① This time, Ruizhong Life has launched a stake in CHINA LONGYUAN H shares for equity investment management; ② Asset returns are under pressure, and insurance funds have initiated a new round of "stake launch" this year; ③ As of December 25, at least 8 insurance institutions have launched stakes in 20 listed companies this year.

According to the Financial Association on December 25 (Reporter Xia Shuyuan), the pace of asset allocation by insurance funds is accelerating. On December 25, Ruizhong Life disclosed the announcement of launching a stake in CHINA LONGYUAN (00916.HK) H shares, stating that the company purchased 4.262 million shares of CHINA LONGYUAN H on December 20, 2024, involving 29.09312 million Hong Kong dollars.

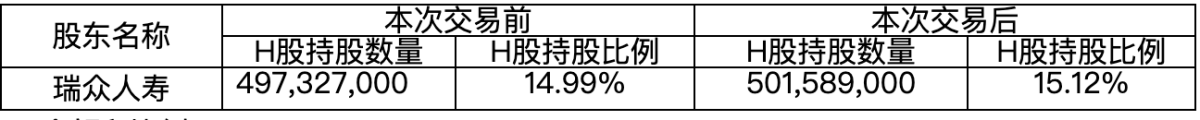

It is reported that after participating in the aforementioned stake launch, Ruizhong Life holds 0.501589 billion shares of CHINA LONGYUAN H, accounting for 15.12% of the total H share capital of this listed company, once again reaching the stake launch threshold. According to incomplete statistics from Financial Association reporters, as of December 25, at least 8 insurance institutions have launched stakes in 20 listed companies this year, with both the number of stake launches and the number of listed companies reaching a new high in nearly 4 years.

Insiders say that insurance companies can achieve a certain smoothing of accounting profits by launching stakes in listed companies, reducing the volatility of investment returns from equity instruments. However, launching stakes also requires insurance companies to have a strategic industrial perspective, combining insights from both primary and secondary markets. Meanwhile, although long-term equity investments have stable investment value in the medium to long term, caution should be taken regarding impairment risks. According to Kong Xiang, the head of the non-bank financial industry at Guosen Securities, insurance enterprises are expected to further increase their holdings in listed companies with high dividends, high capital appreciation potential, and high ROE attributes, matching the insurance industry's long-term and stable asset side demand.

Insiders say that insurance companies can achieve a certain smoothing of accounting profits by launching stakes in listed companies, reducing the volatility of investment returns from equity instruments. However, launching stakes also requires insurance companies to have a strategic industrial perspective, combining insights from both primary and secondary markets. Meanwhile, although long-term equity investments have stable investment value in the medium to long term, caution should be taken regarding impairment risks. According to Kong Xiang, the head of the non-bank financial industry at Guosen Securities, insurance enterprises are expected to further increase their holdings in listed companies with high dividends, high capital appreciation potential, and high ROE attributes, matching the insurance industry's long-term and stable asset side demand.

Ruizhong Life has launched a stake in CHINA LONGYUAN H shares, increasing its shareholding ratio to 15.12%.

As an indispensable and important investment force in the capital markets, the repositioning dynamics of insurers are closely monitored by investors.

On December 25, Ruizhong Life issued an announcement regarding the stake launch of CHINA LONGYUAN H shares, stating that on December 20, 2024, the company purchased 4.262 million shares of CHINA LONGYUAN H, holding a total of 0.501589 billion shares of CHINA LONGYUAN H, accounting for 15.12% of the total H share capital of this listed company.

It is reported that this time Ruizhong Life's stake launch in CHINA LONGYUAN H shares will be included in equity investment management. Before participating in this stake launch transaction, Ruizhong Life held 0.497327 billion shares of CHINA LONGYUAN H, accounting for 14.99% of its H share capital.

As of December 20, 2024, the closing price of CHINA LONGYUAN H Shares is 6.77 Hong Kong dollars per share, and based on that day's end exchange rate of Hong Kong dollars to Chinese yuan, the book balance held by Ruizhong Life Insurance for CHINA LONGYUAN H Shares is 3.143 billion yuan.

In terms of funding sources, Ruizhong Life Insurance's recent purchase of CHINA LONGYUAN H Shares was financed from its own Account, as well as from the universal and dividend Account insurance liability reserves. The balance for the investment of this stock from the universal Account is 0.295 billion yuan, and the balance for the investment from the dividend Account is 68.5423 million yuan, with both having an average holding period of 5 months.

It is reported that as early as July 22 of this year, Ruizhong Life Insurance increased its shareholding in CHINA LONGYUAN by 5.26 million shares, at a price of 7.45 Hong Kong dollars per share, with a total amount of 39.187 million Hong Kong dollars, increasing its shareholding ratio to 5%, thus first reaching the threshold for raising shares.

Public information shows that CHINA LONGYUAN was established in 1993 and is a large comprehensive power generation group primarily focused on developing and operating new energy, currently under the National Energy Group.

In 2009, Longyuan Electric successfully listed on the main board in Hong Kong, and in 2022, it was listed on the A-share market, becoming the first domestic H-share new energy power central enterprise to return to the A-share market, the first of the five major power generation groups new energy companies to land on the A-share market, the first to simultaneously implement share swap absorption and merger, asset sales, and asset purchase projects.

