Large Technology stocks are leading the decline, with Tesla once dropping over 6%, and the sell-off in QITABANKUAI is also accelerating. Aside from technical factors like profit-taking, the 10-year US Treasury yield is hovering at a seven-month high, intensifying the downward pressure on the stock market. Goldman Sachs states that by the end of the year, USA pensions will sell $21 billion in US stocks, and CTAs will sell an additional $4 billion, resulting in significant selling pressure.

December 27 is the last Friday trading day of 2024. Although market participants are eagerly anticipating the arrival of the "Santa Claus rally", the contrary has occurred as U.S. stocks accelerated their decline in the early trading session on Friday, with this month's market favorites—large-cap Technology Stocks—leading the drop.

An hour and a half after the opening, U.S. stocks traded near their daily lows, with the S&P 500 Index's decline widening to 1.4%, and the Dow Jones Industrial Average fell for the first time in six trading days, dropping more than 420 points or about 1%. The Nasdaq, dominated by technology stocks, fell about 2%, and the chip index dropped as much as 2.3%.

Large-cap Technology Stocks led the decline on Friday, with Tesla at one point falling more than 6%, and the selling outside of technology stocks is also accelerating.

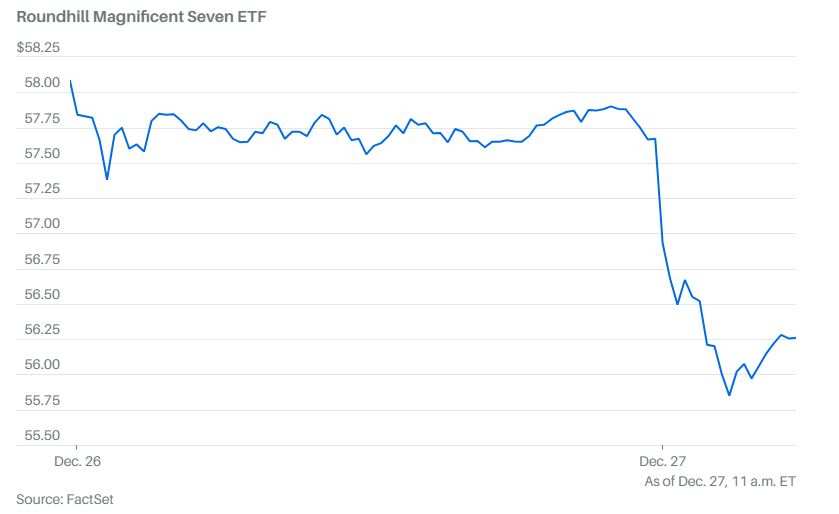

Among the "Seven Sisters of U.S. Tech Stocks", Apple fell 1.8% away from its historical high, Amazon dropped 2.4%, Microsoft declined 2.2%, Alphabet A fell 2.1%, Meta decreased by 1.5%, and NVIDIA and Tesla saw even steeper declines, falling nearly 3% and more than 4%, respectively, with Tesla once down 6.1%. The Roundhill Magnificent Seven ETF, which tracks these U.S. tech stocks, dropped 3.3% at one point to a weekly low.

Among the "Seven Sisters of U.S. Tech Stocks", Apple fell 1.8% away from its historical high, Amazon dropped 2.4%, Microsoft declined 2.2%, Alphabet A fell 2.1%, Meta decreased by 1.5%, and NVIDIA and Tesla saw even steeper declines, falling nearly 3% and more than 4%, respectively, with Tesla once down 6.1%. The Roundhill Magnificent Seven ETF, which tracks these U.S. tech stocks, dropped 3.3% at one point to a weekly low.

The selling pressure outside of technology stocks is also accelerating. Approximately 412 stocks within the S&P 500 Index components fell, with the S&P Technology Sector dropping the most at 1.8%, followed by the 1.6% decline in the Consumer Discretionary Sector and a 1.2% drop in the Communications Services Sector, while the Energy Sector followed oil prices and rose against the market.

Analysts indicate that there was almost no significant economic data or news driving major market changes on Friday, along with European stocks returning after a two-day break, and the overall market being relatively quiet in trading during the year-end holiday week, highlighting the impact of the chips and large-cap Technology Stocks that were flocked to earlier this month.

The 10-year U.S. Treasury yield hovered at a seven-month high, adding downward pressure on U.S. stocks, along with technical factors such as profit-taking.

