Source: Gelonghui

Author: Yuanhe

There are no winners.

The Dining Industry is undoubtedly the most desolate industry in recent years.

Over three years of Masks, countless restaurants have collapsed during the winter of Dining.

Over three years of Masks, countless restaurants have collapsed during the winter of Dining.

After 2023, the Dining industry has fallen into unprecedented internal competition, with Low Stock Price like a vortex pulling all Dining enterprises into an inescapable abyss.

$XIABUXIABU (00520.HK)$The founder even bluntly stated that if prices are not lowered, there will be starvation.

On December 17, 2014, XIABUXIABU was listed on the Hong Kong Stock Exchange, becoming the "first stock of chain hotpot."

Now, it has been exactly ten years.

Ten years after the listing, XIABUXIABU's stock price once reached a peak of 26 Hong Kong dollars in 2021, but subsequently fell to less than one Hong Kong dollar.

Looking at the Hong Kong stock dining industry, such situations are not rare, and almost no one has survived in the entire dining Sector.

$HELENS (09869.HK)$Revenue declines and stock price dropped to the 2 range;

$JIUMAOJIU (09922.HK)$Net income decreased by 67.5%, and stock price fell to below 4 Hong Kong dollars per share;

WDB's profits have once again turned from profit to loss, with the stock price falling below 1 Hong Kong dollar, already becoming a mythical stock.

The Market Cap once exceeded 200 billion.$HAIDILAO (06862.HK)$However, it is also facing the crisis of declining growth, and the Market Cap has been halved.

Since 2020.$Tongqinglou Catering Corporation (605108.SH)$and$Zhongyin Babi Food (605338.SH)$After going public, numerous local Dining enterprises submitted their prospectuses, but none were able to open the doors to the Hong Kong Stock Exchange again. Until recently,$XIAOCAIYUAN (00999.HK)$going public finally brought a glimmer of hope to the bleak Dining industry.

Why is Dining so difficult?

As a hot pot restaurant founded by a **** person in Peking that has yet to open a store in Taiwan, XIABUXIABU is likely the first impression many people have of '**** small hot pots'.

The unique format of 'one pot for one person' made XIABUXIABU widely embraced by young people from the start, and it quickly rose to become a counterpart to HAIDILAO as one of the 'hot pot giants'.

Therefore, despite trending topics occasionally showing 'young people abandoning XIABUXIABU', the fact that it can still trend somewhat indicates that XIABUXIABU maintains a solid base among young people.

Some people express on trending topics that XIABUXIABU is still their white moonlight.

Ten years ago, when XIABUXIABU went public, a specific trip was made to Hong Kong to open an account and buy XIABUXIABU stocks, but after ten years, it has become a significant loss.

Ten years ago, the issue price of XIABUXIABU was 4.7 HKD per share; although it once rose to 26 HKD in 2021, it has now only fallen to 1 HKD. Holding it for ten years has resulted in a loss of nearly 80%.

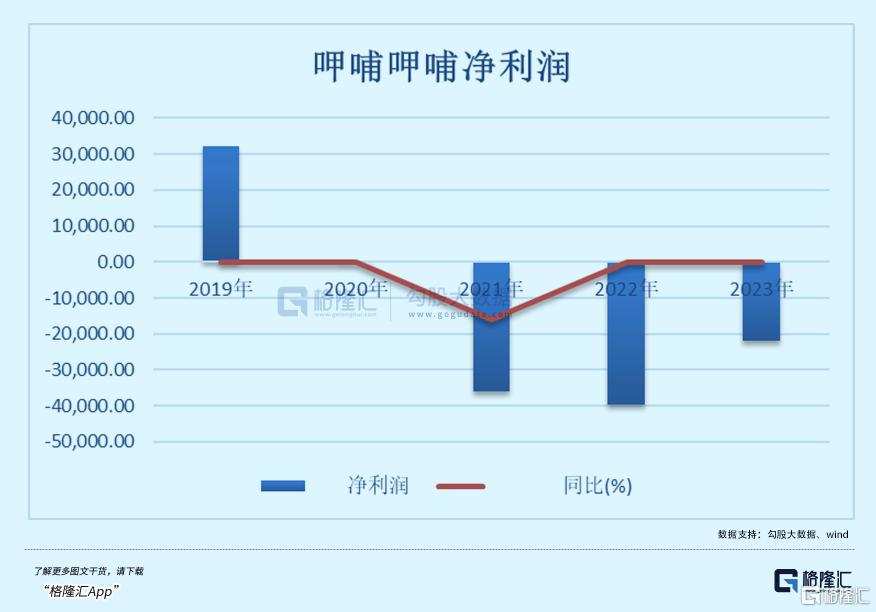

Behind the sharp decline in stock price in recent years is the increasingly dismal performance of XIABUXIABU.

