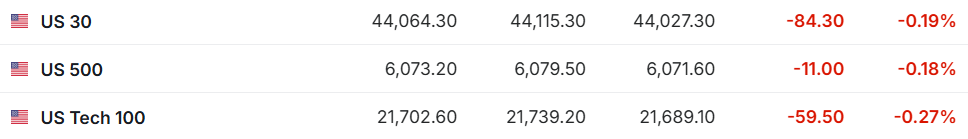

On December 12 (Thursday) during Pre-Market Trading, all three major U.S. stock index futures fell.

1. On December 12 (Thursday) during Pre-Market Trading, all three major U.S. stock index futures fell. As of the time of writing, Dow futures were down 0.19%, S&P 500 Index futures were down 0.18%, and Nasdaq futures were down 0.27%.

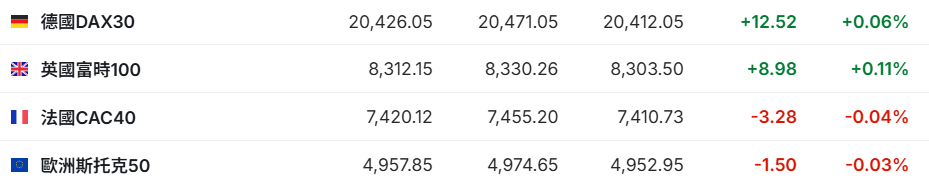

2. As of the time of writing, the DEGUODAXZHISHU was up 0.06%, the UK FTSE100 Index was up 0.11%, the France CAC40 Index was down 0.04%, and the Europe Stoxx 50 Index was down 0.03%.

3. As of the time of writing, Crude Oil was down 0.06%, at $70.25 per barrel. Brent Oil was down 0.07%, at $73.47 per barrel.

3. As of the time of writing, Crude Oil was down 0.06%, at $70.25 per barrel. Brent Oil was down 0.07%, at $73.47 per barrel.

Market News

In November, the US CPI data met expectations, with the market focusing on the PPI data. The US Department of Labor reports that the November CPI month-on-month increase is the largest in seven months. Although overall inflation remains high, price pressure in areas such as rent and vehicle insurance has eased, leading to a slowdown in service sector inflation. The cooling trend in the labor market is attracting attention from the Federal Reserve, and the market expects another 25 basis point rate cut next week, marking the third consecutive cut. The market has already digested the expectation of US rate cuts, with investors focusing on the US PPI data and changes in initial jobless claims. The direction of Trump's policies and geopolitical risks are also under scrutiny. The global economic situation is complex, and central bank decisions are influenced by multiple factors, prompting investors to make investment decisions based on economic data and policy dynamics.

The US Treasury is under significant pressure! The budget deficit in November reached $366.8 billion, a staggering increase of 17% year-on-year. The US Department of the Treasury reported on Wednesday that the budget deficit surged in November, causing the expansion of the deficit for FY2025 (October 1, 2024, to September 30, 2025) to occur at a much faster pace than a year ago when the deficit was as high as $1.8 trillion. On an unadjusted basis, the total deficit for November was $366.8 billion, which is 17% higher than in November 2023. The total deficit for the first two months of this fiscal year is over 64% higher than the same period last year. The total revenue in November reached $301.8 billion, an increase of approximately $27 billion compared to the same period last year. Total expenditures amounted to $668.5 billion, nearly an $80 billion increase year-on-year. By the end of November, the increase in the deficit had caused US debt to rise to $36.1 trillion. The adjusted deficit for November stood at $286 billion, and the total deficit for the year so far is $544 billion, a 19% increase.

