Source: Semiconductor Industry Watch. At yesterday's Conputex conference, Dr. Lisa Su released the latest roadmap. Afterwards, foreign media morethanmoore released the content of Lisa Su's post-conference interview, which we have translated and summarized as follows: Q: How does AI help you personally in your work? A: AI affects everyone's life. Personally, I am a loyal user of GPT and Co-Pilot. I am very interested in the AI used internally by AMD. We often talk about customer AI, but we also prioritize AI because it can make our company better. For example, making better and faster chips, we hope to integrate AI into the development process, as well as marketing, sales, human resources and all other fields. AI will be ubiquitous. Q: NVIDIA has explicitly stated to investors that it plans to shorten the development cycle to once a year, and now AMD also plans to do so. How and why do you do this? A: This is what we see in the market. AI is our company's top priority. We fully utilize the development capabilities of the entire company and increase investment. There are new changes every year, as the market needs updated products and more features. The product portfolio can solve various workloads. Not all customers will use all products, but there will be a new trend every year, and it will be the most competitive. This involves investment, ensuring that hardware/software systems are part of it, and we are committed to making it (AI) our biggest strategic opportunity. Q: The number of TOPs in PC World - Strix Point (Ryzen AI 300) has increased significantly. TOPs cost money. How do you compare TOPs to CPU/GPU? A: Nothing is free! Especially in designs where power and cost are limited. What we see is that AI will be ubiquitous. Currently, CoPilot+ PC and Strix have more than 50 TOPs and will start at the top of the stack. But it (AI) will run through our entire product stack. At the high-end, we will expand TOPs because we believe that the more local TOPs, the stronger the AIPC function, and putting it on the chip will increase its value and help unload part of the computing from the cloud. Q: Last week, you said that AMD will produce 3nm chips using GAA. Samsung foundry is the only one that produces 3nm GAA. Will AMD choose Samsung foundry for this? A: Refer to last week's keynote address at imec. What we talked about is that AMD will always use the most advanced technology. We will use 3nm. We will use 2nm. We did not mention the supplier of 3nm or GAA. Our cooperation with TSMC is currently very strong-we talked about the 3nm products we are currently developing. Q: Regarding sustainability issues. AI means more power consumption. As a chip supplier, is it possible to optimize the power consumption of devices that use AI? A: For everything we do, especially for AI, energy efficiency is as important as performance. We are studying how to improve energy efficiency in every generation of products in the future-we have said that we will improve energy efficiency by 30 times between 2020 and 2025, and we are expected to exceed this goal. Our current goal is to increase energy efficiency by 100 times in the next 4-5 years. So yes, we can focus on energy efficiency, and we must focus on energy efficiency because it will become a limiting factor for future computing. Q: We had CPUs before, then GPUs, now we have NPUs. First, how do you see the scalability of NPUs? Second, what is the next big chip? Neuromorphic chip? A: You need the right engine for each workload. CPUs are very suitable for traditional workloads. GPUs are very suitable for gaming and graphics tasks. NPUs help achieve AI-specific acceleration. As we move forward and research specific new acceleration technologies, we will see some of these technologies evolve-but ultimately it is driven by applications. Q: You initially broke Intel's status quo by increasing the number of cores. But the number of cores of your generations of products (in the consumer aspect) has reached its peak. Is this enough for consumers and the gaming market? Or should we expect an increase in the number of cores in the future? A: I think our strategy is to continuously improve performance. Especially for games, game software developers do not always use all cores. We have no reason not to adopt more than 16 cores. The key is that our development speed allows software developers to and can actually utilize these cores. Q: Regarding desktops, do you think more efficient NPU accelerators are needed? A: We see that NPUs have an impact on desktops. We have been evaluating product segments that can use this function. You will see desktop products with NPUs in the future to expand our product portfolio.

A new AI Chip manufacturer worth one trillion dollars has emerged in the market, but the old company will still perform well.

$Broadcom (AVGO.US)$The fourth quarter Earnings Reports released last week included long-term forecasts for its AI Business, which boosted its stock price and increased the company's Market Cap to 1 trillion dollars. It also seems to have had an opposing effect on $NVIDIA (NVDA.US)$this AI Chip giant's stock price, which dropped about 4% over the past two days, while Broadcom's stock price surged by 38% during the same period.

The gap remains significant. On Monday, NVIDIA's Market Cap was approximately 3.3 trillion dollars, while Broadcom's Market Cap was about 1.2 trillion dollars. However, Broadcom still lags slightly, as the recent surge has pushed the chip manufacturer's stock price to more than 38 times the expected earnings for the next four quarters.

The gap remains significant. On Monday, NVIDIA's Market Cap was approximately 3.3 trillion dollars, while Broadcom's Market Cap was about 1.2 trillion dollars. However, Broadcom still lags slightly, as the recent surge has pushed the chip manufacturer's stock price to more than 38 times the expected earnings for the next four quarters.

