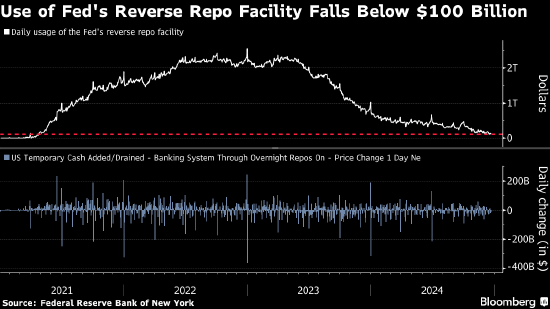

After the Federal Reserve policymakers adjusted their policy this week, the amount of funds stored in a major tool at the Federal Reserve fell below 100 billion dollars for the first time since 2021.

On Friday, about 40 counterparties collectively deposited 98.4 billion dollars into the Federal Reserve's overnight reverse repurchase agreements (RRP). Banks, government-sponsored enterprises, and money market funds can earn interest by using the RRP. According to data from the New York Federal Reserve Bank, the scale of RRP usage has significantly decreased compared to a record 2.55 trillion dollars on December 30, 2022.

On Wednesday, Federal Reserve officials lowered the RRP relative to the lower bound of the policy interest rate target range by 5 basis points to keep the financing markets in the USA running smoothly. The federal funds rate target range was lowered to 4.25%-4.50%, and the new RRP rate is 4.25%, which is the first time RRP rates have aligned with the lower bound of the policy interest rate target range since 2021.

"This is the natural result of the Federal Reserve's decision to readjust the RRP rate to align with the lower bound of the federal funds rate target range," said John Canavan, an Analyst at Oxford Economics. "The relative interest rate of RRP has been lowered, making it slightly less attractive, leading to a decline in RRP demand, which is not surprising given this broader trend."

"This is the natural result of the Federal Reserve's decision to readjust the RRP rate to align with the lower bound of the federal funds rate target range," said John Canavan, an Analyst at Oxford Economics. "The relative interest rate of RRP has been lowered, making it slightly less attractive, leading to a decline in RRP demand, which is not surprising given this broader trend."

As a barometer of excess liquidity in the financial system, although the balance of this tool has decreased by about 2.4 trillion dollars since its peak in December 2022, the pace of decline has slowed in recent months. As the Federal Reserve continues to reduce the balance sheet size through Algo tightening, RRP usage has long been considered a useful Indicator by Wall Street.

Hints have already been made in the minutes of the Federal Reserve's November meeting. Policymakers indicated that they see value in making potential "technical adjustments" to align the RRP rate with the lower bound of the federal funds rate target range.

Recommended reading: The Federal Reserve adjusts the key reverse repurchase tool rate for the first time since 2021.

Market observers indicate that this move may exert downward pressure on MMF interest rates and further impact the size of RRP. Since the adjustment on Wednesday, Treasury yields have been above RRP, which may have prompted Outflow of funds. However, this situation may change next week, as Treasury settlements will reduce supply by approximately 70 billion dollars, leading to lower interest rates and a return of funds to RRP.

Deutsche Bank Analyst Steven Zeng states that RRP is currently at least a few basis points lower than 1-3 month Treasury bills, so some investors may have shifted into Treasury bills.

“这是美联储决定将RRP利率与联邦基金利率目标区间下限重新调整的自然结果,” Oxford Economics分析师John Canavan说。“降低RRP的相对利率,使其吸引力略微下降,从而助推RRP需求减弱这个更广泛趋势不足为奇。”

“这是美联储决定将RRP利率与联邦基金利率目标区间下限重新调整的自然结果,” Oxford Economics分析师John Canavan说。“降低RRP的相对利率,使其吸引力略微下降,从而助推RRP需求减弱这个更广泛趋势不足为奇。”