① What caused ZTE to surge sharply this week? ② What is the reason for EAST BUY's significant rise today?

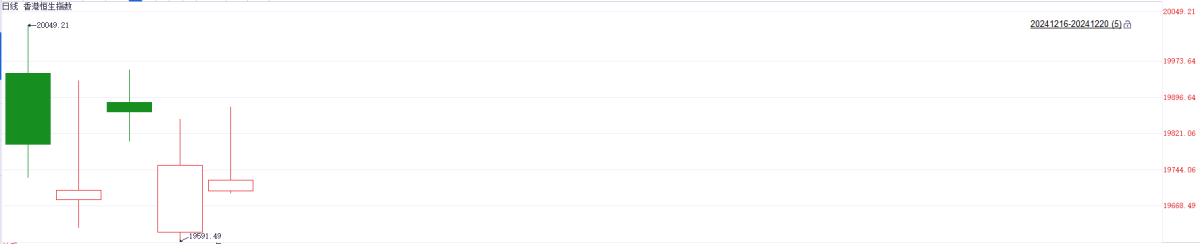

According to financial news on December 20th (Editor: Hu Jiarong), the three major indices in the Hong Kong stock market continued to show fluctuating trends this week. By the close, the Hang Seng Index fell by 1.25%, closing at 19,720.70 points; the Tech Index dropped by 0.79%, ending at 4,444.19 points; and the Hang Seng China Enterprises Index decreased by 0.59%, finishing at 7,143.88 points.

Note: performance of Hang Seng Index.

From the perspective of the Hang Seng Index, after reaching a high on Monday, it showed an overall fluctuation. However, Sino-Domain International pointed out that the overall internal support for the economy and external policies responding to shocks still provide certain support for the overall Hong Kong stock market. The brokerage advises to pay attention to structural market opportunities such as high dividend central state-owned enterprises.

From the perspective of the Hang Seng Index, after reaching a high on Monday, it showed an overall fluctuation. However, Sino-Domain International pointed out that the overall internal support for the economy and external policies responding to shocks still provide certain support for the overall Hong Kong stock market. The brokerage advises to pay attention to structural market opportunities such as high dividend central state-owned enterprises.

This week, WEIMOB INC led the market.

Although the Hong Kong stock market showed fluctuations this week, some individual stocks strengthened against the trend. By the close, WEIMOB INC (02013.HK), ASCLETIS-B (01672.HK), and ZTE (00763.HK) rose by 61.64%, 29.30%, and 14.50% respectively.

The rise of WEIMOB INC is related to a message announced by WeChat Shop. On December 19th, WeChat Shop officially released a notice announcing the launch of the "gift-giving" function in gray testing. CICC believes that as the WeChat e-commerce ecosystem gradually thrives, WEIMOB INC can help existing merchants achieve connectivity between public domain (WeChat Shop) and private domain (mini-program stores), which is expected to gain a more substantial customer increment, while further opening up growth space through ecosystem-related value-added services.

ASCLETIS-B's rise is attributed to its ASC47 research showing encouraging efficacy. In a recent research report, Guoyuan International pointed out that the company is an innovation-driven biotechnology firm, and the development progress of ASC47 and ASC30 for the treatment of obesity is proceeding smoothly, with a broad market space.

The rise of ZTE is related to rumors that Doubao, under ByteDance, will collaborate with ZTE's mobile phones. Later, the relevant person in charge of Doubao responded that the news is false. The person also stated that Doubao has had in-depth cooperation with many mobile phones, but has not discussed the possibility of creating a new brand with ZTE, and there is no related cooperation on chips.

Today's market

From the market performance, Coal, Gold, and Shipping stocks led the decline, while Semiconductor stocks strengthened.

Institutions stated that despite high inventories of Thermal Coal, there is still pressure on coal prices. CHINA QINFA fell more than 8%.

Among the Coal Industrial Concept(coal Industry), CHINA QINFA (00866.HK), China Coal Energy (01898.HK), and MONGOL MINING (00975.HK) fell by 8.15%, 6.37%, and 5.10% respectively.

Note: Performance of coal mining stocks.

Sealand stated that despite high inventories of Thermal Coal, there is still pressure on coal prices, but there is no need to be overly pessimistic about the future market. The institution pointed out that overall, the downward inflection point for coking coal inventories has appeared. If the supply continues to shrink and steel mills maintain high levels of restocking, while coking coal inventories continue to deplete, coking coal prices are expected to stabilize and rebound.

The Fed's hawkish rate cuts put pressure on Gold prices, causing CHINAGOLDINTL to fall nearly 3%.

