This week, four listed companies including Zhongying Technology, Jiangxi Huangshanghuang Group Food, Argus, and Chengdu Qinchuan Iot Technology Co., Ltd. announced that their merger and restructuring plans have failed. According to incomplete statistics, 12 listed companies have announced the termination of merger and restructuring in the past month (see table). The termination of merger and restructuring has hit many stocks hard; on the next trading day, Shenzhen Yitoa Intelligent Control, Hang Zhou Radical Energy-Saving Technology, and Chengdu Qinchuan Iot Technology Co., Ltd. dropped by 8.66%, 9.62%, and 14.63% respectively.

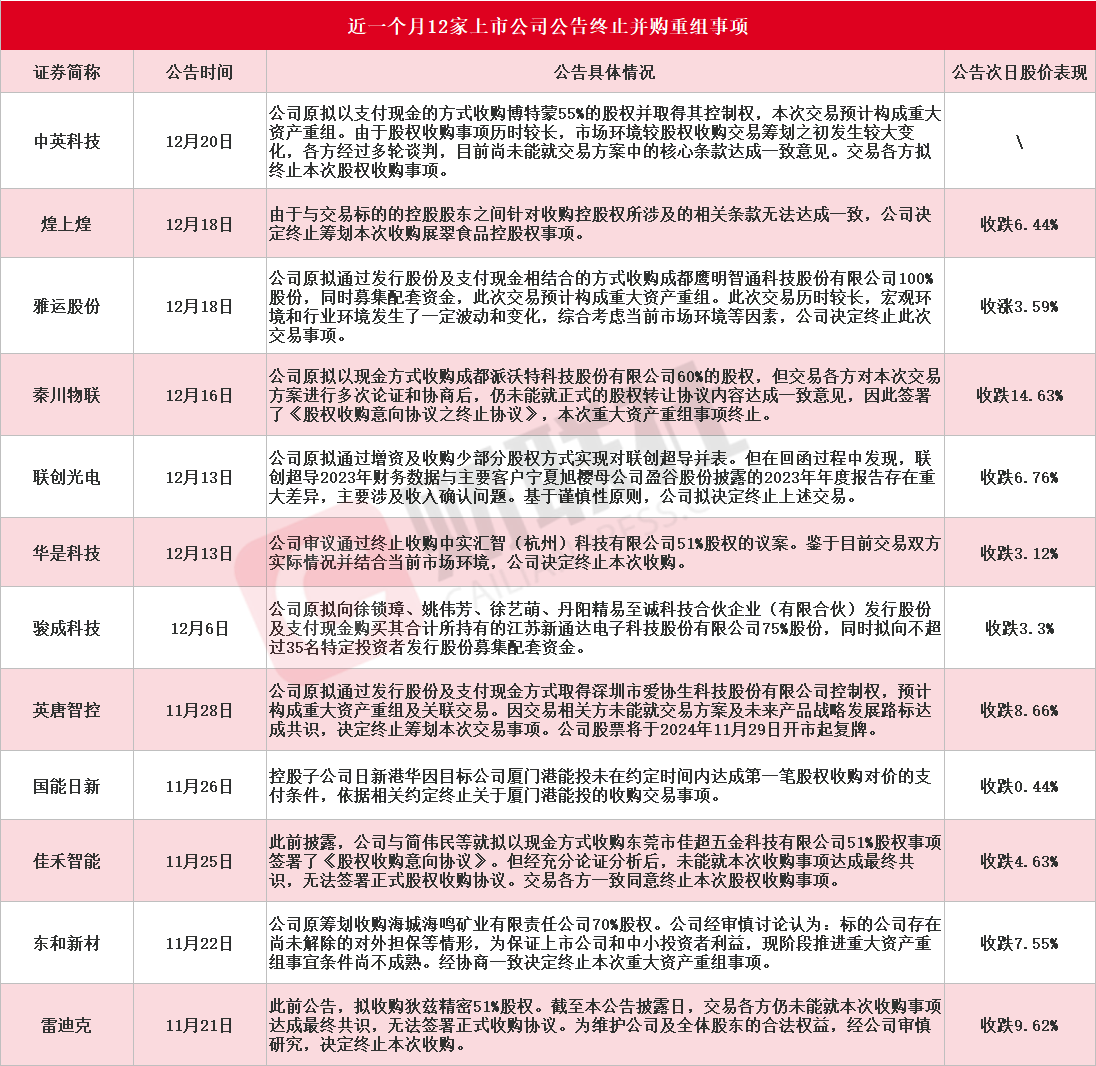

According to a report from Financial Associated Press on December 21 (Editor: Ping Fang), as of the time of writing, according to incomplete statistics, in the past month (from November 21 to December 21), 12 A-share listed companies, including Zhongying Technology, Jiangxi Huangshanghuang Group Food, Argus, Chengdu Qinchuan Iot Technology Co., Ltd., Jiangxi Lianchuang Opto-electronic Science&Technology, Huas Technology, Jun Cheng Technology, Shenzhen Yitoa Intelligent Control, Guoneng Rixin, Cosonic Intelligent Technologies, Donghe New Material, and Hang Zhou Radical Energy-Saving Technology, have announced the termination of merger and restructuring matters. Among them, this week, four listed companies including Zhongying Technology, Jiangxi Huangshanghuang Group Food, Argus, and Chengdu Qinchuan Iot Technology Co., Ltd. announced the failure of their merger and restructuring matters. For detailed information, see the image below:

From the performance in the secondary market, Shenzhen Yitoa Intelligent Control, which terminated the planning of acquiring the controlling stake in Ai Xiangsheng Technology Company, Hang Zhou Radical Energy-Saving Technology, which terminated the acquisition of 51% equity in Ditz Precision, and Chengdu Qinchuan Iot Technology Co., Ltd., which terminated the acquisition of 60% equity in Chengdu Paiwote Technology Co., Ltd., saw their stock prices drop by 8.66%, 9.62%, and 14.63% respectively on the next trading day.

