Looking back at 2024 and looking forward to 2025, let insights transcend time to seek certainty for the future. This issue focuses on the chip networks and computing power of Silicon Valley giants.

During the three years as CEO, Pat Kissing was almost abandoned by all friends: $Intel (INTC.US)$ Corporate clients have largely turned to $Advanced Micro Devices (AMD.US)$ 、 $Microsoft (MSFT.US)$ choosing to work with $Qualcomm (QCOM.US)$ Cooperation, PC manufacturers begin to adopt ARM architecture chips, Taiwan Semiconductor has also been "offended" by him, threatening to cancel the foundry fee discount.

The result of being abandoned by both friends and foes is that he was recently ousted by the Board of Directors of Intel and was forced to retire.

The highly specialized chip Industry has always been a game about friends—players in the Industry also invest significant human resources and financial assets into "socializing", such as $Taiwan Semiconductor (TSM.US)$ in 2012, investment was made to $ASML Holding (ASML.US)$ gain priority supply rights from ASML, a more widely known partnership is the "Wintel" alliance between Intel and Microsoft, where decades of cooperation have allowed both companies to maintain an almost monopolistic share in the mid-to-high-end PC market.

The highly specialized chip Industry has always been a game about friends—players in the Industry also invest significant human resources and financial assets into "socializing", such as $Taiwan Semiconductor (TSM.US)$ in 2012, investment was made to $ASML Holding (ASML.US)$ gain priority supply rights from ASML, a more widely known partnership is the "Wintel" alliance between Intel and Microsoft, where decades of cooperation have allowed both companies to maintain an almost monopolistic share in the mid-to-high-end PC market.

The social aspect of the chip industry, or the importance of its ecosystem, is directly reflected in the semiconductor war triggered by AI in 2024. The giants in Semiconductors are visiting each other, and CEOs with technical backgrounds are busy attending various summits and networking. Just as at a banquet, where some are flamboyant, some are flattering with smiles, and some are forgotten in the corners, various players in the semiconductor social game also show different social faces.

As proud as $NVIDIA (NVDA.US)$ Huang Renxun, who is pursued by the whole world. Busy like $Qualcomm (QCOM.US)$ An Meng, who raises his glass everywhere. Disappointed like Intel's Kissinger, who has already exited.

01 Huang Renxun, encircled by stars

In 2005, in the eyes of Kissinger, who was in his early forties, Huang Renxun was still just a moderate player in Intel's ecosystem layout. That year, Intel seriously considered acquiring NVIDIA, whose Market Cap was only one-tenth of Intel's at the time.

In the year 2024, when Kissinger is 63 years old, Jensen Huang has leaped to become the main character in the chip social gaming scene—his life resembles a line from a skit by Song Dandan at the 2006 Spring Festival Gala: "Performing everywhere, giving speeches everywhere, and even cutting ribbons for others."

Almost every month, Jensen Huang is invited to give a speech, from MIT to the Hong Kong University of Science and Technology, he is gradually replacing Musk as the new generation's life mentor for students. Influencers on TikTok are also riding on his popularity. His leather jacket has become a new fashion trend, fully validating the famous remark by NBA legend about Michael Jordan: "You can have hundreds of millions of dollars, but you're still cool."$Starbucks (SBUX.US)$It’s a well-known saying: you can have hundreds of millions of dollars, but that doesn't change what you look like.

However, Jensen Huang's greatest power does not come from money, but from chips.

In the Technology Industry, almost everyone has a need for Jensen Huang. Since 2023, NVIDIA's chips have become the most sought-after Commodity in the technology industry.

Take Musk as an example; he has been troubled for almost an entire year trying to buy more H100 chips.$Tesla (TSLA.US)$This year, it is expected to spend 4 billion dollars. Musk even needs to call on Tesla's H100 for xAI. To obtain more chips, Musk is also negotiating with Jensen Huang to get NVIDIA to invest in his xAI. At the beginning of December, Musk's xAI just reached an agreement with NVIDIA for 1.08 billion dollars at a High Stock Price, aiming to gain priority supply of the GB200 chip.