In the absence of major news, data, and with light trading, Tom Essaye, the editor of The Sevens Report, writes that the 10-year US Treasury yield, as a pricing anchor for assets, will impact the stock market; the higher the yield, the greater the pressure on the stock market.

Paul Hickey, co-founder of Bespoke Investment Group, shares the same view, stating that the 10-year US Treasury yield has recently sustained above 4.60%, hitting a seven-month high, while earlier this April, the highest rate had exceeded 4.70%. "If it (re)reaches this level in the coming days, it could pose problems for the stock market."

On Friday, the US Treasury yield showed a mixed trend; short-term yields, which are more sensitive to interest rates, fell, while the 10-year benchmark US Treasury yield briefly rose to 4.62%, close to the seven-month high of 4.64% reached yesterday, resulting in a steeper US Treasury yield curve.

David Kruk, head of trading at France's La Financiere de L’Echiquier, stated that the most important phenomenon by the end of this year is the rise in the 10-year US Treasury yield:

"This indicates that everyone is waiting to see the effect of inflation following Trump's inauguration in January. Furthermore, most trades are technical, such as short covering and profit taking, but there isn't a significant trend like there is at this time every year."

Analysts have also pointed out that due to the resilience of the US economy, investors are more concerned that Trump's tariffs and tax cuts will drive up prices, forcing the Federal Reserve to adopt a more hawkish stance, while also watching mid-January's employment and inflation data for any unexpected disruptions to the Federal Reserve's plans.

Currently, traders bet that the Federal Reserve will lower interest rates less than twice by the end of 2025, and since the eve of the Federal Reserve FOMC meeting on December 17, yields on 5- to 30-year US Treasury bonds have collectively risen over 15 basis points. As of Thursday, the Bloomberg US Treasury Index has fallen by 1.7% in December, reducing the year-to-date increase to less than 0.5%.

Goldman Sachs predicts that by the end of the year, US pensions will sell $21 billion in US stocks, with CTA expected to sell an additional $4 billion.

