Traders believe that the possibility of the Bank of Japan raising interest rates this week is less than 20%. In addition to the interest rate decision itself, Ueda's post-meeting news conference will also draw close attention.

The Bank of Japan will discuss its interest rate hike path at this week's policy meeting, with officials believing that, although the timing of the next rate hike is approaching, the urgency to act is limited.

Earlier this month, informed sources told Bloomberg that Bank of Japan officials believe the cost of waiting before raising rates is small. This news pushed the yen to its lowest level since November, as investors bet that the Bank of Japan will continue to keep interest rates unchanged, highlighting the yen's vulnerability to further declines.

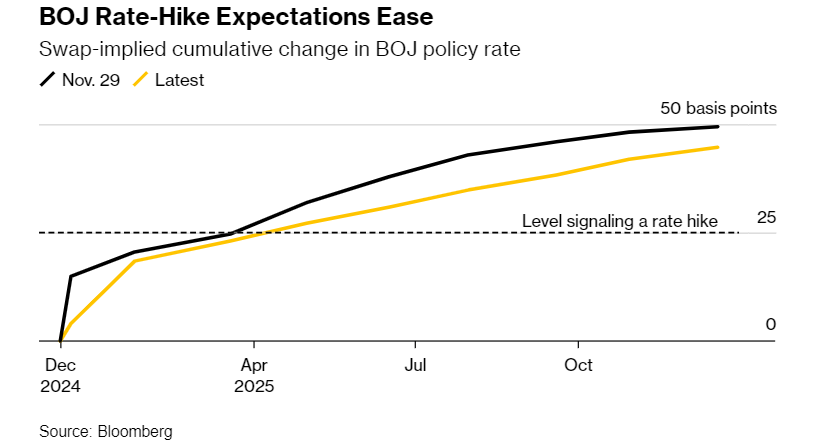

Although traders currently believe the likelihood of the Bank of Japan taking action this week is less than 20%, given the Bank of Japan's historical surprises, few will let their guard down.

Although traders currently believe the likelihood of the Bank of Japan taking action this week is less than 20%, given the Bank of Japan's historical surprises, few will let their guard down.

Informed sources indicate that Bank of Japan officials are open to a rate hike in December, with some not opposed to proposing a rate increase at this meeting, reflecting their proximity to a third rate hike under Governor Kazuo Ueda's leadership.

"The Bank of Japan is getting closer to a rate hike," said Izuru Kato, chief economist and senior observer of the Bank of Japan at Totan Research. "My view is that they will hold their position in December and raise rates in January next year."

Although recent data suggests that the economy and prices align with the Bank of Japan's forecasts (a prerequisite for a rate hike), Ueda must also handle the currently widespread market expectation that the Bank of Japan will keep rates unchanged, along with the shadow of July this year. At that time, after the summer rate hike, global markets became uneasy, and the central bank was criticized for its lack of clear communication. Other risk factors also include domestic politics and the movement of the yen.

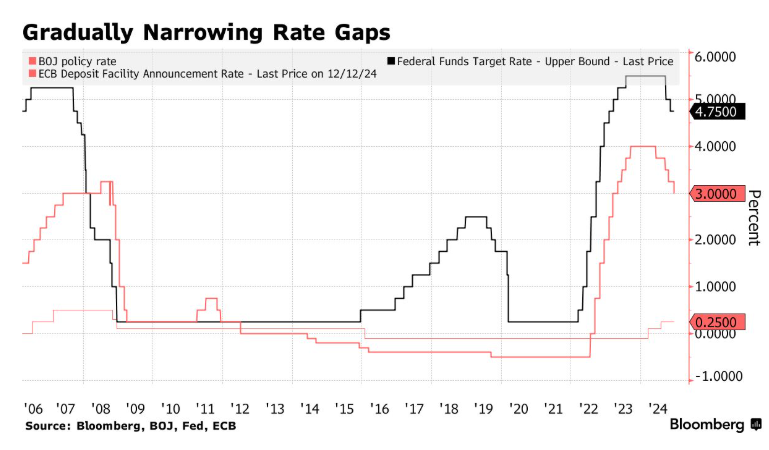

The Federal Reserve will conclude its two-day meeting on December 19, at which time it is expected to cut rates by another 25 basis points. Any stern stance from the Fed regarding policy prospects, combined with a further dovish position from the Bank of Japan, could pressure the yen. Informed sources say Bank of Japan officials will make a final decision only after carefully assessing the data and financial markets.

Analysts suggest that the possibility of the yen plummeting amid expectations of an interest rate cut by the Federal Reserve is low, and the Bank of Japan has time to continue analyzing data.

SBI Shinsei Bank senior economist Shotaro Mori stated, "There is no urgency for a rate hike in this meeting since the Bank of Japan does not have a clear inclination. I believe the likelihood of a rate hike in January next year is quite high."

The overnight index swap indicates that the probability of the Bank of Japan raising interest rates this week is 15%, significantly lower than 66% at the end of November. The swap market is also fully pricing in the next policy tightening before the end of May next year.

Meanwhile, according to a survey released by Bloomberg last week, there is a divergence in economists' opinions, with 44% of 52 respondents expecting the Bank of Japan to raise rates this week, while 52% believe there will be a hike next month.

Ueda and his committee members have repeatedly stated that if their economic outlook is realized, the Bank of Japan will raise interest rates. Given the recent strong economic indicators, including the upward revision of third-quarter economic growth, they have ample data to support this. About 86% of economists say that the economic conditions justify a rate hike this month.

Regardless of the outcome, Ueda's post-meeting press conference will attract significant interest from market participants. If the Bank of Japan abandons the rate hike, the key focus will be on any signals for rate hikes in January next year or even later.

As the Bank of Japan's policy decision is scheduled to be announced just four days after Trump begins his second presidential term next month, the central bank may be unable to adjust interest rate settings if financial markets experience volatility.

Meanwhile, if the Bank of Japan raises interest rates this week but does not issue any further signals for rate hikes, Ueda may be criticized for poor communication management and could potentially stir up shockwaves in the global market again.

The recent interest rate hike by the central bank in July was seen as a surprise and laid the groundwork for a collapse in the Global market.$Nikkei 225 (.N225.JP)$The Index recorded the largest decline since records began. This chaos led to senior central bank officials being summoned by parliament. Although the Nikkei 225 Index has rebounded from its low in August and has risen by about 18% year to date, it is still far below the historical high set in July.

The instability of Japan's political situation may be another concern for Ueda. The Prime Minister, Shigeru Ishiba, leading the ruling coalition, has failed to secure a majority in parliament and has been engaged in lengthy negotiations with a small opposition party to pass his economic stimulus plan and budget.

The Bank of Japan is raising borrowing costs amid government efforts through the budget, which may increase concerns over the Shibo case.

The consideration of politics may be the main reason for the Bank of Japan to maintain a cautious stance,” said Ryutaro Kono, chief economist for Japan at BNP Paribas. “That is to say, as parliament begins discussions on next year's budget and tax cuts, even January may not be a good time for an interest rate hike.

About a year ago, Ueda said his job would be "more challenging." Since then, he successfully terminated the most aggressive monetary easing plan in modern history in March of this year and raised interest rates for the first time in 17 years. The December meeting set the tone for the final chapter of this historic year.

"There is no doubt that in this uncertain world, Ueda will have to continue to face enormous challenges related to policy decisions," Kato said. "This is not just a problem to be resolved at the December meeting."

Editor/Rocky