According to Canalys data, in the third quarter of 2024, PC shipments in the USA (excluding tablets) increased by 7% year-on-year, reaching 17.9 million units.

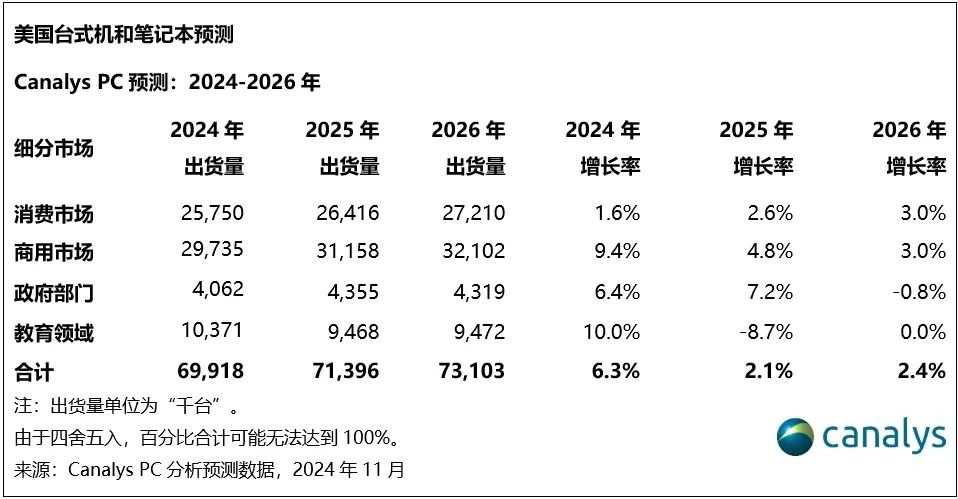

According to Zhithong Finance APP, Canalys data shows that in the third quarter of 2024, PC shipments in the USA (excluding tablets) increased by 7% year-on-year, reaching 17.9 million units. Among them, laptops are the main driving force, with shipments increasing by 9% year-on-year. Looking ahead, due to the weakening momentum of the Windows upgrade cycle and adverse effects brought by macroeconomic policies, the recovery of the USA PC market is expected to continue, but at a slower pace than previously anticipated. It is expected that total PC shipments in the USA will grow by 6% in 2024, reaching nearly 70 million units, and then the growth rate will slow to 2% in 2025 and 2026.

In the second half of 2024, commercial demand remains strong, with shipments in the commercial market growing by 12% in the third quarter. The upgrade to Windows 11 is still underway, and the performance of the commercial market is expected to remain strong, at least until early 2025.

Canalys Analyst Greg Davis stated, "Although previous growth mainly came from the consumer market, the commercial market has become the dominant area of the USA PC market. As we enter the second half of the year, both large and small enterprises are noticeably increasing their PC refresh efforts for Windows 11 devices. In the consumer sector, seasonal promotions around Black Friday and Cyber Monday will help drive shipment growth in the fourth quarter."

Canalys Analyst Greg Davis stated, "Although previous growth mainly came from the consumer market, the commercial market has become the dominant area of the USA PC market. As we enter the second half of the year, both large and small enterprises are noticeably increasing their PC refresh efforts for Windows 11 devices. In the consumer sector, seasonal promotions around Black Friday and Cyber Monday will help drive shipment growth in the fourth quarter."

Although Microsoft and its partners will strive throughout 2025 to enhance user awareness of the end of Windows 10 services, Canalys predicts that a significant portion of device upgrades will occur after the service termination date. This is because the current transition speed is relatively slow, especially with only 10 months left until the deadline in October 2025, and a large number of existing users are still using Windows 10.

Expectations for the PC market in 2025 and beyond have also been downgraded due to potential policy changes that the new government may implement.

Canalys Analyst Greg Davis stated: "As the dust settles on the 2024 USA presidential election, macroeconomic conditions in the USA are not expected to be as stable in the short term as they have been in the past one or two years. Reports suggest that import tariffs may soon be implemented, which will have a significant impact on the PC market." Research by the Consumer Technology Association (CTA) indicates that the proposed tariffs could lead to a price increase of up to 46% for devices, creating downside risks for market forecasts. Supply chain signals indicate that inventory stocking may occur at the beginning of 2025 in response to anticipated price increases, resulting in seasonal adjustments to shipment volumes next year.

Davis further pointed out: "In the long term, budget cuts in government sectors pose a potential risk, particularly in the federal government and education sectors regarding PC procurement. Although the budget for 2025 is not expected to be affected significantly, we anticipate that these sectors may see a decline in technology spending in the future."

Canalys分析师Greg Davis表示:“虽然之前的增长主要来自于消费市场,但商用市场已成为美国PC市场的主导领域。随着进入下半年,无论是大型企业还是小型企业,针对 Windows 11设备的PC刷新力度都明显增强。在消费者领域,围绕黑色星期五和网络星期一的季节性促销活动将有助于推动第四季度的出货量增长。”

Canalys分析师Greg Davis表示:“虽然之前的增长主要来自于消费市场,但商用市场已成为美国PC市场的主导领域。随着进入下半年,无论是大型企业还是小型企业,针对 Windows 11设备的PC刷新力度都明显增强。在消费者领域,围绕黑色星期五和网络星期一的季节性促销活动将有助于推动第四季度的出货量增长。”