Whales with a lot of money to spend have taken a noticeably bullish stance on IBM.

Looking at options history for IBM (NYSE:IBM) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $130,410 and 12, calls, for a total amount of $375,154.

From the overall spotted trades, 2 are puts, for a total amount of $130,410 and 12, calls, for a total amount of $375,154.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $170.0 and $250.0 for IBM, spanning the last three months.

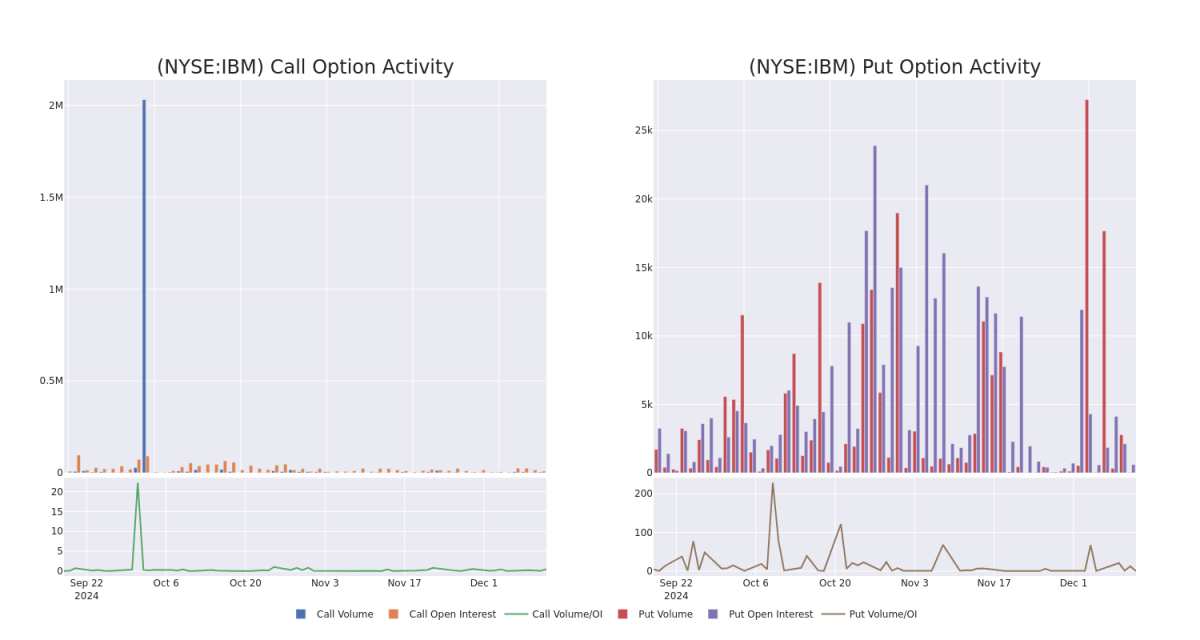

Analyzing Volume & Open Interest

In today's trading context, the average open interest for options of IBM stands at 1211.0, with a total volume reaching 4,352.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in IBM, situated within the strike price corridor from $170.0 to $250.0, throughout the last 30 days.

IBM Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $12.6 | $12.55 | $12.6 | $235.00 | $89.4K | 390 | 4 |

| IBM | CALL | TRADE | NEUTRAL | 01/16/26 | $70.1 | $68.1 | $69.06 | $170.00 | $48.3K | 516 | 7 |

| IBM | PUT | SWEEP | BULLISH | 06/20/25 | $16.2 | $15.75 | $15.75 | $230.00 | $40.9K | 208 | 28 |

| IBM | CALL | SWEEP | BEARISH | 12/27/24 | $3.5 | $3.3 | $3.3 | $235.00 | $33.3K | 167 | 611 |

| IBM | CALL | SWEEP | NEUTRAL | 12/27/24 | $3.3 | $3.3 | $3.3 | $235.00 | $33.0K | 167 | 711 |

About IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

In light of the recent options history for IBM, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of IBM

- With a volume of 1,830,962, the price of IBM is up 1.31% at $233.13.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 41 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IBM options trades with real-time alerts from Benzinga Pro.