Financial giants have made a conspicuous bearish move on EQT. Our analysis of options history for EQT (NYSE:EQT) revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $85,152, and 7 were calls, valued at $508,455.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $42.0 and $50.0 for EQT, spanning the last three months.

Volume & Open Interest Development

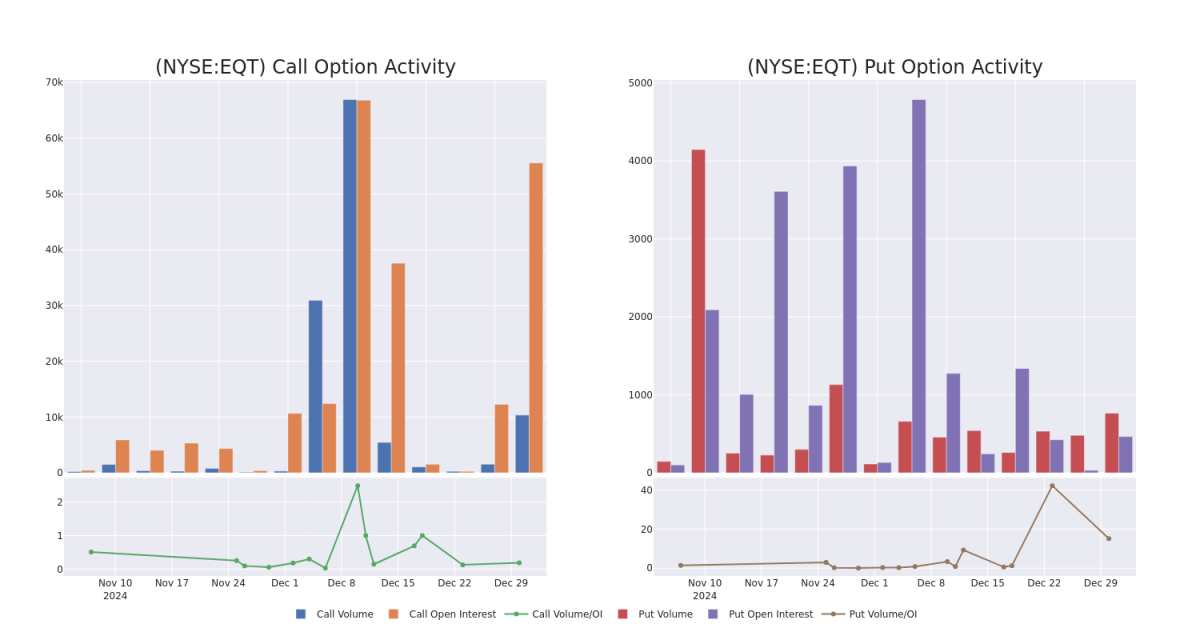

In terms of liquidity and interest, the mean open interest for EQT options trades today is 7005.88 with a total volume of 11,123.00.

In terms of liquidity and interest, the mean open interest for EQT options trades today is 7005.88 with a total volume of 11,123.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for EQT's big money trades within a strike price range of $42.0 to $50.0 over the last 30 days.

EQT Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQT | CALL | SWEEP | BEARISH | 06/20/25 | $3.2 | $3.15 | $3.15 | $50.00 | $174.1K | 11.1K | 1.0K |

| EQT | CALL | TRADE | BEARISH | 01/17/25 | $0.51 | $0.43 | $0.45 | $50.00 | $92.6K | 13.0K | 5.3K |

| EQT | CALL | SWEEP | BULLISH | 01/17/25 | $0.46 | $0.46 | $0.46 | $50.00 | $92.2K | 13.0K | 2.3K |

| EQT | CALL | SWEEP | BULLISH | 01/17/25 | $1.18 | $1.14 | $1.15 | $47.50 | $56.0K | 2 | 487 |

| EQT | PUT | SWEEP | BEARISH | 01/31/25 | $0.54 | $0.51 | $0.54 | $42.00 | $47.9K | 45 | 671 |

About EQT

EQT Corp is an independent natural gas production company with operations focused in the Marcellus and Utica shale plays in the Appalachian Basin. At year-end 2023, EQT's proven reserves totaled 27.6 trillion cubic feet equivalent, with net production of 5.79 billion cubic feet equivalent per day. Natural gas accounted for 94% of production.

Having examined the options trading patterns of EQT, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of EQT

- Currently trading with a volume of 4,936,372, the EQT's price is up by 4.56%, now at $46.34.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 43 days.

What The Experts Say On EQT

In the last month, 4 experts released ratings on this stock with an average target price of $51.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Citigroup has decided to maintain their Buy rating on EQT, which currently sits at a price target of $51. * An analyst from Bernstein downgraded its action to Market Perform with a price target of $50. * Showing optimism, an analyst from Mizuho upgrades its rating to Outperform with a revised price target of $57. * An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $49.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest EQT options trades with real-time alerts from Benzinga Pro.