HSBC has lowered Adobe's Target Price from $536 to $510, implying a potential downside of about 7.26% from the current price, and maintains a 'Hold' rating. HSBC believes that the company is facing difficulties in effectively monetizing its AI capabilities, and the efforts made in AI have not resulted in revenue growth, potentially weakening its competitive advantage.

Due to $Adobe (ADBE.US)$ The company's stock price fell over 9% in Post-Market Trading as the 2025 fiscal year performance guidance announced was below expectations. HSBC believes that Adobe prioritizes the promotion and popularization of its AI products rather than monetizing AI, and this strategy may require more time to bring significant financial impact.

On Wednesday during Post-Market Trading, Adobe released its fourth-quarter Earnings Reports, with revenue, net income, and adjusted EPS all exceeding market expectations. However, this performance did not alleviate market concerns regarding its long-term growth prospects, as Adobe's fiscal year 2025 and first-quarter performance guidance were far below Analyst expectations, leading to a significant drop in stock price after hours, including:

Revenue: The expected revenue for fiscal year 2025 is $23.4 billion, lower than the Analyst expectation of $23.8 billion.

EPS: The expected EPS is between $20.20 and $20.50, lower than the Analyst expectation of $20.52.

On the same day, HSBC Analysts Stephen Bersey, Abhishek Shukla, and Govinder Kumar released a report stating that Adobe struggles to effectively monetize its AI capabilities and lowered its Target Price from $536 to $510 while maintaining a "Hold" rating. Yesterday, the company's stock price closed at $549.93, implying a potential drop of about 7.26%.

Adobe stated in a conference call that the management's top priority is to focus on the promotion and popularization of AI products while balancing the monetization of AI products. HSBC believes that this strategy may only drive modest revenue growth.

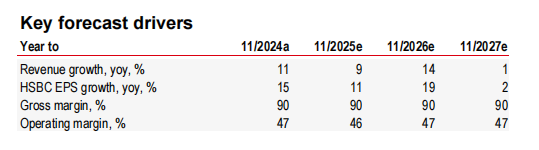

Despite the company launching AI products in early 2024, the revenue growth rate for the past three fiscal years remains at 10-11%, without achieving accelerated growth. The revenue guidance for fiscal year 2025 indicates that revenue growth will slow down, with the growth rate decreasing to 9%, which is 1% lower than the consensus expectation before the earnings report was released. Analysts stated:

"We believe Adobe is facing difficulties in effectively monetizing its AI capabilities, and the efforts made in AI have not led to an increase in revenue growth."

Furthermore, early signs of AI monetization are not encouraging, while the risks posed by competition are steadily increasing, leaving the path of AI transformation uncertain. Since the beginning of this year, Adobe Stocks have dropped by 5.2%, underperforming the Software Industry Index, which has risen by more than 30%. Concerns among investors about AI-based creative tools from companies like OpenAI or Runway AI potentially capturing Adobe's market share have repeatedly surfaced.

HSBC believes that intense competition in the creative product sector for Adobe could quickly commoditize its products and weaken its competitive advantage.

Editor/ping