Whales with a lot of money to spend have taken a noticeably bearish stance on United Parcel Service.

Looking at options history for United Parcel Service (NYSE:UPS) we detected 22 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $327,470 and 14, calls, for a total amount of $635,914.

From the overall spotted trades, 8 are puts, for a total amount of $327,470 and 14, calls, for a total amount of $635,914.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $160.0 for United Parcel Service over the recent three months.

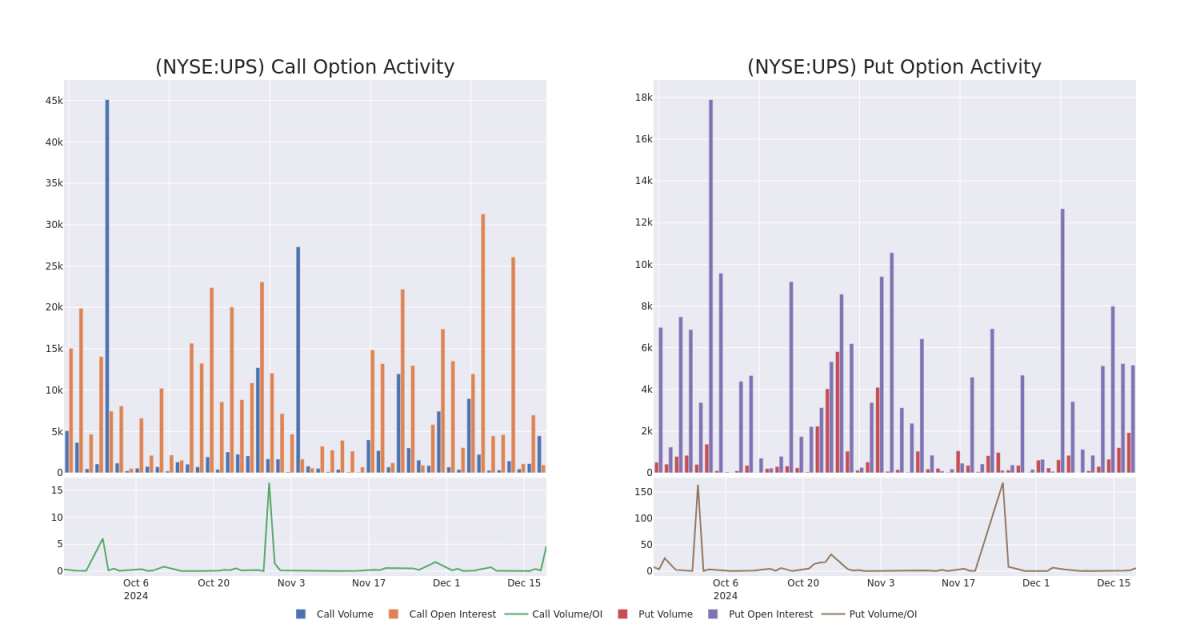

Insights into Volume & Open Interest

In today's trading context, the average open interest for options of United Parcel Service stands at 556.64, with a total volume reaching 6,399.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Parcel Service, situated within the strike price corridor from $100.0 to $160.0, throughout the last 30 days.

United Parcel Service Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | NEUTRAL | 02/21/25 | $6.2 | $6.1 | $6.1 | $125.00 | $123.9K | 9 | 302 |

| UPS | CALL | SWEEP | NEUTRAL | 04/17/25 | $21.25 | $21.0 | $21.0 | $105.00 | $86.2K | 9 | 27 |

| UPS | CALL | SWEEP | BULLISH | 12/20/24 | $1.54 | $1.29 | $1.29 | $124.00 | $58.5K | 136 | 491 |

| UPS | CALL | TRADE | NEUTRAL | 01/16/26 | $28.3 | $27.6 | $27.99 | $100.00 | $55.9K | 234 | 20 |

| UPS | PUT | TRADE | BEARISH | 12/27/24 | $3.65 | $3.5 | $3.65 | $126.00 | $54.7K | 228 | 160 |

About United Parcel Service

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

Present Market Standing of United Parcel Service

- Trading volume stands at 1,267,211, with UPS's price down by -0.62%, positioned at $123.05.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 40 days.

Professional Analyst Ratings for United Parcel Service

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $150.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from BMO Capital has elevated its stance to Outperform, setting a new price target at $150.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.