Deep-pocketed investors have adopted a bearish approach towards Vistra (NYSE:VST), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VST usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Vistra. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $224,668, and 10 are calls, amounting to $627,643.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $175.0 for Vistra over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $175.0 for Vistra over the recent three months.

Insights into Volume & Open Interest

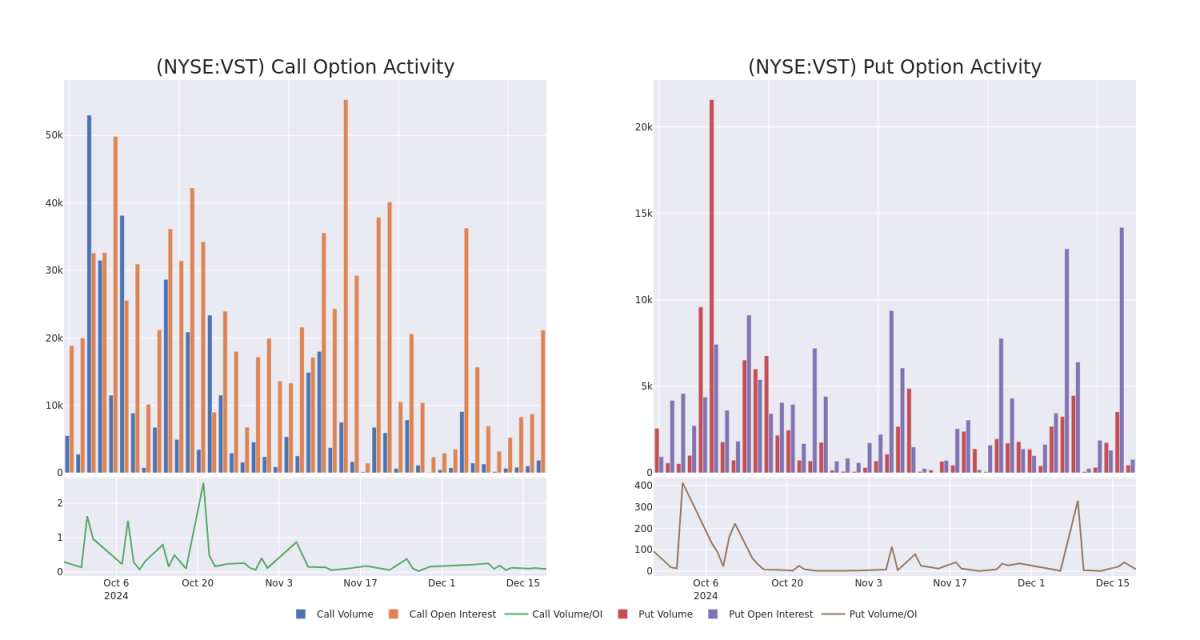

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vistra's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vistra's significant trades, within a strike price range of $80.0 to $175.0, over the past month.

Vistra Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | BULLISH | 01/17/25 | $2.1 | $1.55 | $1.9 | $170.00 | $214.9K | 4.5K | 1.1K |

| VST | CALL | SWEEP | BEARISH | 06/20/25 | $16.6 | $16.2 | $16.2 | $160.00 | $77.7K | 641 | 49 |

| VST | CALL | SWEEP | BEARISH | 02/21/25 | $4.7 | $4.5 | $4.5 | $170.00 | $65.2K | 209 | 146 |

| VST | CALL | SWEEP | BEARISH | 01/17/25 | $3.7 | $3.1 | $3.4 | $155.00 | $60.1K | 4.8K | 225 |

| VST | PUT | SWEEP | BULLISH | 01/17/25 | $38.6 | $38.5 | $38.5 | $175.00 | $57.7K | 32 | 15 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company's own performance.

Current Position of Vistra

- Currently trading with a volume of 1,948,136, the VST's price is up by 1.35%, now at $134.68.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 69 days.

Expert Opinions on Vistra

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $169.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Vistra, targeting a price of $169.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vistra with Benzinga Pro for real-time alerts.