US inflation remains firm, and US Treasury yields have slightly risen. The price of US government bonds fell on Wednesday, unable to maintain the gains triggered by the inflation data, which was perceived to enable the Federal Reserve to lower interest rates next week, but the long-term outlook remains unclear. With the rise in oil prices, selling pressure led the 2-year US Treasury yield to rise by 5 basis points at one point, ultimately narrowing to 1 basis point. Earlier in the US market, following the alignment of the November CPI data with economists' expectations, short-term Treasury yields led the drop, gradually rebounding thereafter. The inflation data reinforced traders' views that the Federal Reserve will cut rates by 25 basis points on December 18 local time, marking the third rate cut this year. The swap contracts related to this decision reflect a loosening close to 23 basis points, compared to 20 basis points before the report was released. Even as US Treasury yields recede from their declines, this pricing remains unchanged.

Wealth is skyrocketing faster than a rocket! Elon Musk becomes the first person with a net worth exceeding $400 billion. Since Donald Trump's victory in the US presidential election last month, Elon Musk's wealth has surged, making him the first person to reach a net worth of $400 billion, marking a new milestone for the world's richest person. The recent catalyst was an internal stock sale of Musk's space exploration company, SpaceX, which, according to Bloomberg Billionaires Index, increased Musk's net worth by approximately $50 billion. Tesla's (TSLA.US) stock price also reached an all-time high on Wednesday, leading Musk's wealth to rise to $447 billion. According to the Bloomberg Billionaires Index, Musk's wealth increased by $62.8 billion in a single day, setting the record for the largest single-day increase ever and helping push the combined wealth of the world's top 500 billionaires above $10 trillion for the first time.

A significant 'small article' reveals the Bank of Japan's policy direction for next week: leaning towards not raising interest rates. Today, media released a significant 'small article'—indicating that the Bank of Japan intends to maintain stable interest rates next week. Media cited five sources familiar with the thoughts of the Bank of Japan's policymakers who indicated that most members of the BOJ’s committee prefer to keep interest rates stable next week, as policymakers are more inclined to spend more time carefully analyzing overseas market risks and clues regarding next year's wage growth outlook in Japan. The BOJ’s decision is crucial to the fate of the recently resurfaced yen 'arbitrage trades,' which were precipitated by the 'Black Monday' and the widespread 'global stock market sell-off' that occurred this summer, triggered by the unwinding of the yen 'arbitrage trade' leading to large-scale liquidation.

Stock News

Adobe (ADBE.US) earnings 'explode': FY2025 guidance falls short of expectations, fear of AI 'taking jobs' becomes a reality? Adobe’s Q4 revenue was $5.61 billion, a year-on-year increase of 11%, better than the market expectation of $5.54 billion; the earnings per share, excluding certain items, was $4.81, also above the market expectation of $4.67. Adobe’s annual recurring revenue (ARR) for its digital media in the quarter was $17.3 billion, slightly exceeding analysts' average expectations. In the fourth quarter, revenues in the digital media segment, including Adobe's flagship creative and document processing software, increased by 12% year-on-year, reaching $4.15 billion. Revenues in segments including marketing and analytics software increased by 10% year-on-year to $1.4 billion. Adobe expects revenues to reach approximately $23.4 billion in the fiscal year ending in November 2025, with earnings per share, excluding certain items, expected to be between $20.20 and $20.50.

The cost of autonomous ride-hailing taxis is too high, and General Motors (GM.US) has abandoned Cruise, gaining approval from Wall Street. Most Wall Street Analysts believe that it's necessary for traditional American auto giant General Motors to exit its autonomous ride-hailing business, Cruise, emphasizing that this latest development for General Motors is a positive catalyst for long-term shareholder value and the long-term trend of General Motors' stock price. However, the decision to exit this previously highly promising business has still disappointed some investors, as General Motors had boasted that its autonomous driving business (i.e., Robotaxi) could generate up to 50 billion dollars in revenue by 2030. Executives at General Motors stated that after assessing the continuous investments required in the competitive landscape of autonomous ride-hailing taxis, the company decided on Tuesday to officially terminate and exit the Cruise business.

