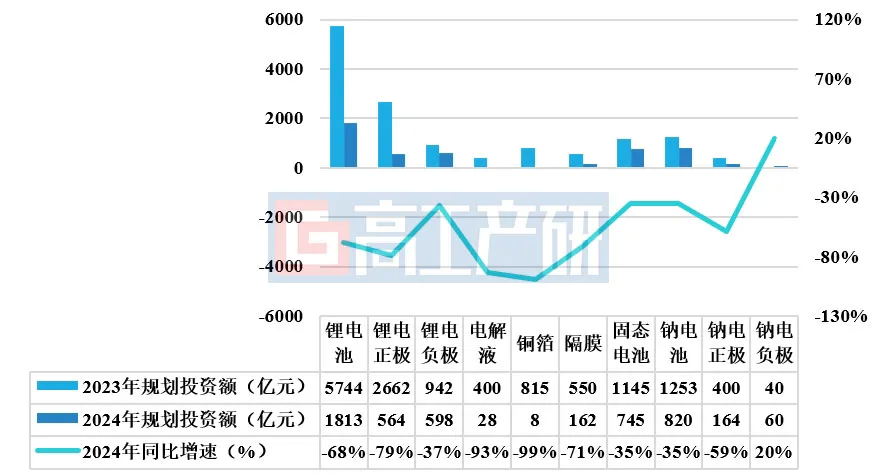

According to the incomplete statistics from the Gao Gong Industry Research Institute (GGII), the planned investment for 2024 in China for Lithium Battery and main materials, Sodium Battery and anode and cathode materials, and Solid State Battery is approximately 496 billion yuan, a year-on-year decrease of 64%.

According to Zhito Finance APP, in 2024, China's Lithium Battery New Energy Industry will enter a period of adjustment, significantly reducing investment in expansion projects. According to incomplete statistics from the GGII, the planned investment in 2024 for China's lithium batteries and main materials, sodium batteries and cathode and anode materials, and solid state batteries is approximately 496 billion yuan, a year-on-year decrease of 64%.

Specifically:

1) In terms of lithium batteries, in 2024, China will have about 60 new planned projects for lithium batteries (including contracts, announcements, and construction), a decrease of 37% compared to 2023, with a planned capacity of approximately 590GWh, nearly a 60% decrease compared to 2023. Based on the announced investment amounts for the projects, the total planned investment for lithium batteries in 2024 will exceed 180 billion yuan, a decrease of 68% compared to 2023.

1) In terms of lithium batteries, in 2024, China will have about 60 new planned projects for lithium batteries (including contracts, announcements, and construction), a decrease of 37% compared to 2023, with a planned capacity of approximately 590GWh, nearly a 60% decrease compared to 2023. Based on the announced investment amounts for the projects, the total planned investment for lithium batteries in 2024 will exceed 180 billion yuan, a decrease of 68% compared to 2023.

2) In terms of lithium battery materials, the planned investment for China's lithium battery cathode materials, anode materials, electrolytes, separators, and copper foil projects in 2024 is 136 billion yuan. Among them, the planned investment amounts for copper foil and electrolytes have decreased the most, both down over 90%, mainly due to low processing fees for copper foil and high copper prices, as well as the low sales cash ratio of electrolyte companies; the planned investment amount for anode materials has the smallest decrease at 37%, mainly driven by the demand growth for fast-charging anode materials and silicon-based anode materials due to new products like the 46 series large cylindrical batteries and semi-solid batteries.

3) In terms of solid state batteries, in 2024, China will have about 33 new planned projects for solid state batteries, with a planned capacity of approximately 138GWh and a total planned investment of about 74.5 billion yuan, a year-on-year decrease of 35%, which is lower than the decrease in lithium batteries.

4) In terms of sodium batteries, in 2024, China will have about 27 new planned projects for sodium batteries, with a planned capacity exceeding 180GWh and a total planned investment exceeding 82 billion yuan, a year-on-year decrease of 35%, including 3 projects with investments exceeding 10 billion yuan each, namely the SiChuan Juneng Energy Storage Hohhot 50GWh sodium battery and energy storage industry park project (20 billion yuan), BYD (Xuzhou) sodium-ion battery project (10 billion yuan), and Hubei Jingzhou Economic Development Zone Putai Energy Technology sodium-ion battery integrated production project (over 10 billion yuan).

5) In terms of Sodium-ion Batteries materials, the planned investment amount for new Cathode Material in China for 2024 is approximately 16.4 billion yuan, a year-on-year decrease of 59%; planned capacity is approximately 0.49 million tons, a year-on-year decrease of 40%; the planned investment amount for new Anode Material is approximately 6 billion yuan, a year-on-year increase of 20%, with a planned capacity of approximately 0.23 million tons, a year-on-year increase of 22%. Among these, Anode Material for Sodium-ion Batteries is the only segment that shows growth.

Summary of planned investment amounts for Lithium Batteries and main materials, Sodium-ion Batteries and Cathode/Anode Materials for 2023-2024.

Data source: GGII (Gaogong Industry Research Institute), overall, in 2024, the pace of investment expansion for domestic Lithium Batteries and materials, Solid State Batteries, Sodium-ion Batteries and materials will slow down, but the investment expansion for new products such as Solid State Batteries and Sodium-ion Batteries will remain relatively active.

Looking ahead to 2025, GGII expects Lithium Battery and materials enterprises to remain cautious in their expansions, with a new wave of expansion anticipated in 2026. By 2027, Sodium-ion Batteries are expected to accelerate in industrialization (shipment volumes >10GWh), and all-solid-state Batteries are expected to achieve small-scale production. Local governments should always pay attention to industry development trends and potential enterprises with strong innovative capabilities in new technologies to attract more quality projects.

1)锂电池方面, 2024年中国锂电池新增规划项目(含签约、公告、开工,下同)约60个,较2023年减少37%,规划产能约590GWh,较2023年下降近60%。按项目公布的投资金额计算,2024年中国锂电池规划投资总额超1800亿元,较2023年减少68%。

1)锂电池方面, 2024年中国锂电池新增规划项目(含签约、公告、开工,下同)约60个,较2023年减少37%,规划产能约590GWh,较2023年下降近60%。按项目公布的投资金额计算,2024年中国锂电池规划投资总额超1800亿元,较2023年减少68%。