Financial giants have made a conspicuous bullish move on Eli Lilly. Our analysis of options history for Eli Lilly (NYSE:LLY) revealed 22 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 31% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $322,985, and 14 were calls, valued at $978,793.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $400.0 to $1080.0 for Eli Lilly over the recent three months.

Insights into Volume & Open Interest

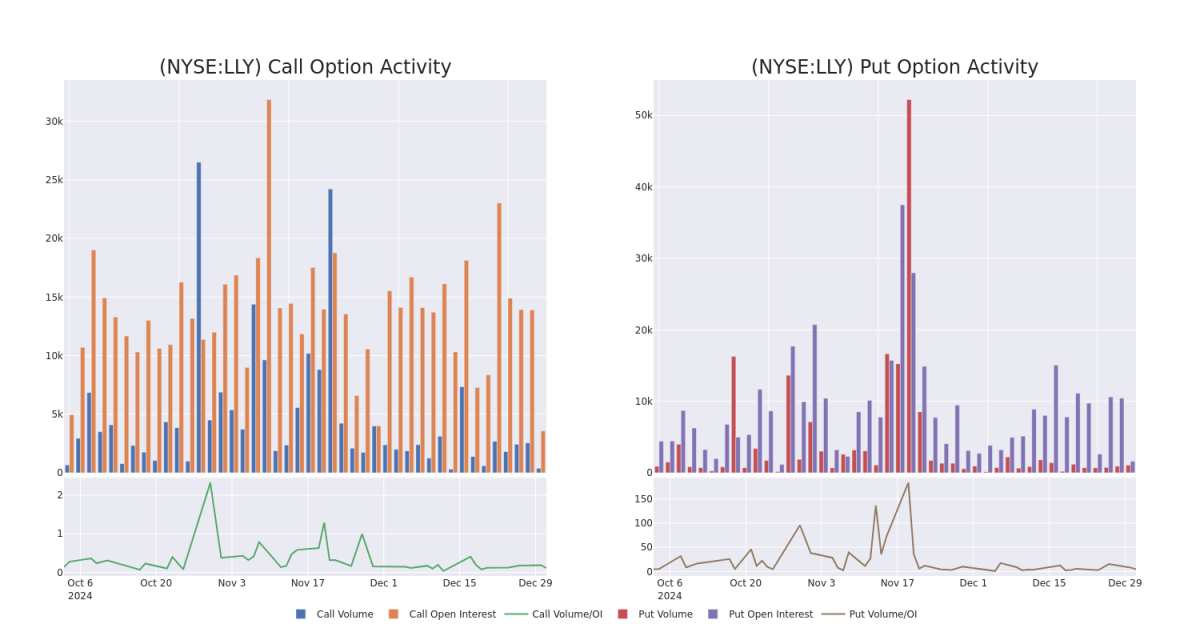

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 323.88 with a total volume of 1,468.00.

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 323.88 with a total volume of 1,468.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $400.0 to $1080.0 over the last 30 days.

Eli Lilly Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BEARISH | 03/21/25 | $76.3 | $75.1 | $75.32 | $730.00 | $338.8K | 365 | 45 |

| LLY | CALL | SWEEP | BEARISH | 01/17/25 | $18.2 | $17.1 | $18.0 | $775.00 | $99.0K | 59 | 100 |

| LLY | CALL | TRADE | BEARISH | 01/15/27 | $411.55 | $408.0 | $408.0 | $400.00 | $81.6K | 15 | 2 |

| LLY | CALL | SWEEP | BEARISH | 01/17/25 | $18.25 | $17.8 | $17.8 | $775.00 | $80.1K | 59 | 45 |

| LLY | PUT | SWEEP | BULLISH | 01/17/25 | $5.8 | $5.65 | $5.65 | $730.00 | $75.1K | 1.3K | 478 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Having examined the options trading patterns of Eli Lilly, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Eli Lilly's Current Market Status

- With a trading volume of 139,021, the price of LLY is down by -0.45%, reaching $770.32.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 37 days from now.

Expert Opinions on Eli Lilly

In the last month, 1 experts released ratings on this stock with an average target price of $997.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $997.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eli Lilly options trades with real-time alerts from Benzinga Pro.