European stock markets stabilized after four consecutive days of decline, as investors awaited the Federal Reserve's interest rate decision for clues on next year's MMF policy path.

The Stoxx Europe 600 index closed up about 0.2%. Banks, Technology, and Energy stocks outperformed the Large Cap, while mining and chemical stocks saw the largest declines.

Deutsche Bank rose as Unicredit announced it increased its stake in Deutsche Bank to around 28%. Crédit Agricole rose slightly, appointing Olivier Gavalda to replace CEO Philippe Brassac. Renault saw an increase amid reports that Honda Motor and Nissan are exploring merger possibilities.

However, the momentum in European stock markets weakened towards the end of the year due to concerns over regional economic growth and political risks in major economies such as France and Germany. The Stoxx 600 index is about 2.6% lower than the record high reached in September.

However, the momentum in European stock markets weakened towards the end of the year due to concerns over regional economic growth and political risks in major economies such as France and Germany. The Stoxx 600 index is about 2.6% lower than the record high reached in September.

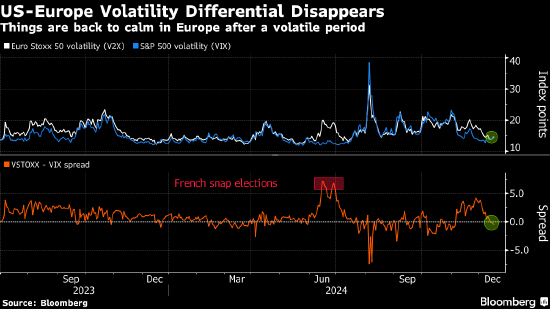

However, volatility is waning, with the European VSTOXX index completely erasing the gap that opened with the S&P 500 Index-linked VIX last month. Although the lower positions of investors in the European stock market reflect a dimmer outlook for the region, there is growing confidence that the European stock market will recover its upward momentum.

The focus on Wednesday will be on the Federal Reserve's interest rate decision and signals regarding the policy path for 2025. Swap traders have almost fully priced in expectations for a 25 basis point rate cut by the Federal Reserve at this week's meeting.

由于对区域经济增长以及法国和德国等主要经济体的政治风险心存担忧,欧洲股市年末涨势减弱。斯托克600指数比9月创下的纪录高点低约2.6%。

由于对区域经济增长以及法国和德国等主要经济体的政治风险心存担忧,欧洲股市年末涨势减弱。斯托克600指数比9月创下的纪录高点低约2.6%。