European stock markets fell after the Federal Reserve's hawkish remarks suggested that the number of interest rate cuts next year would be fewer than expected.

The Stoxx Europe 600 Index closed down 1.5%, with all sectors declining. Semiconductor stocks fell after Micron Technology issued disappointing revenue forecasts, dragging down European chip equipment manufacturers including ASML Holding and BE Semiconductor Industries NV.

Federal Reserve officials cut rates by 25 basis points as expected, but lowered the outlook for further rate cuts next year as the 2% inflation target remains difficult to achieve. The US stock market rebounded slightly on Thursday, indicating that the previous day's sell-off was excessive.

The Bank of England kept interest rates unchanged on Thursday.

The Bank of England kept interest rates unchanged on Thursday.

"The signs that inflation will rise and become uncontrollable have sounded alarm bells, and all potential issues facing the market could now emerge," said Ricardo Gil, Deputy Chief Investment Officer at Trea Asset Management. "There are only a few trading days left this year, but January will likely be a more chaotic month."

The Stoxx Europe 600 Index is currently about 4% lower than the record high set in September, with year-end gains shaken by concerns over economic growth and political dilemmas in France and Germany.

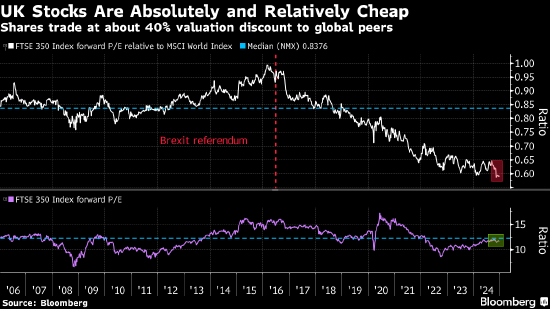

The UK FTSE100 Index slightly narrowed its losses after the Bank of England maintained the main interest rate at 4.75% and indicated a gradual easing of policies could continue into 2025. The benchmark index closed down 1.1%, having earlier dropped by 1.5%. Although it still lags behind the Eurozone's Stoxx 50 Index and the S&P 500 Index, the UK FTSE100 Index has still achieved nearly a 5% gain so far this year.

英国央行周四维持利率不变。

英国央行周四维持利率不变。