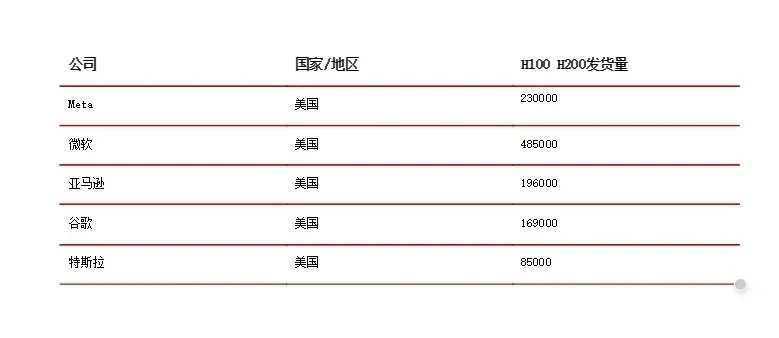

Apart from Musk, Microsoft, $Alphabet-C (GOOG.US)$ 、 $Meta Platforms (META.US)$ 、 $Amazon (AMZN.US)$ are also scrambling to stockpile the H100. Analysts from Omdia Technology Consulting estimate that Microsoft purchased 0.485 million NVIDIA Hopper chips this year, and additionally, the purchasing numbers from Meta, Amazon, and Alphabet-C all exceeded 0.15 million. They don’t mind spending so much money; Musk even wants to boast: we will have the most H100 chips in the future. Zuckerberg excitedly announced that Meta possesses a powerful computing power cluster. All this seems to bring us back to the era of rationed supplies: being able to buy something is a skill.

Apart from technology companies, governments around the world are also eager to build good relationships with Jensen Huang. The Indian government hopes to collaborate with NVIDIA to develop chips, the Vietnamese government invites NVIDIA to build a computing center, and universities are eager to invite Jensen Huang for visits, making him one of the most traveled Silicon Valley figures in 2024.

In this social game, Jensen Huang is clearly the 'bro' at the table, sitting in the main seat, and everyone takes pride in being 'closer to bro.' After all, his supply quota determines the competitive landscape in multiple battlefields such as LLM and autonomous driving—if NVIDIA decides to cut supply to a manufacturer, that manufacturer will be immediately eliminated.

However, there are times when Jensen Huang cannot sit in the 'main seat,' like in front of his upstream manufacturer, Wei Zhejia.

Earlier this year, Jensen Huang performed a big dance in the mainland, and after taking off his colorful coat, he then went to Taiwan Semiconductor to meet with Wei Zhejia. At that time, TSMC's chairman Liu Deyin had only a few months left before retirement, and Wei Zhejia, who served as president for six years, would take over the chairmanship, deciding the success or failure of Jensen Huang's business for a considerable time.

Jensen Huang's purpose in visiting Wei Zhejia is of course 'to urge collection.' Since last year, TSMC's production capacity has been fully booked, and according to Jensen Huang, 'The demand for chips is so high that everyone wants to be the first to get chips, and everyone wants to get the most chips.'

For other big shots in Silicon Valley, Jensen Huang is a supplier they cannot offend. But for Wei Zhejia, Jensen Huang is just one of the important clients. From Qualcomm to AMD and then to Meta, TSMC's production lines are filled with orders from tech companies.

Between respect and dislike, there is often only a thin line. In 2024, Jensen Huang and Pat Gelsinger gradually became villains in the eyes of others.

In order to break free from exclusive dependence on Taiwan Semiconductor, semiconductor companies, including NVIDIA, have chosen Intel, whose technology is relatively weaker, as an alternative for wafer foundry. Jensen Huang personally announced the choice of Intel for foundry services, starting from the second quarter, delivering orders for 5,000 wafers each month to this 'backup' for Taiwan Semiconductor.$Broadcom (AVGO.US)$Last year, there were already attempts to collaborate with Intel to reduce dependence on Taiwan Semiconductor. Although the whole world knows that Intel's technology is relatively inferior to that of Taiwan Semiconductor, no one wants to put all their eggs in one basket.

With more profits, Jensen Huang naturally becomes the 'imaginary enemy' of various alliances. Various anti-NVIDIA alliances have been formed around the names of Meta, OpenAI, and AMD. Even if they cannot completely replace NVIDIA's computing power, they still want to minimize their dependence on H100—after all, Jensen Huang's chips are too expensive.

02 'Abandoned by All' Kissinger.

While it is terrifying for Gelsinger and Huang to be regarded as villains, it is even more frightening to be viewed as an incompetent and useless person.

