The Vital Farms, Inc. (NASDAQ:VITL) share price has done very well over the last month, posting an excellent gain of 32%. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

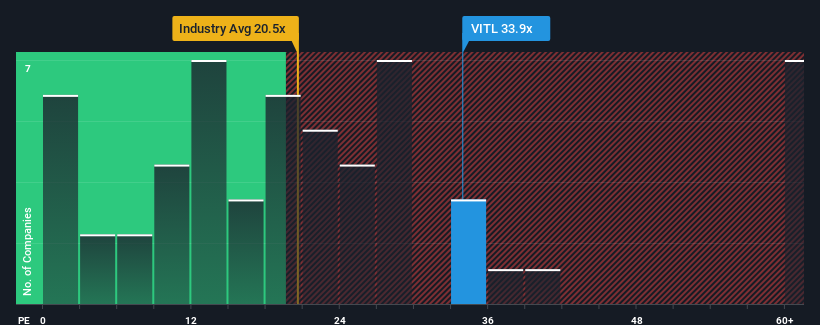

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider Vital Farms as a stock to avoid entirely with its 33.9x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Vital Farms has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Vital Farms' to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Vital Farms' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 136%. Pleasingly, EPS has also lifted 701% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 1.1% as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's alarming that Vital Farms' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Vital Farms have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Vital Farms' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Vital Farms that you need to take into consideration.

If you're unsure about the strength of Vital Farms' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.