Author: Leeor Shimron Source: Forbes Translated by: Shan Oppa, Golden Finance

2024 marks a historic turning point for Bitcoin and the cryptocurrency ecosystem. This year, the first Bitcoin and Ethereum ETFs were successfully launched, marking the true entry of institutions into the crypto field. Bitcoin first broke through $100,000, while stablecoins continued to solidify the dollar's dominant position globally. In addition, the winning presidential candidate in the USA will support Bitcoin as one of the core campaign promises during the election process.

These milestone events together lay the groundwork for 2024 as an important year for the cryptocurrency industry to take the global stage. As the industry moves into 2025, here are my predictions for the seven key events that might occur next year.

1. Major economies in the Group of Seven or BRICS will establish and announce strategic Bitcoin reserves.

The Trump administration's proposal to establish a Strategic Bitcoin Reserve (SBR) for the USA has sparked widespread discussion and speculation.

The Trump administration's proposal to establish a Strategic Bitcoin Reserve (SBR) for the USA has sparked widespread discussion and speculation.

Although incorporating Bitcoin into the U.S. Treasury's balance sheet requires strong political will and congressional approval, the proposal itself has profound implications.

The signals released by the USA may prompt other major countries to consider similar actions. According to game theory, these countries might act in advance to seize a strategic advantage in reserve diversification. Bitcoin's limited supply and its increasingly prominent attributes as a digital store of value may accelerate the response of various nations.

Currently, the world is entering a race to see which major country can be the first to include Bitcoin in its national reserves, holding it alongside traditional assets such as Gold, Forex, and sovereign Bonds.

This move will not only further strengthen Bitcoin's position as a global reserve asset but may also reshape the international financial landscape, having far-reaching effects on the global economy and geopolitics. If a major economy takes the lead in establishing a strategic Bitcoin reserve, it could signify a new era in sovereign wealth management.

2. The growth of stablecoins continues, with circulation doubling, surpassing 400 billion USD.

Stablecoins have become one of the most successful mainstream applications of Cryptos, bridging the gap between traditional finance and the crypto ecosystem. Millions of users globally utilize stablecoins for remittances and everyday transactions, hedging against domestic currency volatility risks through the relative stability of the USD.

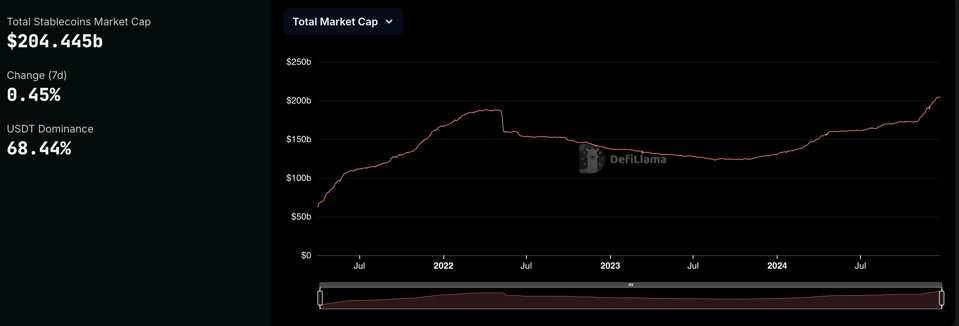

In 2024, the circulation supply of stablecoins reached a historical high, exceeding 200 billion USD, with the market primarily led by Tether and Circle. Stablecoins rely on blockchain networks such as Ethereum, Solana, and Tron to enable seamless and borderless transactions.

Looking ahead, the growth of stablecoins is expected to accelerate in 2025, potentially doubling to exceed 400 billion USD. This growth will be driven by the potential passing of specific legislation regarding stablecoins, which could provide much-needed regulatory clarity and promote innovation in the industry. USA regulators are increasingly recognizing the strategic importance of stablecoins in reinforcing the global dominance of the USD and solidifying its position as the world’s reserve currency.

Stablecoins have set a historical high this year, with total supply exceeding 200 billion USD.

3. Bitcoin DeFi will become a growth driver under the L2 ecosystem.

Bitcoin is transcending its 'store of value' role; with the development of L2 networks such as Stacks, BOB, Babylon, and CoreDAO, the Bitcoin DeFi ecosystem is gradually emerging. These L2 networks enhance Bitcoin's scalability and programmability, allowing DeFi applications to thrive on the most secure and decentralized blockchain.

In 2024, Stacks welcomed a transformative year with the launch of the Nakamoto upgrade and sBTC. The Nakamoto upgrade allows Stacks to fully inherit Bitcoin's finality and introduces faster block speeds, greatly improving user experience. Meanwhile, sBTC (a trustless Bitcoin-backed asset) was launched in December, allowing users to participate in DeFi activities such as lending, exchanging, and staking without leaving the Bitcoin ecosystem.

