Source: Boyong think tank

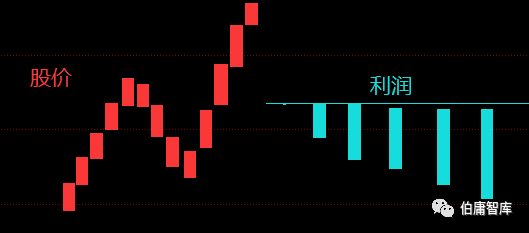

In our traditional valuation perception, the valuation of a company is closely related to its profitability. Our positive thinking is that the more profitable a company is, the greater its valuation market value will be, which is easy for us to understand.

But in the stock market, we find such a phenomenon, that is, some companies continue to lose money, but their share prices continue to reach new highs. What is more, the more companies lose money, the better the stock price rises. Why? Where is the underlying logic?

In order to talk about this issue, we must re-examine the value and valuation. If we give value a more appropriate name, it is "the value of the future". But in fact, in our subconscious, value always represents the present. The future is dynamic, while the present is static, which leads to many people's fixed thinking about valuation. in the future, we remember when it comes to value or valuation. The first thing we have to think about is the future value, not the present value. These two subconscious minds will affect the way we think about valuation.

For example, if you buy and sell live pigs, you are willing to buy it for 100 yuan today, not because it is worth 100 yuan in your heart today, but because you think it will be worth more than 100 yuan tomorrow, so as long as the value of the future is higher than that of today, then you can invest today.

In order to understand the logic of "the greater the loss, the greater the value" under certain conditions, let's first wrap the fried chestnuts on the plate.

For example, your child, you mostly send him to school. Before graduating from college, he never made money. That is to say, if you think of him as a company, it is a company that has been losing money for 18 years. And with the current situation of continuous financing and losses, he studied computer science during college. After graduation, in order to further his studies, you continue to spend more money for him to go to graduate school and doctor's degree. Until he has become a top software engineer, although he has not yet earned a penny, but you know, his value does increase, because as a top engineer, he can get back all his previous investment in five years, you see, we can understand this example.

If you compare your child to a company, there is no doubt that from the financial report, this is a company that has lost money for 30 years in a row, and it has lost more and more over the past 30 years, and it is also accompanied by a loss in financing. Obviously, this is a money-burning company. What we can see is that only the increasing intangible assets in the financial report. For such a company, I believe most people will lose their pass when they see it. But can you pass it? Of course not, even if you are an illiterate who has not been to school, you will understand its value.

In fact, the underlying logic of investment is the same. In many cases, when it is a human problem, it is easy for us to clarify the logic, but once it is replaced by a company problem, it becomes confusing.

So let's be clear that value is not determined by current profits, but by its future cash flow. If it is really determined by profit figures, you will find a lot of things ridiculous.

One year BABA's goal was to earn one yuan. As soon as the news came out, the capital market quickly gave it billions of valuation financing, and you can earn 100000 a year. Are you worth billions? Of course not, so you see, your current profit is higher than that of others, but their valuation is tens of thousands of times higher than yours, because your future explosions are different, so valuation is not simply competing with current profits, that is the most superficial view.

And some enterprises are still losing money, such as JD.com and Amazon.Com Inc, but their market capitalization is hundreds of billions and trillions. As soon as you work, you earn money every month and never lose money. Are you worth more than them? No, so the profit figure is not decisive in terms of value, so why do you also earn tens of thousands of dollars, but people estimate it to be worth tens of billions of dollars, and you are, after all, a wage earner? Its essence is that whether you lose money now or earn a dollar, it is only superficial, as long as it has the expected conditions to earn more cash flow in the future, then its value will match this expected cash flow.

When Ali announces that he will only earn one yuan, the next step is not only to earn two or three yuan, but to herald the shaping of the business model and the improvement of the industry, and then it may be tens of billions or tens of billions of dollars. Although you earn more than a hundred thousand yuan a year, but you are the valuation of the wage earners after all, because your future cash flow expectations can be seen, so don't look at the current profits, but look at the expected cash flow. This is the valuation that capital is really chasing.

With an understanding of the underlying logic, let's talk about several types of loss but value growth.

The first kind of ① is an enterprise that rolls an internal snowball. As I just mentioned in the example, the process of raising a child is a process of rolling its internal snowball. Although the internal snowball continues to lose money, its internal snowball continues to grow, and this kind of internal snowball has the basic ability to pry the larger cash flow in the future, so its value increases step by step.

