① On December 16, Minsheng Bank posted an article on its official website stating that in the first quarter of next year, it plans to adjust some of the rules of the Extraordinary Benefits Program for retail customers. Among them, various service points such as airport high-speed rail transfers and shuttle services will be raised; ② it is not surprising that many banks continue to adjust bank card point exchange rules, etc. The root cause is that under the pressure of interest spreads, banks' profits are constantly being diluted, and they have to “reduce costs and increase efficiency.”

Financial Services Association, December 17 (Reporter Peng Kefeng) I also saw banks adjust the threshold for redeeming points for high-end customers!

On December 16, Minsheng Bank published an article on its official website stating that in the first quarter of next year, it plans to adjust some of the rules of the Extraordinary Benefits Program for retail customers. Among them, points for various services such as airport high-speed rail transfers and airport transfers will be raised. It is worth noting that CCB also previously issued an announcement to adjust the benefits and activities of various CCB high-end credit cards in 2025.

A middle-level person from a listed bank confessed to the Financial Federation reporter that it is not surprising that many banks, such as CCB and Minsheng, continue to adjust bank card point exchange rules, etc. Other banks have made similar moves in recent years. The fundamental reason for this is that under the pressure of interest spreads, banks' profits are constantly being diluted, and they are forced to “reduce costs and increase efficiency.”

A middle-level person from a listed bank confessed to the Financial Federation reporter that it is not surprising that many banks, such as CCB and Minsheng, continue to adjust bank card point exchange rules, etc. Other banks have made similar moves in recent years. The fundamental reason for this is that under the pressure of interest spreads, banks' profits are constantly being diluted, and they are forced to “reduce costs and increase efficiency.”

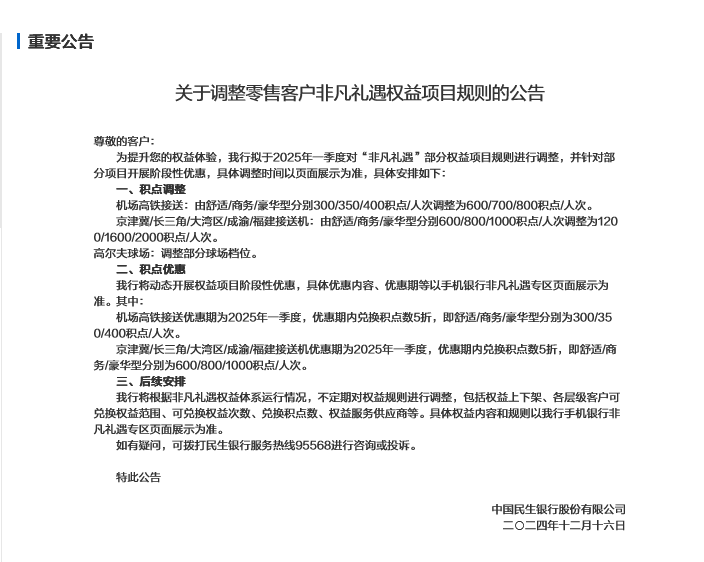

Minsheng Bank Announces: “Extraordinary Rewards” Multiple Benefit Rules Will Be Adjusted

Yesterday, Minsheng Bank published an announcement on its official website on adjusting the rules of the Extraordinary Benefits Program for Retail Customers.

In the announcement, Minsheng Bank stated that in order to enhance the customer's rights experience, the bank plans to adjust the rules of some “Extraordinary Rewards” benefit programs in the first quarter of 2025 and launch phased discounts for some projects. The specific adjustment period is subject to the page display.

Among them, the details relating to the point adjustment are: Airport high-speed rail transfers: 300/350/400 points/passenger from comfort/business/luxury respectively to 600/700/800 points/person. Beijing-Tianjin-Hebei/Yangtze Delta/Greater Bay Area/Chengyu/Fujian Pickup Flights: 600/800/1000 points/passenger for the Comfort/Business/Luxury category were adjusted to 1200/1600/2000 points/person respectively. In addition, Minsheng Bank also stated that for golf courses (rights), it will also adjust some stadium positions.

