillion in the first quarter, dragging down GDP growth by 8.4 percentage points in the first quarter and 1.8 per cent for the whole year.

Summary:

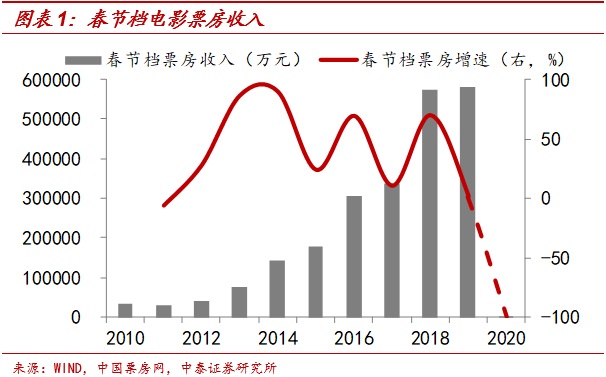

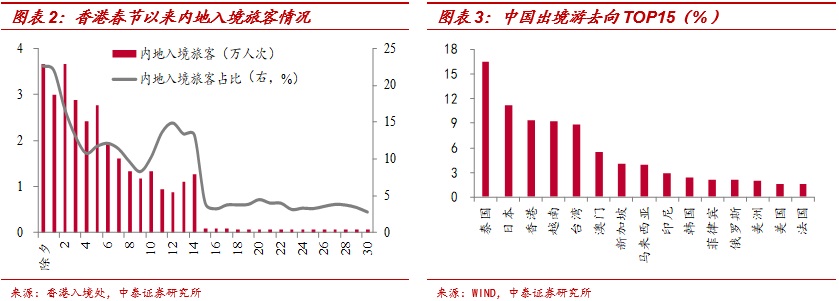

1、The consumer sector has been badly hurt.Under the impact of the epidemic, most economic activities are close to a half-stop state, and the consumer sector has suffered serious losses. Judging from the main indicators, the box office revenue of the Spring Festival has lost nearly 100%, inbound tourists from Hong Kong and Macao have dropped by more than 80%, nearly 80% of the surveyed catering enterprises have lost more than 100%, and traffic passenger traffic has also declined by more than 50%. It may be difficult to make up for all the losses caused by the epidemic.

2、Based on the calculation of input-output table.We estimate the most relevant consumption types, such as tourism, catering retail, transportation, movies and so on, among which tourism suffered the most, with revenue declining or 1.2 trillion in the first quarter, accounting for nearly 20% of the annual tourism income. Retail revenue from catering fell by 960 billion, transportation by 140 billion and movies by 10 billion.

The decline in consumer income will also have an indirect impact on other industries, which we estimate using the input-output table. The decline in tourism revenue will lead to a drop of about 550 billion in other industries, including 320 billion in catering and retail, 82 billion in transportation and 6 billion in movies. Therefore, if you only consider the impact of tourism, retail and other consumption on the industry, then the decline in consumption will reduce GDP by about 1.4 trillion in the first quarter. If the indirect impact on other industries is taken into account, the decline in consumption will reduce GDP by about 1.8 trillion in the first quarter.

3、The policy goes into the "fast lane".At present, real estate is in a downward cycle, and even if there is no epidemic, the economy is facing great downward pressure. In order to achieve the growth target, policy is destined to be more active.

In terms of currency, China's interest rate reduction cycle continues, the seven-day reverse repurchase policy rate is expected to fall below 2.25%, the one-year MLF is expected to fall below 2.85%, and the interest rate on 10-year government bonds is expected to fall to around 2.6%. On the financial front, we will open the "main door" and continue to block the "partial door". In 2020, China's fiscal deficit ratio is expected to rise to 3.5% or more, and the amount of special debt is expected to exceed 3 trillion yuan. Policy banks will also make some efforts. In terms of real estate, the marginal relaxation of regulation and control policy is doomed.

Looking ahead, the main factors driving market structure opportunities this year are still policies, especially the environment of loose liquidity and lack of assets. Instead of changing the direction of asset allocation, the epidemic has put more downward pressure on the economy and accelerated the pace of positive policies.

1、The consumer sector has been severely damaged.

Under the impact of the epidemic, most economic activities are close to a half-stop state.In order to prevent the spread of the epidemic on a large scale, most provinces have introduced measures to restrict the movement and gathering of people. According to statistics, Guangdong, Zhejiang, Jiangsu, Beijing, Shanghai, Chongqing, Heilongjiang, Liaoning and Tianjin and other provinces and cities have all or partially adopted "community closed management measures." Economic activities are often accompanied by the movement and aggregation of population. In the case of strict community management, in addition to the most basic food, clothing, housing and transportation, the vast majority of economic activities are in a state of semi-suspension.