Apple (AAPL.US) is collaborating with Broadcom (AVGO.US) to develop an internal AI Chip. Apple is working with Broadcom to develop the company's first internal server chip specifically designed for AI. Insiders reveal that this internally named Baltra chip may be ready for mass production by 2026. The media adds that the new AI chip, used for inference, will be able to process new data and then pass it on to large language models to generate outputs, which is a different task from training models. Sources indicate that the chip will be manufactured by Taiwan Semiconductor (TSM.US), potentially using its 3-nanometer process. According to previous reports, after OpenAI's ChatGPT chatbot took the world by storm in December 2022, the plan to introduce Apple's chips into its servers accelerated.

Is the dream of a merger among food giants shattered? Hershey (HSY.US)'s major shareholders reject Mondelez (MDLZ.US)'s initial offer. Insiders disclose that the primary owners of American chocolate maker Hershey (HSY.US) rejected the initial acquisition bid from Mondelez (MDLZ.US). This deal was originally expected to create a food giant with nearly 50 billion dollars in total sales and become one of the largest acquisitions in the history of the packaged foods industry. Insiders indicate that Hershey Trust Co., which holds about 80% of the voting rights in Hershey, rejected the acquisition offer on the grounds that the bid was too low. Earlier this week, there were reports that Mondelez had preliminary discussions with Hershey. As of last weekend, Mondelez's Market Cap was about 84 billion dollars, while Hershey's was 35 billion dollars. The Hershey Trust has previously used its voting rights to block deals. In 2016, Mondelez exited negotiations after Hershey rejected a 23 billion dollars takeover bid.

NVIDIA (NVDA.US) will increase its workforce in China to 4,000, greatly advancing research into autonomous driving technology. NVIDIA (NVDA.US) has significantly boosted its research team in China this year, especially in the field of autonomous driving technology, by adding hundreds of new employees. According to insiders, by the end of this year, NVIDIA's total workforce in China is expected to increase from about 3,000 people in early 2024 to around 4,000, with about 200 new employees added in the Beijing area to strengthen autonomous driving research. Additionally, the company has expanded its after-sales service and network Software Development teams, reflecting its overall expansion strategy in China. NVIDIA's total number of employees in China is approaching 600, and a new office has been established in the Beijing Centergate Technologies. Recent news from NVIDIA China states that recent social media rumors claiming NVIDIA is cutting supplies to China are false, and China is an important market for NVIDIA, which will continue to provide high-quality services to Chinese customers in the future.

A joint criticism from EU comparison websites against Google's (GOOGL.US) search reforms calls for strict penalties from regulators. On Wednesday, over 20 comparison websites in Europe jointly criticized Google's proposed changes to its search results, stating that these adjustments still do not comply with EU technology regulations and strongly urging regulators to bring charges against Google’s relevant departments. This action stems from a series of reforms Google proposed to comply with the Digital Markets Act (DMA), which aims to prevent Google from giving undue advantage to its own products and services on its platform. Last month, Google announced its latest proposals, which include expanded and uniformly formatted units aimed at giving users the opportunity to choose between comparison sites and vendor websites. At the same time, Google expressed that if an agreement cannot be reached with competitors, the “ten blue links” model from years ago may be restored as an alternative.

Important economic data and event forecasts.

Beijing time 21:30: Initial jobless claims in the USA for the week ending December 7 (in ten thousand), and USA November PPI year-on-year (%).

Beijing time 21:15: European Central Bank announces interest rate decision.

At 21:45 Beijing time: European Central Bank President Lagarde holds a monetary policy press conference.

At 02:00 Beijing time the next day: The Federal Reserve publishes account fund flows for the third quarter of 2024.

Earnings forecasts.

On Friday morning: Broadcom (AVGO.US), Costco (COST.US).

3. 截至发稿,WTI原油跌0.06%,报70.25美元/桶。布伦特原油跌0.07%,报73.47美元/桶。

3. 截至发稿,WTI原油跌0.06%,报70.25美元/桶。布伦特原油跌0.07%,报73.47美元/桶。