Deep-pocketed investors have adopted a bearish approach towards ConocoPhillips (NYSE:COP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in COP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for ConocoPhillips. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $90,960, and 6 are calls, amounting to $243,820.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $97.5 to $115.0 for ConocoPhillips over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $97.5 to $115.0 for ConocoPhillips over the recent three months.

Volume & Open Interest Trends

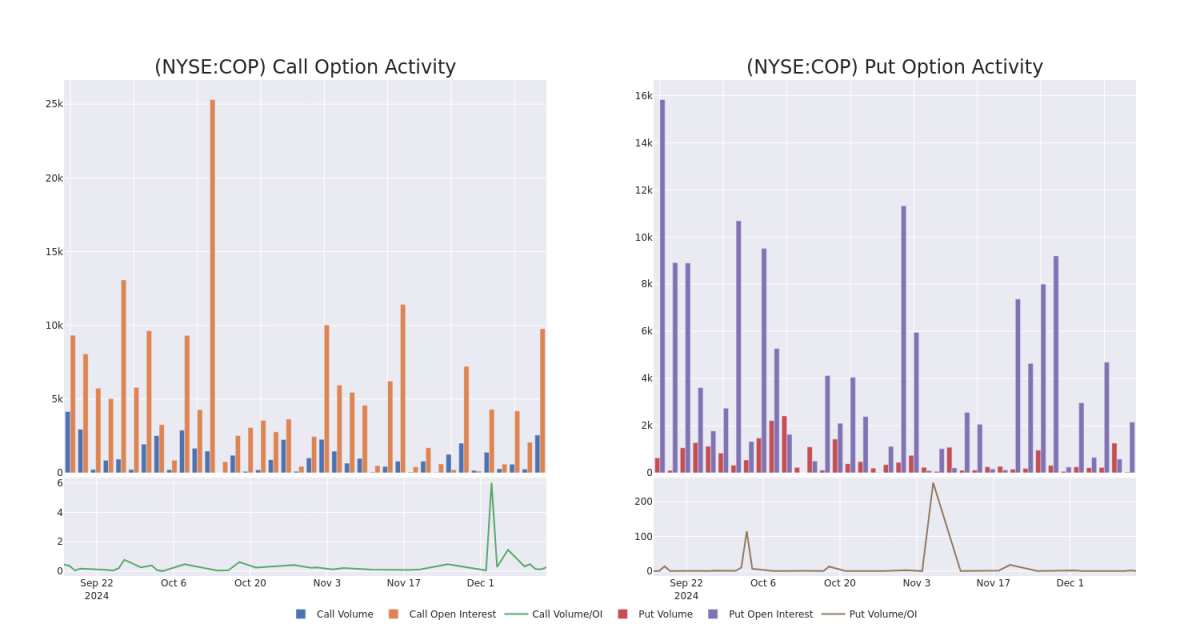

In terms of liquidity and interest, the mean open interest for ConocoPhillips options trades today is 1703.0 with a total volume of 2,593.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for ConocoPhillips's big money trades within a strike price range of $97.5 to $115.0 over the last 30 days.

ConocoPhillips 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | CALL | SWEEP | BEARISH | 01/17/25 | $0.78 | $0.68 | $0.76 | $110.00 | $82.7K | 4.6K | 1.6K |

| COP | PUT | TRADE | BULLISH | 03/21/25 | $4.25 | $3.2 | $3.39 | $97.50 | $47.4K | 162 | 0 |

| COP | PUT | SWEEP | NEUTRAL | 03/21/25 | $14.6 | $14.4 | $14.5 | $115.00 | $43.5K | 1.9K | 30 |

| COP | CALL | SWEEP | BEARISH | 09/19/25 | $10.2 | $10.15 | $10.15 | $100.00 | $36.5K | 123 | 40 |

| COP | CALL | SWEEP | BEARISH | 06/20/25 | $8.3 | $7.15 | $7.1 | $100.00 | $35.5K | 434 | 53 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

Where Is ConocoPhillips Standing Right Now?

- With a volume of 2,982,009, the price of COP is up 0.4% at $101.31.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 55 days.

Professional Analyst Ratings for ConocoPhillips

In the last month, 3 experts released ratings on this stock with an average target price of $140.66666666666666.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Wells Fargo has decided to maintain their Overweight rating on ConocoPhillips, which currently sits at a price target of $134. * Showing optimism, an analyst from JP Morgan upgrades its rating to Overweight with a revised price target of $123. * An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $165.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ConocoPhillips with Benzinga Pro for real-time alerts.