The consumer sector has suffered heavy losses. According to the main indicators:The box office revenue of the Spring Festival has lost nearly 100%.According to the statistics of China Box Office, the box office revenue of the whole Spring Festival is only 30 million, down 99.5% from last year's 5.8 billion.And from New Year's Eve to Feb. 22, the film grossed only 34.38 million yuan at the box office, down 99.7 percent from the same period last year.According to statistics, in recent years, the Spring Festival accounts for about 30% of the box office revenue in the first quarter and about 10% of the annual box office revenue. It may be difficult to make up for all the losses of the Spring Festival festival, and the impact of box office revenue is inevitable.

The number of inbound visitors to Hong Kong and Macao fell by more than 80%.Affected by the epidemic, 30 provinces and cities across the country have successively launched a first-level response to major public health emergencies, all scenic spots and cruise ships across the country have suspended operations, and the number of tourists has been greatly reduced.

According to the statistics of the Immigration Department of Hong Kong, during the Spring Festival this year (New Year's Eve-the sixth day of junior high school), the number of mainland inbound visitors dropped 85% compared with the same period last year.And since the implementation of the mandatory immigration quarantine measures on February 8, the number of mainland visitors per day has been less than 1000.. During the Spring Festival this year (New Year's Eve-the sixth day of junior high school), mainland inbound tourists also fell 83.3% from a year earlier (+ 25.6% in 2019), according to the China Macau Tourism Administration.Hong Kong and Macao are the main destinations for mainland tourists, and tourism revenue for the Spring Festival will also be greatly affected.

Nearly 80% of the surveyed catering enterprises lost more than 100%.Affected by the epidemic, many large shopping malls across the country have closed down, a number of chain catering brands have announced their closure, and some regional governments have issued emergency notices banning the operation of all catering shops.

According to the report of the Chinese Cuisine Association, compared with last Spring Festival,During the epidemic, 93% of the catering enterprises surveyed chose to close their stores, 78% of the catering enterprises lost more than 100% of their revenue, and 95% of the catering enterprises lost more than 70% of their revenue.Of China's 4.7 trillion catering income in 2019,15.5% comes from the Spring Festival.Even if the epidemic is over and the Spring Festival holiday is over, the losses in the catering industry may be difficult to recover.

In the case of revenue damage, the burden on catering enterprises is still increasing, and it is estimated that the main costs of catering enterprises reached 18.1 million in the first quarter, of which labor costs accounted for 59 per cent.Under the impact of the epidemic, most enterprises are faced with problems such as tight cash flow, especially small and medium-sized enterprises.According to a joint survey of 995 small and medium-sized enterprises conducted by the School of Economics and Management of Tsinghua University, the HSBC School of Business of Peking University and Beijing small and Micro Enterprise Integrated Financial Services Co., Ltd., 85.01% of the enterprises lasted at most three months. Only 9.96% of enterprises can last for more than six months.

The volume of passengers has dropped by more than 50%.During the Spring Festival travel period (January 10-February 18), a total of 1.476 billion passengers were sent by railways, roads, waterways and civil aviation across the country, according to the Ministry of Transport.It is down 50.3% from the same period last year, and the daily passenger traffic has fallen by more than 80% since January 29.

According to the regular statistics, since January 23, the flight cancellation rate has been showing an upward trend.As of February 22, the flight cancellation rate is still over 70%.The number of countries (regions) suspended has also reached 20, with a maximum of 23.According to the Civil Aviation Administration, since the implementation of the free refund policy, as of February 10, the amount of free refund by domestic and foreign airlines has exceeded 20 billion, and this part of the economic losses caused by the epidemic may be difficult to make up.

2、Calculation based on input-output table

How big is the impact of the epidemic on consumption?We estimate the most relevant types of consumption, such as tourism, catering retail, transportation, movies and so on.

Tourism is the most affected, with annual income falling or nearly 20%.Due to the large scale of tourism revenue during the Spring Festival Golden week, which generally accounts for about 9 per cent of the annual tourism revenue, if the epidemic ends completely by mid-March, then the overall tourism revenue will fall by 1.2 trillion in the first quarter. The estimate of tourism income in the Blue Book of Tourism economy recently released by China Tourism Research Institute is 1.18 trillion, which is basically consistent with our estimate. This means that nearly 20% of the tourism revenue for the whole year will be lost.