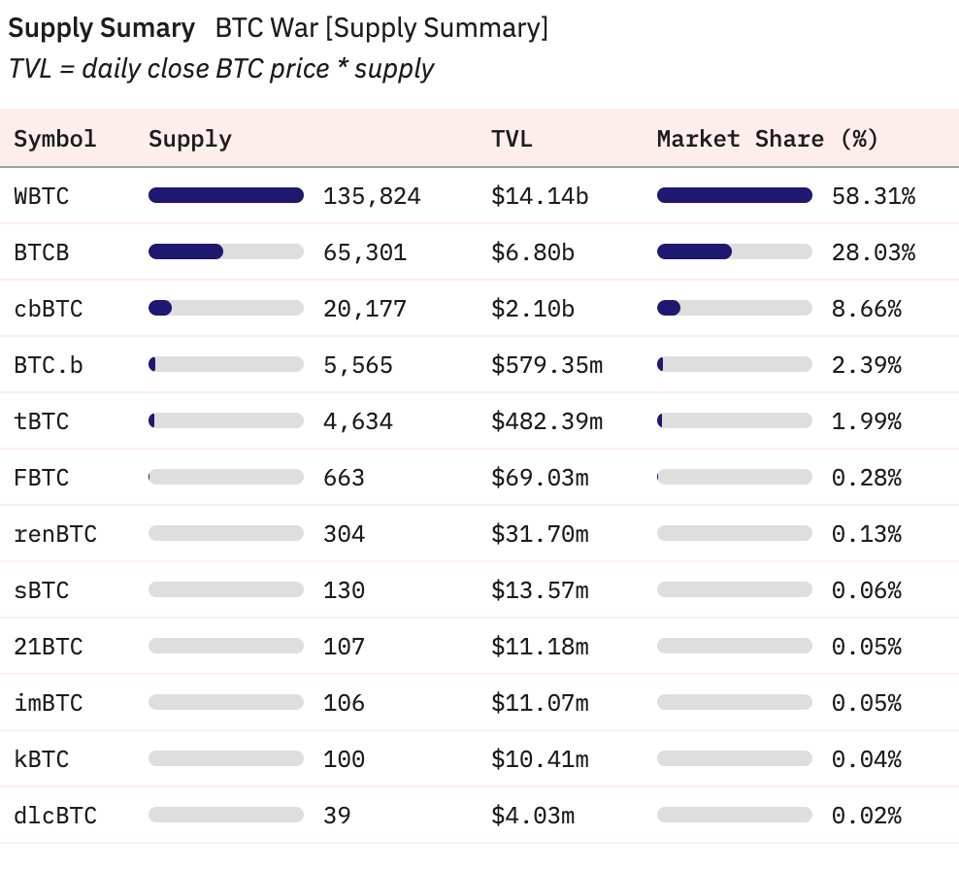

Before this, Bitcoin holders who wanted to participate in DeFi had to wrap their Bitcoin on other networks, such as Ethereum.

This method relied on centralized custodians, such as WBTC (BitGo), BTCB (Binance), and cbBTC (Coinbase), increasing centralization and censorship risks.

Bitcoin L2 reduces these risks, providing a more decentralized way for Bitcoin to play a greater role within its native ecosystem.

In 2025, Bitcoin DeFi is expected to experience explosive growth. I predict that the total value locked (TVL) in Bitcoin L2 will exceed the current $24 billion represented by wrapped Bitcoin derivatives, which is approximately 1.2% of the total Bitcoin supply.

As Bitcoin's market cap reaches $2 trillion, L2 networks will enable users to unlock the potential value of Bitcoin more securely and efficiently, further solidifying Bitcoin's core position in decentralized finance.

The value of Bitcoin derivative tokens wrapped on other blockchains exceeds $24 billion, approximately 1.2% of the total value of Bitcoin's total supply.

4. Bitcoin ETFs will continue to surge, with new ETFs focusing on cryptocurrency emerging.

The launch of the spot Bitcoin ETF marks a historic milestone, becoming the most successful ETF debut in history. These ETFs attracted over $108 billion in assets under management (AUM) in their first year, demonstrating unparalleled demand from retail and institutional investors. Major players like Blackrock, Fidelity, and Ark Invest played a key role in introducing regulated Bitcoin into traditional financial markets, laying the foundation for a wave of innovations in cryptocurrency ETFs.

The Bitcoin ETF is the most successful ETF ever launched.

Following the success of the Bitcoin ETF, the Ethereum ETF made its debut, providing investors with the opportunity to invest in the second-largest cryptocurrency by market cap. Looking ahead, staking is expected to be integrated into the Ethereum ETF for the first time in 2025. This feature will enable investors to earn staking rewards, further enhancing the appeal and utility of these funds.

I expect that ETFs for other leading cryptocurrency protocols will soon be launched, such as Solana, which is known for its high-performance blockchain, thriving DeFi ecosystem, and rapid growth in gaming, NFTs, and memecoins.

Additionally, we may see the launch of weighted cryptocurrency index ETFs, aimed at providing diversified investment opportunities across the broader crypto market. These indices could include top-performing assets such as Bitcoin, Ethereum, and Solana, as well as a mix of emerging protocols, providing investors with a balanced portfolio that captures the growth potential across the entire ecosystem. Such innovations would make cryptocurrency investment easier, more efficient, and attract a wide range of investors, further driving capital into the space.

