In addition to the free list, when will byte beat prove itself on the best-seller list?

If the game market in 2020 is to rank one of the top ten highlights, "can byte beat become the spoiler of the game industry, or even challenge Tencent" is definitely among them.

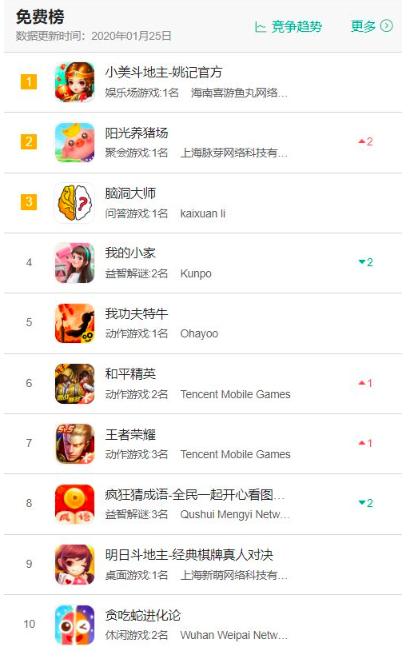

During the Spring Festival, the byte jump bombed the free list of App Store games. At its peak, there are eight products in the free list Top 10 that rely on byte-beating traffic, and four of them are released individually or jointly. This means that, at least in the dispute over the flow of the Spring Festival, the byte jump has grabbed the largest share of the increase.

In addition, LatePost reported later at the beginning of the year that byte jumps will weaken the layout of the game's intermodal transport, transform its release into a single generation, and reserve a number of heavy games for the 2020 release line, including 2 "King of the Thief" mobile games, 1 MOBA, 1 SLG, 1 street basketball theme, and several MMO.

Yesterday, according to a report by foreign media Reuters, Byte Jump will appoint Yan Shu to lead the game business and report directly to Zhang Yiming. It is understood that Yan Shu was in charge of the Byte Jump Strategic Investment Department and later led the game self-research team Oasis under the war investment department. after taking over the oasis, he promoted the acquisition of Shanghai Moji.

Combined with these signals, the left hand is enough to dominate the free list of traffic, the right hand is already a reserve of heavy games, coupled with management changes, this year's byte jump, is bound to take some big moves in the game field.

And if you want to stir up the game industry, in addition to the free list, at least you need to prove your strength on the best-seller list. How long will it take? Will it happen in 2020?

What is the stage of the byte jump release game?

To get the answer to the question, you have to start with the bouncing byte release product line.

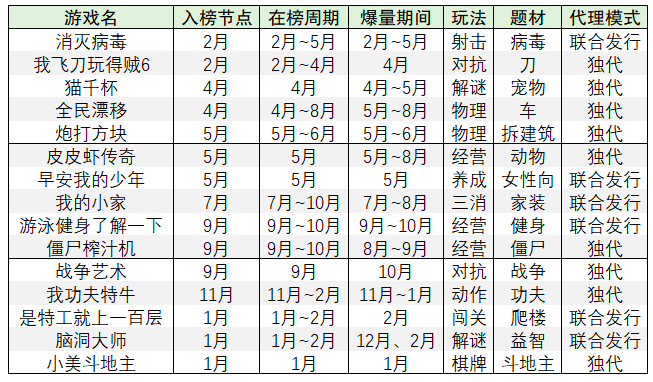

Byte jump has been rooted in the super leisure field for more than a year, and nearly 20 products have been directly involved in the issue. among these products, we can directly see the trend and progress of byte jump on the release line.

In the previous article, Grape Jun mentioned that the ceiling of byte bouncing system traffic is getting higher and higher, from the previous average of 2 to 3 free Top 10 popular styles per month to the 8 products gathered on the free list Top 10 during the Spring Festival this year. So a big premise is that the traffic of byte beat itself can support more and more products.

If we only count the product information of byte jumps participating in the release (single generation, joint distribution), and look at the byte jumps in the past year, we can get the following statistics.

The explosion period is calculated on the basis of the number of new advertisements. Data source: App Growing

First of all, the key products issued by byte jump have always maintained a relatively stable launch frequency. Among them, April to May, September to October, and January to February this year are the strong periods of this kind. In the first two cycles, the phenomenon of concentration and dominance was mostly caused by the long tail effect of popular styles, such as "eliminate virus" and "I play Thief 6" from February to April to May. Received the list performance of several key products in May.

However, during the period from January to February this year, the promotion of byte jump has been slightly increased. In addition to a product that continues to dominate the list, three new works have been launched one after another. This may be due to the influence of the festival, which has increased the frequency of new works.

Second, byte beat is still expanding its product coverage. From the point of view of their participation in the issuance of products and themes, they almost all have different ways of playing and themes. Considering that the current release direction of byte jump is concentrated in the super-leisure field, and this field takes the product's own lightweight + unique play as the core selling point, its agent products are still strengthening diversity.