For example, when you train a child to be a first-class engineer, then its valuation is equivalent to that of a first-class engineer. If at this time, you don't let him go to work and earn money, but continue to train, then he is still in a state of loss, but the valuation is rising. When he is trained to a top engineer, even if he does not make money, it already has the valuation of a top engineer. Because this level has the explosive cash flow of this level, that is, from losing money directly to making millions of dollars a year, he has such expected cash flow, so he is worth this valuation.

From the valuation can also be mapped to our lives, the valuation logic of the company is the same as the underlying logic of our valuation, some people continue to roll their own internal snowball, although they did not create too much cash flow at that time, even sustained cash flow outflows or losses, but his intrinsic value continues to rise, while some people choose to work all their lives and never roll their internal snowballs, so Even if the cash flow of its life is positive and has never lost money, its value is always like a snail, that is to say, the poor have never lost money, but they have been poor all their lives.

At the same time, we should be clear that losses and losses are not the same. In the capital market, some enterprises have expanded their losses, but their stock prices have reached new highs. This is the "child-raising model". The performance of some enterprises has declined slightly, but their stock prices have plummeted. Some companies' performance has reached record highs, but stock prices have turned downwards. Why are there so many different situations?. To understand these appearances, we need to return to the nature of valuation.

Losses are different from losses, which leads to some losses resulting in new highs and some plummeting.

One kind of loss is at the expense of the enlargement of the internal snowball, and the other is the stagnation or reduction of the internal snowball.

This is like, your child paid to sign up for cram school, gilded to be admitted to an engineer, while another child spent money to eat, drink, whore and gamble. As a result, it is also a loss, one is an increase in value, the other is a sharp decline in value. of course you have to vote with your feet.

Therefore, in the face of corporate losses, we should first analyze from a qualitative point of view what is behind this kind of losses, whether it is the investment to roll the internal snowball or the loss caused by the destruction of value. There is a significant difference between the two. One is active, the other is passive or passive.

For example, you will voluntarily report to the tutoring class to spend 1000 yuan on gold plating, instead of having to spend 1000 yuan to pay off gambling debts, while the compulsion is that enterprises do not want to do so but suffer losses, such as when the industry goes downhill, enterprises are forced to lose money. It's not the same thing to say that I can make money but I want to lose money.

Understand this, we also understand, loss but stock prices continue to hit record highs of the underlying logic.

The second model is active investment expenditure, some companies could have made money, but in order to expand the scale of the continuous reinvestment, resulting in book losses.

Do you still remember the story I told you about the real estate developers who kept investing in building houses? It has been losing money for years, but no one can deny that it is getting richer, and one of the important details is that he could have stopped investing at any time so that he could make money immediately, but he did not do that. but continue to invest and expand.

Remember an argument I made in the course, that is, for capital, the last thing they want is cash, because cash is the worst form of value-added, and what capital wants most is that cash is used and converted into value-added assets.

Therefore, we should be clear that in an ideal situation, what capital likes most is the continuous outflow of capital into the form of other value-added assets, rather than watching the capital remain motionless in the company. Therefore, for us, it is clear that as long as capital flows into value-added assets, it is value-added, regardless of whether the current profit figure is a loss or a profit.

Therefore, for us investors, the best investment targets are those companies that are constantly expanding. You give the money to the company, and the company puts our money back into production to earn more money, so that we are willing to give it the money. As a result, the valuation is inevitably on the high side.

On the other hand, some companies guard their acre all day long and pay a fixed dividend every year. When we invest our money in this kind of company, you should not expect to earn excess income unless it is extremely undervalued, because it simply does not use our money to convert into more value-added assets that generate cash flow, so it is impossible to make more money, and we will not be able to get high returns.

So when a company needs to raise money for expansion, many financial controllers always stare at the cash outflow and criticize it, but at this time the stock price has already reached a new high, but they do not realize that this is an extremely short-sighted behavior, in the traditional investment thinking, we hate cash outflows and companies spend money, and think that this is a bad phenomenon.

But this is a very wrong idea. We invest money in the company to let the company spend, and the company does not spend how to help us make money. So, take Shanghai Airport as an example, other people's production expansion is to make more money, and it is a kind of value enhancement. However, many financial reporting controls only see profit losses and cash flow outflows, staring at the profit figures of losses. What if you are so lack of bottom-level logic? Sometimes it is not as good as the thought of a farmer.

After understanding this, let's go to see Amazon.Com Inc, JD.com, Tesla, Inc., iQIYI, Inc. and New Oriental Education & Technology Group online.

