In the third quarter of 2024, PC shipments in mainland China (including desktop computers, laptops, and workstations) slightly decreased by 1% year-on-year, totaling 11.1 million units.

According to the Zhikaa Finance APP, data released by Canalys shows that in the third quarter of 2024, PC shipments in mainland China (including desktop computers, laptops, and workstations) slightly decreased by 1% year-on-year, totaling 11.1 million units, among which Consumer market shipments increased by 4% year-on-year due to pre-holiday stockpiling and government consumption incentive measures. At the same time, benefiting from the launch of new products and quarterly promotions, tablet shipments continued to maintain an upward trend, growing by 5% year-on-year, reaching 7.7 million units.

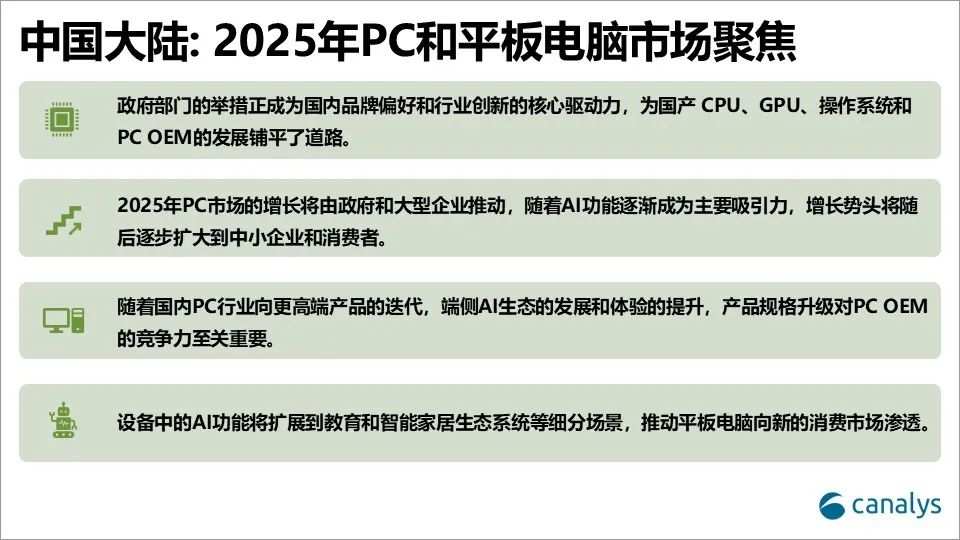

Canalys expects that the PC market will continue to recover in 2025, stimulated by supportive policies for Consumer and corporate procurement, with desktop and laptop growth projected at 9% and 4% respectively. After experiencing rapid growth in 2024, tablet shipments are expected to decline slightly by 2% in the following year, but the integration of AI functions will continue to drive tablet penetration in the Consumer market and Educational scenarios.

Starting from 2023, the Chinese PC market has undergone a significant transformation, with domestic manufacturers rising to prominence. The government's "Xinchuang" (local innovation) related incentive policies have created a favorable environment for the prosperous development of domestic manufacturers. In the third quarter of 2024, local manufacturer Softcom Power (formerly known as "Tongfang") ranked second in shipments due to strong performance in government departments, the education sector, and gaming laptops. Affected by the unfavorable economic environment, demand from small and medium-sized enterprises and large enterprises has weakened, and the commercial market faced challenges, declining by 7% in the third quarter of 2024. In contrast, the government sector experienced growth, with an increase of 3% driven by the recovery of spending in governments and education. These types of incentive policies are expected to continue and will drive the recovery of the Chinese PC market in the coming year.

Starting from 2023, the Chinese PC market has undergone a significant transformation, with domestic manufacturers rising to prominence. The government's "Xinchuang" (local innovation) related incentive policies have created a favorable environment for the prosperous development of domestic manufacturers. In the third quarter of 2024, local manufacturer Softcom Power (formerly known as "Tongfang") ranked second in shipments due to strong performance in government departments, the education sector, and gaming laptops. Affected by the unfavorable economic environment, demand from small and medium-sized enterprises and large enterprises has weakened, and the commercial market faced challenges, declining by 7% in the third quarter of 2024. In contrast, the government sector experienced growth, with an increase of 3% driven by the recovery of spending in governments and education. These types of incentive policies are expected to continue and will drive the recovery of the Chinese PC market in the coming year.

Canalys Analyst Xu Ying stated: "Government policy incentives have been a core element of the economic situation in China since entering the second half of 2024, with incentive measures introduced by central and local governments boosting retail sales, while also raising the shipment of High Stock Price PCs. We expect this positive trend to bring favorable impacts to shipments in the fourth quarter. Additionally, top-down encouragement measures are pushing domestic industries to invest more in local CPUs, GPUs, platforms, and original equipment manufacturers. Looking ahead, due to the current stimulus measures boosting the economy in the fourth quarter of 2024 and 2025, Canalys expects further recovery in government department and large enterprise spending."

Gaming laptops and AI PCs achieved substantial growth in the third quarter of 2024, with increases of 24% and 70% respectively. Consequently, the average selling price (ASP) of PCs rose by 4% to reach $800. Notably, the market share of AI PCs in the overall PC market grew to 15%, up from just 7% in the fourth quarter of 2023. Xu Ying explained: "Although there is a wide downturn in the market, the increasing expectation for a good user experience, along with subsidy policies, has kept high-value PCs with AI or gaming functions resilient. As the market evolves, manufacturers will need to strengthen their product competitiveness in these high-value product categories in order to maintain competitiveness and profitability."

The sales of tablet computers in mainland China maintained a growth trend during the pre-holiday promotion season, with a year-on-year increase of 5%. Xu Ying stated: "New trends are emerging in the tablet computer field, including products specifically aimed at Children's Education and cloud-based user experiences. These trends will increasingly utilize AI to enhance functionality, primarily focusing on Education, government, and household sectors. AI-driven innovation is creating new opportunities in the tablet market, bringing potential for significant growth in specific usage scenarios."

从2023年开始,中国PC市场经历了巨大转变,国内厂商开始名列前茅。政府的“信创”(本土创新)相关鼓励政策为国内厂商的繁荣发展营造了有利环境。本土厂商软通动力(原名“同方”)在2024年第三季度由于政府部门和教育领域及其游戏本的强劲表现,出货量跃居第二。受经济环境不景气的影响,中小企业和大型企业均需求疲软,商用市场面临挑战,2024年第三季度下跌7%。相反,政府部门出现增长,在政府和教育领域支出复苏的推动下,增速达3%。这类刺激政策有望继续保持,并将在未来一年推动中国PC市场的复苏。

从2023年开始,中国PC市场经历了巨大转变,国内厂商开始名列前茅。政府的“信创”(本土创新)相关鼓励政策为国内厂商的繁荣发展营造了有利环境。本土厂商软通动力(原名“同方”)在2024年第三季度由于政府部门和教育领域及其游戏本的强劲表现,出货量跃居第二。受经济环境不景气的影响,中小企业和大型企业均需求疲软,商用市场面临挑战,2024年第三季度下跌7%。相反,政府部门出现增长,在政府和教育领域支出复苏的推动下,增速达3%。这类刺激政策有望继续保持,并将在未来一年推动中国PC市场的复苏。