Those holding Forge Global Holdings, Inc. (NYSE:FRGE) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 70% share price decline over the last year.

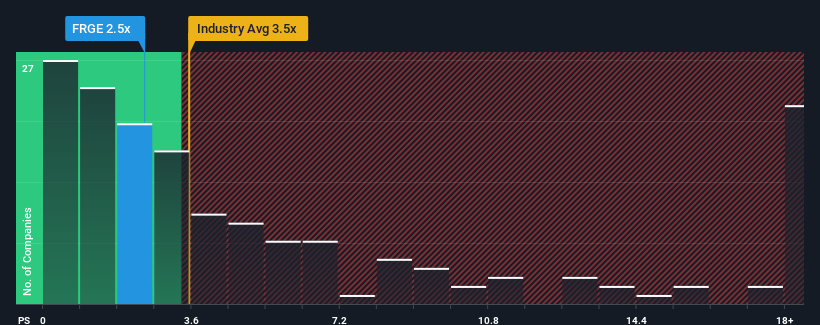

In spite of the firm bounce in price, Forge Global Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Forge Global Holdings Performed Recently?

Forge Global Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Forge Global Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Forge Global Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Forge Global Holdings' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Forge Global Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 32% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the six analysts following the company. With the industry only predicted to deliver 10.0%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Forge Global Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Forge Global Holdings' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Forge Global Holdings' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Forge Global Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Forge Global Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.