Since the beginning of this year, the bond ETF market has developed rapidly.

As of December 17, the scale of bond ETFs has exceeded 164.6 billion yuan. Currently, there are 5 bond ETFs with a scale of over 10 billion yuan, including Bosera CSI Convertible Bond And Exchangeable Bond ETF, China Universal Government Bond ETF, HFT CSI Short-Term Financing ETF, CHENGTOUETF, and Ping An Chinabond Medium-High Grade Corporate Bonds Spread Factor ETF with scales of 36.132 billion yuan, 33.495 billion yuan, 28.687 billion yuan, 13.5 billion yuan, and 10.975 billion yuan respectively.

From the beginning of the year until now, all bond ETFs have posted positive returns. Among them, the 30-Year Treasury Bond ETF has increased by over 20% this year, while the HFT SSE 10-Year Local Government Bond ETF has risen by over 10%.

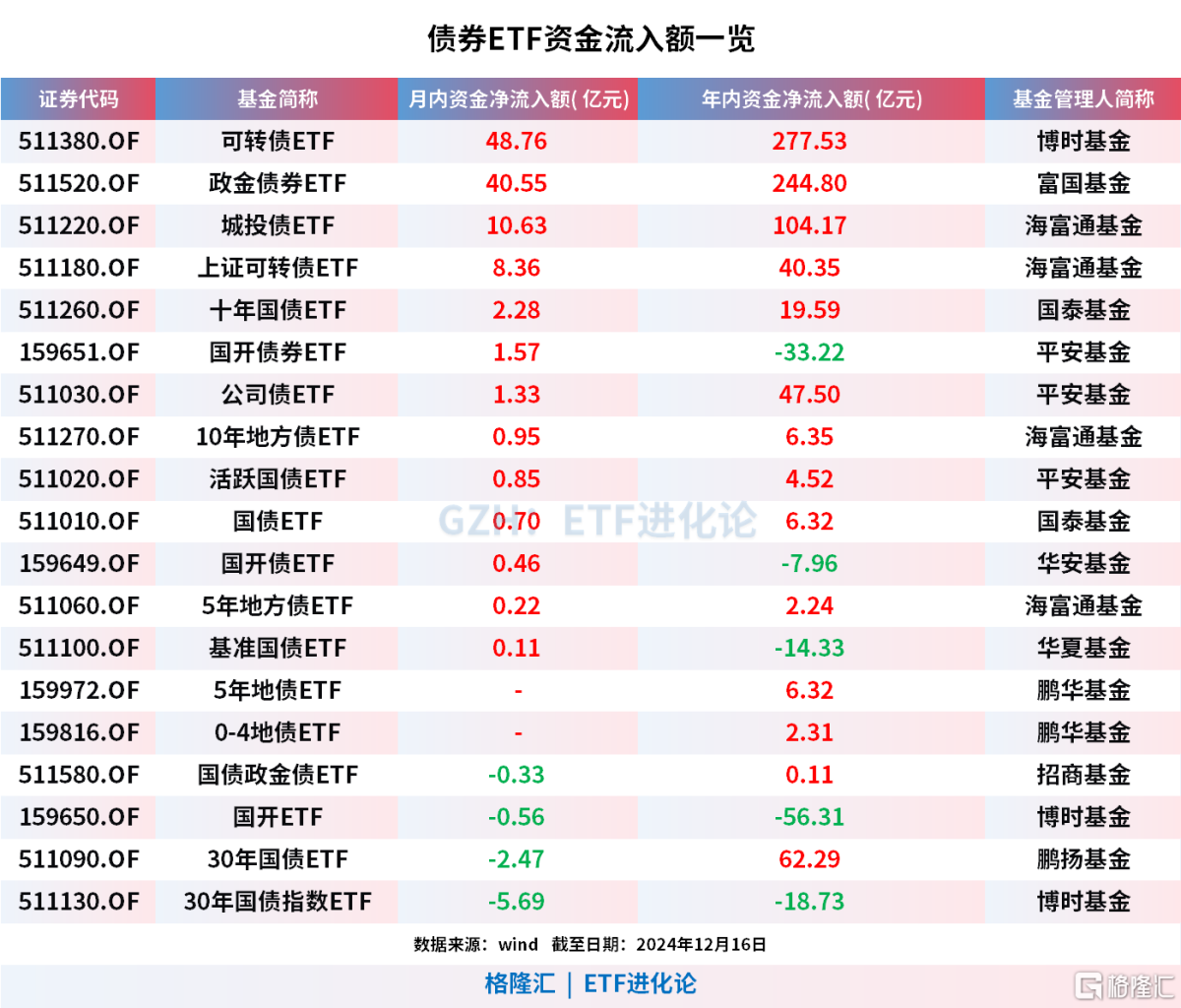

Since December, there has been a net inflow of over 10.7 billion yuan into bond ETFs, with Bosera CSI Convertible Bond And Exchangeable Bond ETF and China Universal Government Bond ETF seeing net inflows of 4.876 billion yuan and 4.055 billion yuan respectively this month.

Since December, there has been a net inflow of over 10.7 billion yuan into bond ETFs, with Bosera CSI Convertible Bond And Exchangeable Bond ETF and China Universal Government Bond ETF seeing net inflows of 4.876 billion yuan and 4.055 billion yuan respectively this month.

From the beginning of the year until now, there has been a net inflow of over 69.3 billion yuan into bond ETFs, with Bosera CSI Convertible Bond And Exchangeable Bond ETF, China Universal Government Bond ETF, and HFT CSI Short-Term Financing ETF seeing net inflows of 27.753 billion yuan, 24.48 billion yuan, and 10.417 billion yuan respectively.

Regarding the bond market, Huachuang Securities pointed out:

Under the expectation of extreme loosening, the bond market is in a non-stable state and cannot be understood with past common sense. After a rapid and significant decline in yields, the market is concerned about reversal risks, but there do not seem to be any obvious bearish factors in the short term. (1) If the overall loosening policy is implemented, profit-taking positions will emerge, but the probability of a short-term reserve requirement cut has decreased. (2) Attention should be paid to the layered volatility risk of fund prices at the end of the year, but the further upward space for DR007-policy