For example, Amazon.Com Inc is a typical example of making full use of shareholders' money to invest. after the first wave of shareholders give you money, you make money, and then people see it and invest more money for you. Amazon.Com Inc once again uses the earned money to invest in new projects, making money, financing and investing, so on and on and

At this time, the financial reporting controller pointed out a disadvantage, that is, cash flow is tight, or that this is a kind of money-burning mode, please note that the money-burning mode is that the money is burned, the profit is not seen, or the internal snowball is not improved, while Amazon.Com Inc, the money is burned. but more money comes, in fact, this is the best model for investment in growth stocks, that is, since we require the company to grow high and make more money. Then we have to put up with the company's investment expenses, or let the horses run without letting them graze.

As a result, we can see that investment cash outflows should not be morally kidnapped and criticized with traditional investment ideas, but should be criticized with traditional investment ideas. in the final analysis, we give money to the company for the company to spend, just like we invest money in Maotai. isn't it a good thing for him to build more wine cellars and sell more money? Should we build our own wine cellar and sell yours?

On the other hand, we see that many people put their money into a company that never knew or could not expand its production at all. some companies have only that amount of assets and generate a certain amount of cash flow every year, and it is also listed on the stock market. In fact, it is not short of money. But when you look at its financial results, you find that it is a very sound company, so many people buy stocks, which is equivalent to investing money in it, but you find that its profits have not changed. But roe has fallen, and in a word, some companies are only responsible for volatility.

Why, because he put your money in the bank, did not use your money to create more income, then its stock price will only fluctuate normally, but will not have a sustained new high, it is like your father gave you the money to sign up for a training course, but you saved the money. If you were a parent, would you approve of this behavior?

On the other hand, the traditional financial reporting control, after seeing the above company's financial report, is ecstatic and thinks that such a company has absolutely sound performance, stable performance, and no investment cash flow outflow, operational nature is regarded as income, and it is not a money-burning mode. There is no capital risk in the abundant cash flow on the account. Look, what a beautiful financial report, but you forget the bottom logic. You forget that you invest your money in the company to spend it, not to save it.

On the other hand, after the wise people understand the business that the company is going to invest in, they will invest in it as soon as the company spends money. At this time, the stock price may have begun to pick up, while the next investors will invest after the project comes out. At this time, the stock price has usually reacted early, but you do not realize that when you see that the future income is being calculated after the project is completed, others will start to calculate and invest when the money is spent. Therefore, in the capital market, we must work harder than others.

Therefore, we should make it clear that the loss of increasing value is to roll the internal snowball that can generate more cash flow, and the loss of weakening value is to destroy the loss of internal snowball, for example, the loss of increasing value is to invest in more elevators to occupy, and the loss of no value is that your elevator cannot recruit advertisers. For Muyuan, the loss of increasing value is that you have invested in expanding and raising pigs. The loss that weakens value is the loss caused by quality problems in your pigs.

Sometimes the decline in performance is more damaging than losses. We will find that some companies' performance declines and their stock prices plummet. This is mainly big consumption, while some losses but stock prices are unusually strong. Why? Cash flow is expected to change in the future, and we still have to return to the real business operation.

For example, in a liquor company, if your performance drops to single digits, the market will think that you will have a hard time next year and the year after next, because this model is very transparent, expectations are also very transparent, and there is not much room for imagination flexibility, so, people don't want to invest their money in you, because they don't want to earn this pitiful growth, so investors who expect growth of more than 20% will say goodbye, and selling will be serious.

But this is not the case in Internet companies or online education companies, such as JD.com, Pinduoduo, New Oriental Education & Technology Group online, iQIYI, Inc., NetEase, Inc youdao and so on. Why are their stock prices stronger as they lose money?

Because the loss in exchange for the improvement of the internal snowball, such as the company invested a lot of user subsidies and marketing, in exchange for more than double the growth of active users, or Tesla, Inc. used a huge amount of investment in exchange for new energy vehicle technology innovation, once the new technology application, the explosive power will be unlimited, this is why Tesla, Inc. continues to lose money, but the market is more and more after Tesla, Inc., it is obvious This is a snowball that is getting bigger and bigger.

And New Oriental Education & Technology Group online, we must not use its profit figures to value, otherwise you will think that this is a negative value company, what should be used to measure it? The answer is expected cash flow.

That is to say, we have to see this part of the loss that New Oriental Education & Technology Group expanded online, that is, the increased input or subsidy, the number of users increased, according to a reasonable conversion rate, how much profit can be brought once they become effective users, as well as the optimism brought about by this successful model of changing investment for users.

Edit / Jeffy