At the same time, it is worth noting that in addition to the typical super-leisure, byte beat obviously began to try some hot directions in moderate and heavy games in the second half of 2019, such as "Little Beautiful landlords" in the popular leisure category, "good Morning my Boy" to women, and "Art of War: infinite Evolution", which sells itself as a chess game.

The Art of War: infinite Evolution

It can be seen that while ensuring the diversity of super-casual games, byte jump is expanding its hunting area on the one hand, and trying to match the popular categories of mobile games with its own users on the other hand.

Finally, when searching the materials for these products, we can find that decompression and challenge are two high-frequency concepts.

Represented by decompression is the "elimination of virus", "I kung fu special cattle" and other products, this kind of products play briskly, magic, visual effects are interesting, very suitable for the release of pressure. On the other hand, challenging products often shape the difficulty wall with multiple hurdles and puzzles, such as "national drift" and "smart people", or challenge people with antagonistic games, such as "I play thief 6 with flying knives".

The popular advertising material of "I am good at Kung Fu". Data source: App Growing

From the user's point of view, these products are more satisfied with the users' entertainment needs, novelty-seeking psychology and winning psychology, and prefer to customize the products for this group of specific users. In fact, from the early byte beat game intermodal transport cooperation program, they also pay more attention to the products that meet the needs of users of their own platform.

Official cooperation programme for byte jump at the beginning of 2019

What is certain from the current performance is that byte beat is already creating a clearer portrait of its game crowd, as well as testing how well products in different areas match their users, and how to match them.

What is impossible to determine is, where is the upper limit of byte-beating traffic? From the trend of the list at the beginning of this year, in addition to byte jump to participate in the release of products, more outbreaks are due to the increased dependence of the industry on byte jump traffic. And the game to byte jump in the product sweep volume, and byte beat to mobilize resources to push the game, are two very different operations.

By comparing the two games of "Little Meidou landlord" and "Sunshine Pig Farm", which are published by byte jump, we can find that they have a big difference in advertising magnitude and performance.

"Little Meidou landlord" launched an explosive advertisement on January 21 this year, adding 161 sets of advertising materials in a single day during the peak period, and so far a total of 2917 sets of advertising materials have been put in. On the other hand, the sweeping volume of "Sunshine Pig Farm" is much higher than that of "Little Meidou landlord". Its peak delivery node is January 11, with 3104 sets of advertising materials added in a single day, and a total of 96535 sets of materials have been put in so far.

These two products have also reached the top of the free list, but the resources consumed are not in the same dimension. To some extent, it also shows that there are many unique methods for the use of byte jump on its own traffic, and it will be more powerful when he takes the initiative to use the traffic.

So based on these phenomena, we can more or less speculate on the trend of byte jump in the release of the game. First, byte runout will continue to test the carrying capacity of traffic, trying to push multiple models at the same time, or push a single product higher. Second, byte hopping will dig deep into the attributes of its own traffic and refine the user portrait. In this process, not only the super casual games, but also the adaptation of traditional games will be a key point.

Therefore, the medium and heavy games of byte jump reserve in 2020 are likely to be in the vanguard of its exploration of hairstyle methodology, and its strategic significance may outweigh the actual benefits.

The byte beats now, very much like Tencent at that time

Looking back on mobile games in the past few years, Tencent had the most thorough impact on the industry after joining the bureau. Today, the frequent byte beats in the leisure field can be said to be very much like Tencent in the period when the end changed hands.

Both companies started with traffic, cutting into mobile games with casual games, followed by frequent results, and then transitioned to heavy games. But strictly speaking, they are both similar and different.

1. Both have super App and traffic, but the distribution methods are very different.

Both Byte Jump and Tencent have super App with hundreds of millions of active users. Byte jumps are famous for short videos. The global MAU of its products has exceeded 1.5 billion, of which the DAU of Douyin has reached 320 million. And Tencent relies on social networking, gave birth to QQ, Wechat two major platforms, so far contributing 731 million and 1.151 billion of the MAU.

However, the difference between short video entertainment and social networking makes the traffic system of the two families extend in two different directions. In order to seize the attention time of users, its core products are lightweight, fast-paced and fragmented, resulting in plug-and-play characteristics of both users and product content. the interoperability of traffic between several major products is also very high.

The social route chosen by Tencent makes users show the phenomenon of circle clustering. This difference leads to the difference in the logic of game distribution between byte beat and Tencent.

From the point of view of the product design, the byte jump is that the content attribute of the product is more specific, and the information flow attribute is more prominent.

