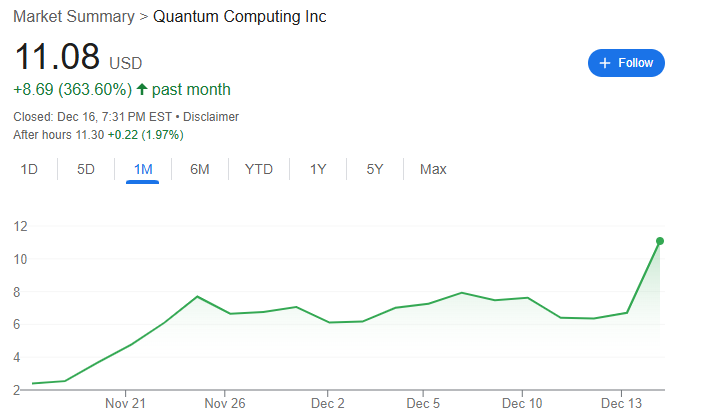

The market is enthusiastic about the potential of quantum Technology participating in AI, with Quantum Computing leading quantum stocks on Monday, soaring 65.25% overnight, and over the past month, the stock has accumulated a gain of over 360%; Rigetti Computing's Volume surpassed the US Treasury ETF - TLT, and D-Wave Quantum's Volume exceeded that of Berkshire.

Recently, there has been continuous news in the field of quantum computing. Although commercialization is still far off, it has already sparked a wave of market activity in the USA stock market.

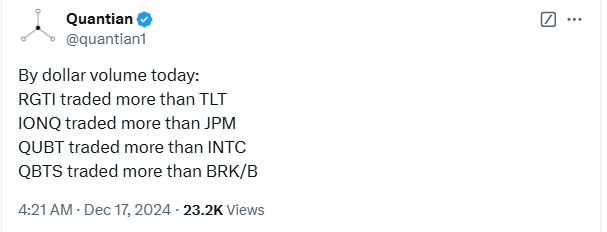

On Monday, the trading enthusiasm for quantum computing stocks surged. In terms of dollar Volume, Rigetti Computing's Volume surpassed the US Treasury ETF TLT, IonQ's Volume exceeded JPMorgan, Quantum Computing's Volume surpassed Intel, and D-Wave Quantum's Volume exceeded Berkshire, which is owned by Buffett.

Among them, Quantum Computing led the quantum stocks, soaring 65.25% in one night, with a cumulative increase of over 360% in the past month; D-Wave Quantum rose 45% overnight, skyrocketing over 400% in the past month; Rigetti Computing jumped nearly 18% overnight, with a cumulative increase of 548% in the past month!

Among them, Quantum Computing led the quantum stocks, soaring 65.25% in one night, with a cumulative increase of over 360% in the past month; D-Wave Quantum rose 45% overnight, skyrocketing over 400% in the past month; Rigetti Computing jumped nearly 18% overnight, with a cumulative increase of 548% in the past month!

IonQ soared 23% to $41.81 in Monday's trading, with a cumulative increase of 66% over the past month. On Monday, Morgan Stanley raised IonQ's Target Price from $14.90 to over $37, more than doubling it.

Analysts at Morgan Stanley, including Joseph Moore, stated: "We cannot determine the exact catalysts for the appreciation of stocks in this field during this period, but we do see continuing signs that investment in quantum should continue to grow rapidly... Clearly, the market is enthusiastic about the potential of quantum Technology to participate in the $200 billion AI TAM in 2026, although we believe this is still uncertain."

Recent news in the field of quantum computing includes a proposal by a USA Congressman for the federal government to provide $2.7 billion in funding for quantum technology.

At the company level, Amazon AWS recently launched a program called "Quantum Embark" aimed at helping customers prepare for the era of quantum computing; last week, Google released a new type of quantum computing chip named Willow, sparking a surge in quantum computing stocks.

How are quantum stocks performing in the USA market?

An investment website in the USA founded by former New York Stock Exchange Analyst Ken analyzed the fundamentals of five quantum computing companies.