Pat Gelsinger was just 'fired' from the company he worked at for over 30 years. Although Intel's statement is that he retired, hours later, several foreign media outlets, including Bloomberg, reported that Gelsinger was actually pushed out by the Board of Directors due to poor performance, as the conflict between him and the board had become irreconcilable.

At 63 years old, Kissinger has spent half of his life at Intel: in 1989, he developed the 80486 chip as Chief Architect. A few years later, at the age of 32, he became Intel's youngest Vice President. However, everything changed in the 12 years after he left in 2009. Intel missed the opportunity to produce chips for Apple and ultimately missed the boat on the mobile internet. Under the leadership of Suzee Fang, AMD has been gradually eating away at Intel's market share in the PC and Datacenter Businesses.

It is against this backdrop that Kissinger returned to Intel as CEO. On January 13, 2021, the day of his return, Intel's stock price rose by 7%, and within two months of his appointment, Intel's stock price reached a 20-year peak. He was full of energy, warming up with push-ups before events, and people believed that such a passionate CEO could lead Intel out of the mire.

However, Kissinger ultimately led Intel into a larger quagmire. Over three years, the Intel under Kissinger lost more than half of its market value.

After taking office, Kissinger made a social error: he rejected the olive branch offered by Taiwan Semiconductor. According to Taiwan Semiconductor's founder Morris Chang, Kissinger's attitude was 'somewhat rude'—this rudeness ultimately caused Kissinger to lose 40% of the preferred opportunities.

After rejecting Taiwan Semiconductor's proposal, Kissinger launched his own IDM 2.0 plan—prior to this, Intel's foundry services were primarily for its own use, but at this time, Kissinger hoped to challenge Taiwan Semiconductor. However, the huge capital investment required for foundries became a burden for Intel.

After experiencing losses exceeding 15 billion dollars over three years, Intel's second-quarter Earnings Reports this year 'blew up'—the company reported a net loss of 1.61 billion dollars. The subsequent 31% stock price crash became the biggest irony of Kissinger's three years of effort. Forced to act, while Chinese e-commerce launched policies like 'Hundred Billion Subsidies' to ease pressure on merchants, Intel rolled out its own Hundred Billion Cuts, which included layoffs and suspending dividends—according to plan, Intel will lay off 0.015 million people by 2025, equivalent to 15% of its total workforce.

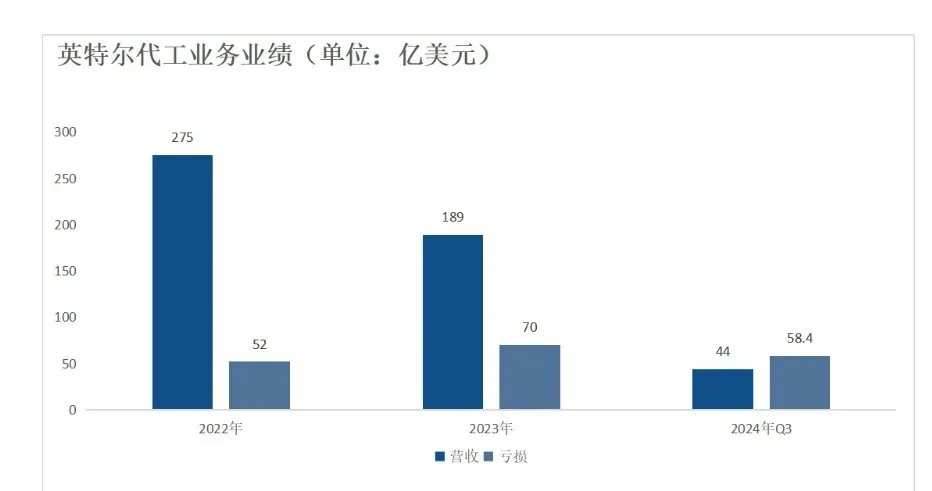

In the third quarter of 2024, Intel again suffered a massive loss of 16.6 billion dollars. The foundry business, which Kissinger had high hopes for, incurred a loss of 5.84 billion dollars, with revenues declining by 8% to only 4.35 billion dollars. Although a large part of this was due to asset depreciation losses and goodwill impairment, without the government's 8 billion dollars in chip subsidies, Intel's operation still faced immense pressure.

Kissinger later admitted at the Deutsche Bank conference in August that he underestimated the difficulty of Semiconductors foundry.