Among Golden Industrial Concept, CHINAGOLDINTL (02099.HK), SD GOLD (01787.HK), and Zijin Mining Group (02899.HK) fell by 2.75%, 2.32%, and 2.09% respectively.

Note: Performance of gold stocks

In terms of news, the Federal Reserve previously lowered interest rates by 25 basis points as expected, and is projected to lower rates only twice next year for a total of 50 basis points, which is lower than previously expected. Powell "hawkishly" stated that the Federal Reserve is cautious about rate cuts, indicating that it is currently "close to or has reached" the point of slowing and pausing rate cuts, emphasizing that future rate cuts will require new progress in inflation.

Huatai Futures stated that following the interest rate meeting, the US dollar maintained a relatively strong position. The recent interest rate cuts by the central banks of the United Kingdom and Sweden further boosted the US dollar, which in turn suppressed Precious Metals prices. However, in the long run, the gradual trend towards looser monetary policy globally will still provide support for Precious Metals prices.

Shipping stocks weakened collectively, with PACIFIC BASIN falling nearly 4%.

Among shipping stocks, PACIFIC BASIN (02343.HK), COSCO Shipping Holdings (01919.HK), and Sinotrans Limited (00598.HK) fell by 3.70%, 2.61%, and 1.96% respectively.

Note: The performance of shipping stocks.

According to previous reports, U.S. President's National Security Advisor Jake Sullivan stated on December 18 local time that the U.S. is cautiously optimistic about the progress of ceasefire negotiations in Gaza, which are currently nearing completion.

Guotou Futures pointed out that the parties involved stated that the ceasefire negotiations in the Gaza Strip have entered the "final stage," while Hamas indicated that an agreement on a ceasefire and the exchange of hostages could be reached if Israel stops imposing new conditions. If there is substantial progress, the far-month contracts will be under significant pressure.

Most semiconductor stocks strengthened, with Semiconductor Manufacturing International Corporation rising over 8%.

Among semiconductor stocks, Semiconductor Manufacturing International Corporation (00981.HK), HUA HONG SEMI (01347.HK), and SHANGHAI FUDAN (01385.HK) rose by 8.22%, 4.63%, and 2.37% respectively.

Note: Performance of semiconductor stocks

News-wise, the surge in Broadcom's US stock has driven an increase in attention towards ASICs, while ByteDance's Doubao "all-in-one" update has reignited external interest in computing hardware.

Huaan pointed out in its electronic industry strategy for 2025 that the global generative AI market is entering a period of rapid growth, with the Chinese market holding particularly great potential. It is expected that by 2025, with the parallel development of three scaling laws, it will effectively break through the "ceiling" of market development. The new infrastructure demand for computing power based on AI will bring investment opportunities in multiple sectors.

In addition, the International Semiconductor Industry Association recently raised its forecast for global chip equipment sales in 2024, projecting a 6.5% increase to reach 113 billion USD. This upward revision is attributed to China's unexpected investments in AI-related fields. These investments have not only driven the development of the global chip equipment market but also provided new growth momentum for the global semiconductor industry.

Individual stock movements.

[EAST BUY rises over 15% and has supported the "gift giving" feature for WeChat stores]

EAST BUY (01797.HK) rose by 15.54%, closing at 16.36 Hong Kong dollars. In terms of news, on the night of December 18, the WeChat team announced that WeChat stores officially launched the gray testing of the "gift giving" feature, which will automatically support the "gift giving" feature for products, excluding jewelry and education training categories, with the original price of products not exceeding 0.01 million yuan. It is worth mentioning that EAST BUY's official account recently announced that the WeChat shop has launched the new "gift giving" feature.

[Herbs Generation Group Holdings Limited's stock performance weakens on the second day of listing, with the stock price falling below the issue price]

Herbs Generation Group Holdings Limited (02593.HK) fell by 17.39%, closing at 3.42 Hong Kong dollars. It is noteworthy that today's closing price has fallen below its issue price of 3.75 Hong Kong dollars. According to public information, Herbs Generation Group Holdings Limited has been rooted in Hong Kong for over twenty years as a diversified supplier of health products and beauty and skincare products. The company was listed on Thursday and closed over 10% higher on the first day.

从恒生指数来看,周一触及高点后整体呈现震荡。不过中泰国际指出,总体上内部托底经济和外部应对冲击的政策逻辑仍对港股大盘有一定支撑力。该券商建议关注高股息央国企等结构性行情机会。

从恒生指数来看,周一触及高点后整体呈现震荡。不过中泰国际指出,总体上内部托底经济和外部应对冲击的政策逻辑仍对港股大盘有一定支撑力。该券商建议关注高股息央国企等结构性行情机会。