Currently, Longyuan Electric owns wind power, photovoltaic, biomass, tidal, geothermal, and thermal power projects, with business operations in 32 provinces and regions in China as well as countries such as Canada, South Africa, and Ukraine. By the end of 2023, Longyuan Electric's controlling installed capacity is 35,593.67 megawatts.

In the first three quarters of 2024, Longyuan Electric achieved operating revenue of 26.35 billion yuan, a decrease of 6.39% year-on-year; net profit attributable to the parent company was 5.475 billion yuan, a decrease of 10.61% year-on-year.

Asset yields are under pressure, and insurance capital has stirred a new wave of "raising shares".

In fact, Ruizhong Life's stake in China Longyuan Power is just a microcosm of the resurgence of insurance companies' enthusiasm for takeovers.

Specifically, this year, the listed companies targeted by the insurance firms include Ping An Asset Management, Great Wall Life Insurance, Li'an Life Insurance, China Postal Insurance, Zijin Property Insurance, New China Life Insurance, and the subsidiaries of China Pacific Insurance forming a concerted action group.

Taking Ping An Asset Management as an example, the company recently targeted the H shares of Industrial And Commercial Bank Of China and China Construction Bank. Kong Xiang analyzes that the cost-effectiveness of Hong Kong stocks is gradually being recognized by insurance funds.

Since 2020, the insurance liability side has rapidly expanded due to the high growth of increasing amount life insurance. In order to meet asset-liability matching and investment return requirements, the demand for dividend-type equity assets has increased, resulting in a significant rise in the number of times low-valued, high-dividend Hong Kong stocks have been targeted by insurance funds. In addition, insurance funds are further increasing equity investment returns by utilizing the pricing advantage of Hong Kong stocks and the tax-exempt policy for corporate income tax.” Kong Xiang stated.

In terms of the main target companies, Great Wall Life Insurance has targeted a total of 6 listed companies this year, namely Wuxi Rural Commercial Bank, City Development Environment, Qinhuangdao Port, Jiangsu Jiangnan Water, Jiangxi Ganyue Expressway, and DYNAGREEN ENV.

At the same time, Zijin Property Insurance has targeted Wuxi Huaguang Environment & Energy Group, while subsidiaries of China Pacific Insurance targeted HUADIAN POWER, HUANENG POWER, COSCO SHIP ENGY H shares, and others; Ruizhong Life Insurance targeted CHINA LONGYUAN and China Tourism Group Duty Free Corporation. According to incomplete statistics from Caixin, as of December 25, at least 8 insurance institutions have targeted 20 listed companies this year, with both the number of targeting instances and the number of targeted listed companies reaching a new high in nearly 4 years.

From the distribution of industries among targeted companies, the insurance capital has switched from real estate and consumer industries in 2015 to public utilities and eco-friendly industries by 2023, moving towards a preference for low-volatility and high-dividend investments. An insurance asset management personnel stated: 'Since the third quarter of 2024, in terms of the industries of targeted stocks, insurance capital has expanded from previous public utilities, environmental protection, and transportation to the pharmaceutical distribution sector, which may reflect an expansion in the scope of high-dividend layouts.'

In Kong Xiang's view, behind the increased targeting of quality listed companies by companies represented by Ruizhong Life Insurance, on one hand, the new regulations have led to greater transparency in asset classification for insurance firms, but equity investments may directly increase fluctuations in the profit and loss statement.

On the other hand, the central rate of long-term bonds continues to decline, increasing the pressure on insurance investment returns. As of December 20, the yields on 10-year and 30-year government bonds were 1.71% and 1.96%, respectively, down 0.85 basis points and 0.87 basis points since the beginning of the year. With the cost of existing liabilities remaining relatively fixed, the ongoing decline in long-term bond rates further intensifies the asset-liability matching pressure for insurance companies. As absolute return-oriented institutions, insurance funds are less likely to engage in credit downgrades, thus exacerbating the pressure of asset scarcity.

In his view, although long-term equity investments have medium- to long-term stable investment value, caution is needed regarding impairment risks.

"From the perspective of accounting standards, insurance companies need to determine whether there is a possibility of impairment for assets on the balance sheet date. If the market price of an asset significantly declines during the current period, it indicates that the asset may be impaired. For assets that show signs of impairment and whose recoverable amount is less than their book value, an impairment loss needs to be recognized, which may have a certain negative impact on the investment returns of insurance funds," said Kong Xiang.

业内人士表示,保险公司通过举牌上市公司能够实现一定的会计利润平滑,降低权益工具投资的投资收益波动,但举牌也要求险企具有战略性产业眼光,一级市场和二级市场视角相结合。同时,虽然长期股权投资具备中长期稳健投资价值,但需警惕减值风险。据国信证券非银金融行业负责人孔祥预计,未来险企将进一步增持具有高分红、高资本增值潜力、高ROE属性上市企业,匹配保险行业资产端长期、稳定的需求。

业内人士表示,保险公司通过举牌上市公司能够实现一定的会计利润平滑,降低权益工具投资的投资收益波动,但举牌也要求险企具有战略性产业眼光,一级市场和二级市场视角相结合。同时,虽然长期股权投资具备中长期稳健投资价值,但需警惕减值风险。据国信证券非银金融行业负责人孔祥预计,未来险企将进一步增持具有高分红、高资本增值潜力、高ROE属性上市企业,匹配保险行业资产端长期、稳定的需求。