And I am afraid that this part of the loss is difficult to make up for in full, there may be three reasons.The first is that tourism consumption needs holidays, which is why Golden week tourism income accounts for a high proportion of annual tourism income, but in fact, it is impossible for us to have another Spring Festival holiday. Second, after the epidemic has completely dissipated, residents may still have scruples about travel, and even if the epidemic ends completely in mid-March, it will take some time for normal tourism activities to resume. Third, the rush to work may occur after the end of the epidemic, and the rush to work may also occupy the leisure time of the residents.

The loss of food and beverage during the Spring Festival may exceed 800 billion.During the Spring Festival in 2019, the retail sales of food and beverage exceeded 1 trillion yuan. It was originally expected that retail sales of food and beverage during the Spring Festival in 2020 would reach 1.1 trillion. Based on a relatively neutral loss of 80%, the loss of catering during the Spring Festival would exceed 800 billion.

In addition, the impact is not only on the Spring Festival, but also on food and beverage retail from February to March.With reference to the situation during SARS in 2003, the growth rate of retail sales of consumer goods was about 4.4% lower than usual at that time.For the whole of the first quarter, the loss of catering retail may reach about 960 billion, accounting for about 9 per cent of the total retail sales of consumer goods in the first quarter.

Similarly, transportation and the film industry have also been severely damaged, with about 140 billion in transportation and more than 10 billion in the film industry.

The decline in consumer income will also have a certain knock-on effect, because the reduction in income in some industries will not only impact the ability of residents and enterprises to consume and invest, but also have an indirect impact on other industries.

We use input-output tables to estimate the indirect impact of the decline in consumer income. Still take tourism consumption as an example, the most affected industries are real estate, food and transportation, of which the impact of the real estate industry may reach 75 billion. If you add up the losses in other industries, the decline in tourism revenue will reduce the income of other industries by about 550 billion. A similar situation exists in several other items of consumption, with the impact of catering retail on other industries expected to reach 320 billion, transportation 82 billion and movies 6 billion.

So, if you only consider the impact of consumption such as tourism and retail on the industry, the decline in consumption will reduce GDP by about 1.4 trillion in the first quarter, which will reduce nominal GDP growth by 6.4 percent in the first quarter and 1.4 percent for the whole year.If the indirect impact on other industries is taken into account, the decline in consumption will reduce GDP by about 1.8 trillion in the first quarter, dragging down 8.4 per cent of GDP growth in the first quarter, or 1.8 per cent of the year.

The results of our current calculations are only based on the assumption that there will be no business failures and that unemployment will not rise significantly, and if this potential loss and falling demand are taken into account, the time and scope of the impact will be wider and wider.

3、The policy enters the "fast lane"

We cannot attribute all the downward pressure on the economy to the impact of the epidemic.China's residents' wealth, fiscal revenue and financial system are all highly related to the real estate market. At present, real estate is in a downward cycle.Even if there is no epidemic, the economy will face greater downward pressure in 2020 and even 2021.

The current economic downturn in the first quarter has become a fact, and in order to achieve the growth target, the policy is destined to be more active.

On the monetary side, China's interest rate cut cycle will continue.China's 7-day reverse repo policy interest rate is expected to fall below 2.25%, 1-year MLF is expected to fall below 2.85%, and the interest rate on 10-year government bonds is expected to fall to around 2.6%.

On the financial front, we should open the "main door" and continue to block the "partial door".In 2020, China's fiscal deficit ratio is expected to be raised to 3.5% or more, and the amount of special debt is expected to exceed 3 trillion yuan. Policy banks will also make some efforts, but due to the continued limitation of hidden debt, the growth rate of infrastructure may pick up to about 8%.

In terms of real estate, the marginal relaxation of regulation and control policy is doomed.After the arrival of the epidemic, the sales pressure is greater, the cash flow of developers is also more tight, increasing the downward pressure on the economy, the pace of real estate policy relaxation may be accelerated. However, once the demand of small and medium-sized cities turns cold again, it may not be very effective just by relaxing regulation and money, but it still needs a way similar to QE to create demand.

Looking ahead, the main factors driving market structure opportunities this year are still policies, especially the environment of loose liquidity and lack of assets.Instead of changing the direction of asset allocation, the epidemic has put more downward pressure on the economy and accelerated the pace of positive policies.

Liquidity easing logic continues, still optimistic about the growth direction of new economic equity assets and interest rate bond assets. Cycle still faces short-term earnings decline, long-term pessimistic expectations, I am afraid it is difficult to have a good performance. Consumption is overvalued and needs to be adjusted before opportunities can be seen. A detailed analysis can be found in our 2020 annual report "winning" in Policy released in early December last year.

Risk Tips:Epidemic spread, economic downturn, overseas risks, policy changes.

Edit / Jeffy