The content of the phased discount is for the first quarter of 2025. The aforementioned 50% discount on the content increase is consistent with the original exchange rules.

A Financial Services Association reporter inquired and found that according to previous public reports, Minsheng's “Extraordinary Rewards” is a one-stop non-financial service system forged by China Minsheng Bank for VIP customers. VIP customers at different levels can enjoy rich “Extraordinary Privilege” services.

CCB also adjusted high-end credit card benefits before, and China CITIC Bank also made similar moves

It is worth noting that CCB also previously announced adjustments to high-end credit card benefits in 2025.

On November 13, CCB announced the benefits and activities of China Construction Bank's high-end credit cards (Global Zhizun Credit Card, Dragon Card Private Bank Credit Card, Dragon Card Premium Platinum Credit Card, Premium Commercial Diamond Card, Premium Commercial Card Platinum Card) in 2025. Among them, a number of benefits have been adjusted. For example, Global Zhizun Credit Card (UnionPay version), Dragon Card Private Bank Credit Card, Dragon Card Diamond Credit Card, and Dragon Card Premium Platinum Credit Card will no longer enjoy CCB's designated domestic airport lounge services from January 1, 2025, and can continue to use the Longteng Airport VIP service (both at home and abroad). However, the Excellent Business Card Diamond Card and Premium Business Platinum Card will no longer enjoy CCB designated domestic airport lounge services from January 1, 2025.

In addition, the Global Zhizun Credit Card (UnionPay version), Dragon Card Private Bank Credit Card, and Dragon Diamond Credit Card will cancel global medical aid, international travel assistance services, and automobile road rescue services from January 1, 2025. Dragon Card is an exclusive Platinum credit card, and the car road rescue service will also be cancelled from January 1, 2025.

In addition, China CITIC Bank recently issued an announcement stating that starting November 1, the bank's UnionPay iPlatinum Credit Card's “iPlatinum Exclusive 36+1 New Life” transaction benefit rule adjustments have been officially implemented. After the adjustments, in addition to the requirement to meet the monthly transaction amount, in addition to the requirement to meet the monthly transaction amount, the UnionPay channel transaction amount requirements have been increased.

The industry claims that bank credit card transactions declined sharply during the year due to banks' “cost reduction and efficiency”

The aforementioned listed bank source told reporters that compared to other bank businesses, in the current economic environment, the pressure on individual and retail businesses is greater, especially the credit card business, which has been under greater pressure in recent years. On the one hand, spending money, consumer loans, etc. have squeezed the development space of bank credit cards; on the other hand, the economic downturn has led to a marked decline in the volume and total amount of credit card transactions. According to their information, the transaction volume of bank credit card businesses dropped by nearly 30% during the “May 1st” and “Eleventh” periods this year, and the number of “Double Eleven” card transactions also dropped markedly. Therefore, banks are also not allowed to adjust credit point exchange rules or raise the threshold.

“Objectively speaking, in the past, various points exchange benefits were benefits that banks gave back to customers after receiving a certain profit from the customer. Now that revenue from the credit card business is declining, banks are naturally canceling some benefits and raising the threshold.” Therefore, customers should rationally view adjustments to point redemption rules.

The above sources also further analyzed that judging from the domestic situation, when faced with a major economic cycle, the foreign banking industry will also take the lead in making adjustments to the credit card business, especially the rights of high-end credit cards.

某上市银行中层人士向财联社记者坦言,建行、民生等多家银行持续调整银行卡积分兑换规则等,并不意外。近年来其余银行也有类似动作。其根本原因,在于息差压力下,银行的利润不断摊薄,不得不“降本增效”。

某上市银行中层人士向财联社记者坦言,建行、民生等多家银行持续调整银行卡积分兑换规则等,并不意外。近年来其余银行也有类似动作。其根本原因,在于息差压力下,银行的利润不断摊薄,不得不“降本增效”。