The CEO, who was expected to achieve great things, made a big bet on the wafer foundry business and dug a huge pit for Intel. When the walls fall, everyone pushes, and Kissinger also faced betrayal from old friends.

Microsoft's actions may have left Kissinger feeling the coldest. In May this year, Intel's important partner Microsoft adopted Qualcomm chips in the new generation of PCs, and in this Copilot + PC strategy, Microsoft 'betrayed' Intel. From a resource investment perspective, Copilot is currently Microsoft's absolutely strategic product, from the Edge browser to Windows and Office, Microsoft has given the best entry points to this tool, even adding a Copilot key to keyboards, reflecting its importance. Opening it up to the ARM camp is really bad news for Intel.

In the datacenter CPU market, in June last year, major customer Google announced the use of AMD's server chips. The top market share Azure began to lean towards AMD's graphics cards and CPUs. Even in Intel's traditional stronghold, the gaming industry, switching to a B-side perspective, some game publishers have abandoned Intel, and Alderon Games even mocked Intel and Kissinger directly: 'After switching to AMD processors, the CPU crash frequency has been reduced by 100 times.

In the third quarter of 2024, Intel's datacenter business revenue increased by only 9%, which can be considered negative growth in light of peers experiencing increases of 100%. After three consecutive years of mistakes by Kissinger, he seems to have lost the trust of partners. This ultimately led the Board of Directors to dismiss this veteran employee of 30 years.

03 Su Zifeng and Ammon 'forming factions'.

In July 2021, the same year Kissinger returned to Intel, Qualcomm also welcomed a new leader: Cristiano Ammon.

Like Kissinger, Ammon comes from a technical background, but at least it seems that he is somewhat "better at socializing" than Kissinger — at least this is the case with his Chinese friends. During his years as president of QCT, he often visited China and met with Chinese clients, including Lei Jun. Even the Chinese name "安蒙" was chosen under the suggestion of his Chinese friends to better fit the habits of the Chinese people.

Clearly, Ammon, who has a technical background, is very skilled at socializing, and he is currently engaged in a more challenging social task. If the social war of chips can be likened to a banquet table, then Ammon plays the role of someone who toasts all around.

Like Intel, Qualcomm is also worried about its ticket to the AI era. In Ammon's chip empire, there are neither the GPU business that neural networks favor nor any datacenter business. Ammon intends to achieve a layout in the AI field through terminal computing.

However, terminals cannot be created solely by Ammon; they require an ecosystem, necessitating a large amount of Hardware assembled with Qualcomm chips, otherwise, chips are just silicon wafers. Thus, social anxiety is diffusing in Ammon's mind.

At the Snapdragon Summit in late October, Ammon personally announced his circle of friends on stage: Microsoft, Meta Platforms, and OpenAI, looking for application scenarios for Qualcomm chips in the AI era, including wearable devices, audio devices, watches, and spatial computing devices. Then comes Epic Games, which announced last September that it would start accepting AI games on its platforms. Lastly, there is the collaboration with General Motors and BMW, whose needs are certainly smart driving and smart cockpits.

— Compared to NVIDIA, which is reaping profits, Ammon's needs for friends are evidently more intense.

Among them, AIPC is Qualcomm's most vocal business at present. Ammon firmly believes that the next generation AIPC will become a turning point for the industry, and Qualcomm has a huge advantage in this.

His confidence comes from his connections — Microsoft. After "backstabbing" Intel, Microsoft chose Qualcomm from the ARM camp as one of its partners for "Copilot + PC," continuously launching multiple products. In Ammon's view, if the market share of Copilot + PC could exceed 50% in the next three years, that would be Qualcomm's perfect opportunity.

Besides Microsoft, AMD is also looking for partners on the application end. Throughout 2024, AMD has almost searched all major PC manufacturers, with Lenovo and Dell rushing towards the ARM camp.

With support on the software side and willingness to adopt on the application side, AMD's social anxiety has eased considerably.

On the stage of chip social networking, there is another person playing the role of "toasting around" just like AMD—Lisa Su, who is eager to expand the business ecosystem.

Since Kissinger's "somewhat rude" offense, the cooperation between AMD and Taiwan Semiconductor has increased significantly. The cutting-edge chips developed together have allowed AMD to erode Intel's market share in both the datacenter and consumer segments, which is the most direct reason for the revenue fluctuations at Intel during Kissinger's three-year tenure.

