Nissan is currently mired in financial difficulties, with only 12 to 14 months of Cash / Money Market reserves left, facing pressure from aggressive Shareholders and a huge debt burden, and its stock price has dropped about 39% so far this year; Honda has once again lowered its performance and delivery guidance.

Are giants like Nissan and Honda preparing for a restructuring, leading to a significant reshuffling of the competition landscape in the Auto Industry?

On Wednesday, according to Nikkei Japan, Honda Motor and Nissan Motor are preparing to negotiate a possible merger, and both companies also plan to ultimately bring Mitsubishi Motors under their holding company, with Nissan currently being the largest shareholder of Mitsubishi Motors, holding 24% of the shares.

The reasons behind the merger are not hard to understand, as competition in the global Auto market intensifies, and the transition to electric vehicles presents challenges, requiring billions of dollars in investment capital for gasoline-powered, hybrid, and pure electric vehicles, making scale and cost crucial.

The reasons behind the merger are not hard to understand, as competition in the global Auto market intensifies, and the transition to electric vehicles presents challenges, requiring billions of dollars in investment capital for gasoline-powered, hybrid, and pure electric vehicles, making scale and cost crucial.

Currently, Nissan is mired in financial difficulties, with only 12 to 14 months of cash reserves left, while Honda's financial situation has also deteriorated, resulting in a further downgrade of performance and delivery guidance.

This potential merger would create a holding company that includes Honda, Nissan, and Mitsubishi Motors, marking the largest restructuring in the Auto Industry since the establishment of Stellantis in 2021. The annual sales volume of the merged entities is expected to exceed 8 million vehicles, enough to challenge global giants Toyota (11.2 million vehicles sold in 2023) and Volkswagen (9.2 million vehicles sold last year).

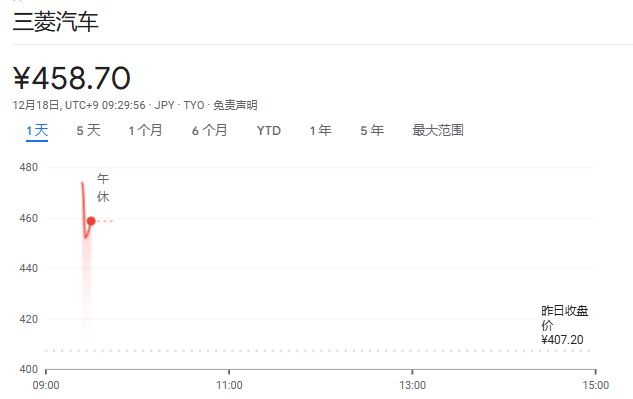

Following the news of the merger, Mitsubishi Motors' stock increased by as much as 17% today, while Nissan Motor's stocks have yet to begin trading, with bid prices already reaching the offer levels.intraday tradingUpper limit. Honda Motor's stock price once fell by 2%. Overnight, Nissan's stock price surged, with Nissan's American Depositary Receipts rising by 11.5% to close at $5.10, while Honda's stock price also slightly increased by 1% to $25.26.

Nissan is mired in financial difficulties, and Honda has lowered its delivery guidance.

Currently, Nissan's situation is even more difficult. Earlier this year, Nissan reported a 99% decrease in operating profit in its North American market. The main problems Nissan faces stem from:

- Rising Car Prices: High prices have led buyers to turn to competitors.

- Decreased Reliability: Consumers' trust in key models has diminished.

- Intense Competition: Toyota, Hyundai, and Kia continue to dominate the market segment where Nissan operates.

Even more worryingly, reports indicate that Nissan has only 12 to 14 months of cash reserves left. The company also faces pressure from activist shareholders and a heavy debt burden, leading to questions about its investment-grade rating in the credit market. To maintain operation, Nissan has significantly increased promotional efforts, including offers such as 0% annual interest financing and low-price leasing for popular models like Rogue, Altima, and Pathfinder, with this trend expected to continue until 2025.

Honda has once again lowered its performance guidance, now expecting a greater decline in Net income, raising its previous forecast of a 9.7% decline to 14%. The company had previously forecasted sales of 3.9 million units for this fiscal year, but has now adjusted the guidance down to 3.8 million units, with group Auto sales in the first half dropping 8% to 1.78 million units. In the six months ending September 30, Honda's revenue grew by 12%, but this was below market expectations.

Nissan's stock price has fallen about 39% so far this year, and the company's Market Cap is approximately 8 billion dollars. Honda's stock price has dropped about 18%, with a Market Cap of around 40 billion dollars.

Additionally, as a partner of Nissan, Mitsubishi Motors is likely to be involved in this merger. However, specific details have not yet been announced. If included in the merger, Mitsubishi may face a complete transformation, possibly phasing out its less competitive models.

The Global Auto competition landscape is turbulent.

Analysts believe that this deal will create a competitor to Toyota Motor, thus consolidating the Japanese auto industry into two camps. After reducing long-term global partnerships with other Auto Manufacturers (Nissan with France's Renault and Honda with General Motors), this will also provide Honda and Nissan with more resources to compete with larger peers.

The Nikkei analysis points out that the merger will help these two manufacturers compete against electric vehicle competitors like Tesla and Chinese Auto Manufacturers, putting them in a better position to compete with the largest Global Auto Manufacturer, Toyota, both domestically and internationally.

Toyota has invested in SUBARU CORP Unsponsored ADR, Suzuki Motor Corp, and Mazda Motor Corp, creating a strong brand group with its top-notch credit rating. In the first six months of this year, Honda, Nissan, and Mitsubishi collectively sold about 4 million Autos globally, far less than Toyota's own sales of 5.2 million units.

合并背后的原因并不难理解,随着全球汽车市场竞争加剧,电动汽车转型带来了挑战,油车、混动和纯电动汽车都需要数十亿美元的投资资本,规模和成本很重要。

合并背后的原因并不难理解,随着全球汽车市场竞争加剧,电动汽车转型带来了挑战,油车、混动和纯电动汽车都需要数十亿美元的投资资本,规模和成本很重要。