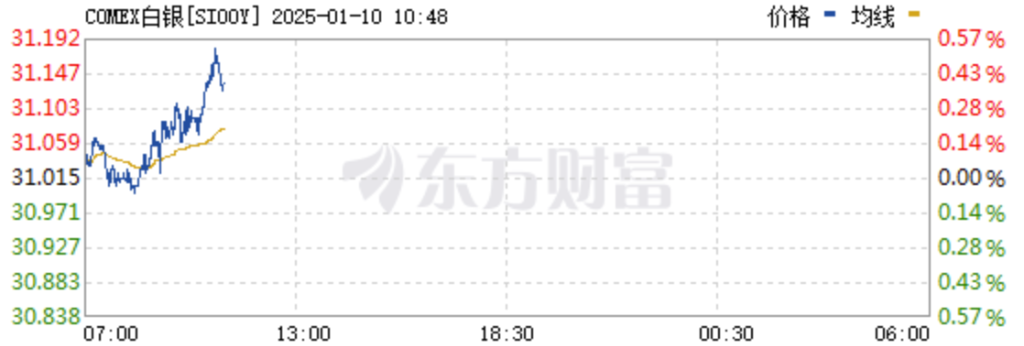

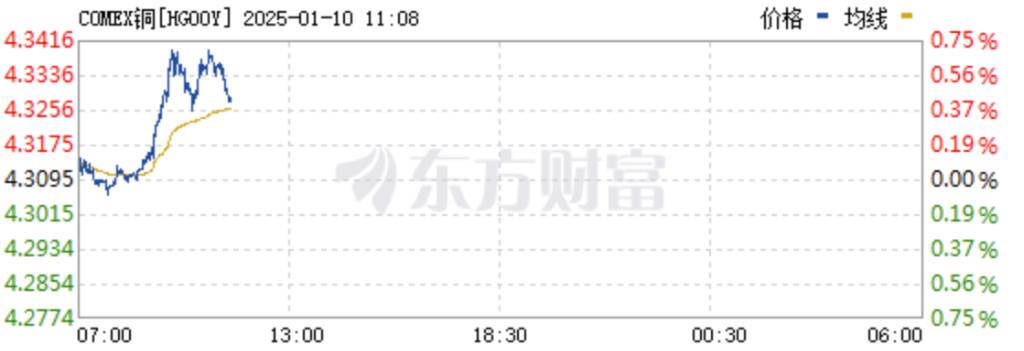

Market concerns about the uncertainty of Trump's trade policy have led to the NYSE Silver Futures price premium over London spot Silver exceeding $0.9 per ounce, nearing the peak seen in December of last year, while the premium for Copper Futures has also reached $623 per ton.

The market expects that Trump's tariff policies will target imported Metals, leading to a price increase on the NYSE, prompting suppliers to rush deliveries to profit.

Recently, as market participants increase their bets that Trump will impose high import tariffs on Metals, Copper and Silver Futures prices in New York have surged above international price benchmarks.

On Thursday, the price of Silver Futures on the New York Commodity Exchange was over a $0.9 per ounce premium compared to London spot Silver, nearing December's peak from last year when Trump promised to impose tariffs on all goods from all countries. Currently, this premium has surged again amid increasing uncertainty regarding Trump's trade policies and growing market anxiety.

On Thursday, the price of Silver Futures on the New York Commodity Exchange was over a $0.9 per ounce premium compared to London spot Silver, nearing December's peak from last year when Trump promised to impose tariffs on all goods from all countries. Currently, this premium has surged again amid increasing uncertainty regarding Trump's trade policies and growing market anxiety.

In addition to Silver, the NYSE Copper Futures also reached a premium of $623 per ton compared to the London Metal Exchange Copper Futures, close to last year's record during historic short squeezes in the global Copper market.

Ole Hansen, the Head of Commodity Strategy at Saxo Bank, stated:

Global investors began seeking to protect themselves from sticky and possibly rising inflation, fiscal debt issues, and the uncertainty related to Trump as the new year started... The abnormal rise in NYSE Metals prices is clearly part of Trump's unpredictability.

To seize the opportunities brought by this round of price surge, traders have been rushing to deliver Silver and Copper to USA warehouses since last year. In the past five weeks, the NYSE warehouses have added 15 million ounces of Silver.

However, Analysts point out that even though the price dislocation provides enormous profit opportunities for traders with spot inventory, it also poses significant risks for those without spot inventory.

Analysts indicate that prices in the New York and London Metal markets typically move in sync, and many algorithm traders and hedge Funds bet that any price gaps that emerge will quickly converge—usually, such arbitrage trades will quickly restore the price consistency between the two sides, but if the price gap continues to widen, investors may face substantial losses.

This situation was a key factor in the squeeze in the Copper market last year: at the time, arbitrage traders bet that NYSE Copper Futures prices would fall relative to the prices of London Metal Exchange Copper Futures, but that did not occur. Today, the Silver market may face similar risks, as the supply of Silver that can be directly delivered to NYSE Futures is limited.

Senior Commodity strategist Daniel Ghali at TD Securities stated in an interview:

The market is unknowingly entering a squeeze, and people are completely ignoring this risk.

However, Ghali also pointed out that due to a severe shortage of global Silver production over the past four years, the inventories in the London market have been significantly depleted, and further outflows may trigger a chain reaction of price increases.

We expect the scale of this inventory consumption to be very significant, which is exactly the Silver short squeeze market you can invest in.

周四,纽约商品交易所白银期货的价格较伦敦现货白银的溢价超过了0.9美元/盎司,接近去年12月的峰值。当时,特朗普承诺对所有国家的所有商品普遍征收关税。目前,

周四,纽约商品交易所白银期货的价格较伦敦现货白银的溢价超过了0.9美元/盎司,接近去年12月的峰值。当时,特朗普承诺对所有国家的所有商品普遍征收关税。目前,