rates is limited. (3) Watch for changes in risk appetite recovery, but there is a short-term gap in policies and economic data. (4) Monitor whether the central bank's management of long bond risks is implemented, but the experience from August has provided institutions with allocation opportunities. (5) Be aware of the risk of a correction in the bond market after excessive growth, but under the protection of allocation positions, the extent of adjustment in the bond market at the end of the year is usually relatively limited.

In the short term, there are no obvious bearish factors causing a reversal in the bond market, but the cost-effectiveness of large-scale position increases after a rapid decline in yields is also low. (1) For accounts that have already increased positions: it is recommended to watch more and act less, going with the flow; (2) If there is still incremental capital in the account: follow the logic of 'plentiful money' to explore yield differentials and look for convex points on the yield curve for allocation.

Zheshang Securities' Research Reports indicate that during a monetary easing cycle, the long-term central point of the 10-year treasury bond yield (3-5 years) may be 1.5-2.0%. The low point of the 10-year treasury bond yield may decline to below 1.5%. This also means that, although this round of year-end market activity's scale and pace have exceeded market expectations, in the end perspective, 1.8% may be the central point of the 10-year treasury bond yield rather than the lower limit. From the end perspective, the Political Bureau meeting and the Central Economic Work Conference's positioning on monetary policy have increased the certainty of bullish positions in the bond market, and this round of year-end activity is still not over. There are currently no clear bearish signals for the bond market before the Spring Festival next year; the bullish factors include the gradual influx of funds from reserve requirement cuts, interest rate cuts, Insurance New Year funds, and refinancing bond funds, suggesting that profit-taking should not be taken lightly. The next key point will be the profit-taking once the next interest rate cut is implemented and the impact of incremental policy expectations before and after the two sessions.

12月以来,超107亿元资金净流入债券ETF,博时可转债ETF、富国政金债券ETF本月资金净流入额48.76亿元、40.55亿元。

12月以来,超107亿元资金净流入债券ETF,博时可转债ETF、富国政金债券ETF本月资金净流入额48.76亿元、40.55亿元。