According to FactSet data, this is the highest PE ratio for the stock in its history, twice the three-year average. It is also the first time since the merger of Broadcom and Avago in early 2016 that it is priced higher than NVIDIA. On Monday, NVIDIA's stock closed at around 31 times the expected earnings.

Investors have plenty of reasons to be excited about Broadcom's potential. The company's diversified chip business gives it a foothold in the hot AI market. Broadcom is a top supplier of network processors that manage the connections between components in datacenter, such as the chip clusters produced by NVIDIA.

It is also an important partner for large technology companies under Alphabet. $Alphabet-C (GOOG.US)$ and$Meta Platforms (META.US)$These companies are designing their own AI chips for their datacenters.

Custom AI chips (also known as ASICs) can perform part of the AI workloads similar to NVIDIA products. Therefore, the strong forecast made by Broadcom CEO Hock Tan last week may be seen as a concerning signal for NVIDIA's own growth potential. In the company's earnings call with analysts, Tan stated that three of Broadcom's major technology clients are expected to spend between 60 billion and 90 billion dollars on ASIC chips and network components in the fiscal year ending October 2027, which are the markets that Broadcom serves in the AI chip space.

Broadcom does not expect to capture all of this business; Chen Fuyang described these figures as the company's 'serviceable addressable market,' or SAM. However, these comments are still seen as a strong forecast of the 12.2 billion dollars in AI revenue growth reported by Broadcom for the recently ended fiscal year.

Jefferies Financial's Blayne Curtis wrote, "Assuming Broadcom can reach the lower end of the SAM range, we expect its EPS to exceed $12 by 2027."

The report states that its adjusted EPS for the latest fiscal year was $4.87.$Amazon (AMZN.US)$Providing customized ASIC chip services for large Technology companies, Broadcom's smaller competitors $Marvell Technology (MRVL.US)$ are also experiencing explosive growth. It is expected that the total revenue for the fiscal year ending January 2026, $Marvell Technology (MRVL.US)$ will surge by 40%.

However, such proprietary chips cannot completely offset the demand for NVIDIA's market-leading chips. It is noteworthy that the two leading Technology giants, Alphabet and Amazon, often boast about their relationships with AI leaders.

Alphabet CEO Sundar Pichai remarked in the company's latest Earnings Reports conference call: "Our partnership with NVIDIA is very good."

Bernstein Analyst Stacy Rasgon stated in an interview: "This is not a zero-sum game." Large Technology companies with resources can design chips that run certain highly specific workloads more efficiently than those from external suppliers. "But there is no such thing as a free lunch," Rasgon said, adding that these chips lack flexibility.

He also pointed out that the primary clients of the Cloud Computing Service provided by these large Technology companies do not want to be locked into a single proprietary computing source. "Enterprise clients want flexibility, and they are all coding on CUDA," he said, referring to NVIDIA's large AI Software coding library, which is a key to the company's strong competitive advantage.

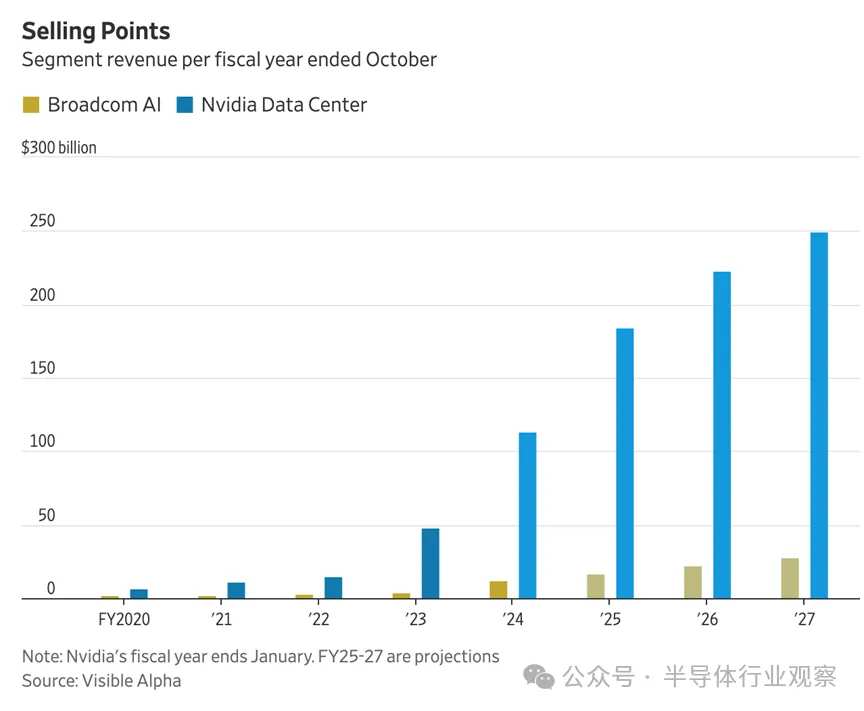

Therefore, the market still holds high expectations for NVIDIA and Broadcom. Although Broadcom's stock price has exceeded the Target Price of most Brokerages, most Analysts studying these two companies rate these Stocks as Buy. Broadcom's AI business is still only a small part of NVIDIA's, which reported Datacenter revenue of $98 billion for the 12-month period ending in October.

