It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Comfort Systems USA (NYSE:FIX), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Comfort Systems USA's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Comfort Systems USA has achieved impressive annual EPS growth of 48%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Comfort Systems USA shareholders is that EBIT margins have grown from 7.4% to 9.9% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Comfort Systems USA shareholders is that EBIT margins have grown from 7.4% to 9.9% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

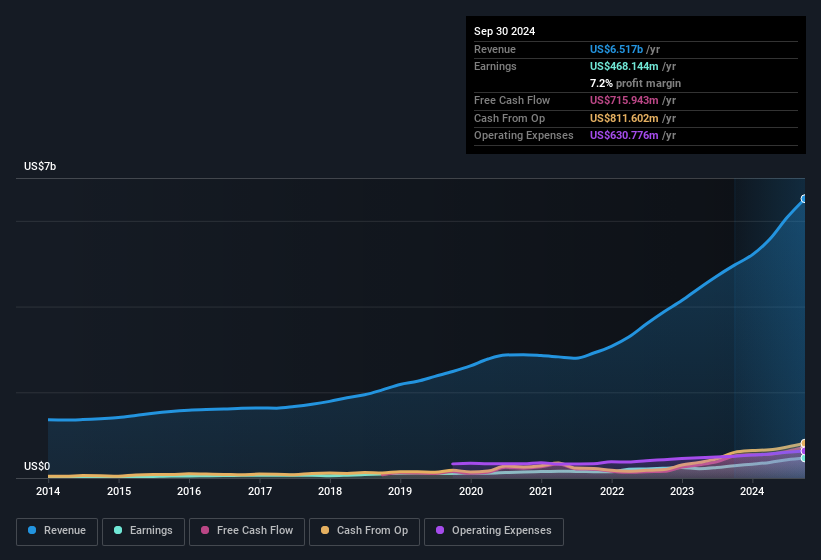

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Comfort Systems USA?

Are Comfort Systems USA Insiders Aligned With All Shareholders?

Owing to the size of Comfort Systems USA, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$220m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Comfort Systems USA, with market caps over US$8.0b, is around US$13m.

The Comfort Systems USA CEO received US$6.6m in compensation for the year ending December 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Comfort Systems USA Deserve A Spot On Your Watchlist?

Comfort Systems USA's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Comfort Systems USA is worth considering carefully. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Comfort Systems USA , and understanding it should be part of your investment process.

Although Comfort Systems USA certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.