During the mask period, losses and low profits became the norm for dining enterprises.

However, by the time it reached 2023, most dining enterprises either turned losses into profits or achieved high growth in profits, while only XIABUXIABU has yet to recover from its losses.

From 2021 to 2023, the net income attributable to the shareholders of XIABUXIABU was losses of 0.29 billion yuan, losses of 0.35 billion yuan, and losses of 0.2 billion yuan respectively.

In the first half of 2024 alone, XIABUXIABU's losses reached 0.27 billion yuan, turning from profit to loss year-on-year.

Calculating since 2021, XIABUXIABU has experienced continuous losses for three and a half years, with total losses exceeding 1.1 billion yuan.

The losses in performance in recent years are the "aftereffects" of XIABUXIABU implementing the "high-end" strategy since 2017.

Ten years ago, XIABUXIABU was thriving, catching the wave of Consumption Upgrade, and thus its founder, He Guangqi, launched the brand's high-end strategy.

In 2017, He Guangqi announced that XIABUXIABU's positioning would upgrade from "fast food" to "light casual dining."

Compared to the emphasis on decoration, layout, tableware, and dishes during the brand upgrade, the most significant change for customers brought by the "high-end" concept is the rise in dish prices.

The sesame sauce that originally sold for 2 yuan per bag turned into a self-service condiment priced at 7 yuan per person, and the single-person meal set that originally sold for over 30 yuan has gradually increased to around 50 yuan, and in the past two years has even further risen to above 60 yuan.

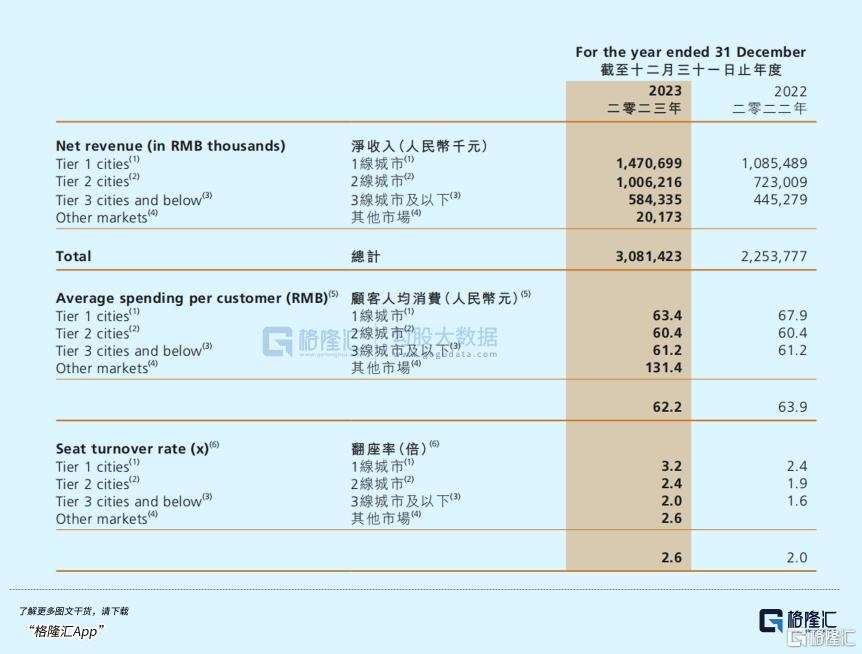

The rise in prices is also reflected in the Earnings Reports.

In 2013, the average spending per customer at XIABUXIABU was only 40.8 yuan, and by 2023, it had risen to 62.2 yuan.

The increase in prices should originally lead to growth in revenue and profits, but this momentum failed after two years.

In 2019, XIABUXIABU's revenue exceeded 6 billion, but since then, combined with the impact of the pandemic, its revenue has not continued to grow rapidly.

This 20 yuan price difference is not enough to turn XIABUXIABU from a popular affordable hotpot into a less appealing mid-range hotpot.

The problem lies in the changing environment faced by the Dining Industry.

Coucou is still that Coucou.