5. One of the 'big seven' companies will add Bitcoin to its balance sheet (beyond Tesla).

The Financial Accounting Standards Board (FASB) has introduced fair value accounting rules for cryptocurrencies, applicable to fiscal years starting after December 15, 2024. These new standards require companies to report their held cryptocurrencies (such as Bitcoin) at fair market value while covering gains and losses from real-time market fluctuations.

Previously, digital assets were classified as intangible assets, forcing companies to write down impaired assets while prohibiting the recognition of unrealized gains. This conservative approach often underestimated the true value of cryptocurrencies held on corporate balance sheets. The updated rules address these limitations, making financial reporting more accurate and cryptocurrencies a more attractive asset for corporate finances.

The seven giants—Apple, Microsoft, Google, Amazon, NVIDIA, Tesla, and Meta—collectively Hold over 600 billion USD in cash reserves, providing them with significant flexibility to allocate part of their capital to Bitcoin. With enhanced accounting frameworks and increased regulatory transparency, it is likely that one of these Technology giants, besides Tesla, will add Bitcoin to its balance sheet.

This move would reflect prudent financial management:

Hedging against inflation: Preventing the depreciation of fiat currency.

Diversifying reserves: Adding unrelated and limited digital assets to their portfolio.

Leveraging appreciation potential: Capitalizing on the long-term growth history of Bitcoin.

Enhancing technological leadership: Aligning with the spirit of innovation by embracing digital transformation.

As new accounting rules come into effect and corporate finance adapts, Bitcoin may become a key reserve asset for the world's largest technology companies, further legitimizing its role in the Global financial system.

The total market cap of Cryptos will exceed 8 trillion USD.

In 2024, the total Market Cap of Cryptos surged to a historic high of 3.8 trillion USD, covering a wide range of use cases including Bitcoin as a value store, stablecoins, DeFi, NFTs, memecoins, GameFi, SocialFi, and more. This explosive growth reflects the expanding influence of the industry and the increasing adoption of blockchain-based solutions across various Industries.

By 2025, the influx of developer talent is expected to accelerate into the crypto ecosystem, driving the creation of new applications, achieving product-market fit, and attracting millions of additional users. This wave of innovation may spawn breakthrough decentralized applications (dApps) in fields like AI, decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and other emerging fields that are still in their infancy.

These transformative dApps provide tangible utility and address real-world problems, which will drive increased adoption and economic activity within the ecosystem. As the user base expands and capital Inflow into the space increases, asset prices will also rise, pushing the overall Market Cap to unprecedented heights. With this momentum, the crypto market is poised to surpass 8 trillion USD, marking the continued growth and innovation of the industry.

7. The revival of crypto startups, and the USA will become a Global crypto powerhouse again.

The USA cryptocurrency industry is on the brink of a transformative revival. The controversial 'mandatory regulation' approach of SEC Chairman Gary Gensler stifled innovation and drove many crypto startups offshore; he will be stepping down in January. His successor, Paul Atkins, brings a markedly different perspective. As a former SEC commissioner (2002-2008), Atkins is known for his supportive stance on cryptocurrencies, advocacy for deregulation, and leadership in initiatives supporting crypto advocacy organizations like Token Alliance. His approach promises to establish a more collaborative regulatory framework that promotes rather than stifles innovation.

"Chokepoint 2.0 action" is a covert initiative to restrict the entry of crypto startups into the USA banking system, the end of which lays the foundation for revival. By restoring fair access to banking infrastructure, the USA is creating an environment where blockchain developers and entrepreneurs can thrive without undue restrictions.

Regulatory clarity: The leadership change at the SEC and balanced regulatory policies will reduce uncertainty for startups and create a more predictable environment for innovation.

Access to capital and resources: As banking barriers are lifted, cryptocurrency companies will find it easier to enter Capital Markets and traditional financial services, leading to sustainable growth.

Talent and entrepreneurial spirit: The anticipated reduction in regulatory hostility is expected to attract top blockchain developers and entrepreneurs back to the USA, thereby revitalizing the ecosystem.

Increased regulatory transparency and new support for innovation will also lead to a significant increase in token issuance within the USA. Startups will feel empowered to issue tokens as part of their fundraising and ecosystem building efforts without worrying about strong regulatory opposition. These tokens, ranging from utility tokens used for decentralized applications to governance tokens for protocols, will attract both domestic and international capital while encouraging participation in USA projects.

Conclusion

Looking ahead to 2025, the crypto industry is clearly entering a new era of growth and maturity. With Bitcoin solidifying its status as a global reserve asset, the rise of ETFs, and exponential growth of DeFi and stablecoins, the foundation for widespread adoption and mainstream attention has been laid.

Supported by clearer regulations and breakthrough technologies, the crypto ecosystem will transcend boundaries and shape the future of global finance. These predictions highlight this year full of potential as the industry continues to prove itself as an unstoppable force.

特朗普政府提议为美国建立

特朗普政府提议为美国建立