The conclusion is that, from a risk perspective, QUBT and QBTS carry higher risks. QUBT faces significant cash flow pressure and uncertain commercialization progress, potentially requiring more financing to maintain operation. QBTS faces high hardware costs and a competitive environment, with valuation possibly experiencing a correction. In contrast, RGTI and QMCO have lower risks. RGTI advances steadily through technical collaboration and has more stable commercialization progress, while QMCO has enhanced market confidence and reduced risks through financial improvements and new product launches.

In terms of return potential, the analysis suggests that IONQ and RGTI are more attractive. IONQ solidifies its market position with its leading ion trap technology and substantial government orders, while RGTI brings stable growth expectations through the development and commercialization of quantum chips. In contrast, QUBT and QBTS have limited short-term returns, suitable for investors who are patient enough to wait for technological breakthroughs.

The summary is as follows:

The leader in the Quantum Computing Industry is IonQ. $IonQ Inc (IONQ.US)$

Market Cap and Cooperation: IONQ is one of the highest-valued quantum computing companies, collaborating with AstraZeneca and Ansys, showcasing the practical application value of quantum computing in drug development and engineering simulation.

Technological Advantage: IONQ's core technology is based on ion trap quantum computing, with high qubit fidelity and stability, demonstrating significant advantages in handling complex computational tasks.

Financial situation: IONQ's revenue slightly exceeded 31 million USD, but consumed approximately 84 million USD in free cash flow, with an expected annual consumption of 0.1 billion USD to achieve a revenue growth of 45 million USD, reflecting its high input, low output growth model.

NVIDIA of the quantum computing world Rigetti Computing. $Rigetti Computing (RGTI.US)$

Technology and Platform: RGTI produces quantum computers and processors, and has developed the Forest cloud platform, providing developers with specialized tools to help build quantum algorithms based on their hardware, similar to NVIDIA's CUDA technology.

Financial Situation: RGTI holds about 92 million dollars in cash, but revenue declined in 2023 and costs increased, which may necessitate financing in the future. The company valuation has reached 100 times its expected revenue for 2025, accompanied by high risks, including potential equity dilution.

D-Wave Quantum $D-Wave Quantum (QBTS.US)$

Technology Application: QBTS focuses on the development and application of quantum annealing technology, providing quantum computing services through its Leap QCaaS platform, with its quantum annealing systems being used by enterprise customers in actual production environments.

Financial Situation: QBTS's Quantum Computing as a Service (QCaaS) revenue grew by 41% year-on-year, accounting for over 84% of the company's total revenue, indicating that the company has achieved success in its business model transformation.

Quantum Computing $Quantum Computing (QUBT.US)$

Technological Innovation: QUBT focuses on making quantum technology more economical and operable, launching the Dirac system, a portable, room-temperature, low-power quantum computing device widely used in AI, cybersecurity, and remote sensing.

Financial Situation: QUBT's financial condition is still in its early development stage, with a year-on-year decline in operating costs of 18% to $5.4 million in the third quarter of 2024, but revenues remain low, and it is expected to be unprofitable in the next 2-3 years, needing to rely on external financing to support operations.

Quantum Corp $Quantum (QMCO.US)$

Product Advantages: QMCO focuses on providing data storage and management solutions, drawing significant market attention with its next-generation hybrid data protection device DXi9200, which offers higher levels of cybersecurity, data compression capabilities, and adaptive scaling features.

Financial situation: In the second quarter of fiscal year 2024, QMCO achieved breakeven adjusted EBITDA, with non-GAAP operating expenses declining by 9%, indicating the company's positive progress in cost control and operational efficiency.

Editor/new

其中,Quantum Computing领涨量子股,一夜飙升65.25%,过去一个月该股累计涨幅超过360%;D-Wave Quantum隔夜上涨45%,过去一个月飙升超过400%;Rigetti Computing隔夜上涨近18%,过去一个月累涨548%!

其中,Quantum Computing领涨量子股,一夜飙升65.25%,过去一个月该股累计涨幅超过360%;D-Wave Quantum隔夜上涨45%,过去一个月飙升超过400%;Rigetti Computing隔夜上涨近18%,过去一个月累涨548%!