Take Douyin as an example, it does not provide a direct download entrance to the game App, on the contrary, it emphasizes the embedding of Mini Game, and sets up a special distribution page of Douyin Mini Game, which provides the internal conversion of users. From the outside, these Mini Game in addition to the distribution of dedicated pages, more traffic comes from content ads within Douyin, a Mini Game to be popular in Douyin, content ads are absolutely indispensable.

In addition, take Jinri Toutiao as an example, it also does not put distribution in the first-level menu of the game section, where the home page takes information as the core, with more emphasis on the release of information flow. However, in the secondary menu of this section, Jinri Toutiao provides a direct download jump, which obviously takes into account the attributes of distribution.

Tencent's distribution strategy is closer to the channel, but also emphasizes the social attribute.

For example, the games sections of Wechat and QQ both highlight the download button in the first-level menu, emphasizing distribution, and also marking information about how many friends are playing on each product to guide users to socialize. In addition, it also covers Topic circle, live broadcast, classification and ranking and other functions, with a complete set of channel attributes. In addition to Wechat QQ, Tencent also has full-time game distribution products like YingYongBao.

two。 All of them have changed from leisure to serious, but they are facing a completely different competition pattern.

Byte beat and Tencent, choose to enter the breakthrough of mobile games, at first glance are casual games, and the subsequent route, but also continued the number of leisure to moderate and severe expansion. But beyond that, the two companies are facing a completely different competitive landscape at two nodes seven years apart.

First of all, the two companies have very different starting points.

The super-leisure field selected by byte beat has more special product attributes. This kind of product is more simplified than traditional casual games, so that it can not be simply classified by category. In the past year, almost all the super casual games arranged by byte beat have this characteristic. For example, giant games have something in common at first glance, but choose to retain the upgrade rather than eliminate the design.

In contrast, Tencent's initial layout products are almost all well-known types of play in the traditional category. For example, the daily series, the happy series and the national series.

Second, they face different opponents. In 2013, Tencent competed with first-generation cards and moderate RPG, such as "my name is MT", "Big Boss", "time Hunter" and "Diffusion million King Arthur" and other products. Therefore, Tencent's entry point is the combination of mass leisure play and flow, which forcibly pulls the competition mode of a small number of users to create most of their income to the direction of using large DAU+ and low ARPPU to form large-scale income. In order to establish the first step of the market advantage.

Today, byte beat faces competitors that are all highly heavy products. These include the big DAU strong competitive and strong operation products represented by "Arena of Valor", the ecological and strong payment products of classic IP such as "Fantasy Journey to the West", and innovative strong numerical products such as "Sword and Expedition" that meet specific needs and changes. At this time, the entry point of byte jump has become a lightweight experience that people can not get under the heavy trend.

In March 2018, an unknown product, "the old iron is stuck in the heart", was accidentally sparked by Douyin. Such games spread through more entertaining content, quickly forming a large group in pursuit of unique interest. And this special way of becoming popular also established the situation that the byte beat occupied the free list later.

Finally, the environment of the two companies is also very different. In 2013, domestic mobile games were at the outbreak node of barbaric growth, and opportunities were everywhere, which laid the best foundation for the growth of heavy games.

Now the version number is restricted and the industry is standardized. The number of game companies cancelled or revoked nationwide reached 18710 in 2019, almost double the number of 9705 in 2018, and the number of version numbers issued was only 20 per cent of that in 2017. The version number has become a prerequisite for the success of heavy games.

But for ultra-casual games with small volume and various realization modes, the impact is not as violent as heavy games. The popularity of advertising allows such games to consider shorter payback cycles and faster production modes.

3. Play games for platform companies with similar strategies but different tactics

From the company's point of view, the current byte beat and Tencent at that time, have a similar goal: through the game, for their own huge traffic to find a suitable way to cash. Tencent came up with a boutique strategy in 2013 to thoroughly develop mobile games, and the signal of byte beating to enter the game on a large scale this year is also very clear.

The two companies also have similar initial layouts on the product line. In his early days, Tencent has successively focused on three directions: moderate and heavy mass leisure, heavy sports, and large IP adapted products. Byte-beating reserve products also cover the hottest directions in the industry in the past few years.

Two "King of the Sea Thief" mobile games are the derivative products of Volkswagen IP; a MOBA is a heavy competitive product targeted at the head of the industry; a SLG may want to seize the strategic game market that made a comeback in the previous two years; a street basketball theme game attacks the direction of leisure competition; and finally, a number of MMO are undoubtedly used to crack down on the most fiercely contested head market by major companies.

In the issuing cooperation strategy, both sides have also taken the horizontal and vertical mode, which is a good way to ensure that the distribution line can maintain the abundance of products.

Tencent relied on this strategy to save many products and contributed to a number of best-selling popular styles. Byte beat is also used in the early days of the layout game, which represents that the product is "eliminate virus" jointly released with Lanfei mutual entertainment. Now this strategy has gradually evolved towards a more single-generation focus.

