After December 9, the company's volume has generally decreased day by day, also reflecting a low willingness for subsequent funds to continue to drive up prices. Overall, the probability of Hello Group's stock price experiencing fluctuations or even declines in the short term is still higher than that of continuing to rise.

On December 9, in Pre-Market Trading, Momo and Tantan's parent company, Hello Group (MOMO.US), released its 2024 Q3 Earnings Reports. In this report, Hello Group showed a decline in revenue and net profit financial data, as well as a decrease in monthly active users and paid users operational data.

From the secondary market perspective, on November 26, Hello Group's stock price began to rebound after hitting a low of $6.32 during trading. As of the close on December 6, the company's stock price recovered to $6.77, up 7.12% from the low.

Such a performance in the earnings report might have led to short selling on Wall Street previously, thereby interrupting this rebound trend. However, after the earnings report was disclosed, Hello Group's stock price gapped up on December 9, continuing the previous uptrend and showing strong buying from the bulls. From December 6 to 13, Hello Group's stock price made a rare 'six consecutive up days', pulling its price up to a maximum of $7.85, just a step away from the previous high of $8.19.

Such a performance in the earnings report might have led to short selling on Wall Street previously, thereby interrupting this rebound trend. However, after the earnings report was disclosed, Hello Group's stock price gapped up on December 9, continuing the previous uptrend and showing strong buying from the bulls. From December 6 to 13, Hello Group's stock price made a rare 'six consecutive up days', pulling its price up to a maximum of $7.85, just a step away from the previous high of $8.19.

Why can there be 'six consecutive up days' despite the continuous decline in performance?

In terms of the performance data increment, Hello Group's performance in Q3 this year does not look good. The earnings report shows that in Q3, Hello Group's net revenue was 2.675 billion yuan (approximately 0.381 billion USD), a year-on-year decrease of 12.1%; not in accordance with US Generally Accepted Accounting Principles, the net profit attributable to Hello Group for the current period was 0.493 billion yuan (approximately 70.3 million USD), a year-on-year decrease of 8.58%.

In the first three quarters of 2024, the company’s cumulative revenue reached 7.926 billion yuan, down 11.92% compared to 8.999 billion yuan in the same period last year; the cumulative net profit during the same period was 0.852 billion yuan, a decrease of 43.15% compared to 1.499 billion yuan in the same period last year.

From the Q3 divisional performance situation, the company’s live broadcasting service revenue in the current period was 1.286 billion yuan; including revenue from virtual gift services and membership subscription services, the revenue from value-added services was 1.356 billion yuan; the mobile marketing revenue was 30.7 million yuan. According to the company's core app revenue calculation, Momo's net revenue in the current period was 2.462 billion yuan, while Tantan's net revenue was 0.212 billion yuan. Except for mobile marketing services, which remained flat compared to the same period last year, Hello Group saw a year-on-year decline in revenue contributed from live broadcast services to value-added services.

As an Internet enterprise, the dual decrease in revenue and profit intuitively reflects the phased change in its platform users.

According to the Q3 operating data disclosed by Hello Group, as of September this year, the monthly active users of Tantan were 12 million; while as of the third quarter this year, the number of paying users of Momo was 6.9 million, and the number of paying users of Tantan was 0.9 million. Compared to the same period last year, in September this year, Tantan's monthly active users decreased by 3.7 million from 15.7 million in the same period last year. In the third quarter of this year, Momo's paying users also decreased by 1 million from 7.8 million in the same period last year, a drop of 11.54%; Tantan's paying users decreased by 0.5 million from 1.4 million in the same period last year, a drop of 35.71%.

From the growth logic of Internet enterprises, the essence of the company's performance growth lies in having a higher platform user time and a higher paying conversion rate, while the dual decline in active users and paying users indicates that the competitiveness of the platforms under Hello Group is further declining, and the company's expected revenue will continue to decrease.

This point is also mentioned in the company's Earnings Reports revenue forecast: In the fourth quarter of 2024, the company expects total Net income to be between 2.56 billion yuan and 2.66 billion yuan, a year-on-year decrease of 14.7% to 11.4%.

In fact, regarding Hello Group's revenue growth expectations, Wall Street began to steadily downgrade them starting in 2020, which is reflected in the secondary market as the company's stock price cumulatively fell by 56.84% in 2020 and by 33.00% in 2021. After two years of significant decline, Hello Group's stock price also fell to a minimum of $3.29 since its listing in 2022. However, from 2022 to 2024, the stock price has clearly stopped falling, fluctuating between $6 and $7, indicating that the market has fully digested the bearish impact of Hello Group's revenue decline, and under the condition that the company is still profitable, the market may be focusing more on investor returns.

How long will this round of rebound last?

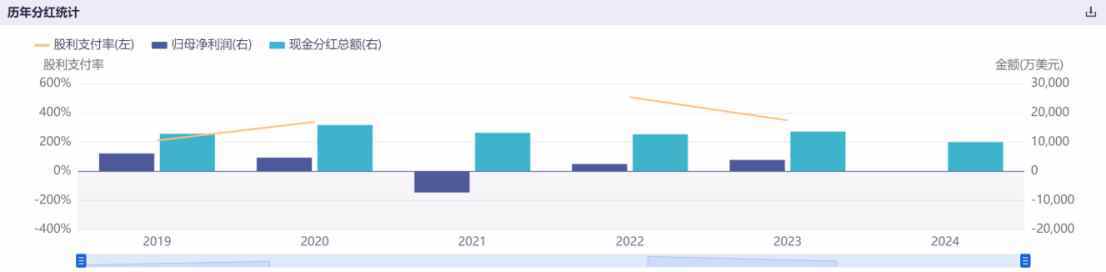

If viewed from the perspective of investor returns, it is not difficult to understand the recent rebound in Hello Group's stock price. From the perspective of investor returns, Hello Group's annual dividend is linked to its annual Net income, therefore if the company's Net income declines, the dividends will also decrease accordingly. However, if the company can slow down the rate of Net income decline, investor dividends will effectively increase based on previous expectations.