The well-known domestic high-frequency communication materials producer, Zhongying Technology, announced on December 20 that it originally planned to acquire 55% of Botemeng's equity for cash and obtain its controlling rights. This transaction was expected to constitute a significant asset restructuring. However, after multiple rounds of negotiations, the parties involved have yet to reach an agreement on the core terms of the transaction plan. The parties involved in the transaction plan to terminate this equity acquisition matter.

The well-known domestic high-frequency communication materials producer, Zhongying Technology, announced on December 20 that it originally planned to acquire 55% of Botemeng's equity for cash and obtain its controlling rights. This transaction was expected to constitute a significant asset restructuring. However, after multiple rounds of negotiations, the parties involved have yet to reach an agreement on the core terms of the transaction plan. The parties involved in the transaction plan to terminate this equity acquisition matter.

Looking back, the restructuring process of Zhongying Technology lasted for less than five months. On July 23, the company announced its intention to acquire control of Botemeng through a cash payment. In the progress announcement on August 22, the equity acquisition ratio was confirmed to be 55%, with an estimated valuation range for the target company of 1.3 billion to 1.6 billion yuan. The company stated that it would quickly enter the thermal management system business of new energy vehicles as a result. In the secondary market, since the low point in September, Zhongying Technology's stock price has accumulated a maximum increase of 95%.

The old brand leader in marinated food, Jiangxi Huangshanghuang Group Food, announced on December 18 that due to the inability to reach an agreement on the relevant terms concerning the acquisition of controlling rights with the major shareholder of the target company, the company decided to terminate the planning of this acquisition of controlling rights in Zhancui Food. The company will continue to work on improving its operating performance and utilize capital markets for resource integration, expanding new profit growth points. Previously, on December 2, Jiangxi Huangshanghuang Group Food announced its intention to make a foreign investment, with the target company being Zhancui Food. In the secondary market, the stock price of Jiangxi Huangshanghuang Group Food dropped by 6.44% the day after the announcement of the termination of the acquisition, but looking at a longer time frame, it accumulated a maximum increase of 107% since the low point in September.

Argus, whose main business involves high-end dyes and textile auxiliaries, as well as various dyeing and finishing application technology services, announced on December 18 that it originally planned to acquire 100% of the shares of Chengdu Yingmingzhitong Technology Co., Ltd. through a combination of issuing shares and cash payments, while raising supporting funds. This transaction was expected to constitute a significant asset restructuring. The transaction took a long time to execute, and there have been certain fluctuations and changes in the macro and industry environment, leading the company to decide to terminate this transaction in light of the current market environment and other factors.

The company had originally planned to enter the new energy business field through this. Argus first disclosed this restructuring intention in April last year, announced the restructuring plan in May last year, and revealed the second revised draft after making significant adjustments to the plan in November last year. In the secondary market, Argus's stock price has accumulated a maximum increase of 57% since the low point in September this year.

On December 16, Chengdu Qinchuan Iot Technology Co., Ltd., which was once ranked among the "Top 500 Internet of Things Companies in the World," announced that the company originally planned to acquire 60% of Chengdu Paiwote Technology Co., Ltd. in cash. However, after multiple discussions and negotiations among the parties involved in the Trade, no consensus was reached on the formal Equity Transfer agreement. Therefore, the "Termination Agreement of the Equity Acquisition Intent Agreement" was signed, and this significant Assets restructuring matter was terminated.

Looking back at the restructuring process of Chengdu Qinchuan Iot Technology Co., Ltd., the company first released an announcement on September 25, proposing to acquire 60% of Paiwote's equity in cash, becoming one of the first listed companies to announce a restructuring plan following the introduction of the "Six Merger Lines." Public information shows that Paiwote attempted to go public three times in 2019, 2022, and 2023 without success. In the secondary market, the day after the announcement of the significant Assets restructuring news, the stock price of Chengdu Qinchuan Iot Technology Co., Ltd. hit the daily limit of 20%, with a maximum cumulative increase of 92.7% over four trading days. However, on the day after the announcement of the termination of the significant Assets restructuring matter (December 17), Chengdu Qinchuan Iot Technology Co., Ltd. saw a decline of 14.63%.

In addition, the popular controllable nuclear fusion and Superconductivity Concept stock Jiangxi Lianchuang Opto-electronic Science&Technology announced on December 13 that the company planned to terminate the acquisition of Jiangxi Lianchuang Superconductivity equity matters. On December 19, the company announced the decision to terminate the acquisition of Jiangxi Lianchuang Superconductivity equity matters and signed the "Contract Termination Agreement." Previously, Jiangxi Lianchuang Opto-electronic Science&Technology announced on August 5 that it intended to include its high-temperature superconducting subsidiary, Jiangxi Lianchuang Superconductivity, into the consolidated financial statements. On November 6, Jiangxi Lianchuang Opto-electronic Science&Technology, which recorded seven consecutive limit-up trading days, announced that, regarding the company's prior acquisition of Jiangxi Lianchuang Superconductivity, discrepancies were found between the data of Jiangxi Lianchuang Superconductivity and relevant parties. Jiangxi Lianchuang Superconductivity and relevant parties had not completed the verification, and the Trade would be suspended until the verification was completed and disclosed. In the secondary market, the next day after Jiangxi Lianchuang Opto-electronic Science&Technology announced its intention to terminate the acquisition matters, it fell by 6.76%.