Source: Caixin News

Author: Xiaoxiang

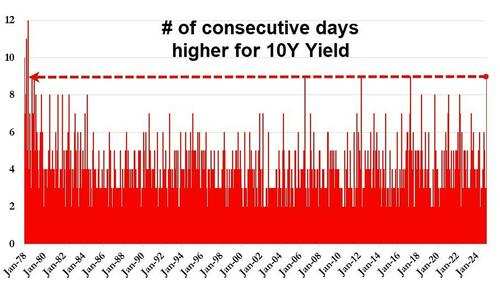

After the Federal Reserve's hawkish interest rate cuts and the expectation that it will slow down the easing pace next year, some records of sell-offs in the US Treasury market have been further broken; the benchmark ten-year US Treasury yield welcomed a "nine consecutive increases" on Thursday, while the yield curve reached its steepest level in about 30 months.

After the Federal Reserve adopts a hawkish stance on interest rate cuts and expects to slow the easing pace next year, some records for selling in the U.S. treasury market have been further broken: the benchmark U.S. 10-Year Treasury Notes Yield saw a "nine-day rise" on Thursday, while the yield curve reached its steepest level in about 30 months.

The differentiation in U.S. treasury yields across different maturities was quite significant on Thursday: short-term yields declined, while long-term yields surged. By the end of the New York session, $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ the yield fell by 4 basis points to 4.329%, $U.S. 5-Year Treasury Notes Yield (US5Y.BD)$ Increased by 1.6 basis points to 4.431%. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ Increased by 4.6 basis points to 4.569%. $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ Increased by 6.2 basis points to 4.74%.

The differentiation in U.S. treasury yields across different maturities was quite significant on Thursday: short-term yields declined, while long-term yields surged. By the end of the New York session, $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ the yield fell by 4 basis points to 4.329%, $U.S. 5-Year Treasury Notes Yield (US5Y.BD)$ Increased by 1.6 basis points to 4.431%. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ Increased by 4.6 basis points to 4.569%. $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ Increased by 6.2 basis points to 4.74%.

This differentiation in yields has caused the U.S. 2-Year Treasury Notes Yield to at one point be nearly 27 basis points lower than the U.S. 10-Year Treasury Notes Yield, marking the steepest level of this often-cited yield curve since 2022.

After the Federal Reserve lowered the policy rate by a total of 100 basis points over the past few months, investor reluctance to Hold longer-term government bonds, given the potential for inflation rebound and economic recovery to hinder the Fed's rate cut process next year, has led to the so-called steepening of the curve.

This week, the Federal Reserve further lowered the target range for the federal funds rate by 25 basis points to 4.25%-4.50%. However, Chairman Powell stated that further reductions in borrowing costs depend on future progress in combating inflation. The Fed also released its latest interest rate "dot plot" on Wednesday, showing that policymakers expect only two rate cuts of 25 basis points each by the end of 2025. This is a reduction by half compared to their expectations in September for rate cuts next year.

It is worth mentioning that after this week’s Federal Reserve decision, some Options traders have even shifted their attention to the possibility of the Fed starting a rate hiking cycle sometime next year.

The trend in the Options market related to the secured overnight financing rate (SOFR) reflects market expectations that monetary policy will become sharply hawkish by the end of 2025, although Fed Chairman Powell mentioned in this week’s press conference that rate hikes next year are "not a likely outcome."

Ian Lyngen, the Head of USA Interest Rate Strategy at BMO Capital Markets, stated that the weakness in long-term government bonds is due to the Federal Reserve's hawkish stance and pressures from government bond expansion. The trend of a steepening curve still has a long way to go before the end of 2024.

Many bond investors are currently also focused on whether the tax reform policy of incoming President Trump can boost the economy and raise inflation, while the budget deficit may worsen further.

Considering the future deficit outlook, the hampered prospect of Federal Reserve rate cuts, and the uncertainty of Trump's administration policies, Asset Management firms prefer to Hold short-term US government bonds, which supports the steepening of the yield curve. Many Analysts point out that the steepening yield curve reflects the pessimistic sentiment in the long bond market, predicting that inflation will rise again next year, alongside the continuously expanding US fiscal deficit, which will have to be filled by issuing more government bonds.

Overall, the U.S. 10-Year Treasury Notes Yield, known as the "anchor for Global Asset Pricing," has steadily risen from its low of 3.60% in mid-September. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ It has increased for nine consecutive trading days.

The last time the yield for this term increased for ten consecutive sessions was back in 1978.

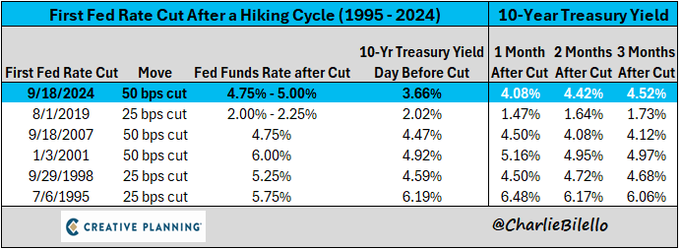

Charlie Bilello, Chief Market Strategist at Creative Planning, noted that it has been three months since the Federal Reserve's first rate cut, but the 10-year Treasury yield has surged by about 86 basis points. This is distinctly different from the performance observed at the beginning of previous rate cut cycles, when the 10-year Treasury yield either fell or remained basically unchanged.

Bilello suggested that what is the bond market saying to the Federal Reserve? The answer has two points:

a) You may have gotten rid of inflation, but inflation has not gotten rid of you, b) Returning to the path of loose monetary policy is not easy.

In terms of economic data, the US Department of Commerce will release the November PCE price index on Friday, which investors should pay close attention to. The median forecasts from industry surveys indicate that the overall and core PCE price indexes in the USA for November are expected to rise by 0.2% month-on-month, with year-on-year increases estimated at 2.5% and 2.9% respectively.

Editor/Rocky