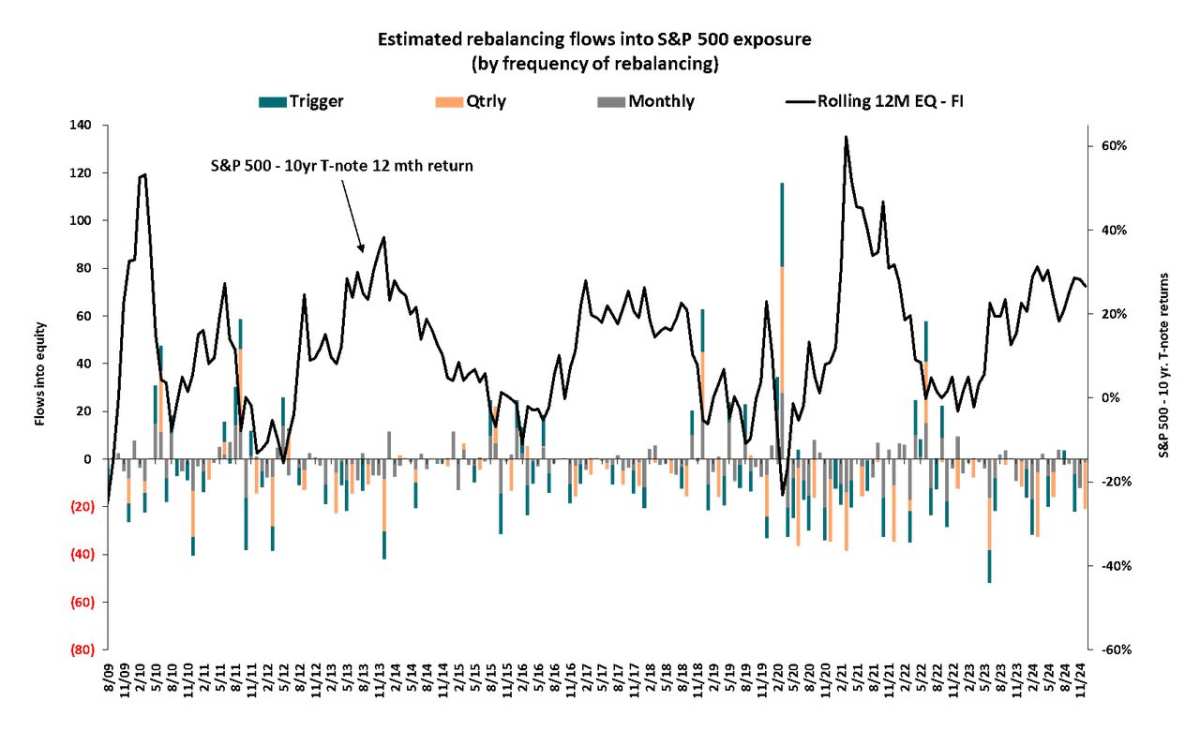

Goldman Sachs and other major investment banks have also noticed the pressure on market liquidity, as well as technical factors such as pension funds adjusting their positions between stocks and bonds at the end of the year, which may exacerbate market sell-offs and volatility in the short term.

On one hand, traders will focus on the repo market next week, alert to the possibility of a repeat of the brief financing pressure observed at the end of the third quarter this year.

At the same time, Goldman Sachs' trading department estimates that, given the trends in stocks and bonds, U.S. pension funds will sell $21 billion worth of U.S. stocks and purchase an equivalent amount of bonds before the end of the month, having had a rebalancing amount that was as high as $30 billion before a slight sell-off on Wednesday.

Based on the absolute dollar value of all buy and sell transactions over the past three years, the $21 billion worth of U.S. stocks to be sold ranks in the 86th percentile, indicating a relatively high amount and significant selling pressure. Since January 2000, it ranks in the 87th percentile, which seems to help explain the reasons for the sudden market sell-off.

Moreover, Goldman Sachs pointed out on Monday that the S&P Large Cap decline triggered by the Fed's "hawkish rate cut" last week also prompted some CTA sell-offs. This so-called "smart money" that follows trends sold about $7.5 billion worth of U.S. stocks in the past five days and is expected to sell another $4 billion in the next five days, although the wave of CTA sell-offs has mostly passed.

Most Wall Street Analysts hold an optimistic view towards the U.S. stock market next year, downplaying the impact of short-term volatility.

Citi U.S. stock strategist Scott Chronert remains bullish on U.S. equities, downplaying the impact of short-term volatility. He believes that high valuations and implied growth expectations set a high standard for the market in the coming year:

“Overall, this pattern, combined with a lack of genuine market corrections over a period of time, makes the market more sensitive to increased volatility. However, if the fundamental situation persists, we will Buy during a pullback of the S&P 500 Index in the first half of next year.”

The previously mentioned Tom Essaye from The Sevens Report also believes that the recent stock market decline has dampened retail investors' blind excitement somewhat, but it hasn't diminished the sentiment among professional advisors.

Market sentiment is no longer blindly optimistic, and ordinary investors are balancing their outlook for the market as the new year begins, which will be a good thing as it reduces the risk of a market bubble.

However, if we receive bad political news, or if Federal Reserve officials signal a pause in rate cuts, this could lead to more short-term, severe declines in the US stock market.

John Higgins, the chief market economist at Capital Economics, reiterated that the S&P 500 Index could rise another 16% by 2025, potentially nearing 7,000 points by the end of next year. He also mentioned that the sell-off in the bond market has led to a weaker stock market since last week.

This optimistic view is based on the belief that the 10-year TIPS yield will not be higher than it is now by the end of next year. Additionally, the S&P 500 component companies' EPS is expected to continue to grow slightly over the next 12 months.

We also still do not believe the USA will undergo large-scale fiscal expansion financed by deficits, as this would significantly raise the USA's long-term bond risk premium, which is currently at a low level.

Editor/new

在“美股科技七姐妹”中,苹果跌1.8%脱离历史最高,亚马逊跌2.4%,微软跌2.2%,谷歌A跌2.1%,Meta跌1.5%,英伟达和特斯拉跌幅更深,分别跌近3%和跌超4%,特斯拉一度跌6.1%。追踪美股七姐妹的Roundhill Magnificent Seven ETF一度跌3.3%至一周最低。

在“美股科技七姐妹”中,苹果跌1.8%脱离历史最高,亚马逊跌2.4%,微软跌2.2%,谷歌A跌2.1%,Meta跌1.5%,英伟达和特斯拉跌幅更深,分别跌近3%和跌超4%,特斯拉一度跌6.1%。追踪美股七姐妹的Roundhill Magnificent Seven ETF一度跌3.3%至一周最低。