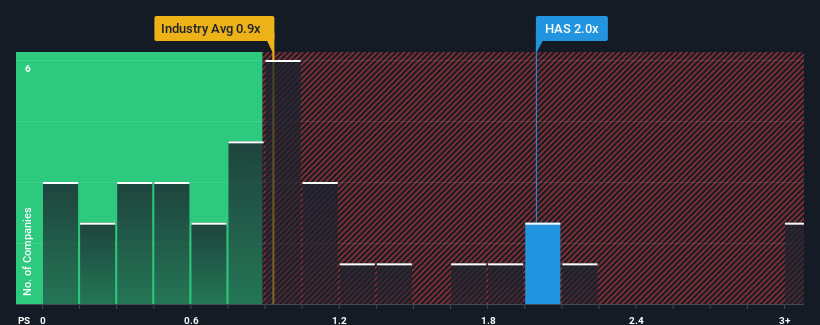

Hasbro, Inc.'s (NASDAQ:HAS) price-to-sales (or "P/S") ratio of 2x may not look like an appealing investment opportunity when you consider close to half the companies in the Leisure industry in the United States have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Hasbro's P/S Mean For Shareholders?

Hasbro has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hasbro.How Is Hasbro's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Hasbro's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 2.6% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.2% per annum, which is not materially different.

In light of this, it's curious that Hasbro's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Hasbro's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 2 warning signs for Hasbro that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.