According to Visible $ALPHA (0303.MY)$ Wall Street expects NVIDIA's Datacenter revenue to more than double in the next two years, which will still be about 10 times the AI revenue expected from Broadcom during the same period. Broadcom's next trillion-dollar milestone may not be as easy to achieve as the first.

Broadcom needs to deliver on its promises.

After Broadcom released its Earnings Report last week, its stock price surged significantly, reminiscent of the situation when NVIDIA's stock price began to rise for the first time in 2023. This chip manufacturer now needs to prove that it can stick around and become another giant in the AI era.

As of Monday's closing (two trading days since the company announced its performance), Broadcom's stock price has soared by 38%, pushing the company's Market Cap close to 1.2 trillion dollars. The core of this increase is Broadcom's prediction that by fiscal year 2027, the potential market for AI components designed for Datacenter operators will reach 90 billion dollars. However, a lot of work remains to be done to turn this opportunity into reality. On Tuesday morning, the company's stock price fell by as much as 4.7%.

Ken Mahoney, CEO of Mahoney Asset Management, which holds the company's Stocks, stated, "This is somewhat reminiscent of NVIDIA's glorious moment a year and a half ago when their figures were astonishing, and everyone had to catch up." Mahoney indicated that Broadcom has shown investors that the demand for AI computing is so great that besides NVIDIA, other winners have sufficient room for development.

Before the performance announcement last week, Broadcom had already performed well this year, with robust growth in its AI Business supporting its position as one of the best-performing Stocks.$PHLX Semiconductor Index (.SOX.US)$However, Broadcom's development has not been smooth sailing: In September, the company released disappointing performance forecasts due to weak non-AI business, leading to a stock price plunge.

The performance of this quarter shifts the focus back to AI. Broadcom's stock price has risen over 110% year to date, expected to achieve its best annual performance since going public in 2009. Analysts have been struggling to keep up with this trend, with several Wall Street firms raising their Target Prices and valuations after the performance announcement. However, data compiled by Bloomberg shows that despite a 19% average increase in analysts' Target Prices since the Earnings Report, the stock price has not risen.

This trajectory inevitably triggers comparisons with NVIDIA, which was the initial AI winner in the stock market. NVIDIA released a shocking Earnings Report in May 2023, followed by a series of performance results and quarterly forecasts that exceeded expectations. It also broke the skepticism that 2024 would be a difficult year for the stock. NVIDIA has risen about 159% this year, but has receded in the past few days—possibly because investors are considering the increasingly fierce competition from Broadcom.

Joe Tigay, portfolio manager of the Rational Equity Armor Fund, stated, "I find that there are many similarities between Broadcom and NVIDIA," expressing his belief that there is reason to expect Broadcom's stock to continue rising like NVIDIA. "Obviously, Broadcom still needs to achieve a PE of 38 times, but it has shown good growth and execution this year."

This multiple (the price investors must pay for expected earnings over the next 12 months) is further approaching record levels. This may indicate limited room for error for Broadcom, but NVIDIA has set a bullish precedent for investors hoping to capture the next potential AI winner. NVIDIA's profits grew so quickly last year that as the stock price rose, the valuation actually became cheaper because the speed of the valuation adjustment was faster.

In the past week, expectations for Broadcom's EPS for fiscal year 2025 have increased by 12%.

However, not every "NVIDIA moment" leads to sustained growth, as some companies fail to meet expectations or experience stagnant stock prices.$Arm Holdings (ARM.US)$In February, optimistic forecasts were given, stating that this was "only the beginning of the AI boom." This led to the stock soaring 93% over the next three trading days, but since then, the stock price has not seen much increase and is currently down more than 20% from its July high.

Alec Young, chief investment strategist at Mapsignals, mentioned, "It's still too early to say whether we will see a series of breakout reports like NVIDIA. Broadcom is indeed performing well, but these things don’t always yield good results."

Editor/Rocky

差距仍然很大。周一,英伟达的市值约为 3.3 万亿美元,而博通的市值约为 1.2 万亿美元。但博通仍略显逊色,近期的飙升已将这家芯片制造商的股价推高至未来四个季度预期收益的 38 倍以上。

差距仍然很大。周一,英伟达的市值约为 3.3 万亿美元,而博通的市值约为 1.2 万亿美元。但博通仍略显逊色,近期的飙升已将这家芯片制造商的股价推高至未来四个季度预期收益的 38 倍以上。