At present, Lisa Su is still making new friends, trying to secure a ticket for AI.

Not long ago, Lisa Su just rebutted AMD: in her view, AMD's NPU is more efficient than Qualcomm's. Lisa Su has also received support from Microsoft. In June of this year, Microsoft CEO Satya Nadella personally endorsed Lisa Su, releasing the AMD Ryzen AI 300 chip, which Microsoft believes has already surpassed the performance requirements of Copilot+PC.

On the application side, Lisa Su also has plenty of partners, with ASUS and MSI successively launching AIPC equipped with the AI 300 chip—after doing gaming chips for decades, AMD is not lacking friends in this industry.

To counter Qualcomm, Lisa Su even collaborated with her biggest rival over the past decade. At the Lenovo conference in Seattle, Lisa Su personally shook hands with Kissinger: they established the x86 ecosystem advisory group, attempting to counter the ARM camp led by Qualcomm. Both Lisa Su and Kissinger are aware that the competition is merely between vendors, but if the x86 camp fails, both will lose all opportunities.

However, in the world of Semiconductors, cooperation is only temporary. Just like the 'backstab' between Microsoft and Intel, the Board of Directors directly abandoned Kissinger, who had worked for 30 years, only to benefit is eternal.

04 Ultraman and Zuckerberg 'turn against'

When Kissinger was young, clients were very 'loyal'.

PC manufacturers contributed hundreds of billions of dollars to Intel every year, and even giants like Dell and Lenovo did not dare to 'recklessly comment' on self-developed CPUs. However, by the time Kissinger turned 60, almost all application manufacturers were attempting to develop their own chips, shaking off their reliance on chip manufacturers.

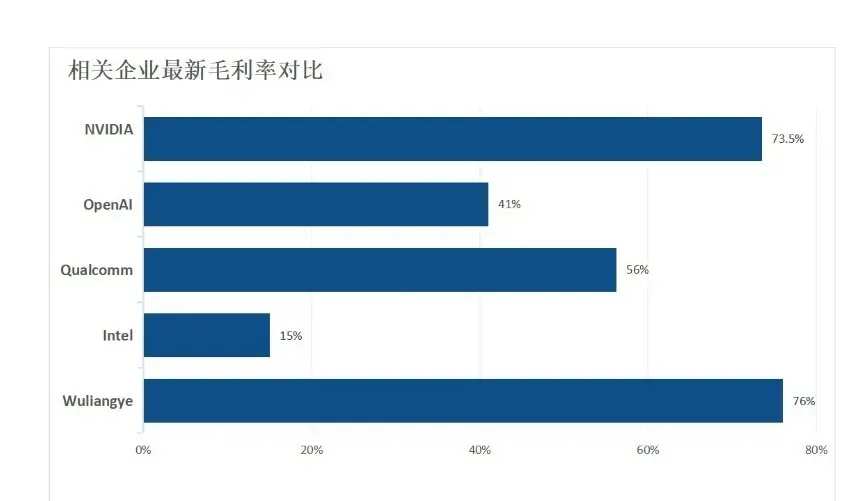

In the third quarter, NVIDIA's gross margin remained a terrifying 73.5%. Qualcomm, which is also a fabless business, only had a gross margin of about 56%. As a chip manufacturer, NVIDIA's gross margin is approaching$Wuliangye Yibin (000858.SZ)$such Chinese Baijiu(Chinese Liquor) manufacturers. Huang Renxun's own pockets have also swelled; in the second and third quarters of this year, Huang Renxun cashed out a staggering 0.6 billion dollars.

The most uncomfortable people are undoubtedly those who pay money to Jensen Huang.

From Sam Altman's perspective, NVIDIA's Earnings Reports are not pleasing. Clearly, Altman is the direct driver of this AI wave, yet it's Jensen Huang who is cutting ribbons everywhere. NVIDIA is reaping huge profits, while Altman’s OpenAI has yet to turn a profit, with the latest profit expectations pushed all the way to 2029—evidently, OpenAI's business model is not favorable, earning money is tough, but the payments to NVIDIA cannot be less.

Altman finds it hard not to reflect.

