On December 18, Zhejiang Huandong Robot Joint Technology Co., Ltd. (referred to as "Huandong Technology") applied for a listing review status change to "Inquired" on the Star Market of the Shanghai Stock Exchange. GF SEC is its sponsor, intending to raise 1.408 billion yuan.

According to Zhitong Finance APP, on December 18, Zhejiang Huandong Robot Joint Technology Co., Ltd. (referred to as "Huandong Technology") applied for a listing review status change to "Inquired" on the Star Market of the Shanghai Stock Exchange. GF SEC is its sponsor, intending to raise 1.408 billion yuan.

The prospectus shows that Huandong Technology is a national high-tech enterprise engaged in the research, design, production, and sales of high-precision reducers for robot joints, providing customers with overall solutions for high-precision reducers required by robots with loads ranging from 3 to 1000 KG. Products include Rotate Vector (RV) Reducers, precision accessories, and Harmonic Drives, with RV Reducers being the company's main product, widely used in the fields of robotics, industrial automation, and other high-end manufacturing.

After years of in-depth development, Huandong Technology and its business predecessors have gone through prototype development, small-batch trial production, mass production, and capacity building, breaking through key core technologies in design theory, critical manufacturing processes, detection and testing, high-precision assembly, and specialized equipment development early on, and achieving large-scale production. The company has established a complete system for reducer design, manufacturing, assembly, testing, and market application, forming a product spectrum of over 40 types of high-precision reducers for industrial robots.

After years of in-depth development, Huandong Technology and its business predecessors have gone through prototype development, small-batch trial production, mass production, and capacity building, breaking through key core technologies in design theory, critical manufacturing processes, detection and testing, high-precision assembly, and specialized equipment development early on, and achieving large-scale production. The company has established a complete system for reducer design, manufacturing, assembly, testing, and market application, forming a product spectrum of over 40 types of high-precision reducers for industrial robots.

Huandong Technology has established good long-term strategic partnerships with several well-known robot manufacturers at home and abroad. The company's major clients include Estun Automation (002747.SZ), Efort (688165.SH), Canop, Aishida Co., Ltd. (002403.SZ) under Qianjiang Robot, Shanghai STEP Electric Corporation (002527.SZ), Siasun Robot&Automation (300024.SZ), Kaelda (688255.SH), Guangzhou CNC, Wuhan Huazhong Numerical Control (300161.SZ) and other well-known brand manufacturers and listed companies, and has achieved supply to international robot companies.

In recent years, the market share of Huandong Technology's main product, RV Reducers, in the domestic robot market has rapidly increased and achieved a leading position. In 2020, Nabtesco held a market share of 54.80% in the domestic robot RV reducer market, holding an absolute advantage, while Sumitomo Heavy Industries had a market share of 6.60%, and Huandong's market share was only 5.25%. From 2021 to 2023, the company's market share was 10.11%, 13.65%, and 18.89% respectively, increasing year by year and ranking just after Nabtesco. During the same period, Nabtesco's market shares were 51.77%, 50.87%, and 40.17%, while Sumitomo Heavy Industries' market shares were 5.06%, 4.70%, and 3.91% respectively. The market shares of international manufacturers have continuously declined, highlighting the domestic substitution characteristics of the company's products. While gradually achieving import substitution of Nabtesco, the company has further solidified its position as a leading domestic RV reducer manufacturer, becoming an important force in promoting the rapid rise of domestic independent brand industrial robots and ensuring controllability in China's high-end equipment manufacturing.

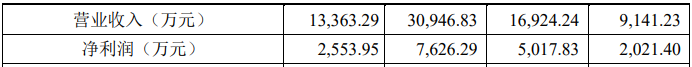

In terms of finance, for the years 2021, 2022, 2023, and the first half of 2024, Huandong Technology achieved revenues of approximately 91.4123 million yuan, 0.169 billion yuan, 0.309 billion yuan, and 0.134 billion yuan respectively, while the net incomes for the same periods were 20.214 million yuan, 50.1783 million yuan, 76.2629 million yuan, and 25.5395 million yuan.

It is worth noting that Huan Dong Technology mentioned in the prospectus that the company faces risks related to major customer concentration and significant reliance on clients.

During the reporting period, the company's main customers were well-known domestic robot brand manufacturers, with sales revenue from the top five clients in each period being 72.6279 million yuan, 142.6638 million yuan, 285.0716 million yuan, and 106.2424 million yuan respectively, accounting for 79.45%, 84.30%, 92.12%, and 79.50% of the operating income in that period, which is quite high; among them, the sales revenue from the largest client Estun Automation was 11.6309 million yuan, 72.8985 million yuan, 159.7311 million yuan, and 70.6643 million yuan, accounting for 12.72%, 43.07%, 51.61%, and 52.88% respectively, indicating a significant reliance on Estun Automation.

If there are adverse changes in the operational or financial status of major clients, or if there are adjustments in their business development strategies, changes in procurement policies, or if the company fails to timely meet the constantly evolving business needs of its clients, resulting in unfavorable changes in the cooperation relationship, and if the company cannot continuously expand new clients and markets, it may have a negative impact on the company's operating performance.

经过多年深耕发展,环动科技及其业务前身经历样机开发、小批量试制、批量化及产业化能力建设,较早地突破了设计理论、制造关键工艺、检测测试、高精密装配和专用装备开发等环节的关键核心技术并实现规模化生产,已建立完善的减速器设计、制造、装配、检测及市场应用体系,形成了40余种工业机器人用高精密减速器的产品谱系。

经过多年深耕发展,环动科技及其业务前身经历样机开发、小批量试制、批量化及产业化能力建设,较早地突破了设计理论、制造关键工艺、检测测试、高精密装配和专用装备开发等环节的关键核心技术并实现规模化生产,已建立完善的减速器设计、制造、装配、检测及市场应用体系,形成了40余种工业机器人用高精密减速器的产品谱系。