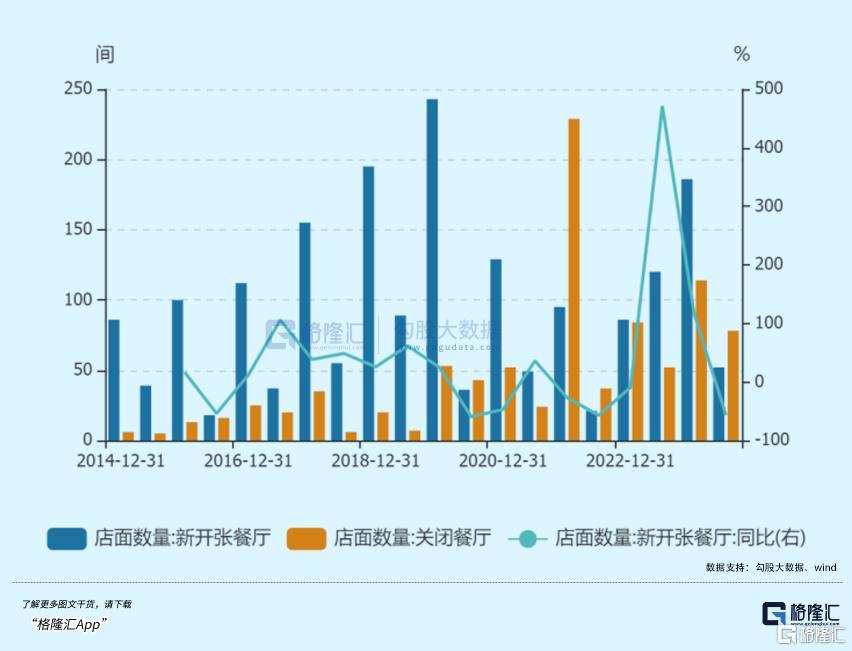

The sub-brand COUCOU launched by XIABUXIABU in 2016 has progressed further on the path to premiumization.

Since opening its first store in Sanlitun, Peking in 2016, the high consumer spending has been an unshakeable label for COUCOU.

At that time, the high consumer spending not only did not hinder COUCOU's expansion but instead achieved an extremely high table turnover rate, becoming the foundation for XIABUXIABU's strong high-end positioning.

Subsequent developments have confirmed COUCOU's success; today, COUCOU has become a revenue powerhouse for XIABUXIABU Group, rivaling the main brand.

Thanks to the rapid expansion of COUCOU, from 2016 to 2021, XIABUXIABU Group's revenue has increased year by year, with a compound annual growth rate of 212%.

But now that the timeline has returned to the present, COUCOU remains the same, yet customers have become hesitant to pay its high prices.

In recent years, COUCOU's per capita consumption has stayed around 140 yuan, peaking at 150.9 yuan in 2022, nearly half higher than HAIDILAO's 99.1 yuan per capita consumption.

This year, "COUCOU's per capita consumption exceeds that of HAIDILAO" also made it to trending topics; compared to the better service and wider brand recognition of HAIDILAO, COUCOU has gradually lost its competitive advantage.

With the overall environment changing, XIABUXIABU Group has ultimately been "abandoned by young people," and has had to shift direction from its previous high-end strategy.

In May this year, XIABUXIABU announced a price reduction, with the price of single-person set meals in stores generally adjusted to below 50 yuan, compared to an average price of 65 yuan previously, a reduction of over 10%.

He Guangqi stated that after the price reduction, XIABUXIABU's revenue, profits, and customer traffic all increased by nearly 10% year-on-year. However, this is not enough to save the group from crisis.

By the end of the first half of 2024, XIABUXIABU had 1,072 stores, a decrease of 26 from 1,098 at the end of 2023.

In the past six months, XIABUXIABU did not open new stores, but it closed more stores at the same time.

Compared to rebranding and efforts to expand, the main theme of the group has become to contract as much as possible and strive for profitability.

And this may be a portrayal of many dining brands.

For dining enterprises, 'survival' may have become the only goal.

According to previous data, more than 1 million Dining-related enterprises across the country exited the market from January to June 2024.

Founded in 1972 and famous for its high-end soup dumplings, Din Tai Fung announced this year that it would withdraw from the Peking market, with 14 stores gradually closing.

Once famous hot pot brand, Brother Guo, has reported closures in many areas across the country this year.

