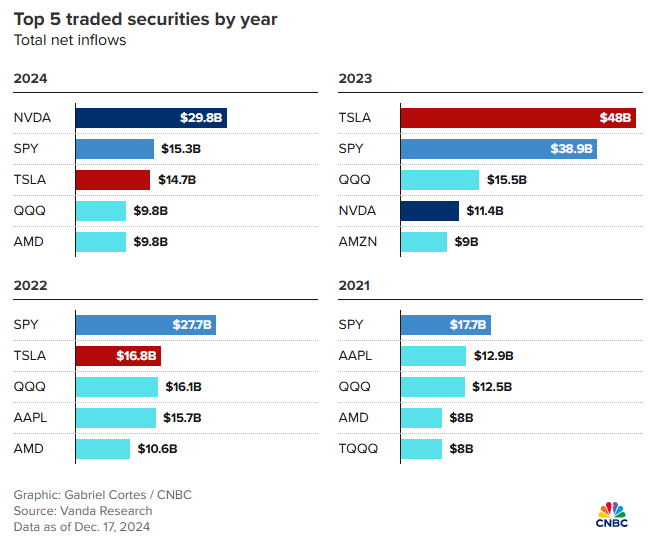

According to Vanda Research data, retail investors have invested nearly 30 billion dollars in NVIDIA stocks this year. As of December 17, it has become the stock with the highest net buy from retail investors in 2024.

According to Zhiyun Finance APP, Vanda Research data shows that retail investors have invested nearly 30 billion dollars in NVIDIA (NVDA.US) stocks this year. As of December 17, it has become the stock with the highest net buy from retail investors in 2024.

Compared to the SPDR S&P 500 ETF Trust, which tracks the broad benchmark of the US stock market, NVIDIA has garnered nearly twice the inflow of funds from retail investors. It is also expected to replace Tesla (TSLA.US), which was favored by retail investors in 2023 and attracted the most net buying from them.

Marco Iachini, senior vice president at Vanda Research, stated: "It turns out that NVIDIA has somewhat overshadowed Tesla, as its price increase is impressive."

Marco Iachini, senior vice president at Vanda Research, stated: "It turns out that NVIDIA has somewhat overshadowed Tesla, as its price increase is impressive."

Stock price skyrocketing.

Over the past year, NVIDIA, a giant in AI chips, has attracted investors of all sizes. NVIDIA was included in the Dow Jones Industrial Average last month and has been the best-performing stock among the 30 components of the index in 2024 so far.

Despite fluctuating performance in December, NVIDIA's stock price is expected to increase by over 180% by the end of the year. This surge in stock price has propelled NVIDIA to become one of the elite companies with a market cap of over 3 trillion dollars. The company is currently the second-largest in market value in the USA, second only to Apple (AAPL.US).

The craze for NVIDIA Stocks has resulted in a higher weight of this stock in the holdings of ordinary investors. According to data from Vanda Research, NVIDIA accounts for over 10% of a typical household trader's portfolio, up from just 5.5% at the beginning of 2024. This stock is now the second largest holding among ordinary retail investors, second only to Tesla.

Moreover, the net inflow of retail investors into NVIDIA in 2024 has increased by over 885% compared to three years ago. Gil Luria, head of technology research at investment bank D.A. Davidson, stated, "NVIDIA is indeed prominent in how quickly retail investors have become an important component of the company's equity." He added, "This rise is particularly remarkable."

Marco Iachini mentioned that before and after NVIDIA announces quarterly Earnings Reports this year, the funds flowing into this stock tend to surge. Retail investors continued to Buy NVIDIA Stocks even when the Large Cap market fell in early August.

It is certain that as this stock loses some momentum, the Inflow has cooled somewhat. Gil Luria stated that although NVIDIA's performance continues to exceed Wall Street's expectations, the extent to which it surpasses expectations is not sufficient for the company's stock price to continue rising rapidly. He added that the stock has now reached a more "balanced" and "reasonable" level.

Although investing is largely a digital activity, market participants' affection for NVIDIA has spread into the real world. At the end of August, some gathered in New York for a well-documented focus party primarily focusing on NVIDIA's Earnings Reports. This event occurred a few months after the stock split 10-for-1, which is often intended to incentivize retail investors.

Although the number of retail investors holding NVIDIA Stocks is large, this factor has not pushed up the stock's PE, unlike Tesla and Palantir (PLTR.US). However, Morningstar stock strategist Brian Colello stated that for a stock the size of NVIDIA, its volatility is "quite large", which may highlight the role of retail investors in driving the stock price. He remarked, "For such a large company, the stock price can experience such significant volatility on any given day, which can sometimes be astonishing."

What do retail investors want next?

2024 marks the second consecutive year in which a stock's net inflow has exceeded that of the SPDR S&P 500 ETF Trust. Marco Iachini stated that the large inflow into the ETF could ease investors' worries about abandoning broadly index funds perceived as safe investments. He noted that the substantial inflow into large technology stocks over the past two years may reflect traders chasing the ongoing bull market.

Marco Iachini stated that despite the strong returns, NVIDIA may be a surprising choice for typical domestic investors in the USA. He mentioned that although NVIDIA's CEO Jensen Huang always wears his signature leather jacket, the company lacks a 'god-like' personality to attract the attention of retail investors.

Marco Iachini noted that Palantir has gained favor with retail investors in the fourth quarter and may become a hot stock in the new year. According to Vanda Research, this stock is the ninth most popular stock for 2024, surpassing Amazon (AMZN.US), Alphabet (GOOGL.US), and Microsoft (MSFT.US). The data shows that Palantir's stock price has soared nearly 380% year-to-date, making it the best-performing stock in the S&P 500 Index.

Vanda Research高级副总裁Marco Iachini表示:“事实证明,英伟达在某种程度上抢了特斯拉的风头,因为它的价格涨幅令人印象深刻。”

Vanda Research高级副总裁Marco Iachini表示:“事实证明,英伟达在某种程度上抢了特斯拉的风头,因为它的价格涨幅令人印象深刻。”