According to Hello Group's forecast in its 2024 Q2 performance, the company's Q3 Net revenue will be between 2.58 billion and 2.68 billion yuan, and the average expectation of Analysts is 2.68 billion yuan. Currently, it seems that Hello Group's actual revenue in Q3 is close to the upper range of previous expectations, while the corresponding Net income performance is far higher than the expectations of Institutions. This indirectly indicates that Hello Group's cost reduction and efficiency improvement measures in Q3 were better than market expectations.

According to the Earnings Reports, the company's current costs and expenditures amounted to 2.286 billion yuan, a decrease of 7.1% year-on-year. This is mainly attributed to the reduction in revenue sharing with live-streaming hosts on the Momo App and Tantan App under Hello Group; the decrease in revenue sharing with recipients of virtual gifts in the Momo App's virtual gifts service; as well as the reduction in the company's salary expenses and Options reward costs during the period.

According to data disclosed by Hello Group management during the Q3 earnings conference call, the company has repurchased over 0.15 billion dollars worth of stock in the past 12 months and has paid approximately 0.1 billion dollars in cash dividends. Furthermore, in recent quarters, Hello Group's buyback amount has fluctuated between 30 million dollars to 60 million dollars per quarter. From a Bearish perspective of Historical Data, even though the company's net income has fluctuated significantly from 2019 to 2023, Hello Group has maintained relatively stable dividends. These actions are undoubtedly significant Bullish factors for shareholders and are important measures to enhance market confidence.

According to calculations from Hello Group's Q3 earnings report, the company currently has a net cash of about 8.7 dollars per share, significantly higher than the current stock price, which is also why there has been considerable buying in the secondary market.

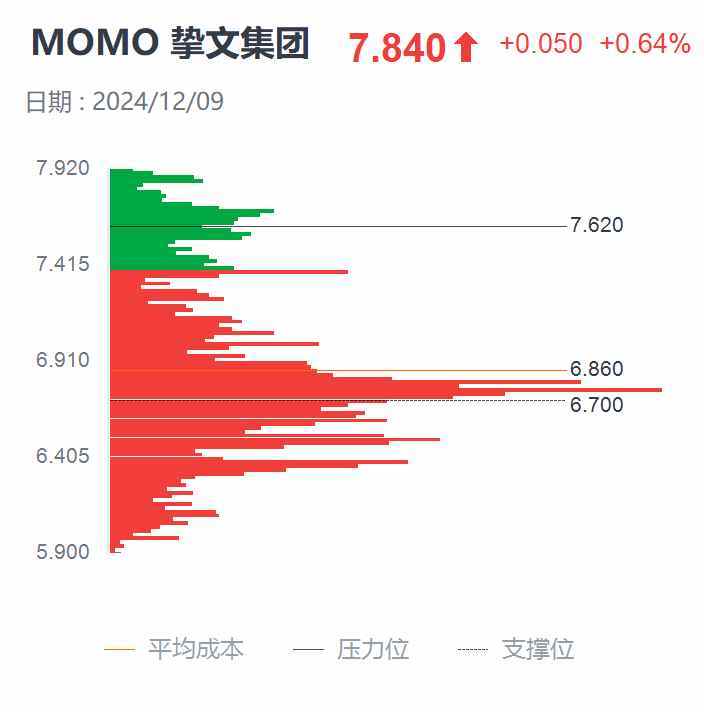

From the trend of the secondary market, funds had actually begun to quietly enter before the Q3 earnings report. In the two trading days following November 26, when the company's stock price reached a low of 6.32 dollars, Hello Group's Volume saw consecutive increases. On November 29, the Volume reached 1.5961 million shares, which was the second highest in November, just after the previous downturn over six days. At this time, a concentrated single peak around the Average Cost had formed on the Position Cost Distribution side, with further tightening of locked-up chips, which reduced the resistance for the upcoming surge, allowing Block Orders to quickly lift the stock price after the earnings report was disclosed.

However, the rapid rise in stock price due to Block Orders also quickly increased the proportion of the profit plate. According to Zhitong Finance APP observations, on December 5, 9, and 13, the proportion of profitable chips for Hello Group was 35.47%, 82.30%, and 98.28%, respectively. At this time, a 'double peak pattern' began to appear in the Position Cost Distribution for Hello Group, with the double peak valley located above the 6.94 dollar cost line. When the stock price rises into the double peak valley area, it would face significant selling pressure from the profit plate below.

Moreover, after December 9, the company's Volume has basically decreased day by day, reflecting a low willingness for subsequent funds to continue lifting the price. Overall, the probability of Hello Group's stock price experiencing fluctuations or even declines in the short term is still higher than further increases.

如此表现的财报放在此前或会引起华尔街的做空,从而打断这波反弹行情,然而在财报披露后,挚文集团的股价却在12月9日跳空高开,在延续此前上涨行情的同时,展现出多方强势买入的形态。12月6日至13日,挚文集团股价出现罕见“六连阳”将其股价拉至最高7.85美元,离前期高点8.19美元只差临门一脚。

如此表现的财报放在此前或会引起华尔街的做空,从而打断这波反弹行情,然而在财报披露后,挚文集团的股价却在12月9日跳空高开,在延续此前上涨行情的同时,展现出多方强势买入的形态。12月6日至13日,挚文集团股价出现罕见“六连阳”将其股价拉至最高7.85美元,离前期高点8.19美元只差临门一脚。