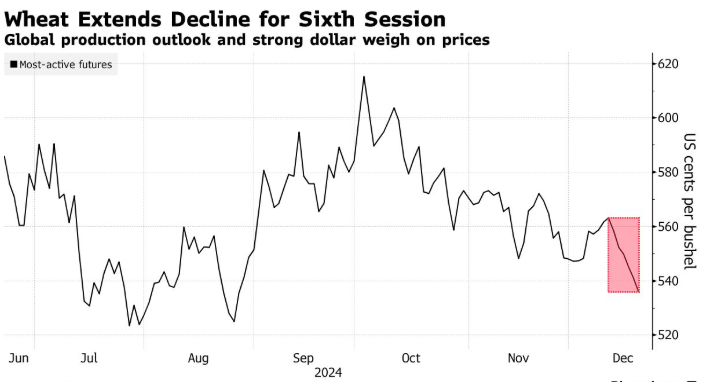

Wheat prices will experience the longest decline in more than five months due to market expectations of sufficient supply and a stronger dollar.

Zhitong Finance learned that wheat prices will experience the longest decline in more than five months due to market expectations of sufficient supply and a stronger dollar. The US Department of Agriculture said that global wheat production will reach the highest level on record in 2024-25, Australia is expected to have a big harvest, and production in parts of Argentina will also be better than expected. Moreover, the US dollar is supported by the prospect of the Federal Reserve reducing the pace of interest rate cuts. Chicago wheat futures fell for the sixth day in a row, the longest losing streak since the end of June. Prices will drop for the second week in a row.

However, production cuts in Russia, the world's largest wheat exporter, may limit the downward trend in wheat prices. Consulting firm SoveCon lowered its forecast for US production in 2025 to its lowest level since 2021 this week. As of press release, wheat futures for March delivery fell 1% to $5.36 per bushel.