Jensen Huang is Altman's 'good friend'; in April this year, the world's first H200 was personally delivered by Huang to Altman's office. Eight years ago, Huang also personally gifted OpenAI the world's first DGX-1. In the 'drinking party' of semiconductors, Huang and Altman are good brothers who can appear alone at the second midnight barbecue gathering.

However, in business, no one likes to be dependent on others; Altman is working hard to break free from his reliance on Huang.

At the beginning of this year, Altman planned to cooperate with Taiwan Semiconductor to build a factory—the cost is 7 trillion dollars. Tencent Technology had previously calculated that with the cumulative costs of factory construction, water and electricity resources, and R&D expenses, even if 7 trillion dollars were indeed invested, it would be spent within eight and a half years, and one of the returns would be: offending global chip companies.

The heavy assets of contract manufacturing deter OpenAI; however, Altman’s determination to make chips remains firm. Not long ago, Altman personally persuaded shareholders to invest in Rain AI, an emerging semiconductor manufacturer, which claims that its chips are more energy-efficient and powerful than NVIDIA's.

In Silicon Valley, the one who pays the most to Jensen Huang is not Ultraman, but Zuckerberg spends even more than him.

Meta is one of the companies that holds the most NVIDIA H100 chips. Even if calculated at the lowest price of $0.03 million, Meta's expenditure on H100 has exceeded $10 billion. This year, in the third quarter, Meta's net income was just $15.6 billion. Facebook managed to earn advertising revenue, but a significant portion of it ended up in Huang's pocket through his cashing out.

Zuckerberg does not want to keep paying Huang. In April this year, Meta released a brand new version of the MTIA chip, which is custom-designed for AI training and inference and manufactured by Taiwan Semiconductor. For consumer products like AR glasses, Meta also attempted to replace Qualcomm with self-developed chips, but this plan was canceled in August of this year.

As outsiders in the chip industry, Zuckerberg and Ultraman are weak and lack friends. But the advantage is that they have the largest application scenario themselves—GPT and Llama3. They do not need to gather clients like Qualcomm and AMD and build an application ecosystem because they are the ecosystem. Therefore, this social game has also simplified a lot; beyond the manufacturing by Taiwan Semiconductor, the only issue the Silicon Valley giants need to solve is the design problem: Broadcom can help them.

This ASIC chip manufacturer saw its stock price surge by about 40% in the past two trading days and has already entered the trillion-dollar club, with Meta, Apple, and OpenAI as its partners.

In addition to Broadcom, there are also startups like Etched launching Transformer-specific chips like Sohu.

In the other largest application scenario for AI chips—the new energy vehicle industry—there are also many people with thoughts similar to Ultraman's.

In July 2024,$NIO Inc (NIO.US)$The first Shenji NX9031 chip tape-out was successful. He Xiaopeng announced the Turing AI Chip at the tenth-anniversary press conference in August, also produced by Taiwan Semiconductor. According to He Xiaopeng's statement in November, this chip has already activated its autonomous driving features. Even Li Xiang, who usually holds back, has been reported to be speeding up the independent development of the autonomous driving SOC.

In the face of these challengers to AI Chips, NVIDIA still possesses a solid ecosystem established around CUDA. This moat, built over the years by countless "friends" globally, is evidently hard for some loose alliances to break through, but the continuous emergence of self-developed chips undoubtedly creates a new ecosystem beyond NVIDIA's moat.

It was previously mentioned: "As cloud manufacturers equip their data centers with self-developed chips and develop many underlying middleware and binary translation features to help customers migrate to their own ecosystems, the equivalence compatibility level of CUDA programs will be higher, and the exclusive dependency will gradually lessen."

On the application side, compared to the struggles of the aforementioned manufacturers, Musk appears unusually quiet. Although Tesla has long equipped itself with its self-developed FSD chip, to date, there has been no news of any self-developed chips from his xAI.

On the contrary, he has been carefully maintaining his relationship with Huang Renxun, currently discussing with NVIDIA to let xAI receive investment from NVIDIA—the purpose is apparent, to gain some priority and inclination from the chip supplier.

In the foreseeable future, Musk will still need to maintain a good relationship with Huang Renxun. Although SpaceX has almost single-handedly changed the history of commercial aviation, and Tesla has achieved self-development in almost all key technologies, in the world of semiconductors, it is difficult to operate without the support of friends. Kissinger, who has already exited the scene, definitely understands this principle best.

Editor/Somer