The milk tea brand, Little Village, which once had 500 stores, now has only 34 locations left nationwide.

The high-end Japanese restaurant Akasaka Tei has even fallen into a dire situation of owing rent and salaries, having to settle debts with goods.

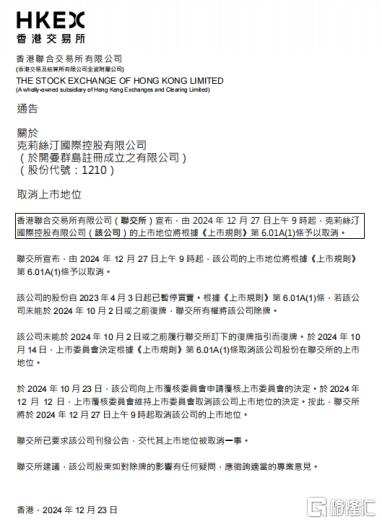

CHRISTINE, once known as the 'first stock in baking,' faces challenges such as store closures and financial crises, leading to the revocation of its listing status.

Even if they manage to survive, most Dining enterprises struggle to earn a profit.

According to data, in the first half of this year, the total profit of dining enterprises in Peking above the designated size was 0.18 billion yuan, a year-on-year decrease of 88.8%, and the profit margin fell to 0.37%.

If distributed evenly across each establishment, the profit is only enough to maintain survival.

Even so, dining enterprises are still choosing to lower prices to attract more customers.

HAIDILAO rebranded its sub-brand 'Haolao Hotpot' to 'Xiao Hai Hotpot,' reducing the average spending from 80 yuan to around 60 yuan.

The sub-brand of JIUMAOJIU, Song Hotpot, has also undergone a new round of price reductions, with the minimum prices for broth, meat dishes, and vegetable categories reduced to 8 yuan, 9.9 yuan, and 6.6 yuan respectively.

Hefulomena has carried out a new round of price reductions, with product price ranges adjusted to 16 yuan - 29 yuan.

Leading dining enterprises with strong funding, better organizational capacity, and supply chains are all moving downwards, making the situation of small dining establishments even more difficult.

Is it possible to survive better in a price war by striving to strip away every drop of profit? Judging by past experiences in Japan, this is not the case.

Japan Dining Industry

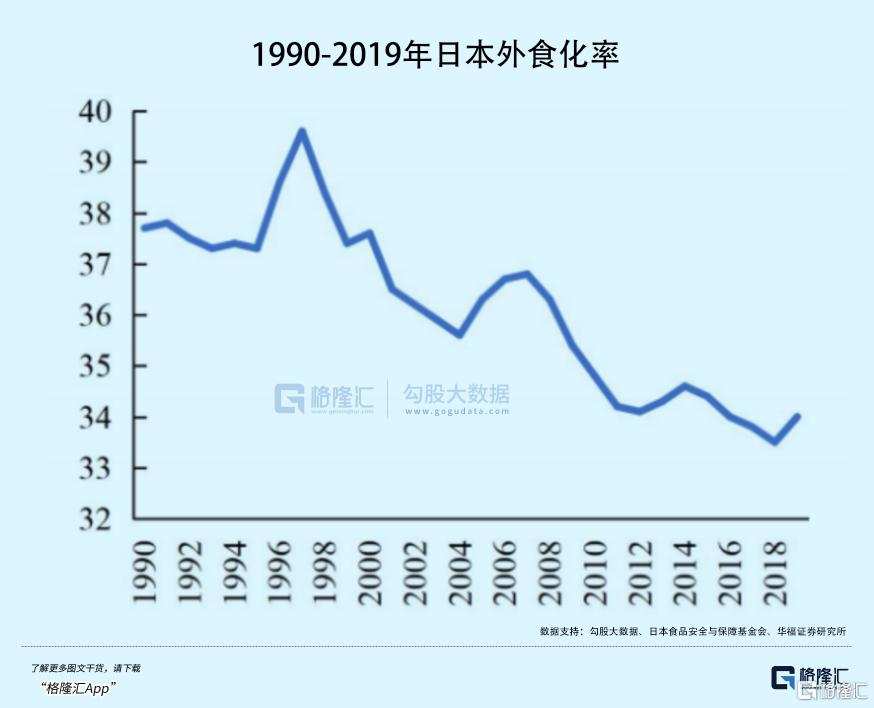

Since the 1990s, Japan's dining industry has experienced three price wars from 1992 to 1995, 1998 to 2002, and 2009 to 2012.

