Wolfe Research's strategists still believe that growth stocks will outperform Large Cap in 2025, and they have identified S&P 500 Index components whose revenue is expected to grow by at least 25%.

According to Zhitong Finance, analysts at Wolfe Research still believe that growth stocks will outperform Large Cap in 2025 and have listed stocks expected to grow at least 25% in revenue this year. In a recent report, analysts stated that they prefer cyclical and growth stocks over high-quality and value stocks; and favor mid-cap stocks over Large Cap stocks. They expect that the performance of the seven tech giants: Apple (AAPL.US), Microsoft (MSFT.US), Alphabet (GOOGL.US), Amazon (AMZN.US), NVIDIA (NVDA.US), Meta (META.US), and Tesla (TSLA.US) will surpass the other components of the S&P 500 Index.

Chris Senyek, Chief Investment Strategist at Wolfe Research, stated: 'We still believe that solid fundamentals and increased AI spending will drive their performance to exceed the S&P 500 Index this year.'

Furthermore, analysts indicated that by 2025, the revenue growth rates of the Information Technology (XLK.US), Energy (XLE.US), and Communications Services (XLC.US) sectors are expected to exceed 25%, with growth rates of 46%, 32%, and 26% respectively. In contrast, Wolfe analysts noted that the Consumer Staples (XLP.US) sector is not expected to see significant revenue growth; the Utilities sector’s revenue growth is only 6%, while the Materials sector (XLB.US) is at 7%.

Furthermore, analysts indicated that by 2025, the revenue growth rates of the Information Technology (XLK.US), Energy (XLE.US), and Communications Services (XLC.US) sectors are expected to exceed 25%, with growth rates of 46%, 32%, and 26% respectively. In contrast, Wolfe analysts noted that the Consumer Staples (XLP.US) sector is not expected to see significant revenue growth; the Utilities sector’s revenue growth is only 6%, while the Materials sector (XLB.US) is at 7%.

They also predict that the real GDP growth rate in the USA for 2025 and 2026 will be 2.5%, while the average forecast from Wall Street economists is 2% - 2.1%. It is believed that as long as the USA does not fall into a recession, or if AI spending expectations do not undergo significant changes, the market concentration in 2025 will remain at a high level.

Senyek said: 'Economic surprises are emerging, and we believe this momentum will continue, as we think consumer and business confidence will rise, with deregulation across industries and tax cuts likely extended, along with possibly modest additional tax cuts starting in 2026.'

Additionally, Wolfe analysts indicated that they believe the market's weak performance in December was a 'technical sell-off, as investors might sell Stocks to lock in last year’s gains.'

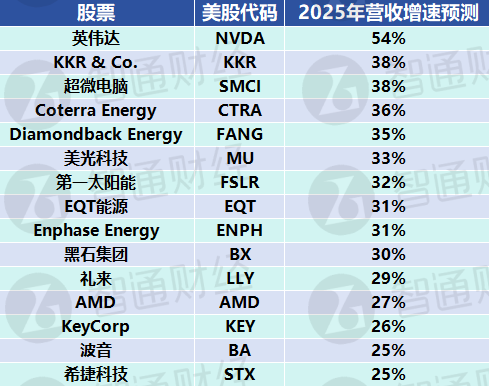

The following are the stocks that Wolfe Research Analysts believe will have a revenue growth of at least 25% among the S&P 500 Index components in 2025:

此外,策略师们表示,预计到2025年,信息技术(XLK.US)、能源(XLE.US)和通信服务(XLC.US)板块的收入增长幅度将超过25%,分别增长46%、32%和26%。相比之下,Wolfe分析师表示,必需消费品(XLP.US)板块的收入料不会出现大幅增长;公用事业板块收入增幅只有6%,而材料板块(XLB.US)为7%。

此外,策略师们表示,预计到2025年,信息技术(XLK.US)、能源(XLE.US)和通信服务(XLC.US)板块的收入增长幅度将超过25%,分别增长46%、32%和26%。相比之下,Wolfe分析师表示,必需消费品(XLP.US)板块的收入料不会出现大幅增长;公用事业板块收入增幅只有6%,而材料板块(XLB.US)为7%。