However, in the specific implementation of these strategies, the methodology adopted by the two companies is quite different. Tencent is based on the summary of big data + operation experience, while the headlines are de-operational and rely more on the guidance of intelligent algorithms.

Byte jump pursues the extreme of the algorithm, and this gene has also penetrated into the game distribution business. In the process of interviewing game programmers, they attach particular importance to the candidate's understanding of the algorithm. This tendency is very different from that of traditional game companies, which can be understood as that byte jump requires technical talents who are in line with the company's main strategy, whether it is the main-end strategy or the game business strategy. The company pays more attention to the data-driven model.

The emphasis on the program is also reflected in the salary level. In the early process of building a game team, byte jump offered an annual salary of 1.8 million for the main project, according to people familiar with the matter.

By contrast, Tencent's methodology has always been based on user research. Split the user attributes in enough detail, study the demands, summarize the experience with the existing successful cases, and then use these results to guide the product direction, and even some commercialization strategies. After Tencent implemented the boutique 2.0 strategy, this methodology became the foundation of all the core products.

Luo Wei, the producer of the release of Legend of Blood, once told Grape that they had launched game packages of 28 user models to delaminate and locate the target users, and then predict the LTV of each user based on this model.

It can be seen that their similarity comes from the attributes of platform companies, and both sides touch the game in the process of looking for the realization of traffic, but they take different ways because of different genes. So although the posture of byte jumping into the battlefield of the game is somewhat similar to that of Tencent, the hands of both are fundamentally different.

Byte beat may prefer to go its own way.

The biggest spoiler in the game industry in 2020?

Because of the background of the Internet giant, the out-of-circle effect caused by its entry into the game field has attracted special attention. But for the gaming industry, it is nothing new for Internet giants to want to eat the cake of games.

Baidu, Inc., 360, BABA, have been in the strong period of the channel, attracted a lot of manufacturers, agents issued a batch of products. Like byte jumps, they all have unique traffic and have been pushed into partial products in a short period of time. However, with the evolution of the market, most of the big Internet companies have retreated to the second line on the game track, and only BABA began to rise recently.

A senior practitioner believes that the success logic of games and Internet products is not the same: "because games are content, it takes enough time to settle down and understand." "Today, the domestic game market is paying more and more attention to research and development, technology, content and creation, such as the success of the Ark of tomorrow in 2019, which verifies the feasibility of niche play plus high-quality content. Similar success stories have forced game companies to become boutique and focus on research and development.

From this point of view, byte jump and all large Internet companies face the same problem, how to establish content thinking, and then form a production model. The formation of this pattern did not take place overnight, and the byte beat clearly realized the importance of holding R & D in hand, and started the layout early.

It is understood that as early as 2017, byte jump intended to set up a research and development team, which later became an oasis. Last year, byte beat set up a thousand-player game team in Beishang, Shenzhen and Hangzhou, attracting a large number of practitioners to join. So lengthening the time dimension, this problem may be solved.

From another point of view, the byte-beating game business is not the only way out. First of all, the development of the super-casual game itself is still very short, and its high-speed iterative characteristics make it possible to have a more effective way of realization, or a product model, in the future. Then with the byte beat their own original advertising cash and other ways, the revenue capacity in this area is not a fixed number.

Second, the byte jump in the basic product layout, and does not focus on a domestic market. The data of 1.5 billion MAU of its products cover the overseas user data of all the products. So this means that he can transfer any model that has been verified at home to the overseas product system and replicate it successfully.

In this process, super casual games will be the first batch of beneficiaries. The popular trend of overseas super casual games is obvious, and because of the minimalist and interesting characteristics of these products, there is almost no nationality and cultural threshold. Today, there are also super-casual games such as the Legend of Bow and Arrow, which are successful overseas before counterattacking the domestic market.

When byte jumps in China to figure out the specific strategies for the transformation of moderate and heavy games, overseas is also likely to become the next growth point. And these special advantages, are in the past large domestic Internet companies do not have, or because there is no choice of layout and lack.

Of course, all of what I said above are the most optimistic assumptions. If you want to really land these so-called "advantages", you may have to face many pessimistic possibilities. A person familiar with the matter once told us that at the beginning of setting up the R & D team, Byte Jump had a possible exchange with Top 1 vendors in the vertical field of the game, but ended up buying only Mercer.

Such a reality may also exist in building a self-research team, the most need is accumulation is patience, byte beat will give self-research how much time and patience? For example, in the super-leisure storm, if you can't find a solution to the revenue model, how much patience will byte jump have to find a breakthrough in the next game?

At this point in the analysis, the conclusion of the Grape King has been very clear. When the byte beat is really ready for the hand, he may have more than one tipping point. But the issue needs to be explored, and research and development needs to be accumulated, and it may be too short to talk about disrupting things in 2020.

Edit / emily