JPMorgan Chase & Co maintained its 'Underweight' rating on Super Micro Computer, Inc (NASDAQ:SMCI) and reaffirmed its $23 price target following a recent meeting with company management.

What Happened: Despite market rumors suggesting potential shifts in customer orders, Super Micro management assured investors that its customer base remains solid, with no substantial changes to order allocations, reported Tipranks.

The company's customer base "remains robust with no significant movement of orders," the analyst tells investors in a research note.

Why It Matters: The company also expressed confidence in its capacity to fulfill orders and is actively preparing for the launch of new products in the second half of fiscal 2025.

Why It Matters: The company also expressed confidence in its capacity to fulfill orders and is actively preparing for the launch of new products in the second half of fiscal 2025.

The note by Samik Chatterjee also addressed concerns about the company's Malaysian operations, confirming that the plant is on track to ramp up production in the first half of 2025. Additionally, Super Micro believes that its working capital requirements will sustain a quarterly revenue range of $5.5 billion to $6 billion.

The firm further highlighted Nvidia's Blackwell product line, which is anticipated to experience significant growth in the second half of fiscal 2025. Super Micro is well-positioned to capitalize on this trend with its strong presence in customized versions of the product.

What's Happening With SMCI: Super Micro Computer Inc. (SMCI) is teetering on the brink of losing its spot in the prestigious Nasdaq 100 Index during its annual December reshuffle. The company finds itself alongside other underperformers like Moderna and Biogen due to a recent market cap plunge.

A recent auditing scandal by Ernst & Young, which flagged governance issues, sent shockwaves through the company and the auditor resigned. The company has appointed a new auditor and Nasdaq has given an extension to the company for submitting its financial reports by February 2025.

This significant drop in market capitalization puts Super Micro at risk of being excluded from the particular Nasdaq 100 Index, a blow that could further erode investor confidence. The company will need to demonstrate a strong recovery to regain its footing and secure its place in the coveted index.

Price Action: Shares of SMCI were 1.62% up at $38.91 per share in premarket on Thursday. This compares to the Nasdaq 100 futures, which were down by 0.4%.

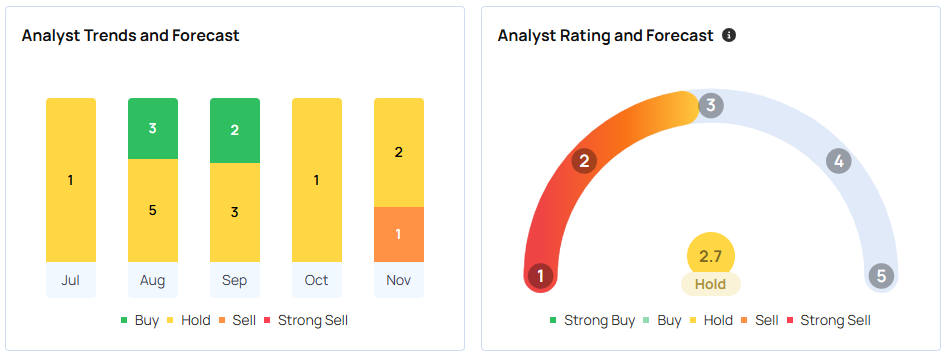

Analyst Views: According to Benzinga, SMCI has a consensus price target of $531.47 based on the ratings of 17 analysts. The highest price target out of all the analysts tracked by Benzinga is $1300 issued by Rosenblatt as of Aug. 7. The lowest target price is $23 issued by JPMorgan on Nov. 6.

The average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush implies a 29.15% downside for SMCI.

Photo via Shutterstock