In the sluggish economic environment, the public's willingness and ability to consume have both declined, and the significant economic pressure has greatly reduced the proportion of consumers dining out, leading the dining industry to gradually fall into low-price competition to attract customers.

However, it is also because of this that Japanese fast food brands have gradually risen. Brands like Yoshinoya and Shiqijia have improved operational efficiency and reduced unnecessary expenses through unified procurement and central kitchen models, thus gradually emerging in the low-price battle.

Also rising in the low-price battle is the well-known Salia.

The positioning of family restaurants should have made Salia more impacted by the sluggish economy and declining birth rates, but by enhancing its operational efficiency and maximizing product cost-effectiveness, Salia instead achieved counter-cyclical growth, increasing its number of stores by ten times from 1992 to 2003.

However, as the low-price battle gradually spreads, the sales revenue increase brought by price reduction strategies will gradually decrease, the effectiveness will also diminish, and along with rising costs, corporate profits will continue to be eroded.

Taking the third round of price wars in Japan as an example, between 2009 and 2012, Shiqijia and Matsuya gained significant customer flow increase due to early price cuts, with their stock prices rising by 31.2% and 13.9% respectively over three years.

However, Yoshinoya, another Japanese fast food chain, faced a late price drop on one hand, while its costs had already been minimized, ultimately losing in the third round of price wars, with its stock price falling by 14.7% over three years.

These several price wars show that lowering prices does not necessarily harm profits.

Taking XIABUXIABU as an example, starting in 2023, the average spending per customer at XIABUXIABU began to decline, but at the same time, the group's gross margin increased from 61.9% in 2021 to 62.6% in 2023.

In the first half of 2024, the gross margin of the XIABU group further increased to 65.4%.

In a price war, what is truly tested is not the price itself, but how to streamline processes, improve efficiency, and thereby provide consumers with more favorable prices through standardized operations.

Although Sally's average spending per customer is only about 30 yuan, in the 2023 fiscal year, Sally's net sales reached 183.244 billion yen, with the net income attributable to the parent reaching 5.154 billion yen, operating a total of 1,540 stores worldwide, among which there are 1,055 in Japan.

Analyzing SALIHYA's business model reveals several unconventional actions, such as rarely launching new products tailored to local conditions, while the menu has remained unchanged for many years. Additionally, its expansion has been extremely slow; SALIHYA entered the Chinese market in 2003, yet from 2003 to 2008, only about 20 new stores were opened each year.

Consequently, although the number of SALIHYA stores reached 500 in 2001, and subsequently expanded into mainland China, Hong Kong, Taiwan, and Singapore, it was not until 2011 that the number of SALIHYA stores exceeded 1,000.

An extremely efficient production system management and a profit-first expansion philosophy allowed SALIHYA to grow against the tide during Japan's price wars.

When growth peaked domestically in Japan, this system could be rapidly replicated overseas, becoming a new growth point.

In contrast to the domestic market, the price war has crushed a considerable number of high-end dining establishments and low-tier restaurants; at the same time, it has forced dining enterprises to establish supply chain systems and improve operational management, thereby compressing costs.

Although it is not guaranteed that the domestic market will replicate Japan's path, ultimately, those enterprises with a certain brand effect and robust operational models will stand out in the price war.

Conclusion

As 2025 approaches, the internal competition and clearing in the Dining industry will continue.

For Consumers, the price war is also a battle of choices. However, consumer thinking does not necessarily pursue the ultimate cost performance, but considers both cost performance and quality-price ratio in parallel, requiring an appropriate low price while pursuing quality.

Currently, whether it's the briefly popular internet celebrity restaurants or the overrated high-end dining, many have deviated from the essence of dining, neglecting the essence of dishes and services in the Dining industry.

The low-price war for such dining enterprises' clearing is, to some extent, a return to the essence of dining.

Similarly, looking at the experience of Japan, price wars do not continue indefinitely, but there is a high probability of them recurring.

By mid-2024, the number of dining establishments nationwide has decreased year-on-year by over 0.6 million, and the clearing of supply may also mean that competition is easing.

With strong policy stimulation for consumption, perhaps greater opportunities will arise after intense competition. (The end of the article.)

Editor/Rocky

口罩三年间,无数餐馆倒在餐饮寒冬里。

口罩三年间,无数餐馆倒在餐饮寒冬里。